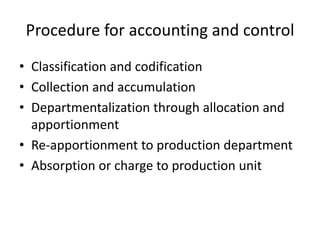

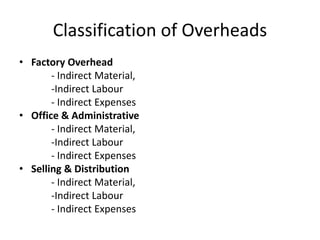

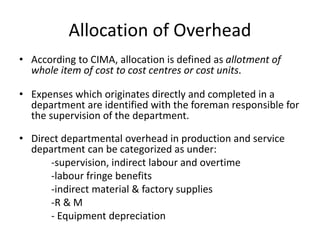

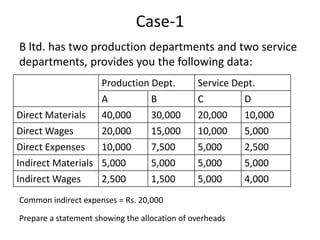

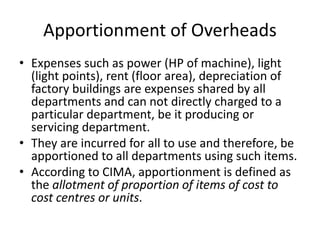

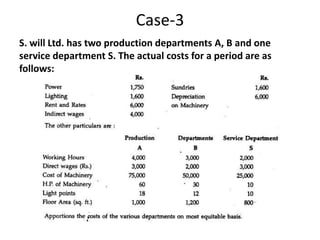

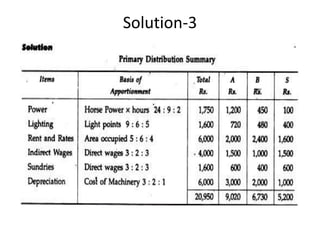

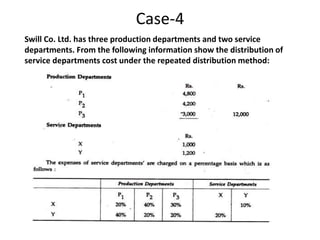

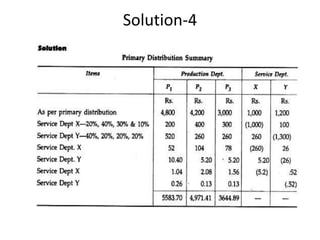

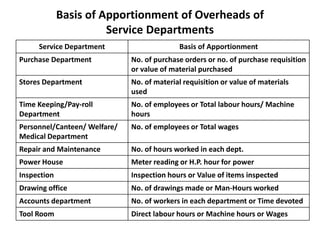

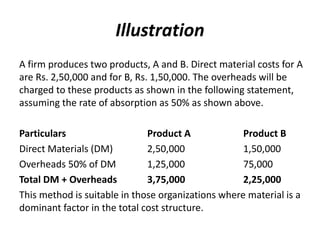

Overhead costs are indirect expenses that are incurred in addition to direct material and direct labor costs. They include indirect materials, indirect labor, and indirect expenses. Overheads must be classified, collected, allocated to cost centers, and then absorbed or charged to production units. They are classified as factory, office/administrative, or selling/distribution overheads. Overhead allocation involves allotting whole costs to cost centers, while apportionment involves allotting proportionate shares of common costs between cost centers. Absorption of overheads involves charging production with an equitable share of overhead costs using an absorption rate.