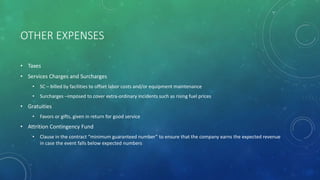

This document discusses budgeting for events by outlining potential sources of revenue including sponsorships, donations, ticket sales, and fees. It also categorizes expenses as fixed like personnel salaries and transportation or variable like food and beverage. Financial statements are presented as tools to track the financial status of an event, including the balance sheet, income statement, and statement of cash flow.