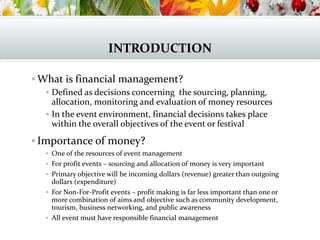

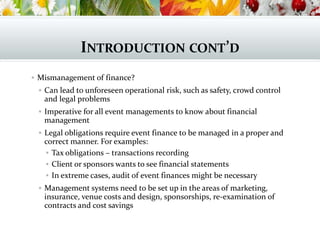

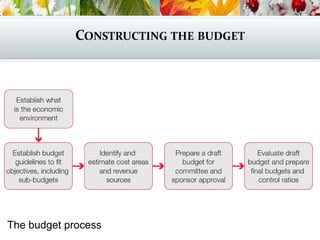

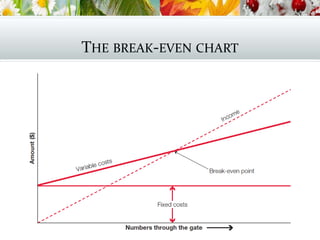

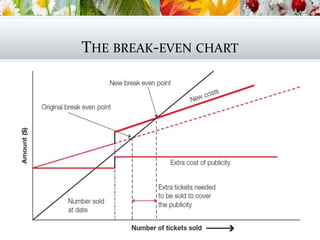

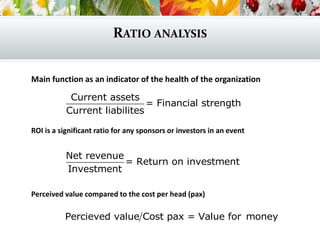

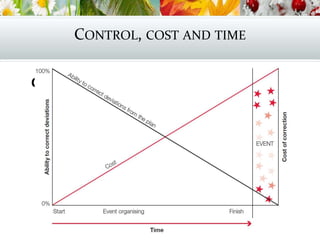

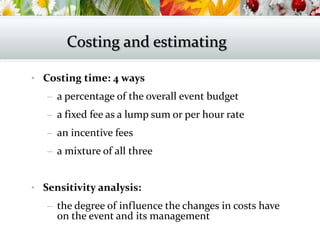

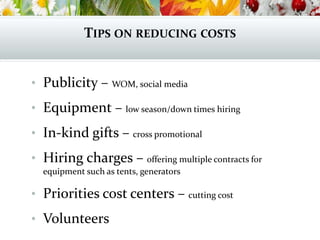

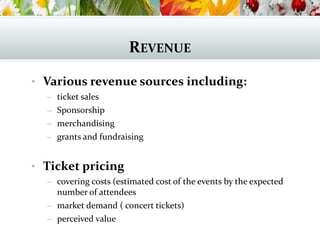

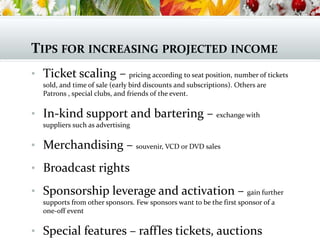

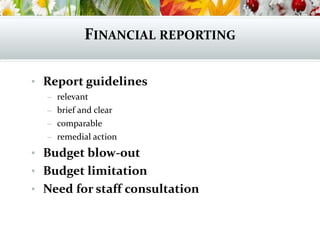

This document provides an overview of financial management for events. It discusses the importance of financial management, how to create an event budget, methods for estimating costs and ticket pricing, monitoring spending and revenues, using budgets for control, and tips for reducing costs and increasing income. The key aspects of financial management covered include creating a budget, forecasting cash flow, using ratio analysis and break-even charts for evaluation, cost estimation and control, and financial reporting.