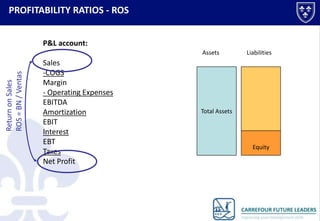

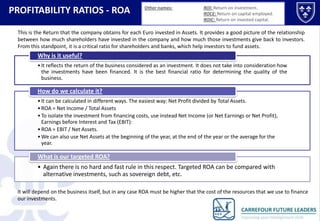

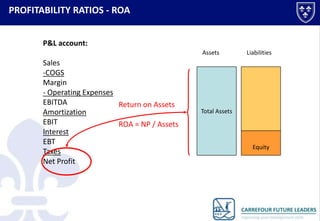

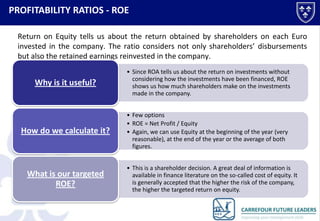

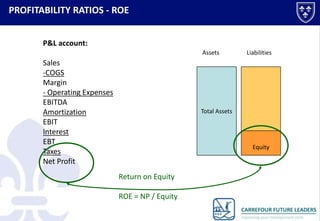

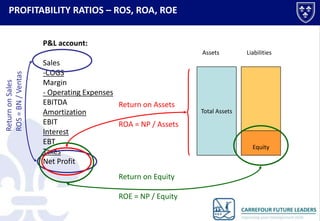

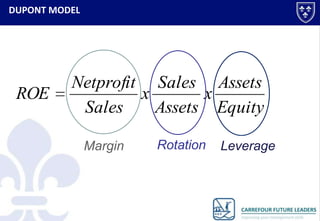

This document discusses different profitability ratios used to analyze financial performance, including return on sales (ROS), return on assets (ROA), and return on equity (ROE). ROS compares net profit to sales and shows profit as a percentage of each sale. ROA compares net profit or earnings to total assets to measure return on invested capital. ROE compares net profit to equity to measure return to shareholders. The document provides formulas to calculate each ratio and explains they are useful for comparing performance over time, against competitors, and targeted levels that depend on business risk.