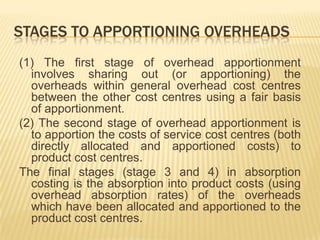

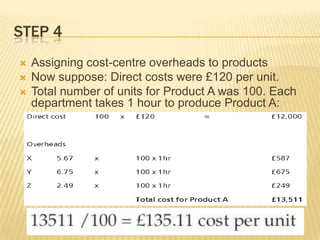

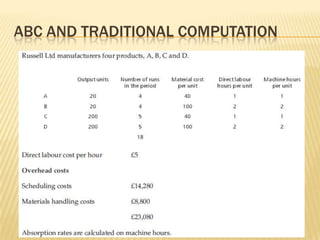

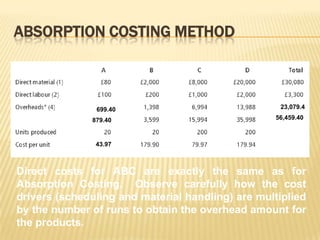

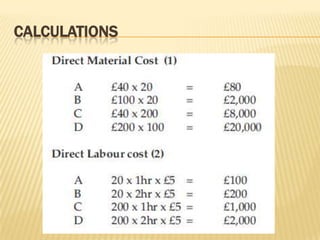

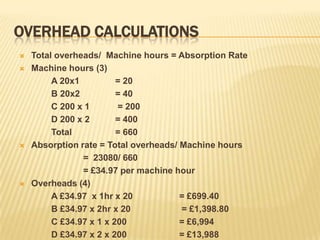

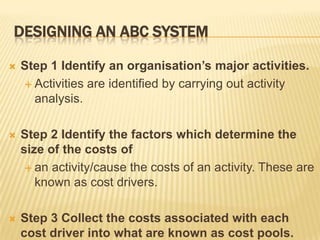

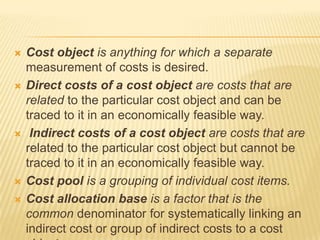

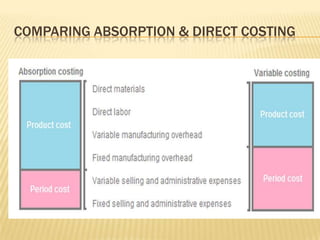

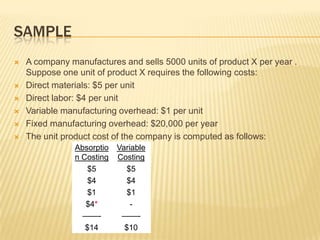

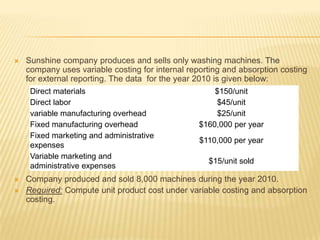

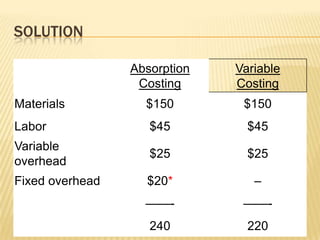

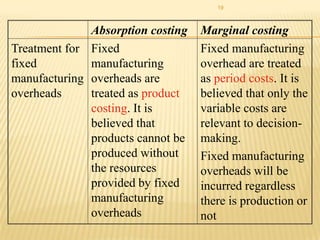

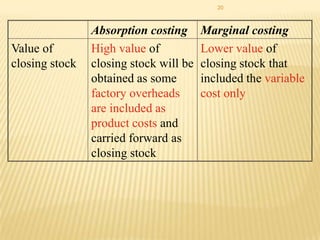

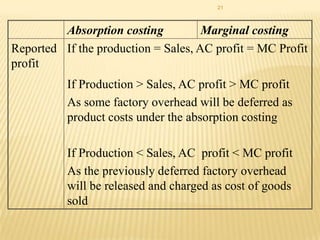

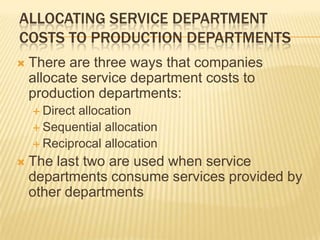

This document discusses cost measurement and different costing methods, including absorption costing and variable/direct costing. It provides examples to illustrate the calculation of product costs under absorption costing and variable costing. Absorption costing includes both variable and fixed manufacturing costs in product costs, while variable costing treats fixed costs as period costs not included in product costs. The document compares the two methods and discusses their treatment of inventory costs and reported profit.

![ABSORPTION COSTING [TRADITIONAL METHOD]

Absorption

costing is an old method of

product costing which aims to include

in the total cost of a product (unit, job

and so on) an appropriate share of an

organisation’s total overhead.

Product costs are built up using

absorption costing by a process of

allocation,

apportionment

and

overhead absorption.](https://image.slidesharecdn.com/unit9costmeasurement-140201030511-phpapp02/85/Unit-9-cost-measurement-50-320.jpg)