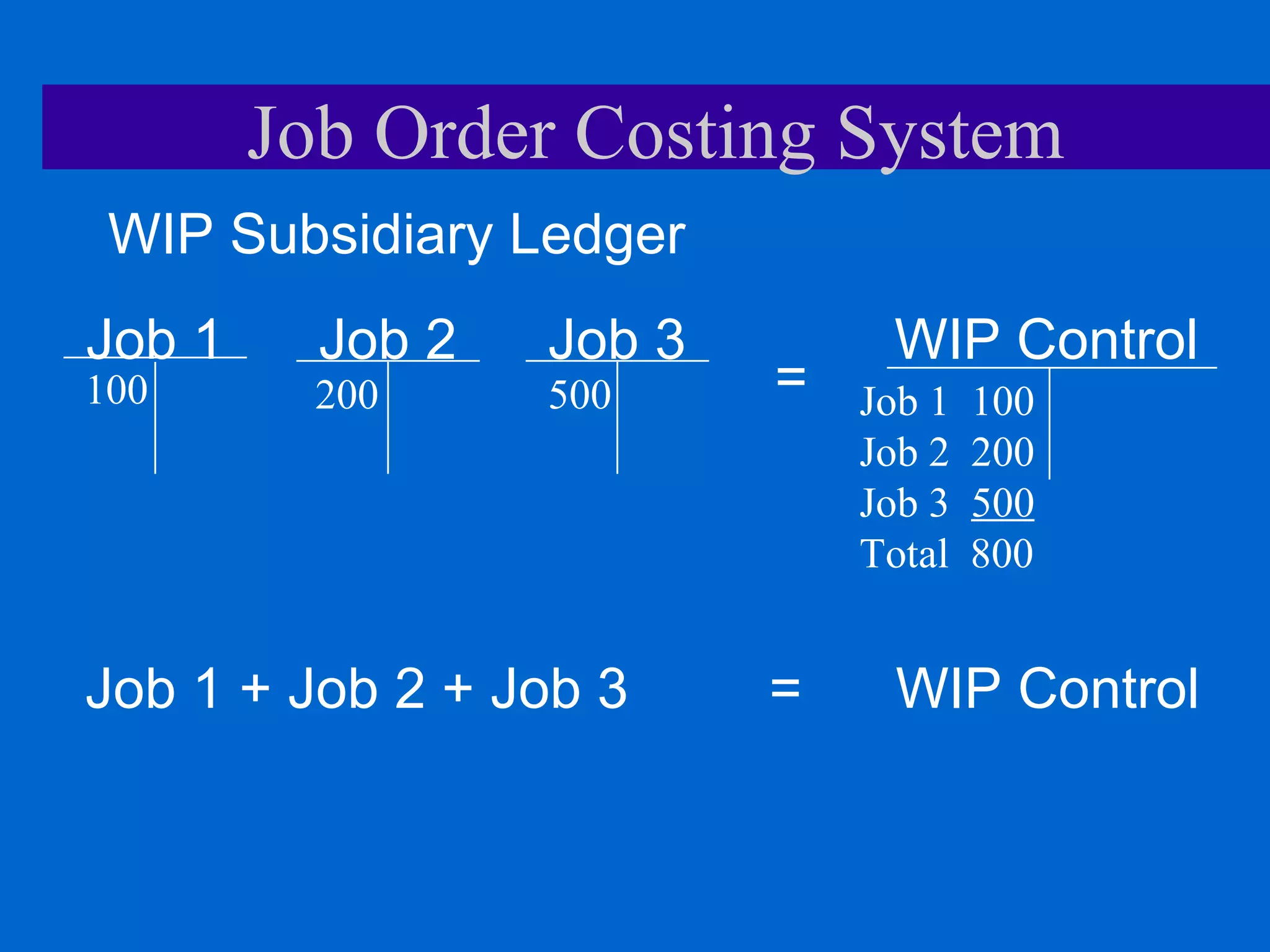

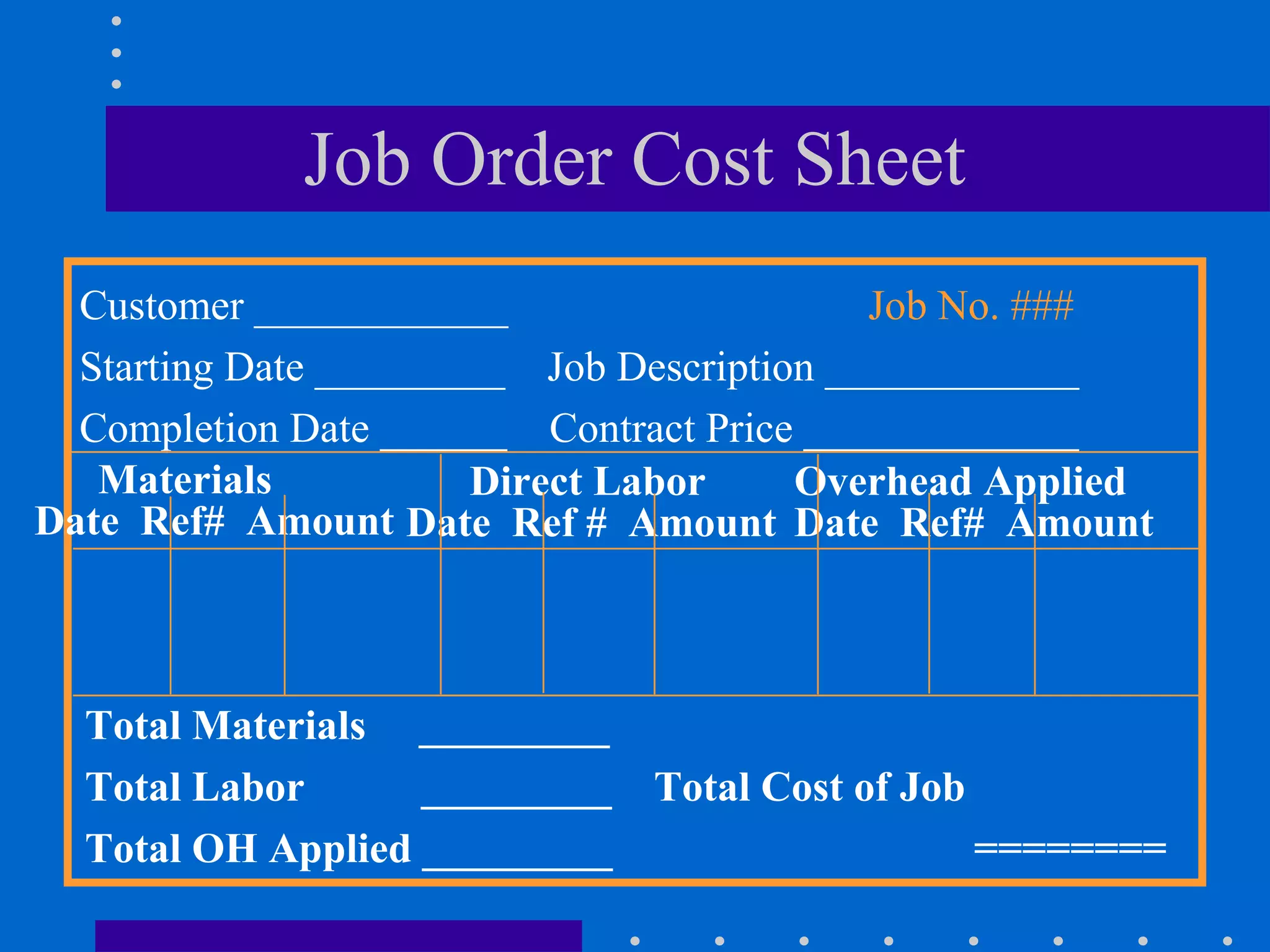

This document discusses job order costing systems, including how they track costs by individual jobs rather than in batches like process costing, how the job order cost sheet accumulates actual direct and overhead costs for each job, and how standard costing compares actual costs to budgeted standards to evaluate performance and set prices.