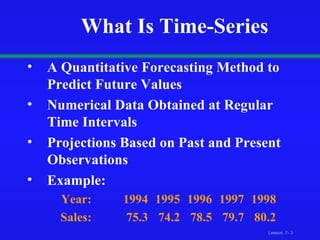

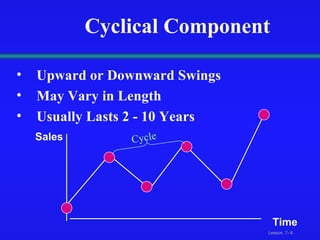

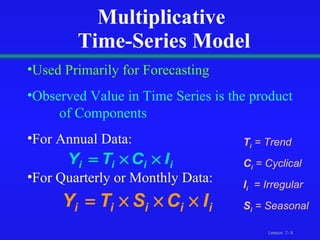

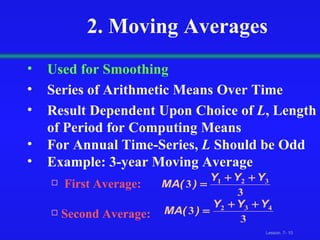

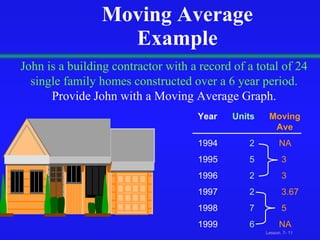

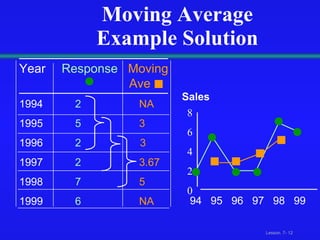

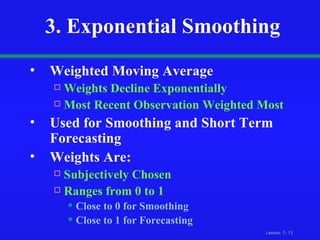

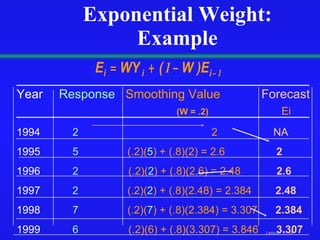

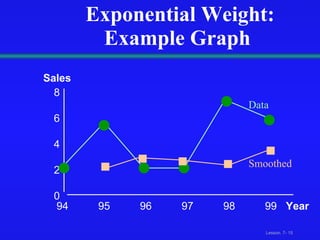

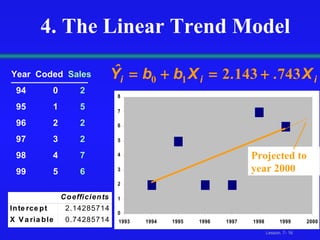

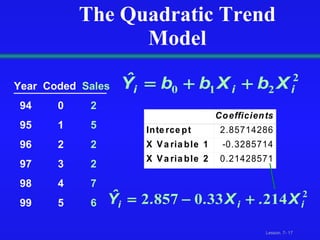

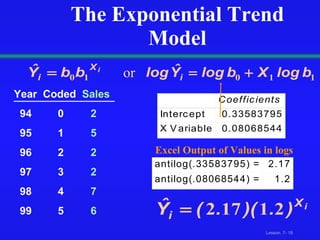

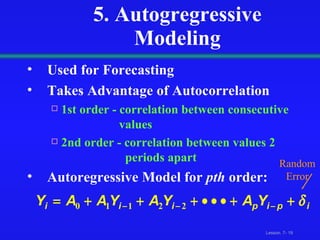

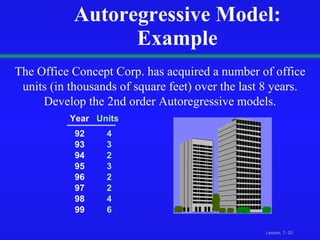

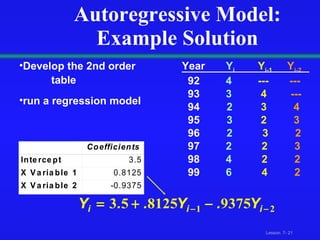

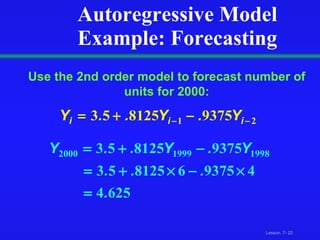

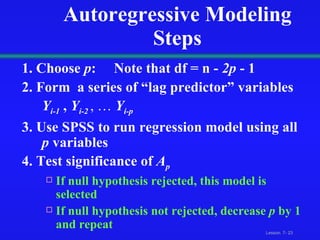

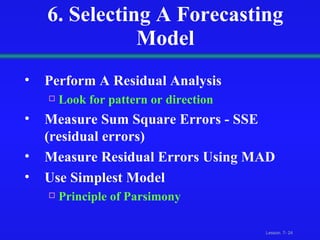

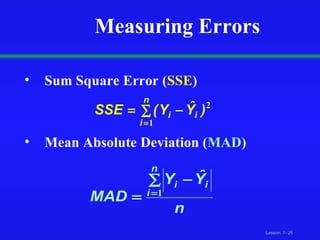

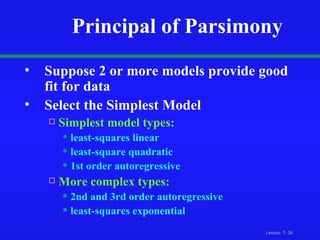

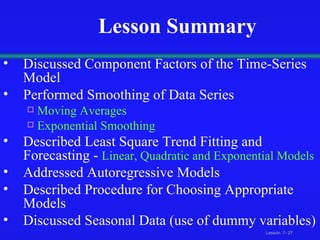

This document discusses various techniques for time-series analysis and forecasting, including decomposition methods, smoothing methods like moving averages, exponential smoothing, and trend and autoregressive models. It covers identifying components like trend and seasonality, fitting linear, quadratic and exponential trend models, developing autoregressive models of different orders, and selecting the appropriate forecasting model based on residual analysis and model simplicity.