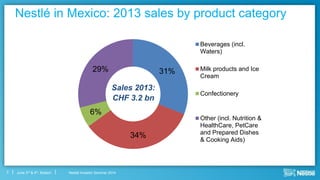

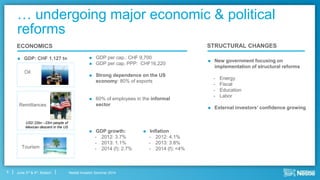

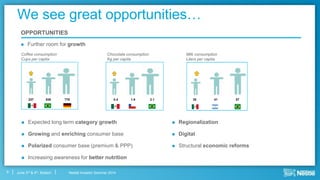

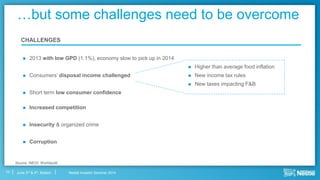

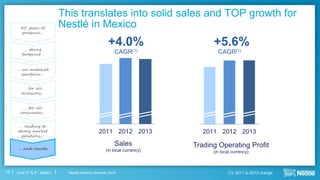

The Nestlé Investor Seminar 2014 outlined the company's operational performance in Mexico, showcasing a sales figure of CHF 3.2 billion in 2013 and emphasizing growth opportunities despite challenges in the economy. Key themes included the demographic landscape, the evolving retail environment, and Nestlé’s commitment to nutrition, health, and wellness, alongside initiatives that enhance sustainability and customer engagement. The seminar depicted Nestlé's strategic focus on enhancing operational efficiency, expanding market presence, and investing in innovation to cater to a diverse consumer base.