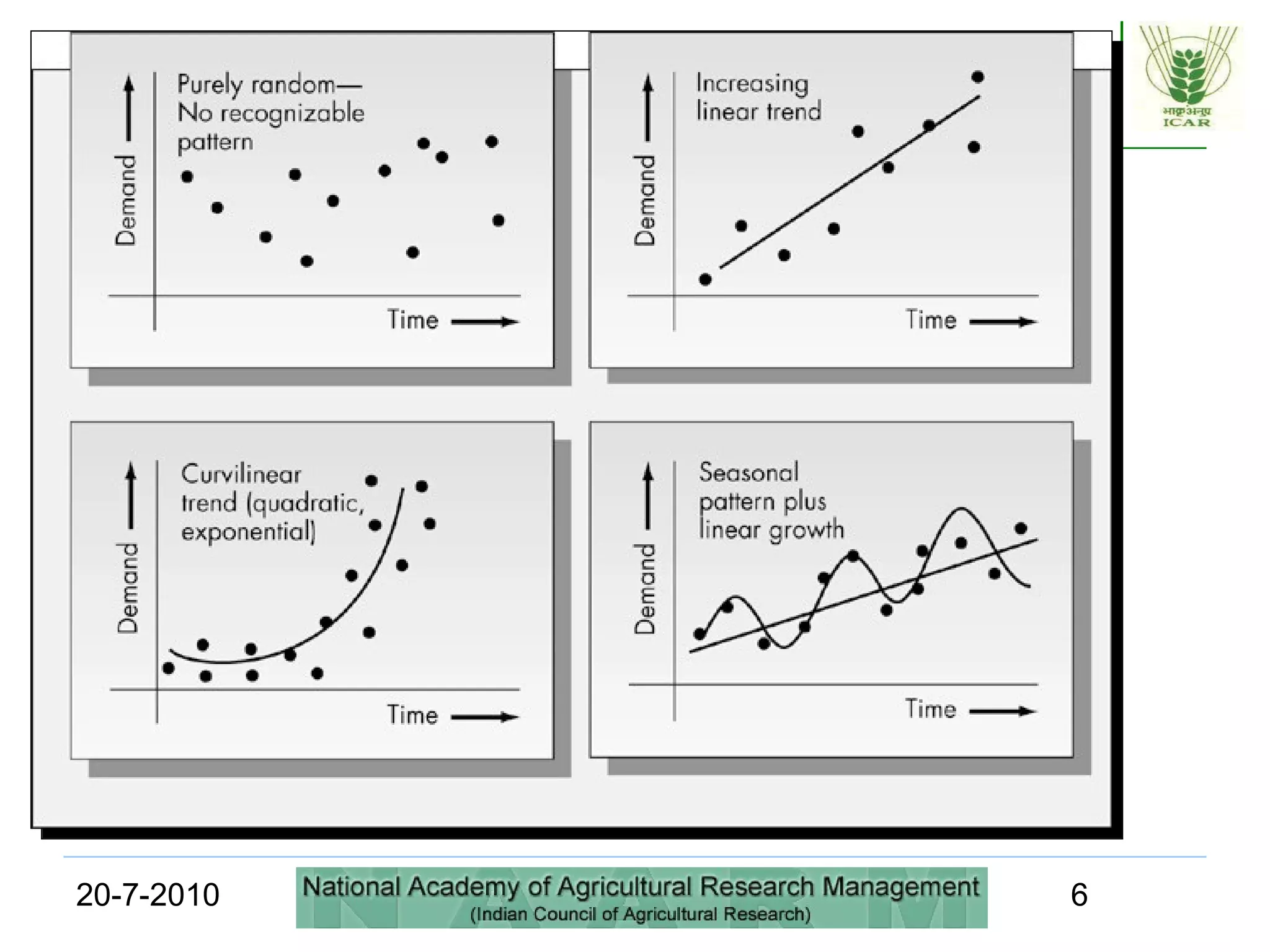

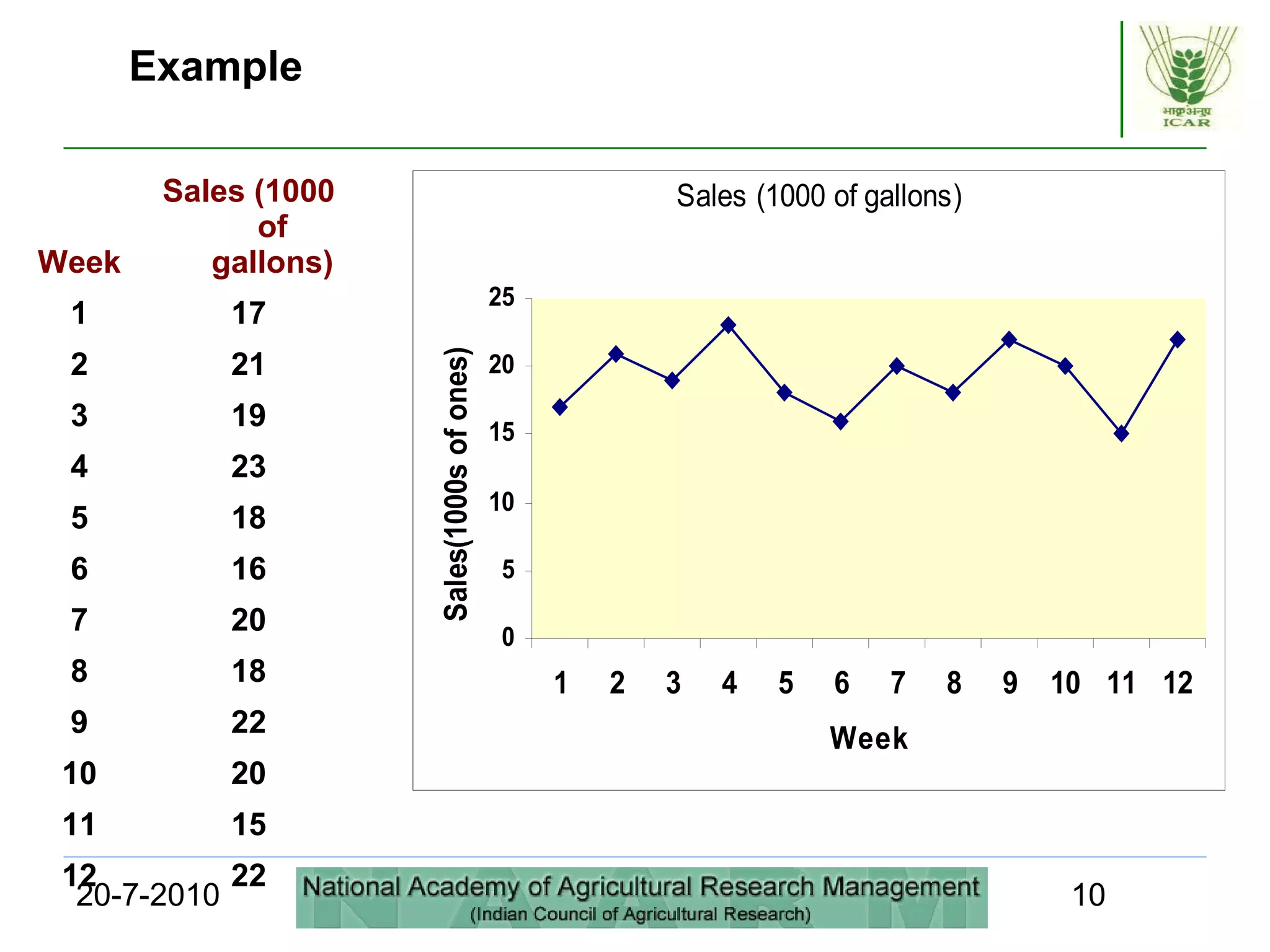

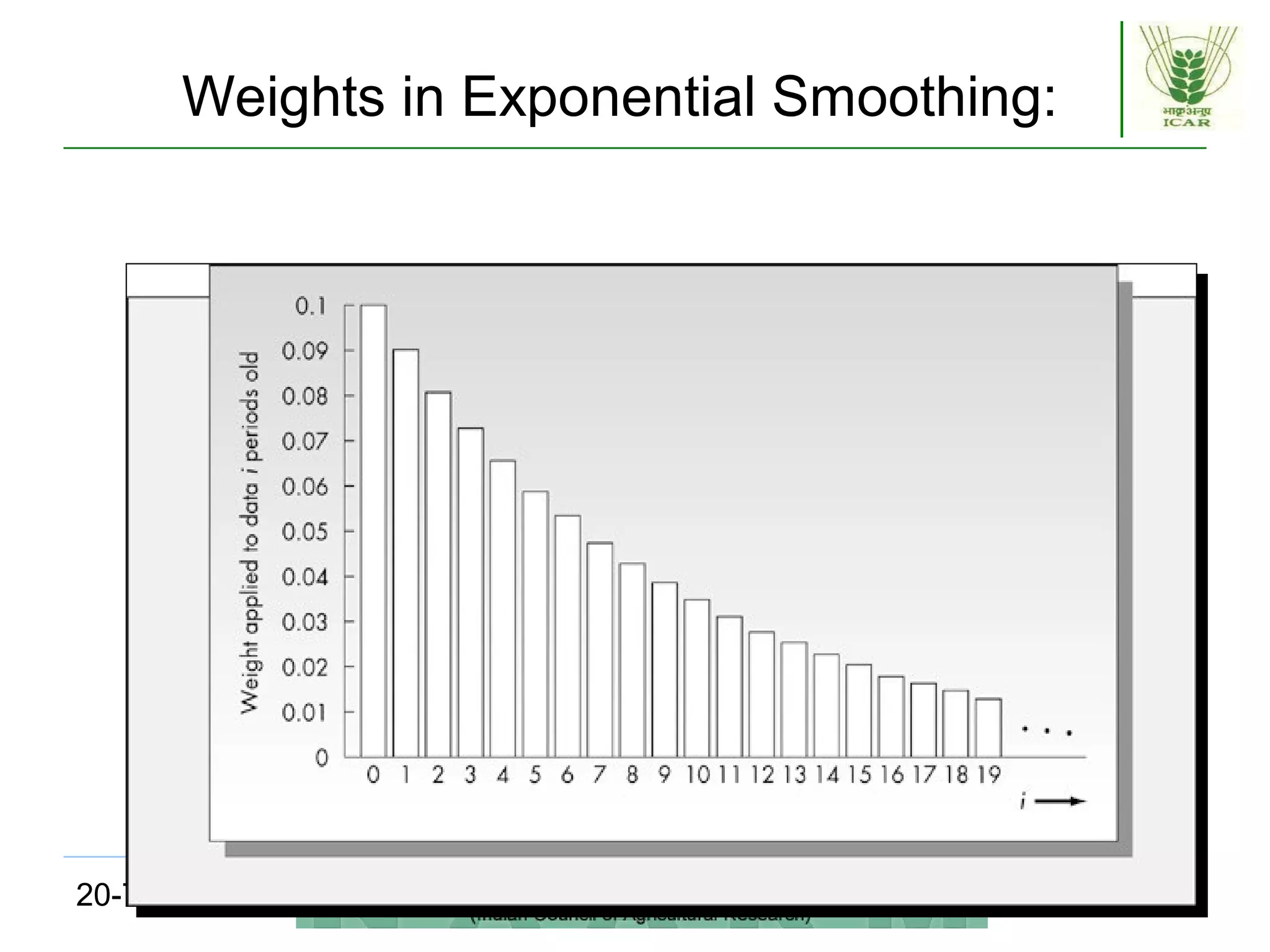

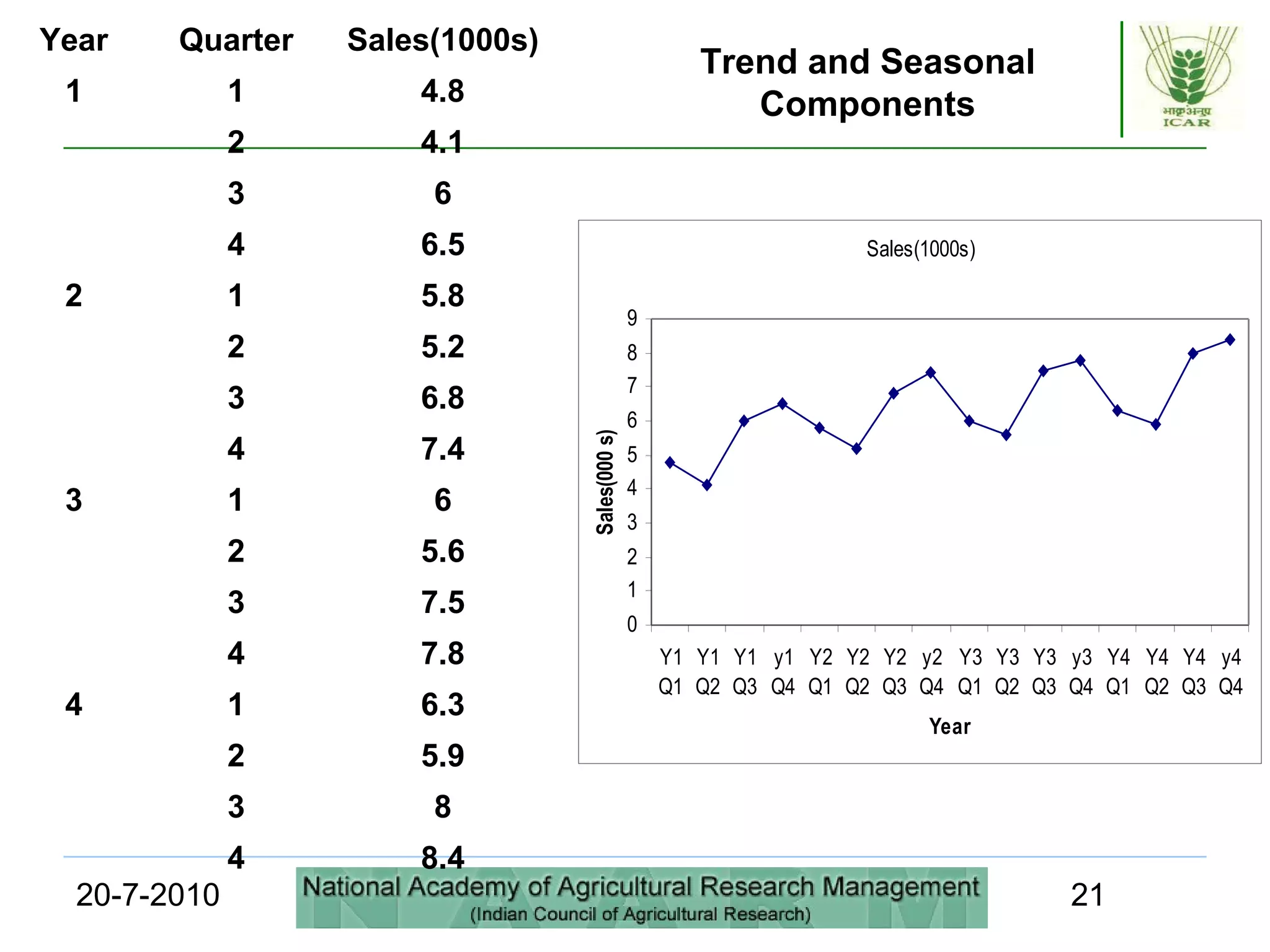

This document discusses quantitative forecasting methods, including time series and causal models. It covers key time series components like trend, seasonality, and cycles. Three main time series methods are described: smoothing, trend projection, and trend projection adjusted for seasonal influence. Moving averages and exponential smoothing are explained as common techniques for forecasting stationary time series. The document also covers decomposing a time series into trend, seasonal, and irregular components. Regression methods are mentioned as another approach when a trend is present in the data.