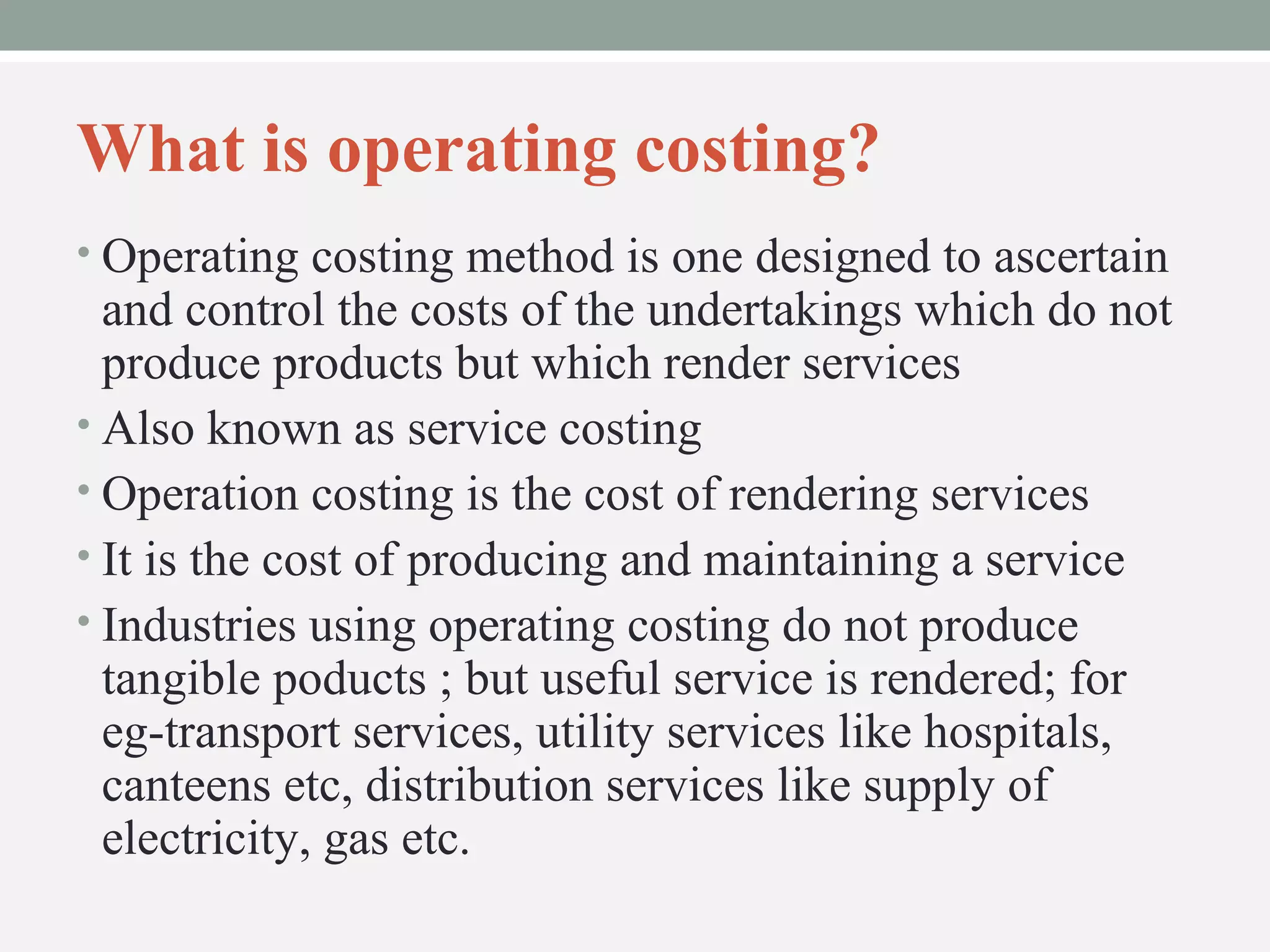

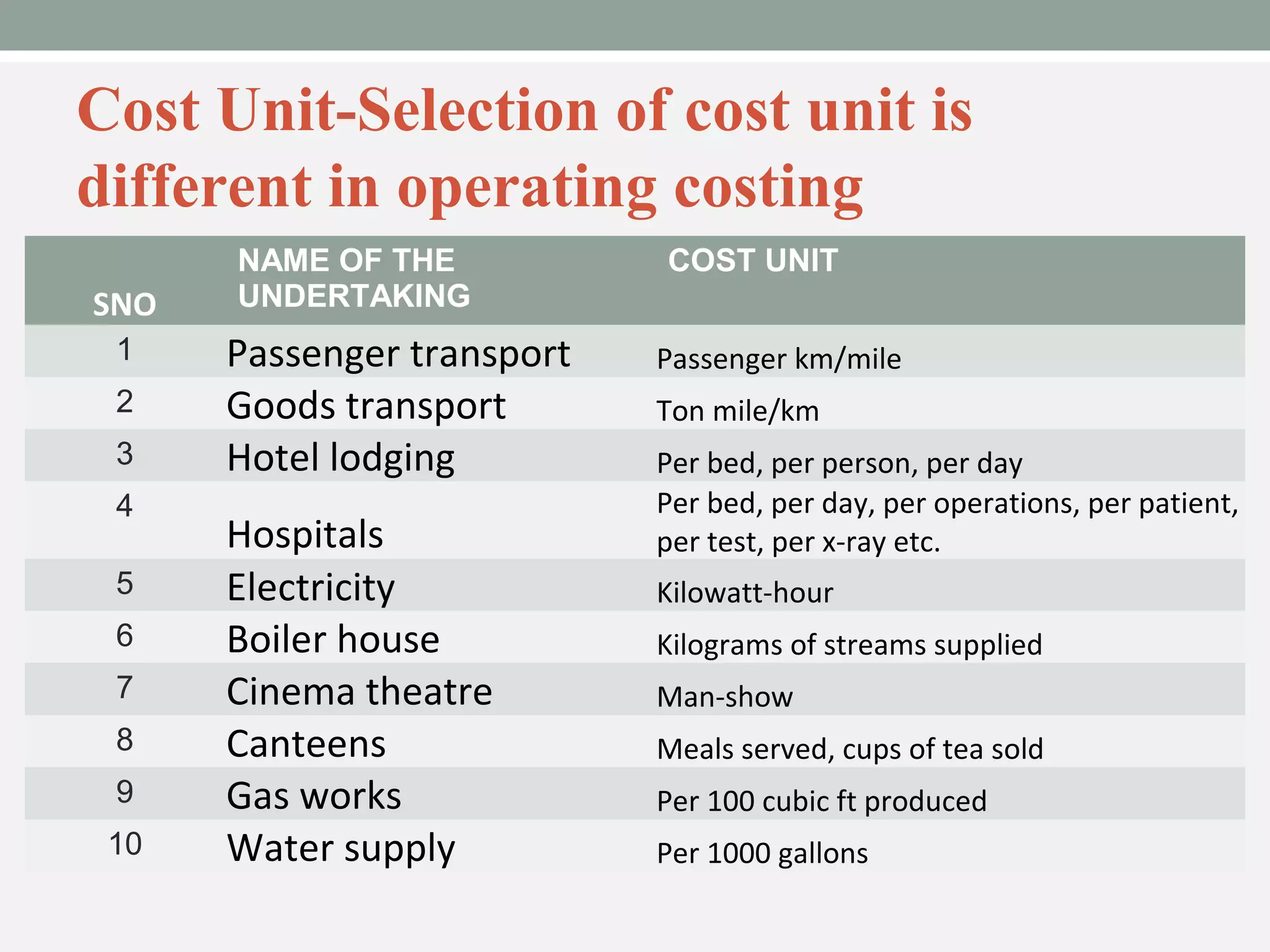

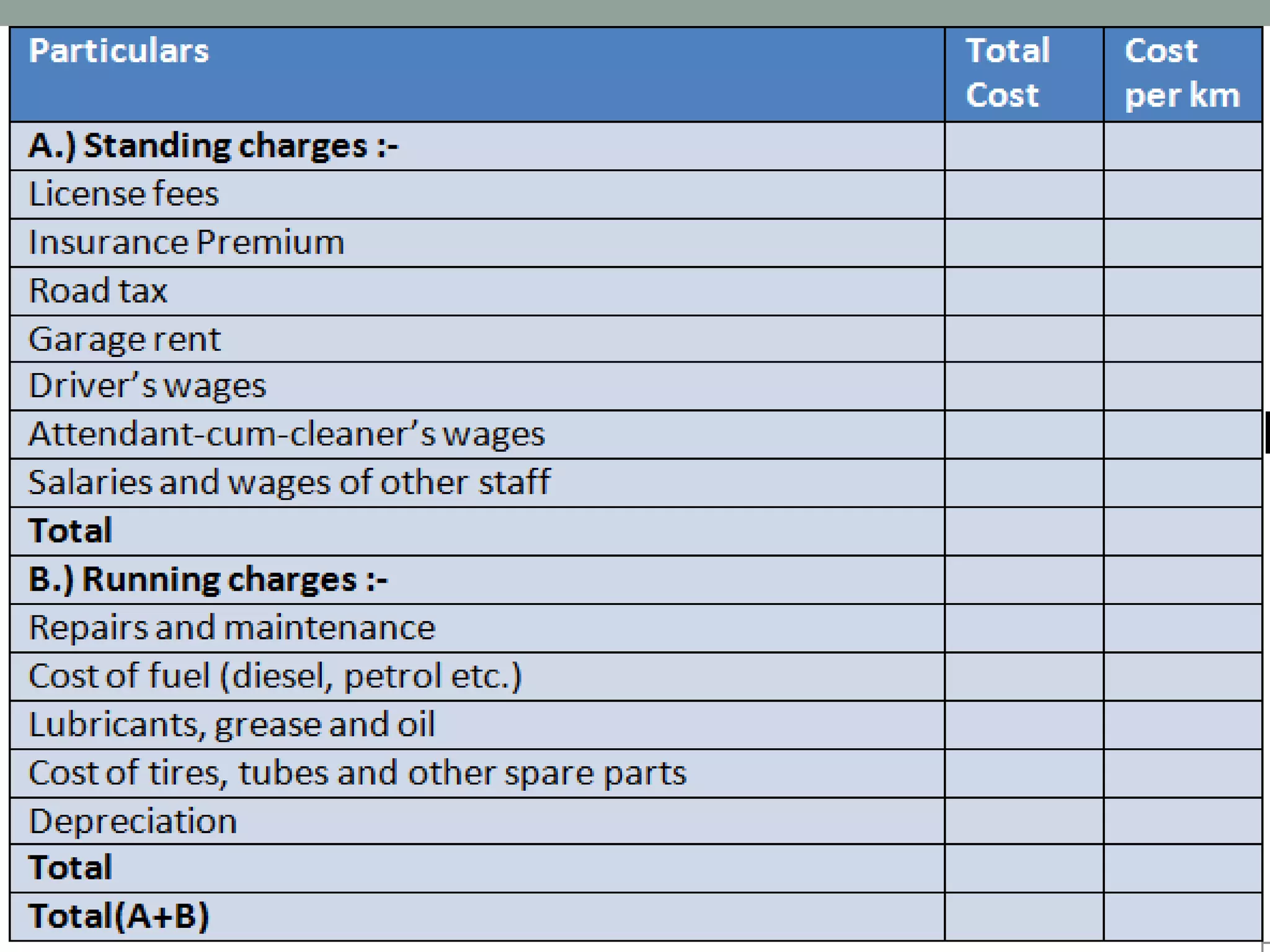

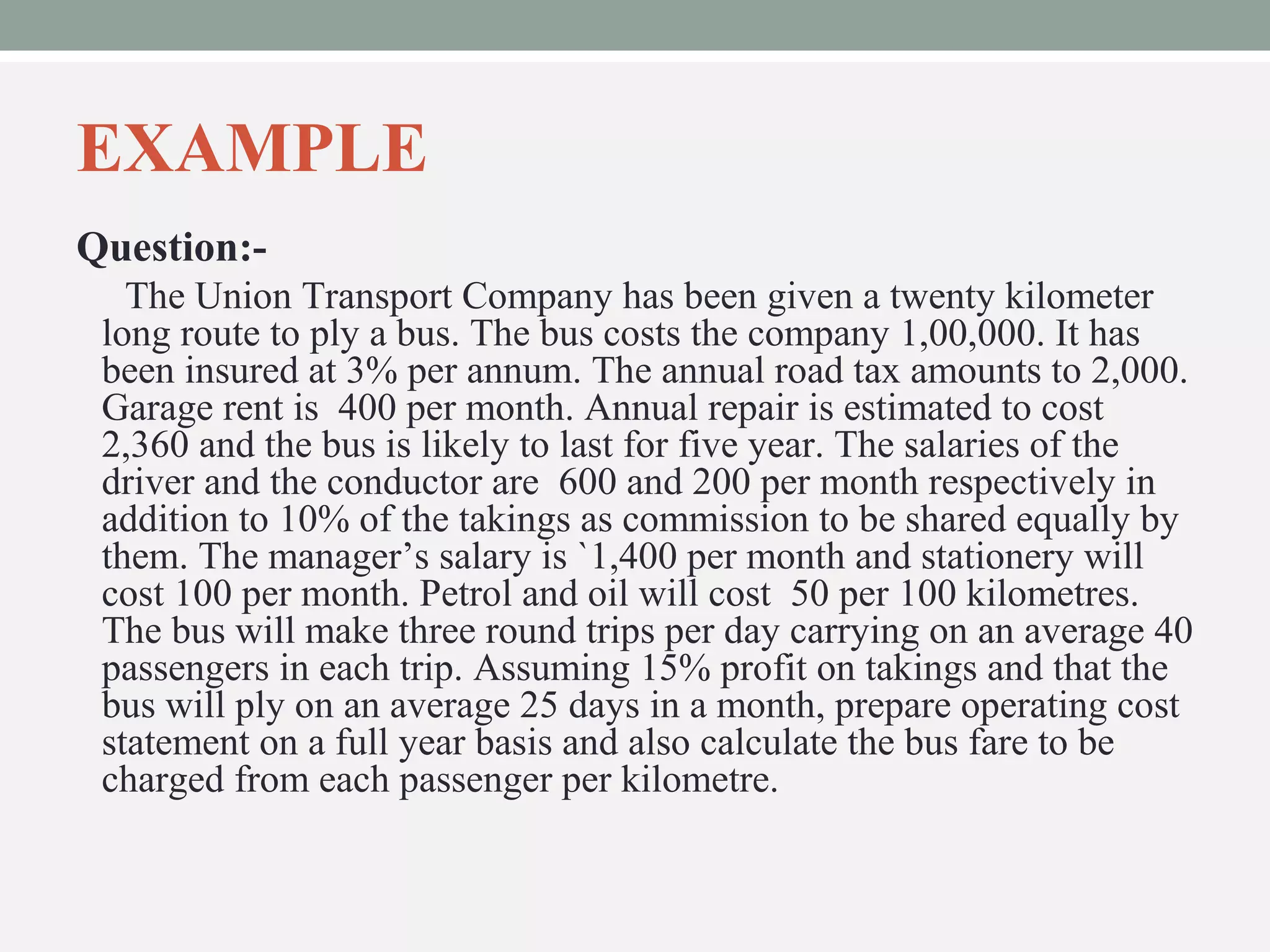

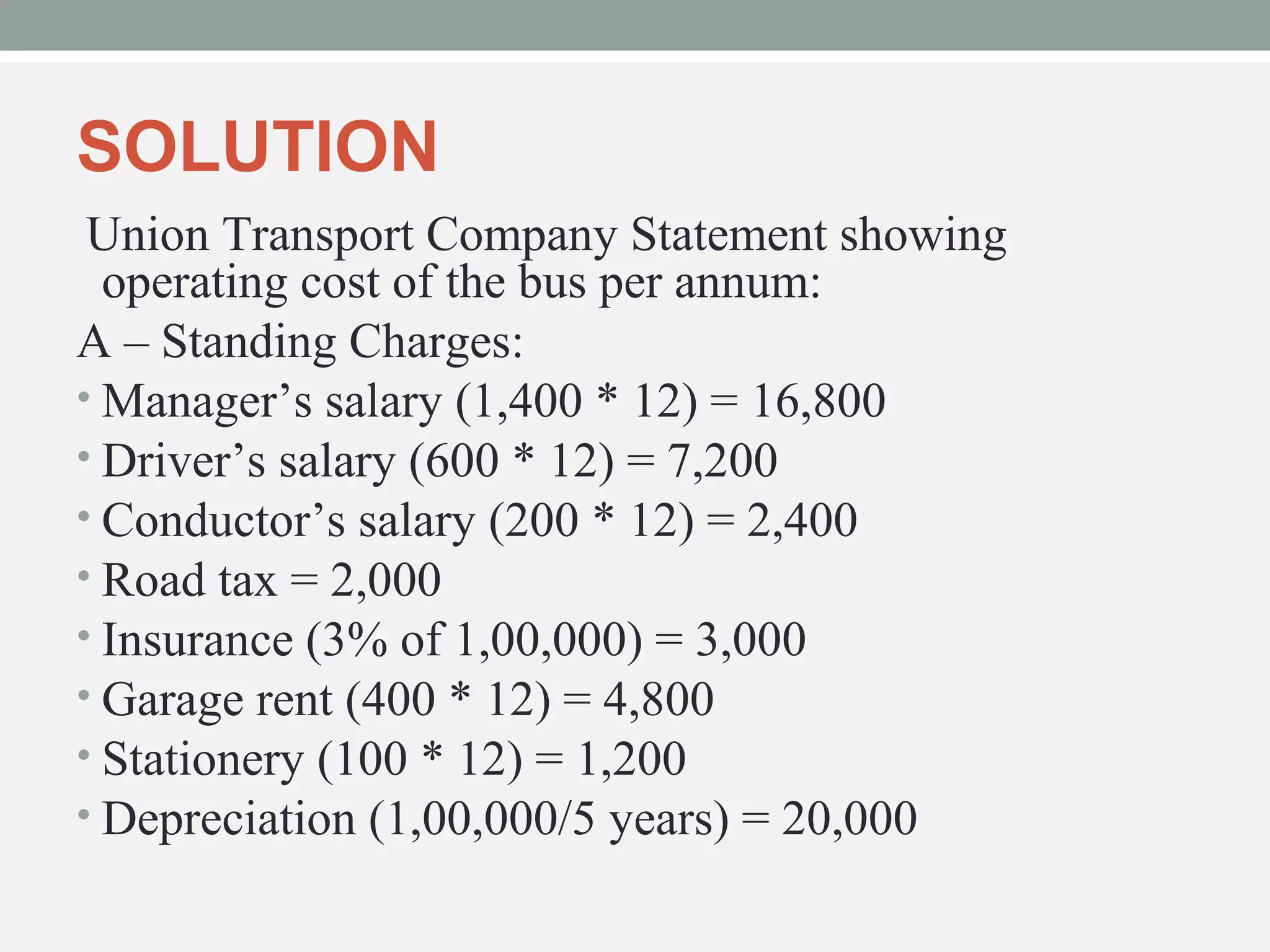

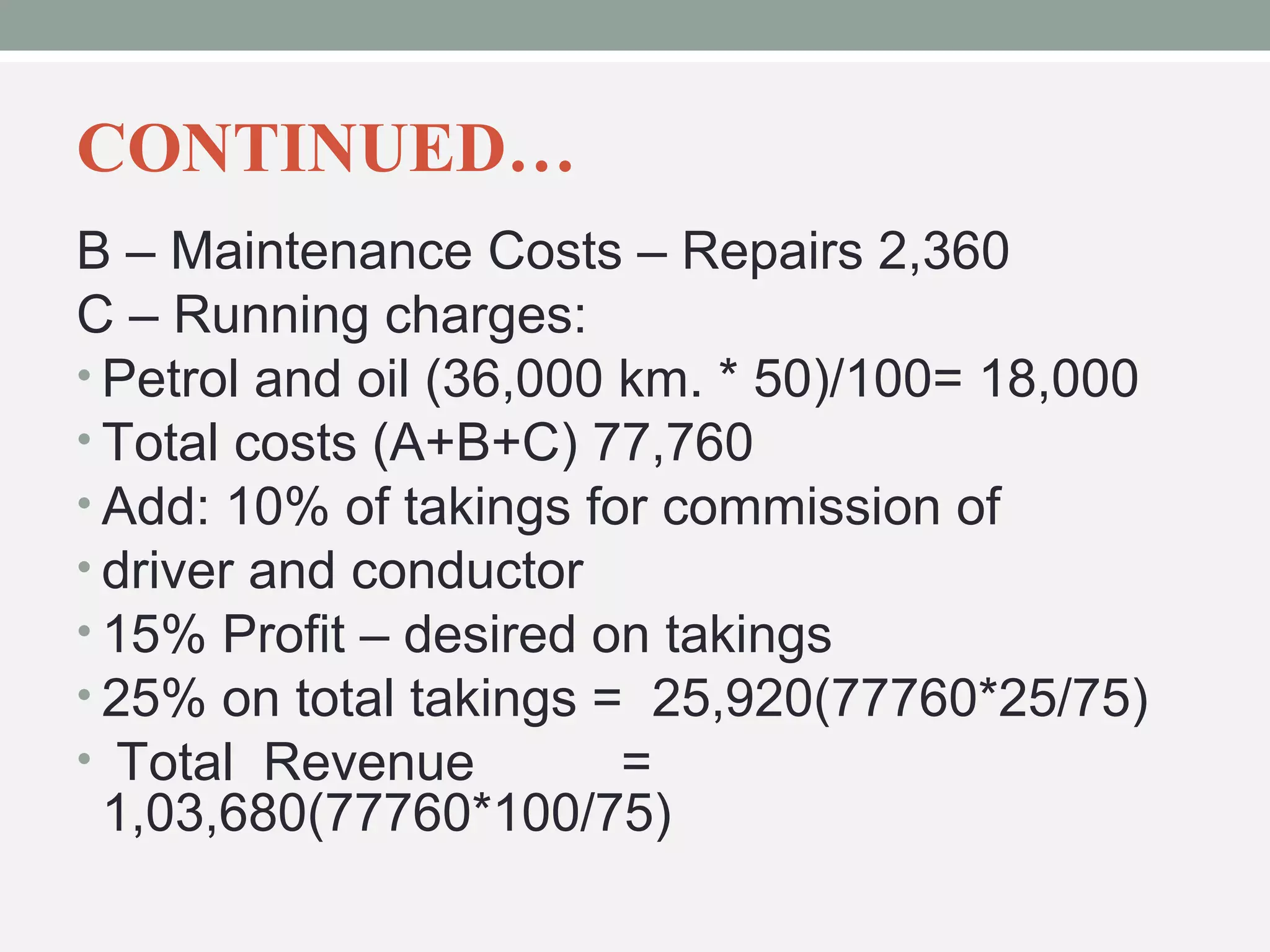

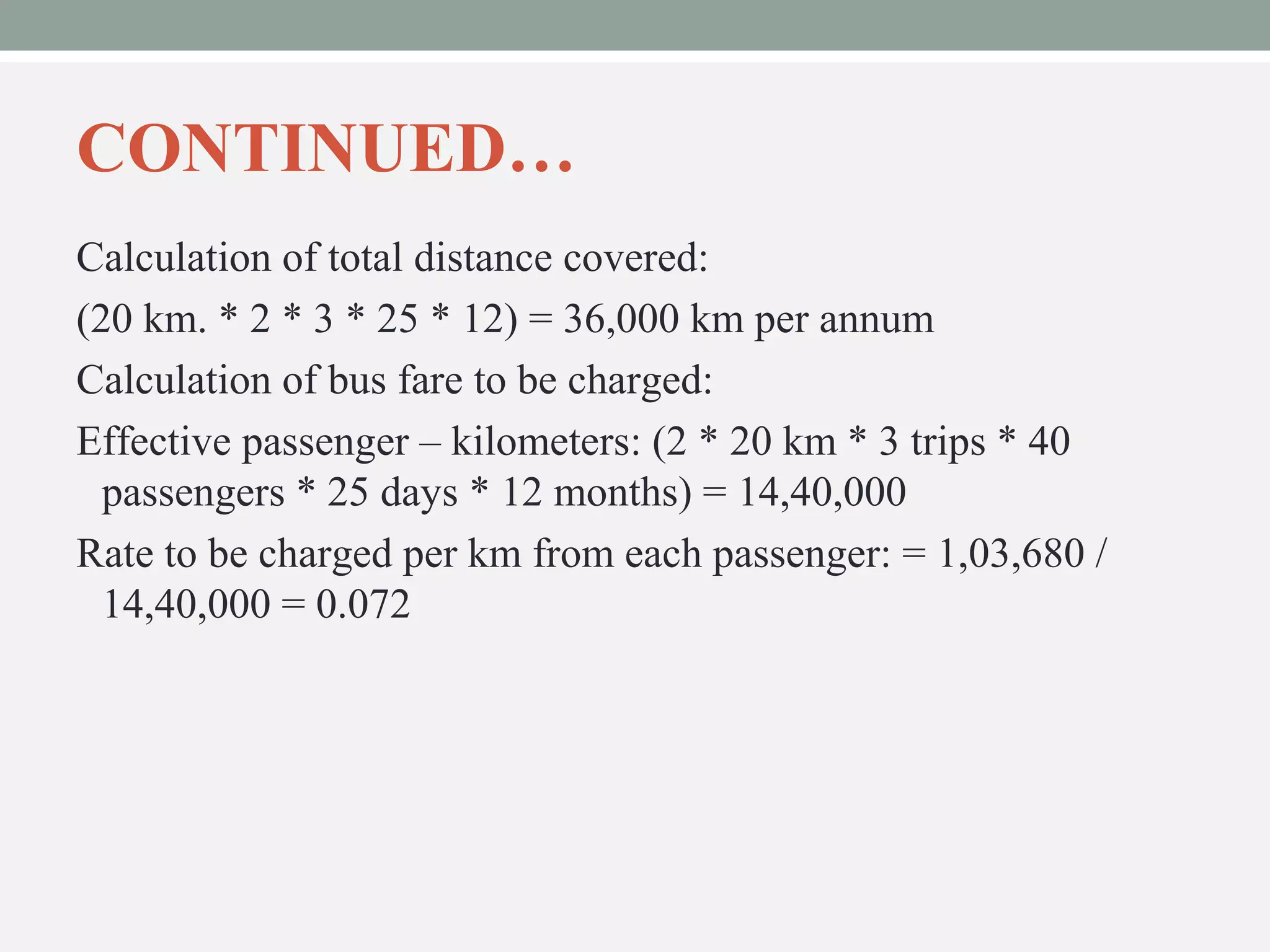

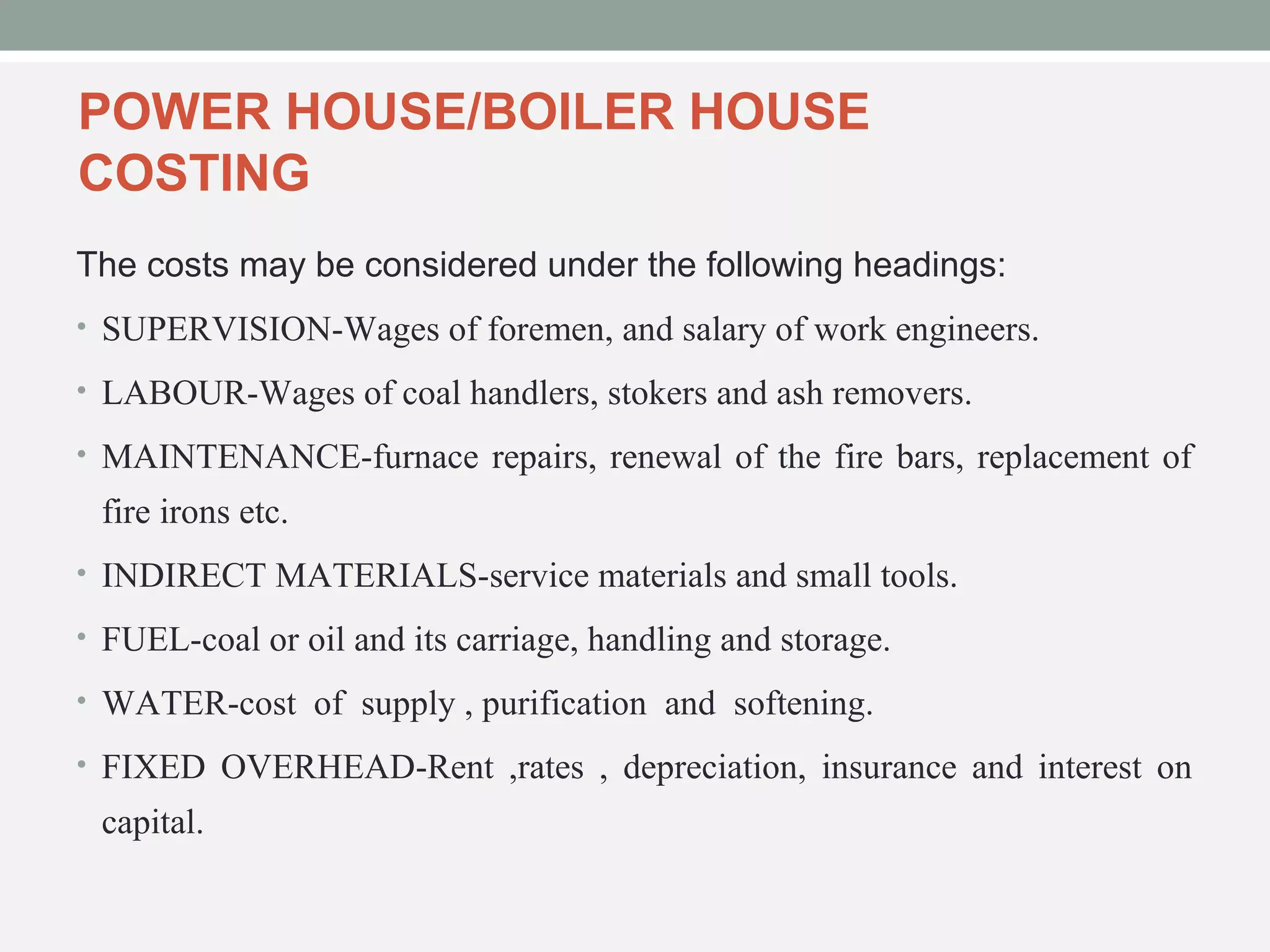

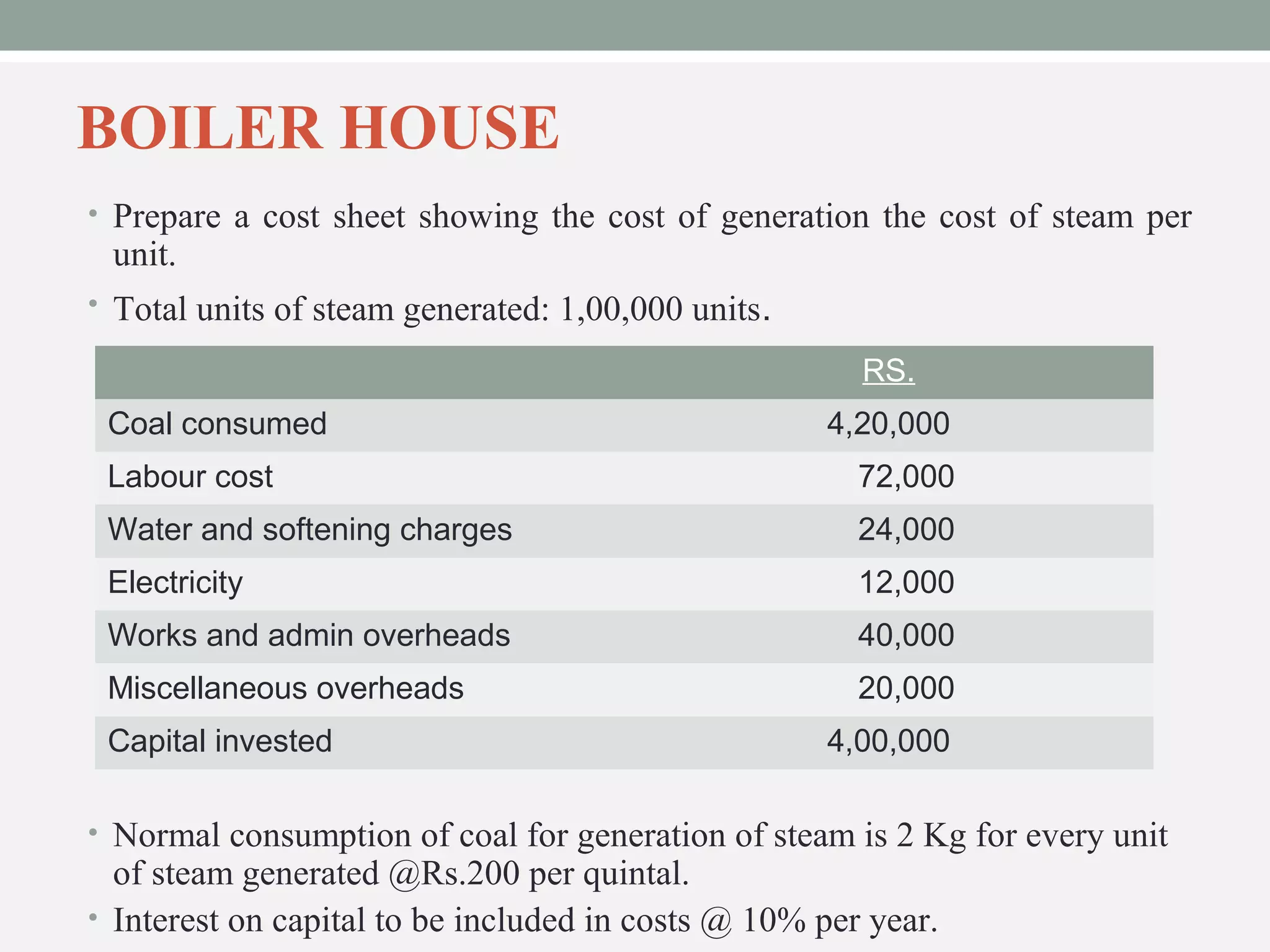

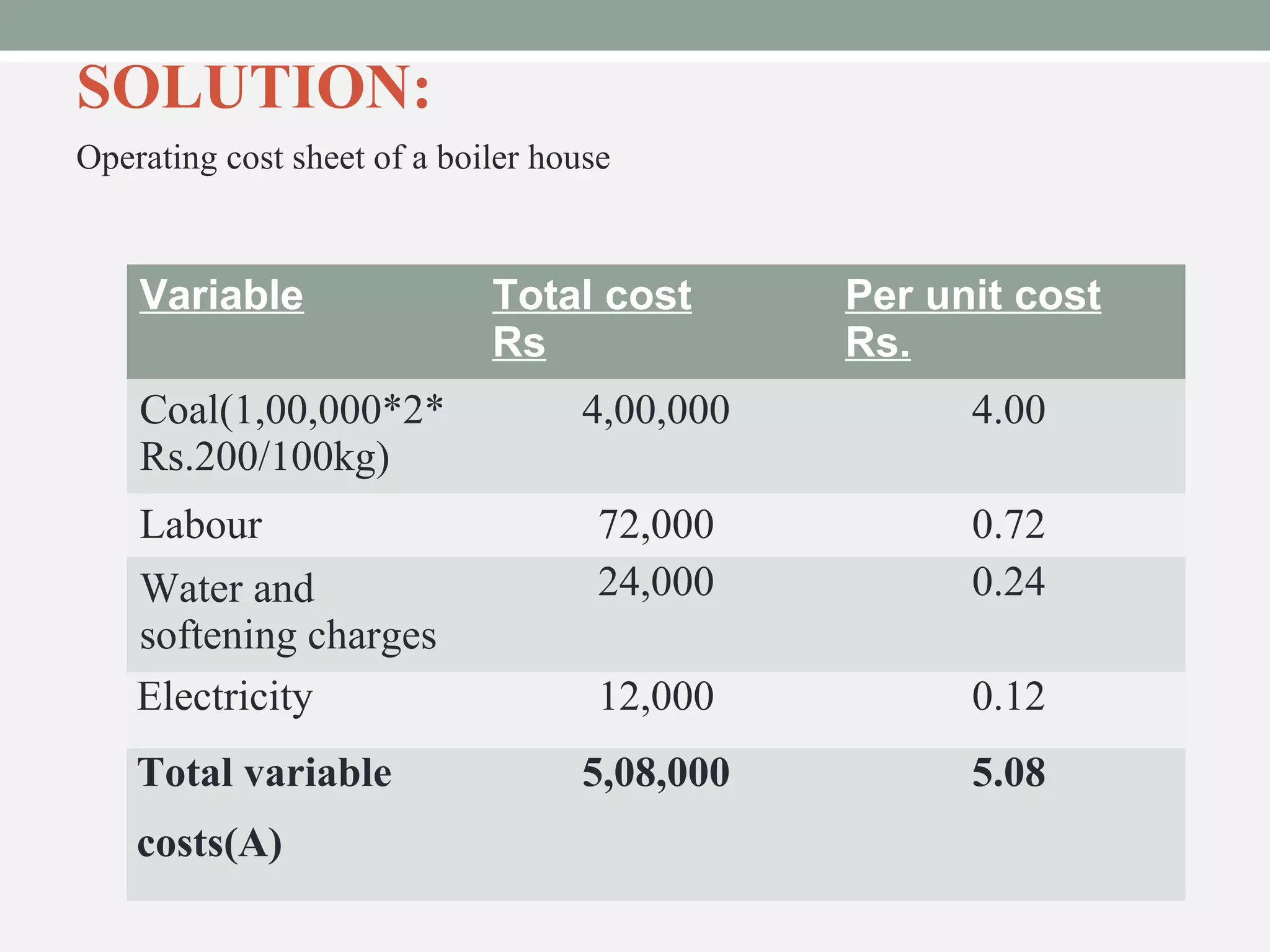

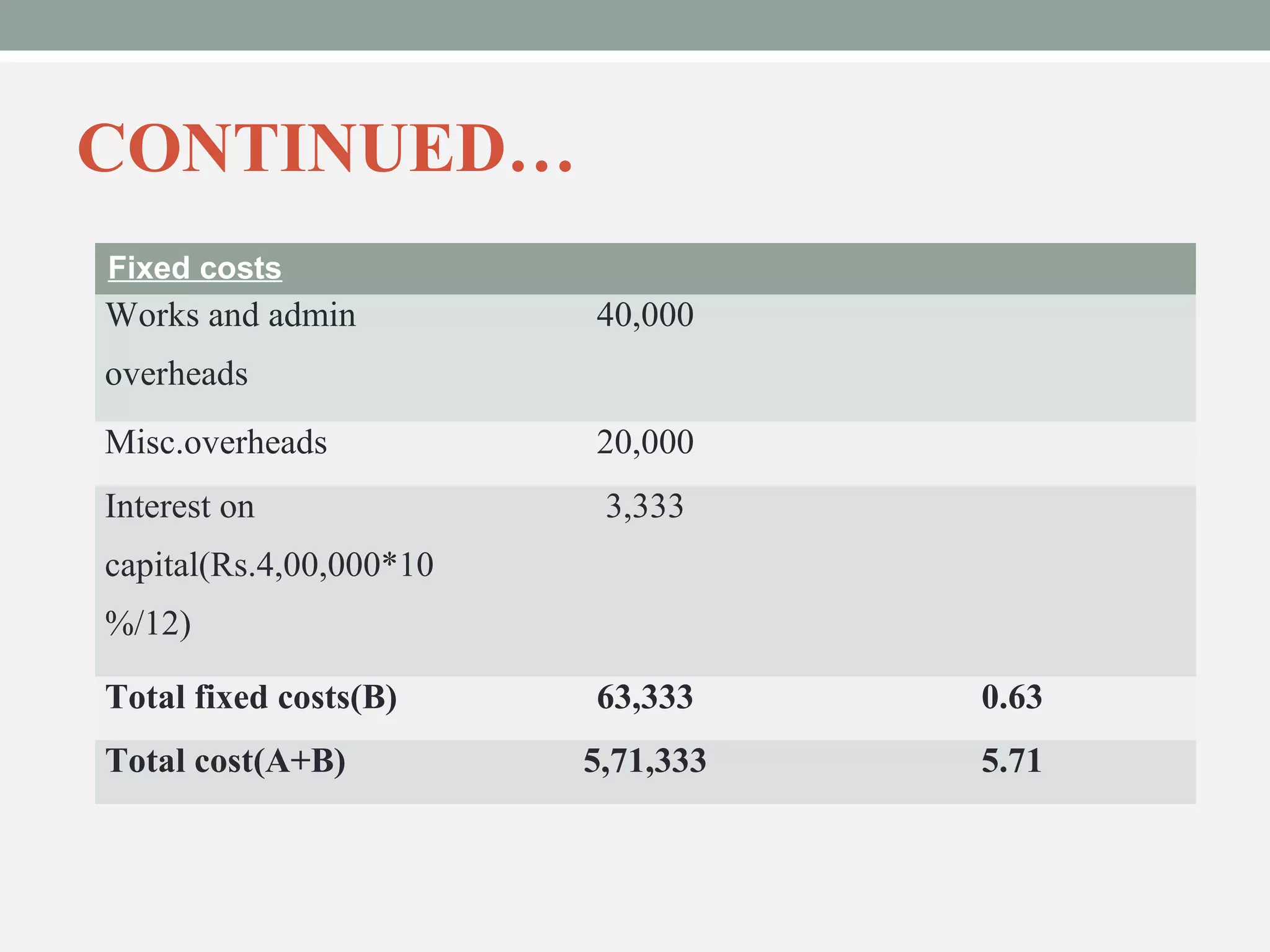

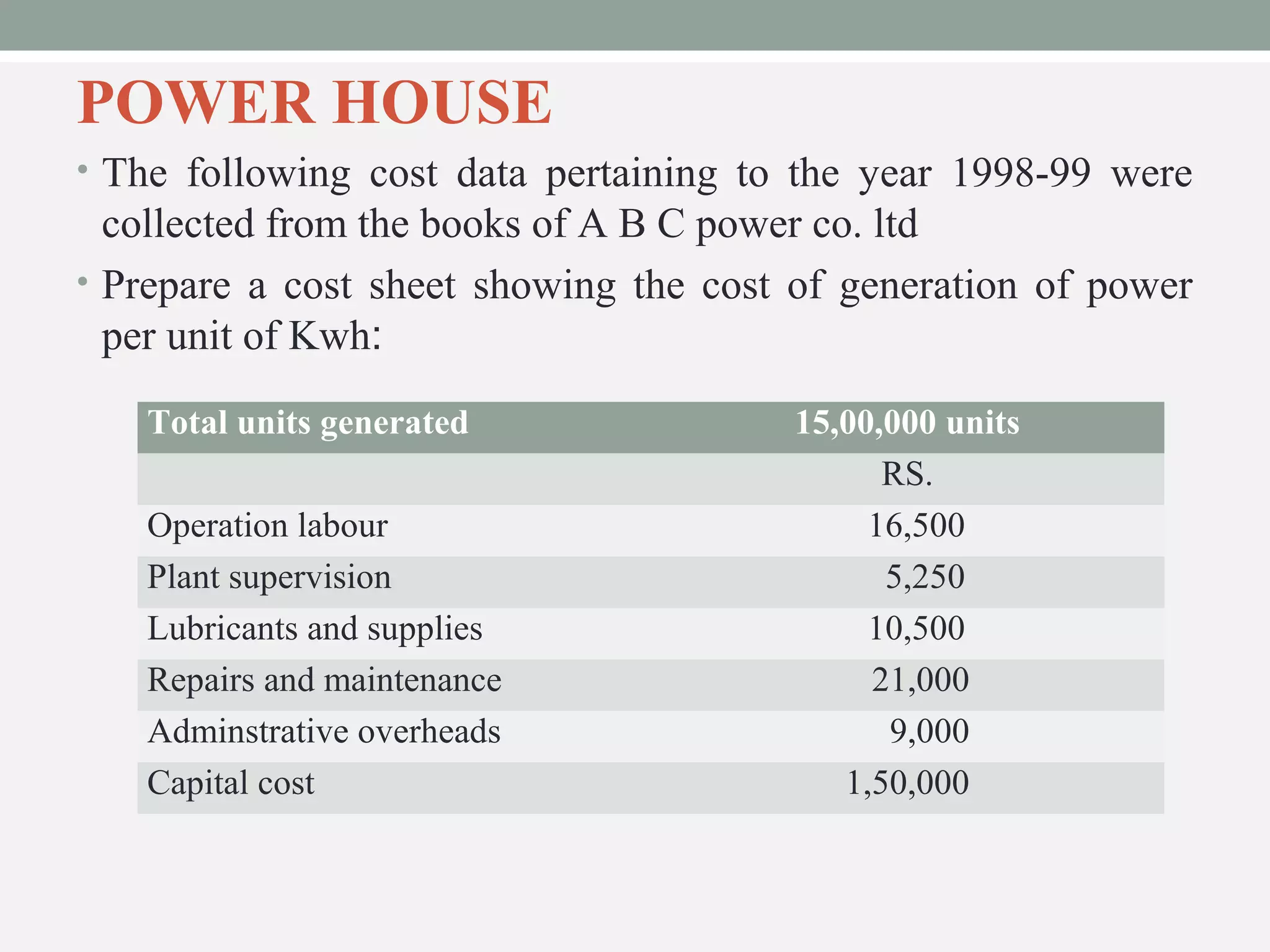

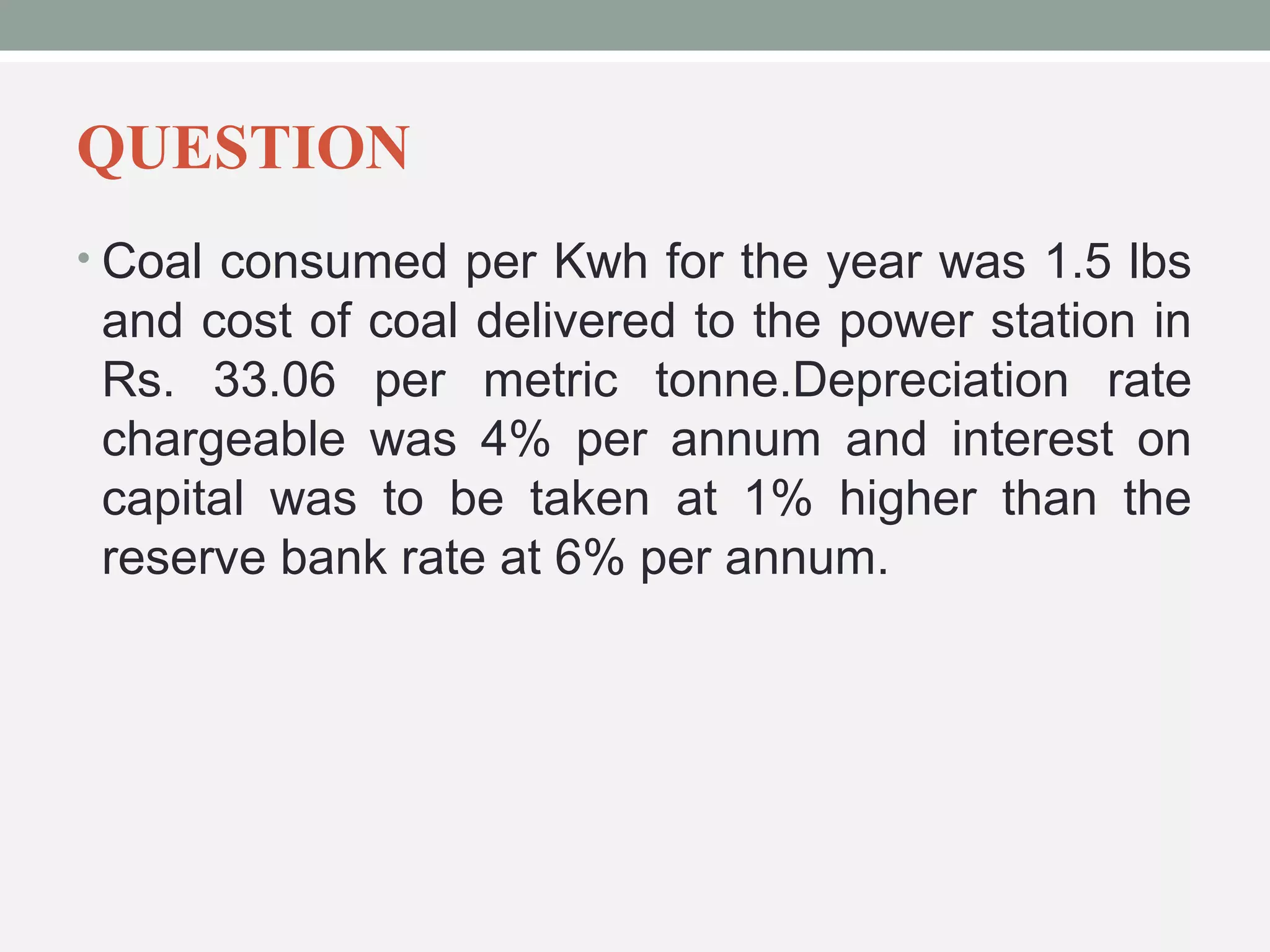

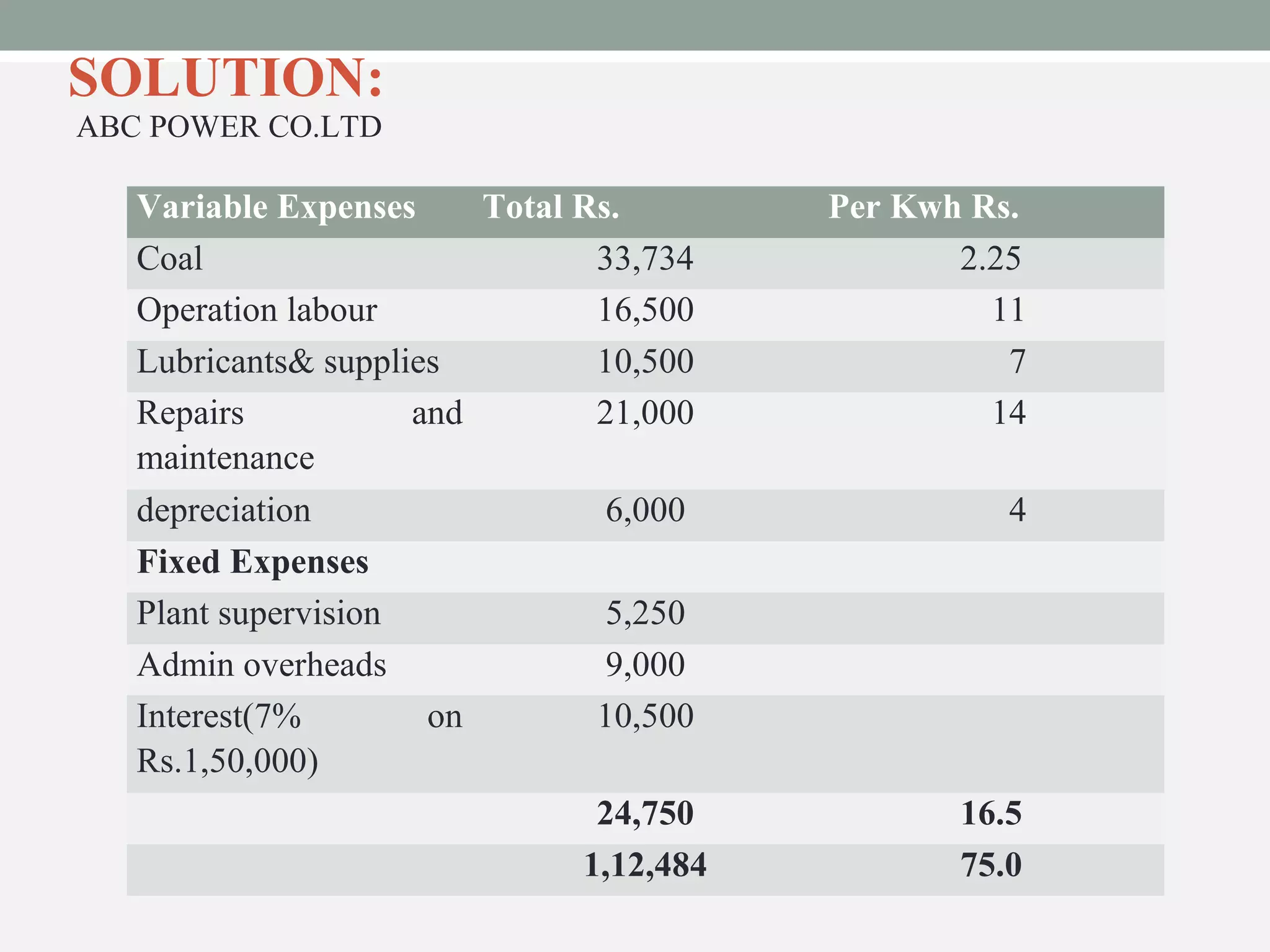

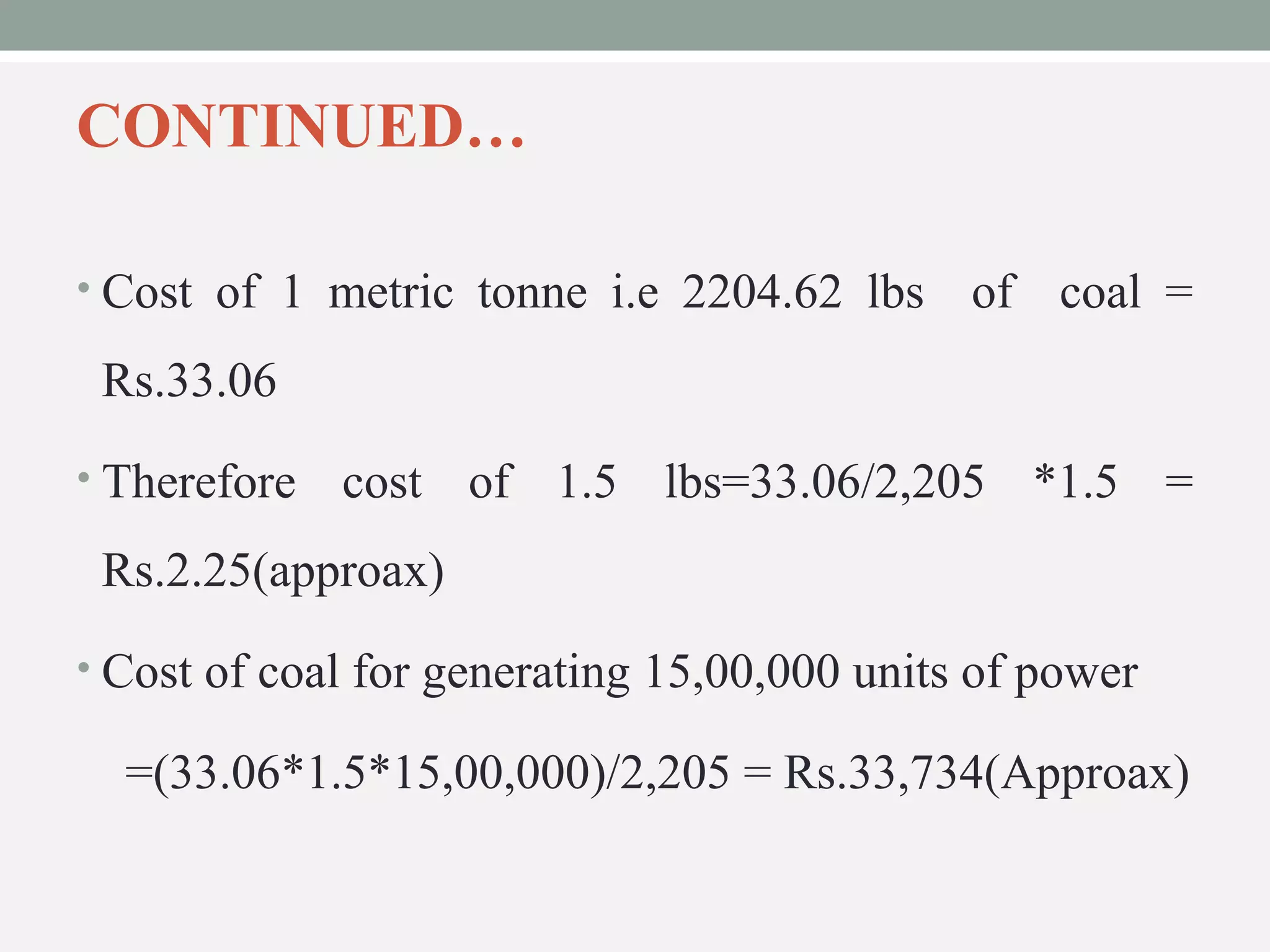

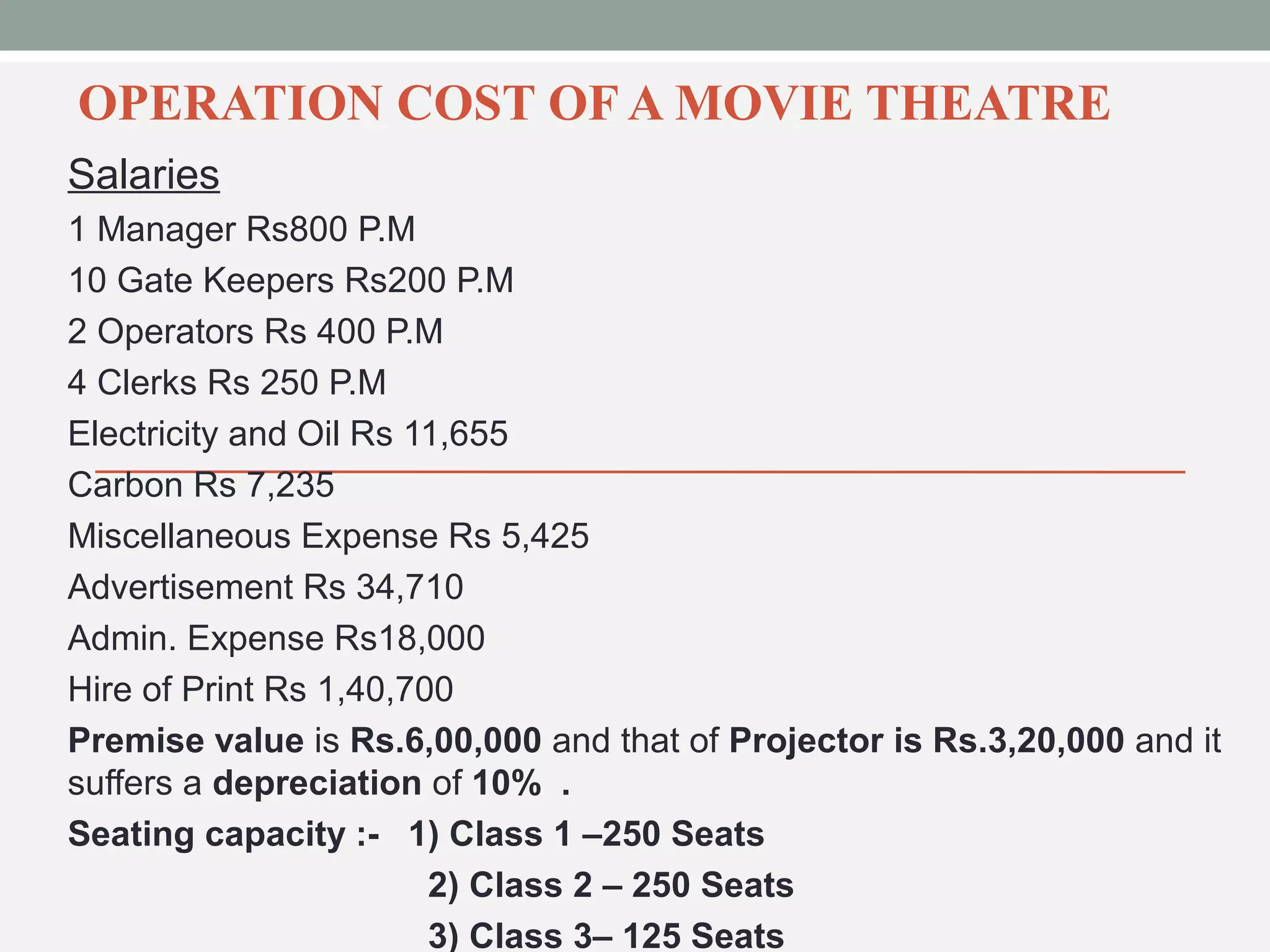

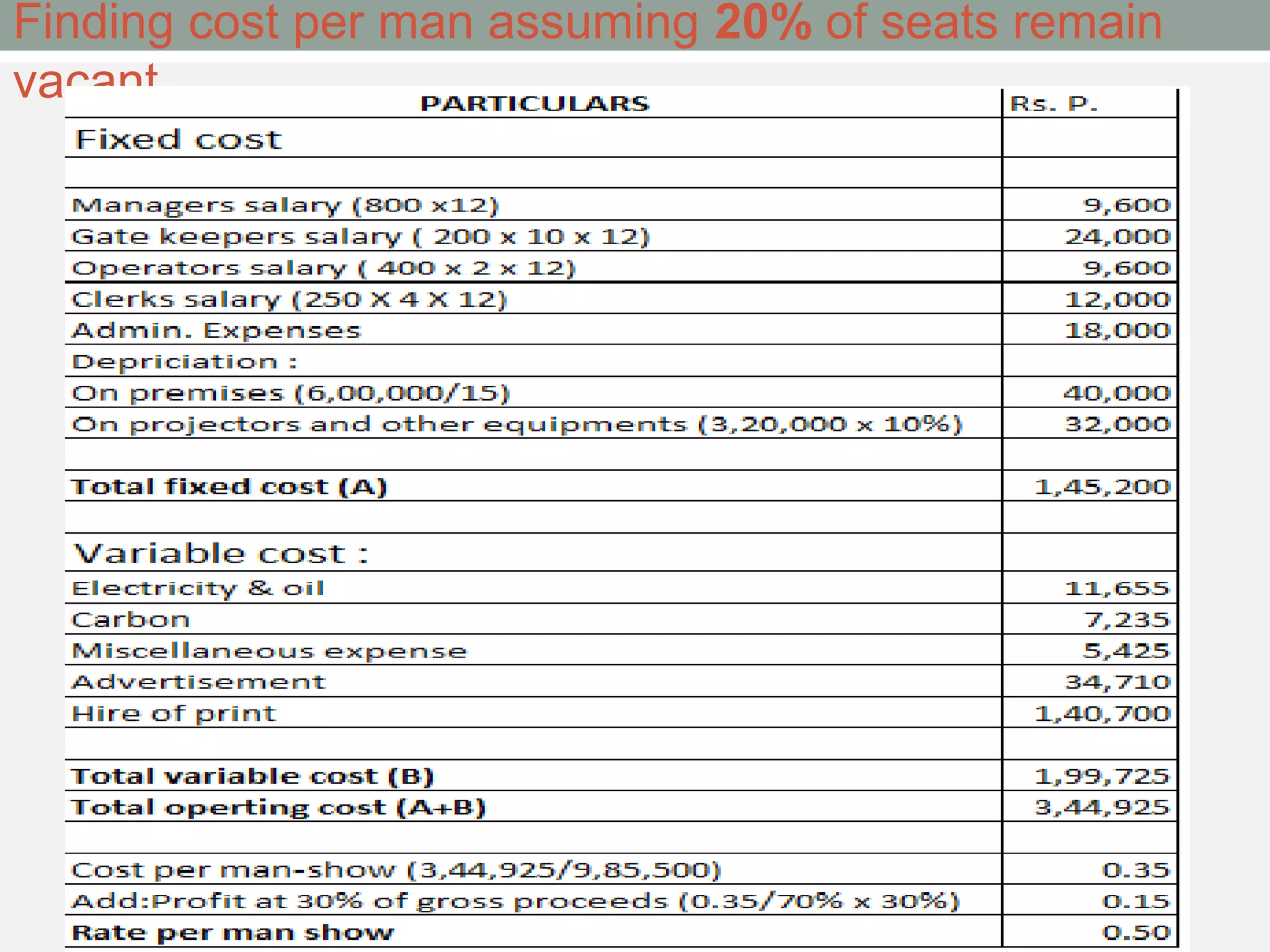

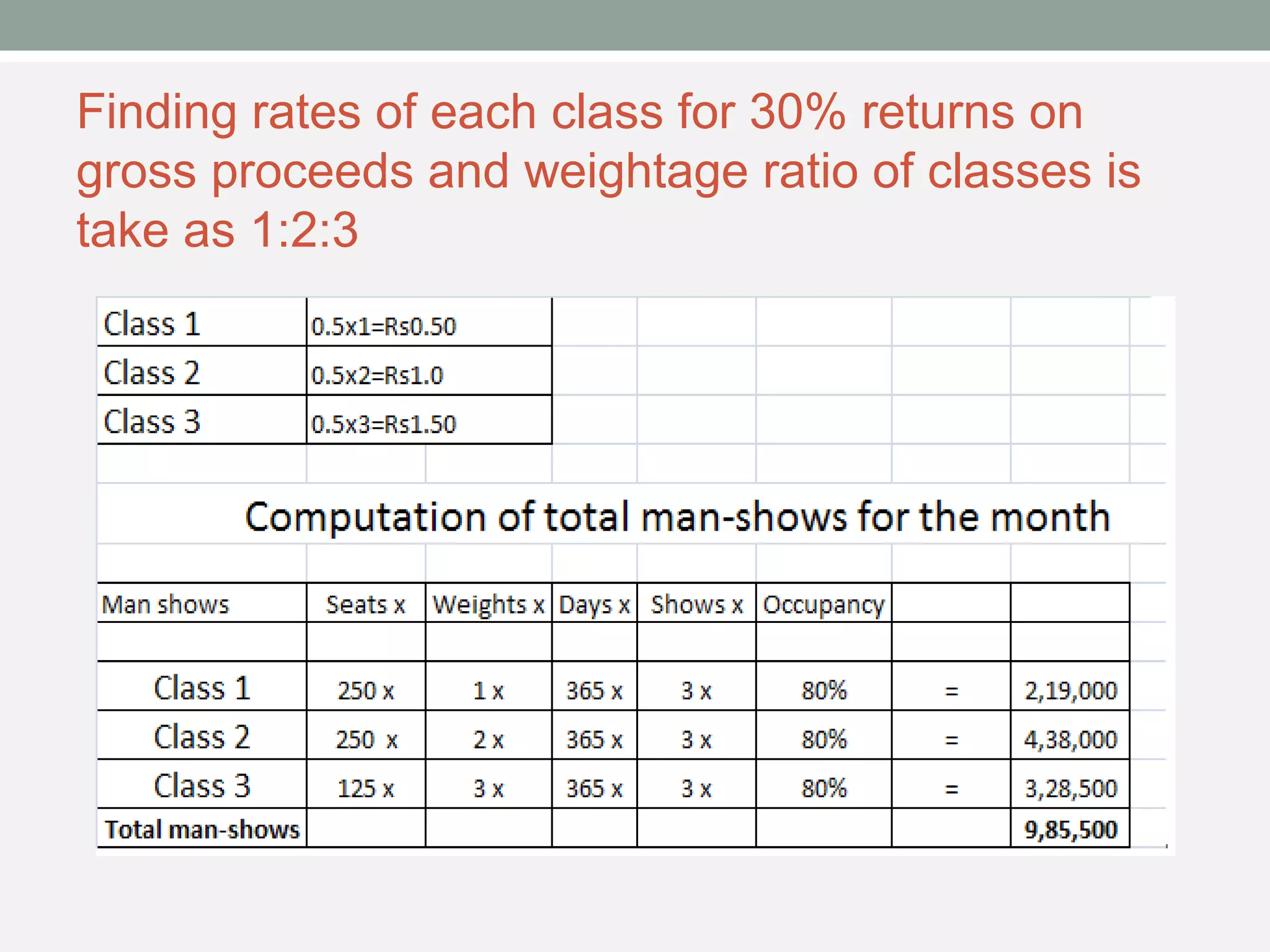

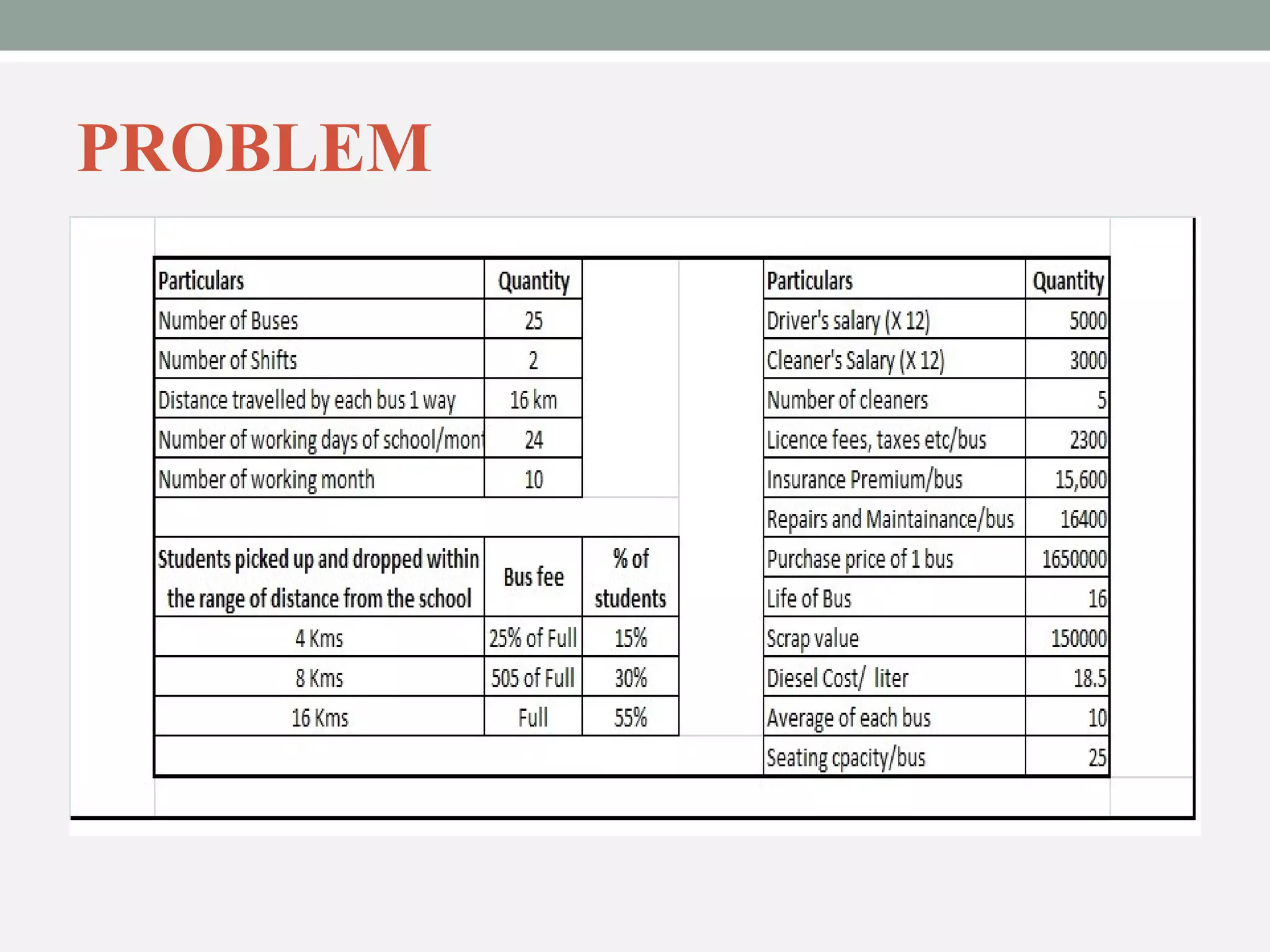

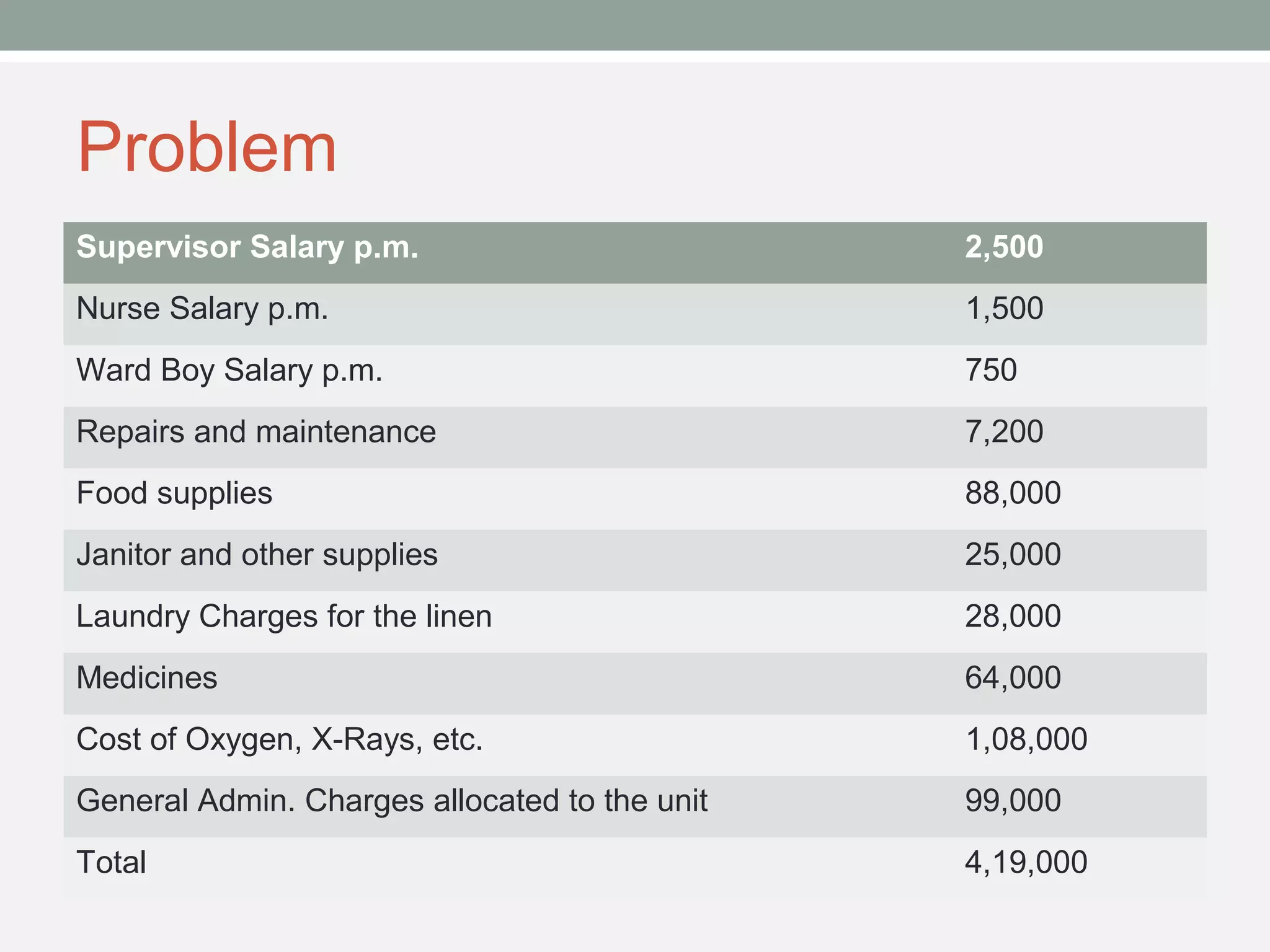

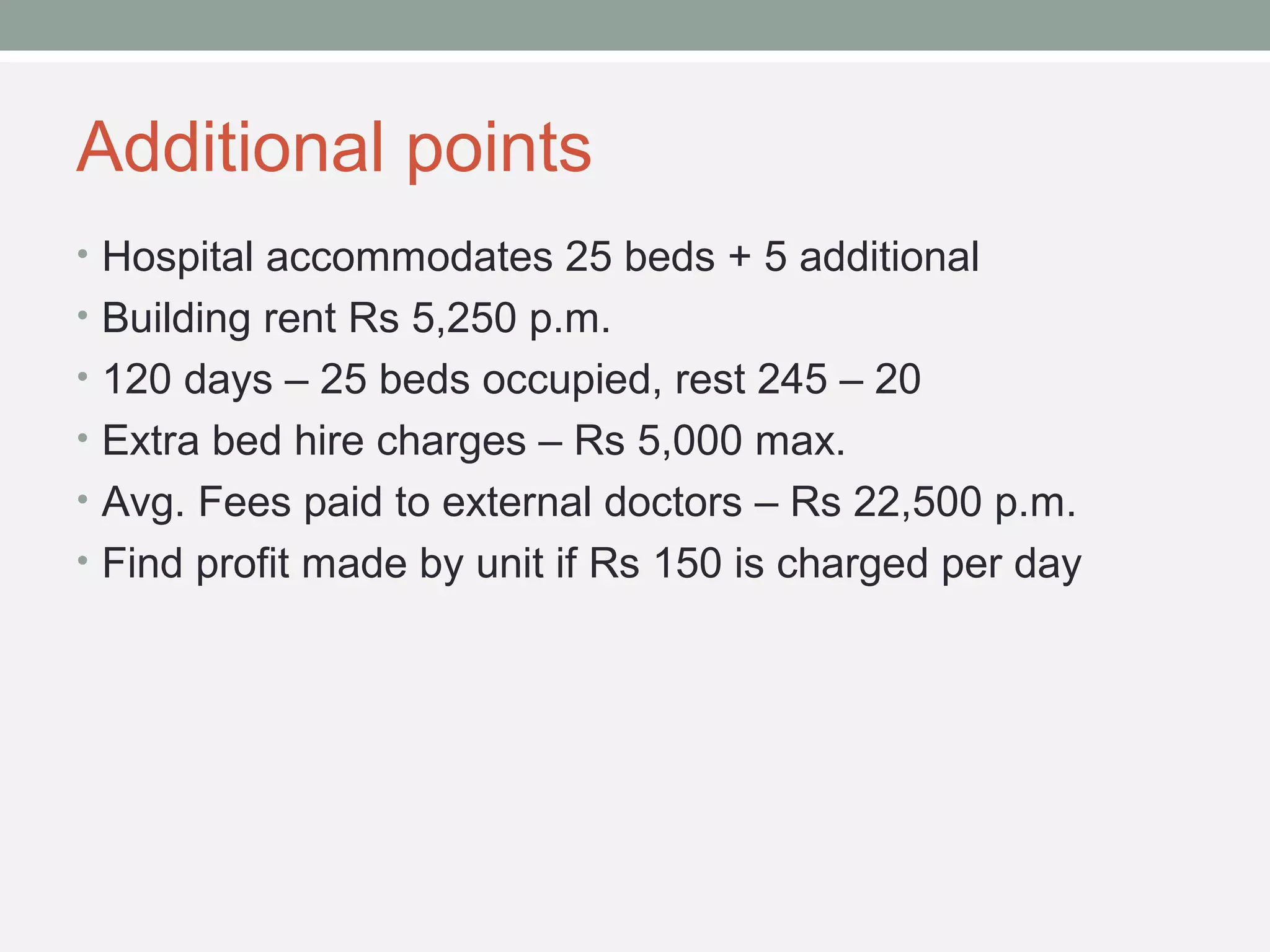

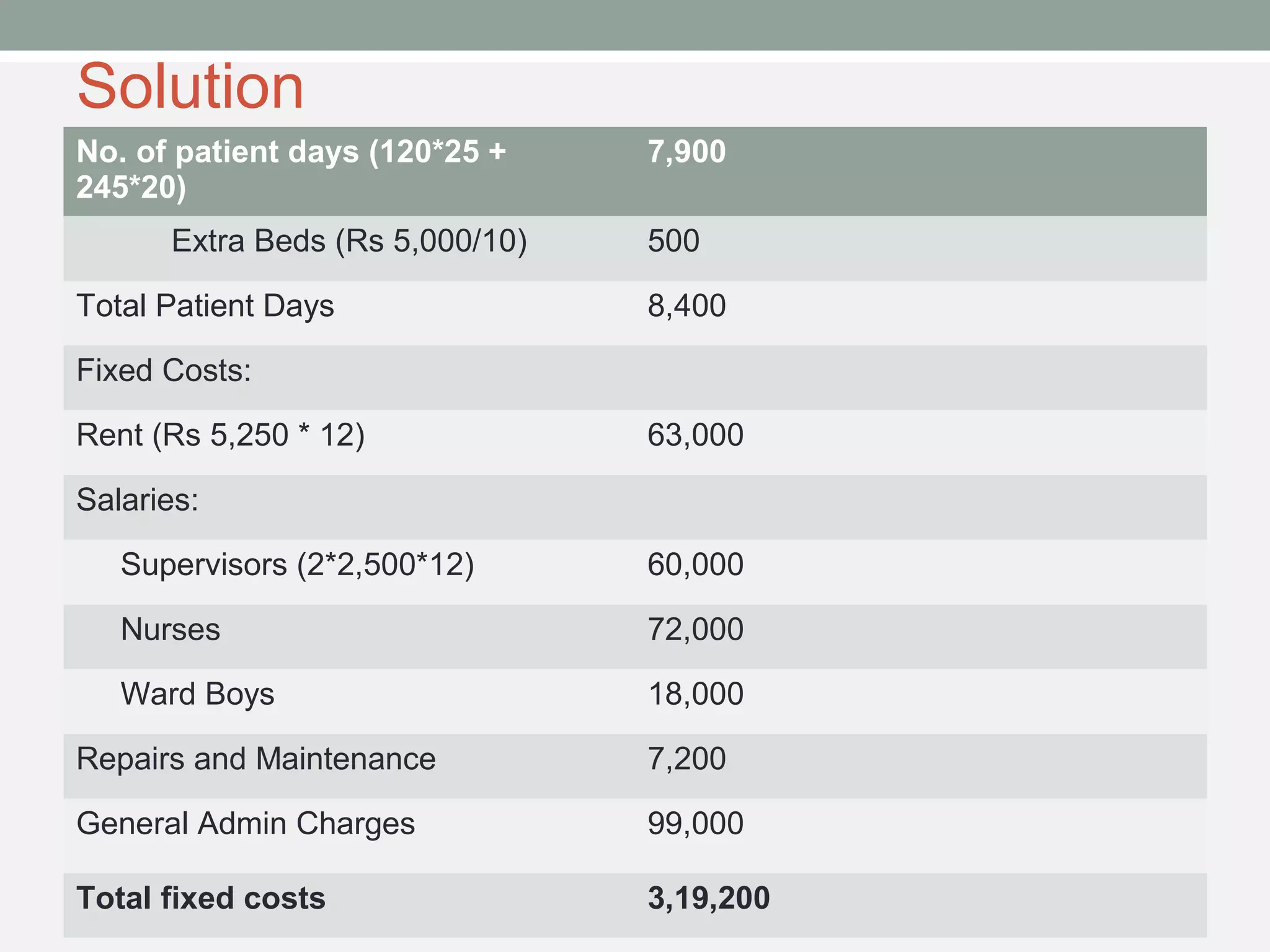

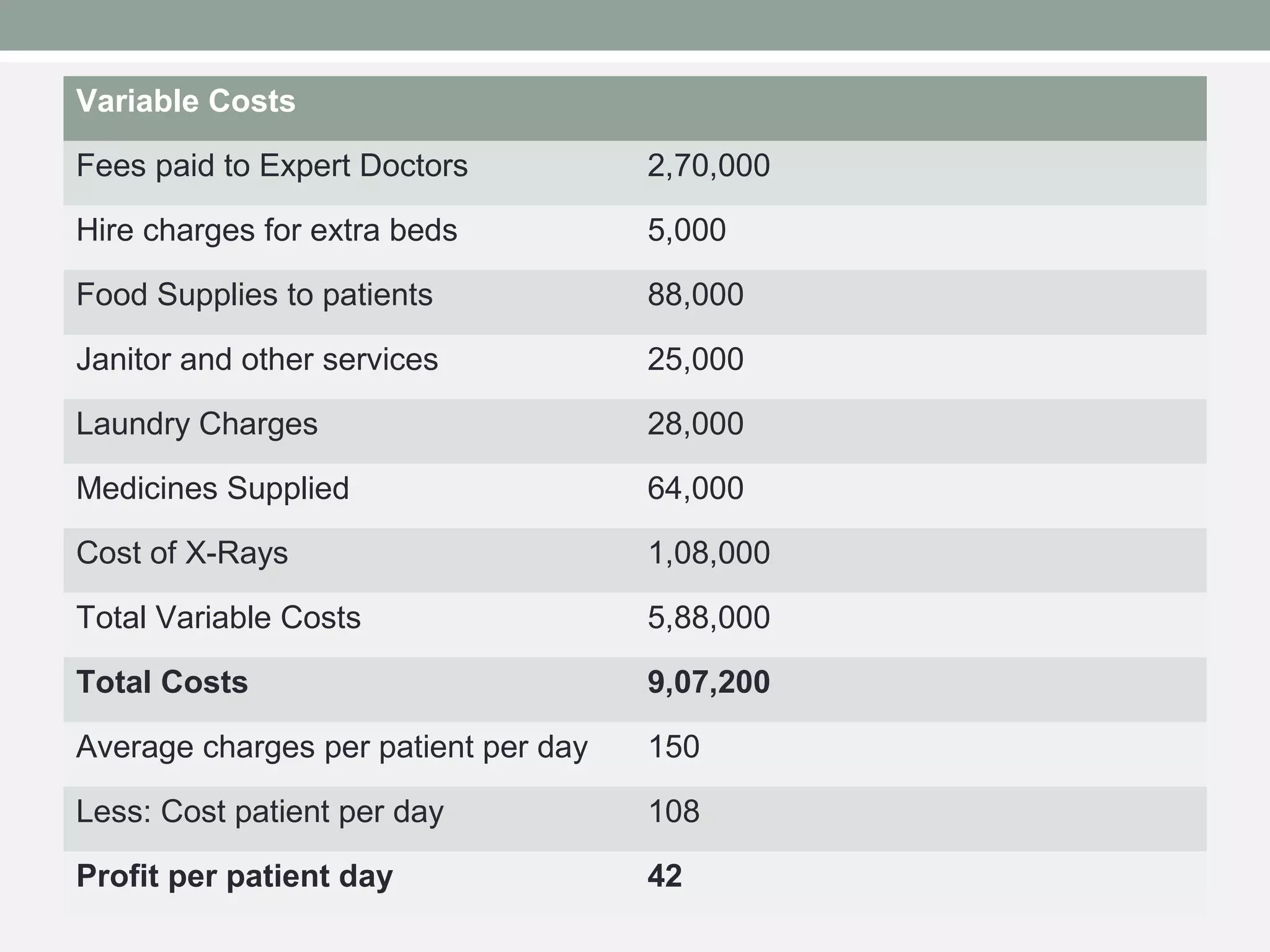

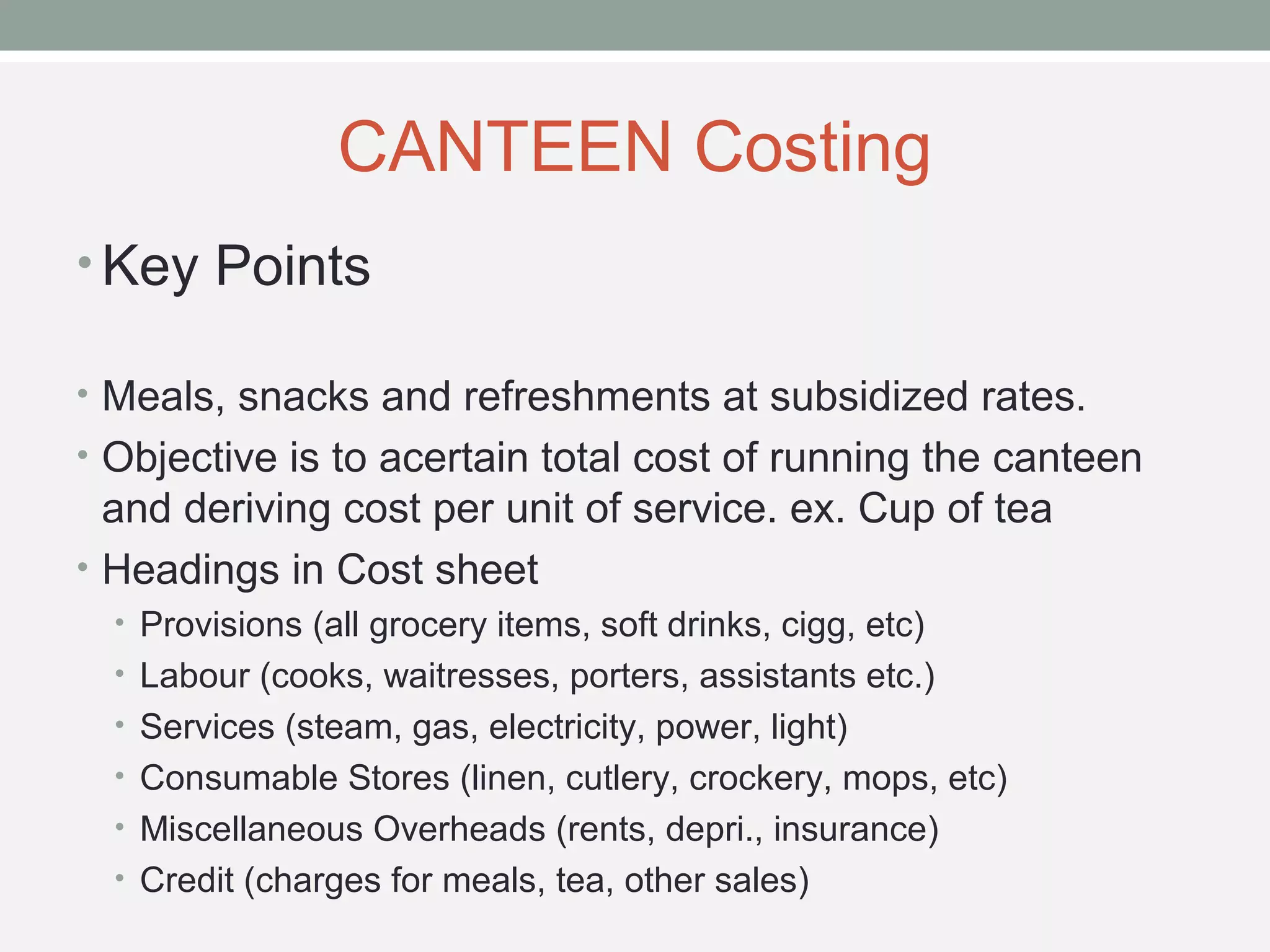

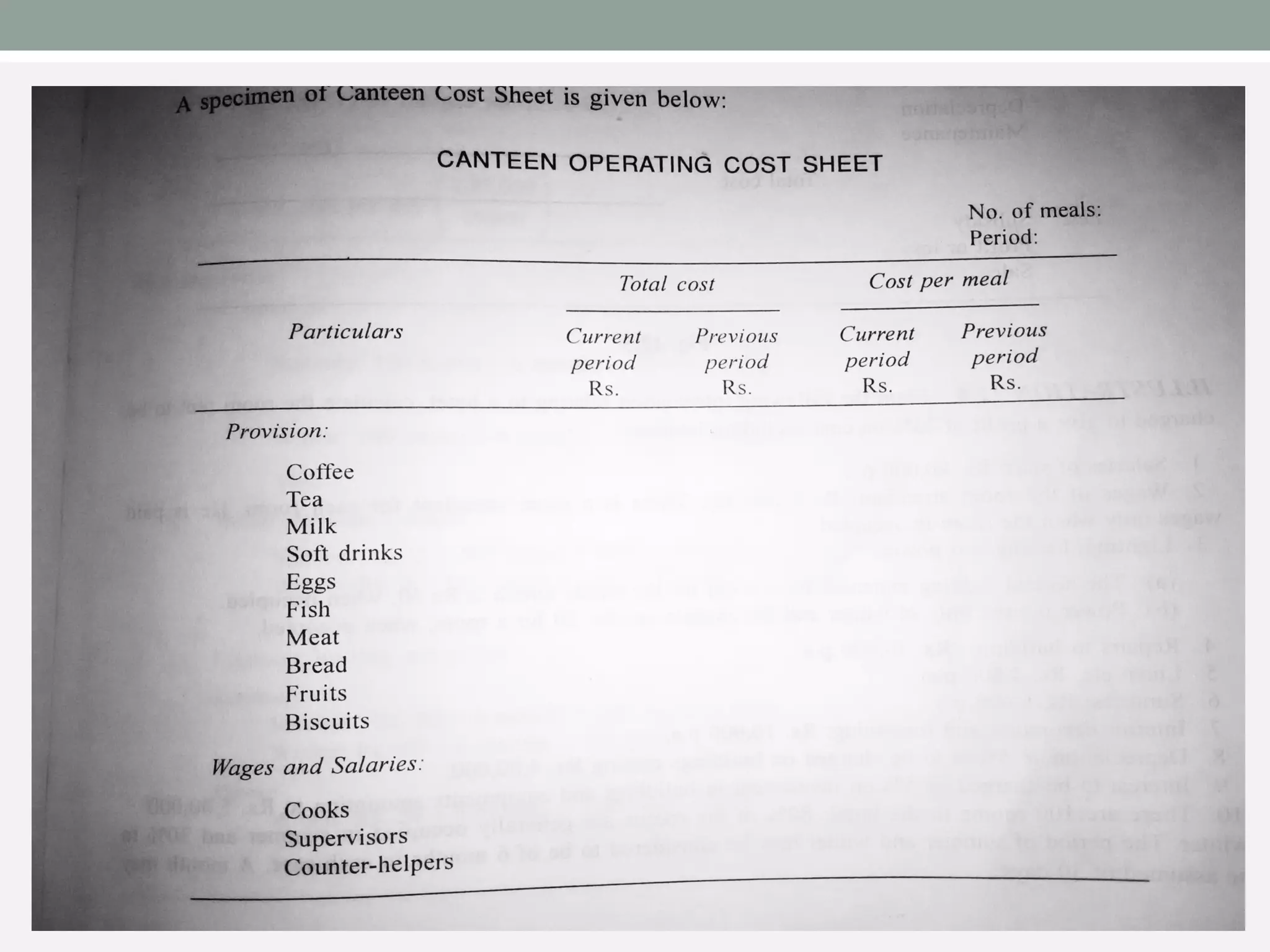

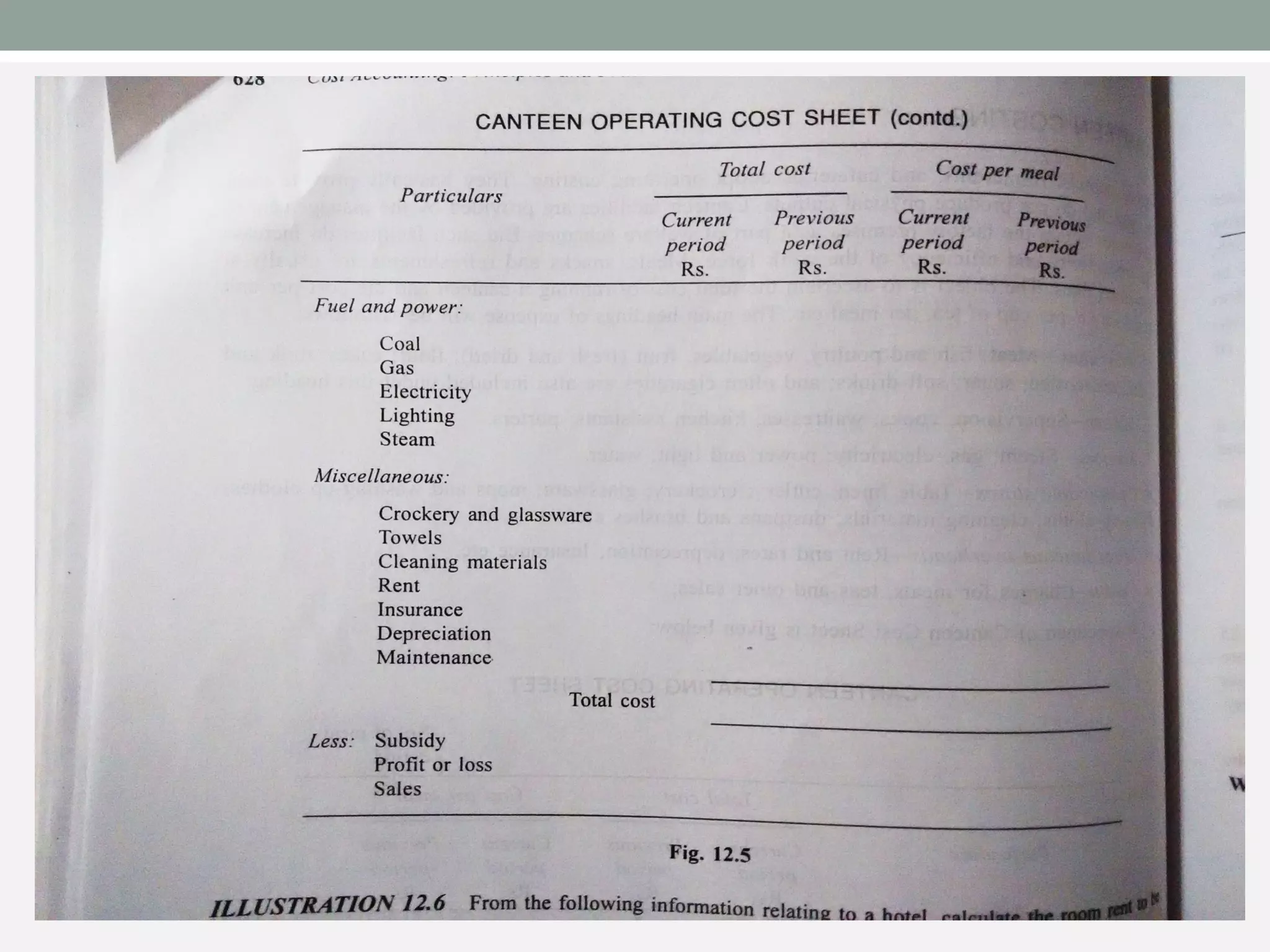

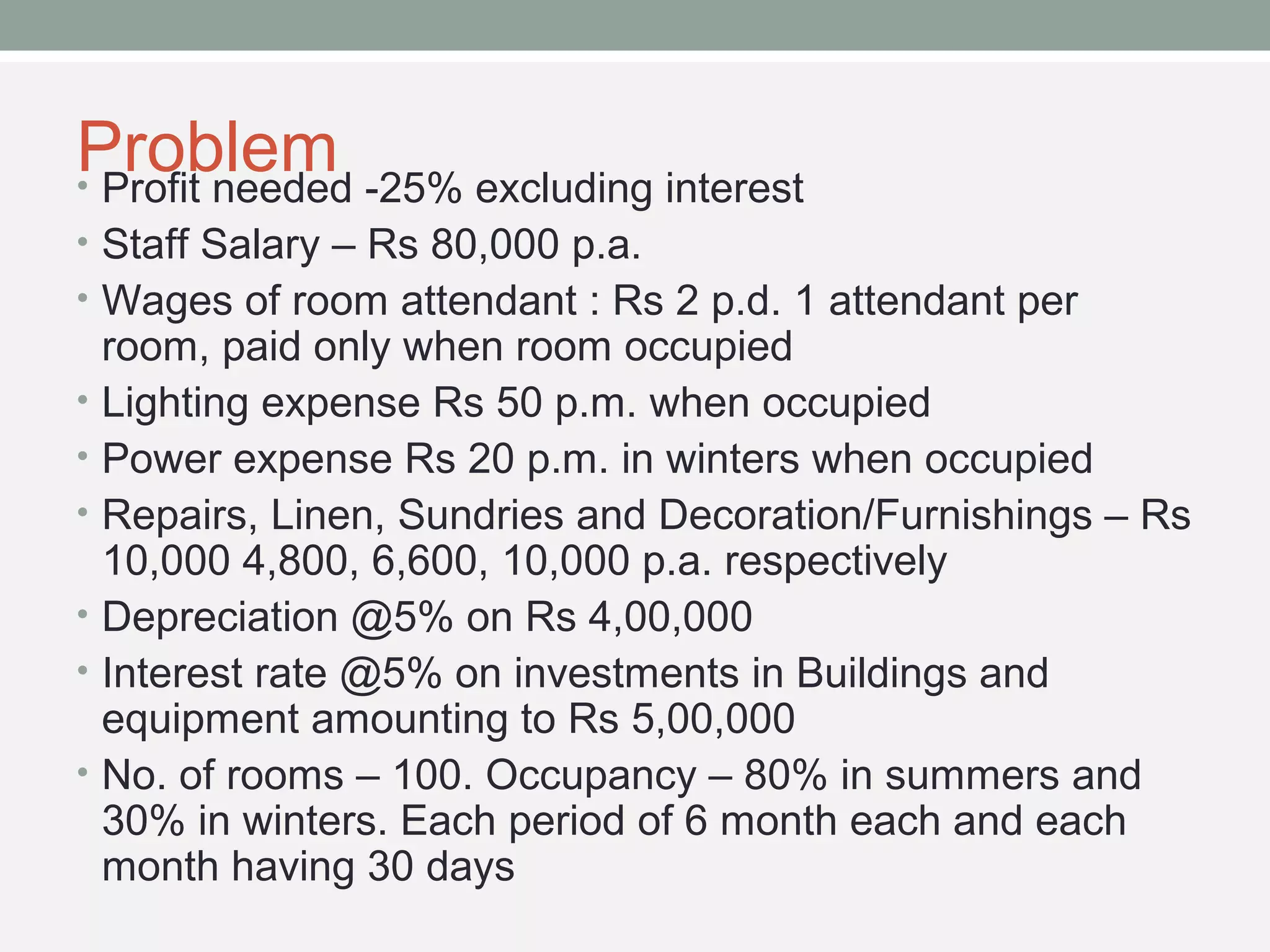

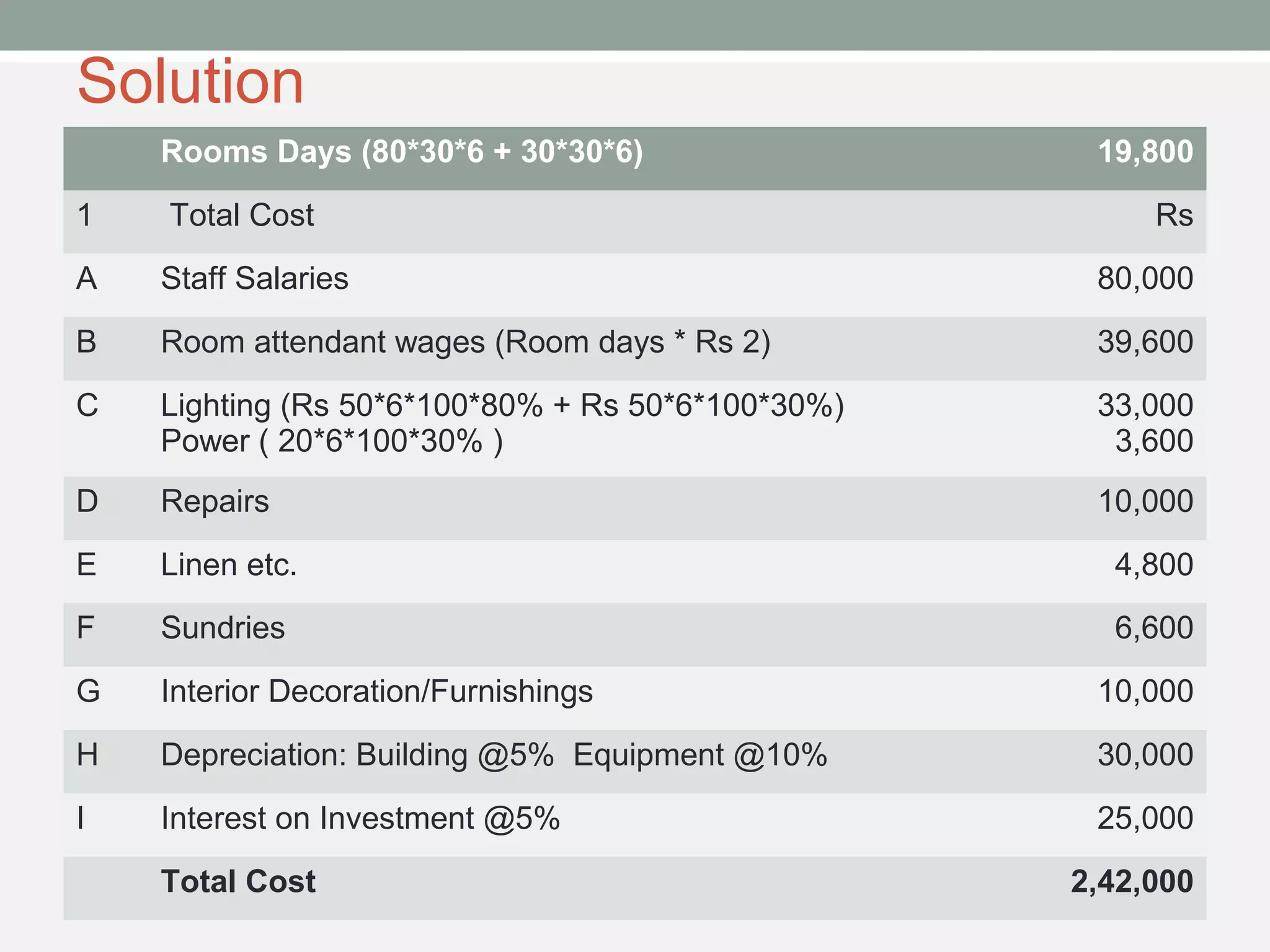

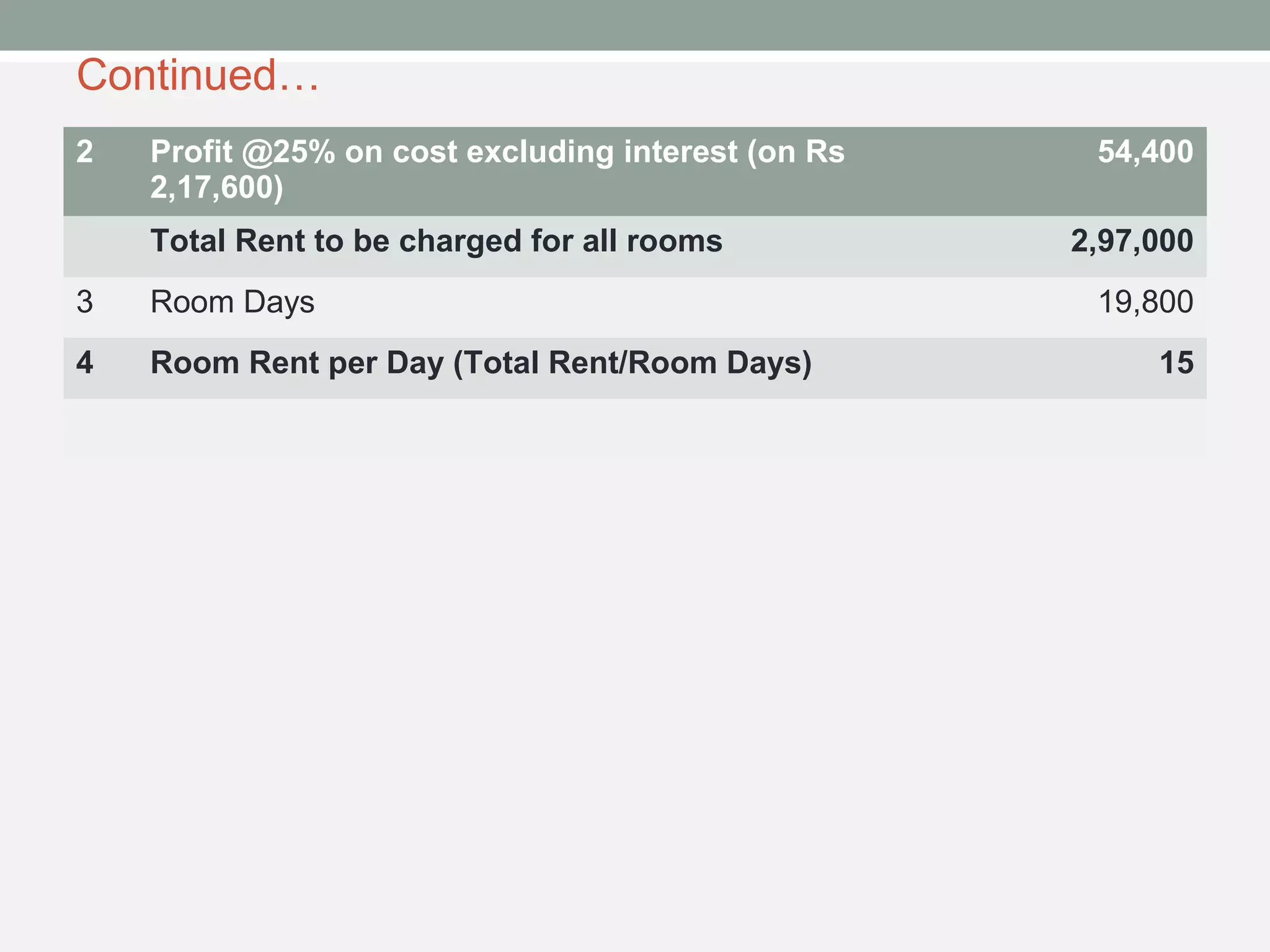

Operating costing, also known as service costing, is focused on ascertaining and managing costs in service-oriented industries that do not produce tangible products, such as transportation, hospitals, and utilities. The method involves distinguishing between fixed, semi-variable, and variable costs, and applying specific cost units for different service types to calculate expenses accurately. The document provides detailed examples, including transport costing, hospital costing, and canteen costing, along with calculations for determining rates and costs associated with these services.