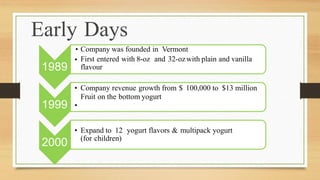

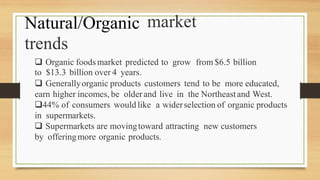

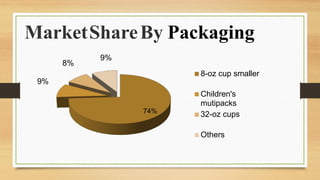

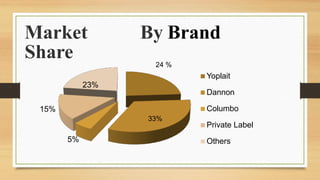

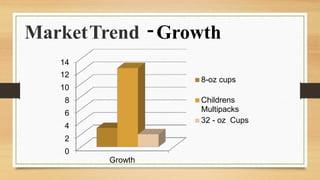

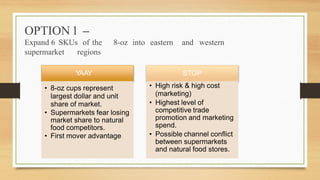

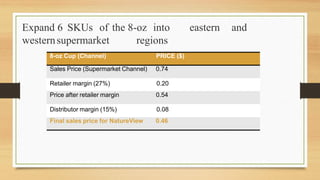

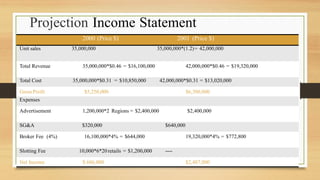

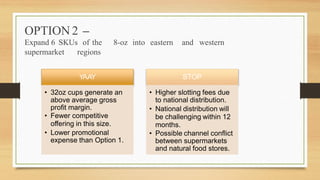

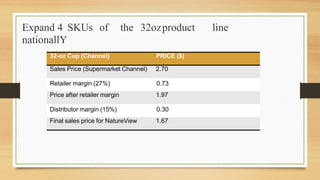

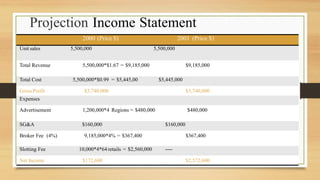

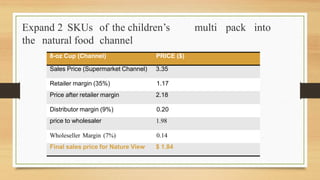

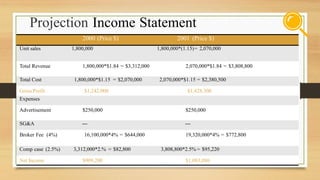

The document provides an overview of NatureView Farm and analyzes options for the company to reach $20 million in revenue by 2001. It discusses the yogurt market trends, NatureView's background and finances, and proposes three options: expanding 8-oz cups into supermarkets; expanding 32-oz cups nationally; or expanding children's multipacks into natural food stores. An analysis of costs, revenues and growth projections is given for each option. The recommendation is to expand the multipacks into natural food stores to minimize channel conflicts and attract new customers, achieving high growth for NatureView.