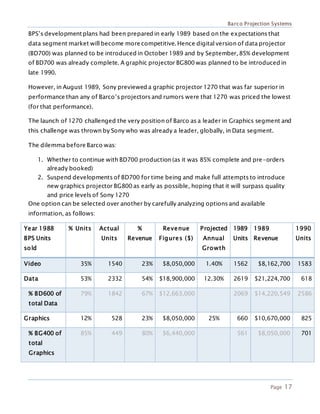

Barco Projection Systems, the market leader in graphic projectors, was surprised by Sony's new superior graphics projector launching at a lower price. Barco needs to counter quickly by launching new superior models and re-pricing existing ones. The document analyzes Barco, Sony, their products and strategies, the projection systems market and customers, technological environment, competitors like ElectroHome, and collaborators like distributors. It considers Barco's planned digital BD700 launch and Sony's 1270 product threatening its leadership in graphics and data projectors.

![Barco Projection Systems

Page 14

Opportunity for BD700:

- A digital projector like BD700 would score over current manual projector.

- Forecast revenue in 1990 would be $17.2 mn (BD700 is supposed to make incremental

revenue of 25% which is equivalent to $4.3 mn, hence total revenue would be $17.2

mn)

- By September 1989, German distributors had booked orders @ $16,000

Risks in suspending plans of BD700:

- Completing BD700 on time was important for Engineers’ morale as well as Customers’

morale. Suspending BD700 project carried a risk of demoralized workforce and

disappointed customers

- It was clear that BD700 would not beat Sony 1270’s performance during Infocomm

show. Hence discontinuing BD700 production plans for BG700 or 800 would not meet

the objectives

Conclusion: Barco should continue with its original plans of producing BD700 by committed

date of October 1989.

Reasons:

1. Revenue-wise as well as margin-wise, “data” segment contributed much more to Barco

than Graphics segment. Hence it makes sense staying on track with pre-decided

BD700 production plan

[Revenue: Data = 54%, Graphic = 23%. Margins: Data = 51%, Graphic = 29%]

2. Barco holds 2nd position, globally as well as within each region, in “data” segment (first

being Sony). And it is predicted that from 1989 to 1994, maximum growth is going to

be in “data” segment.

[Note: Growth prediction for Graphics segment is 40.2% while that of “data” segment is

only 12.3%. However, in general as well as for Barco, total sale of “data” segment is

more than that of Graphics. Resultantly, in absolute terms, growth for “data” segment

would be more than that of Graphics]. Hence it makes sense continuing with BD700

production, as planned

3. The concerns raised about the success of Sony 1270 as well 1270’s price concerns

were more from Distributors, than anybody else. But since 61% of Barco’s sale &

revenue was through it’s own, fully owned Distributors, Barco need not come under

pressure generated by other Distributors. [61% of data and 75% of Graphics sale of

Barco was via their fully-owned Distributors]](https://image.slidesharecdn.com/barcocasestudyteamafinal-160412194022/85/Barco-case-study-team-a-final-15-320.jpg)