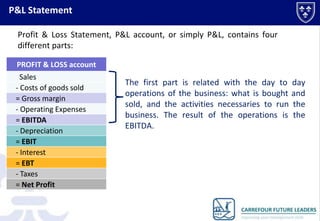

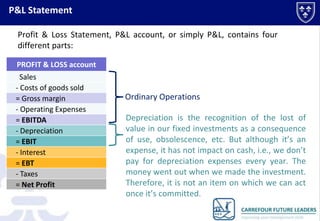

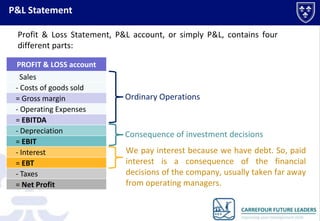

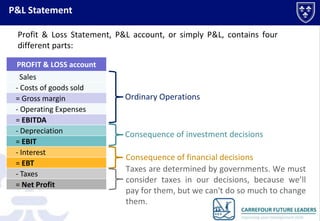

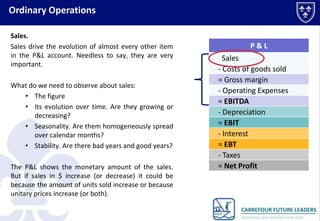

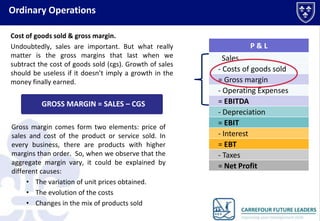

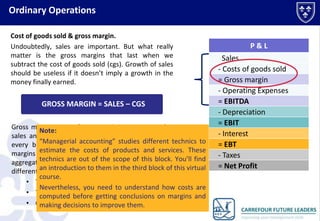

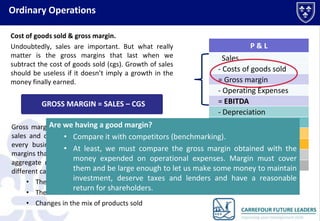

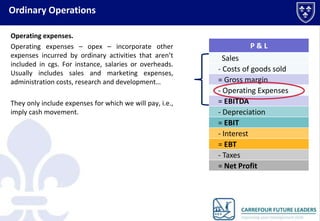

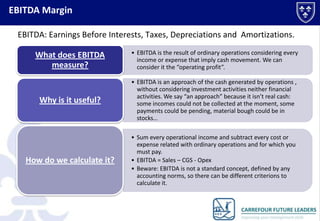

The document discusses the key components of a profit and loss (P&L) statement, including sales, cost of goods sold, gross margin, operating expenses, EBITDA, depreciation, interest, taxes, and net profit. It explains that the top part of the P&L relates to the day-to-day operations of the business, while the bottom part relates to consequences of investment and financial decisions. Gross margin is calculated as sales minus cost of goods sold and indicates the money earned after accounting for product costs. Operating expenses are other costs incurred in ordinary business activities. EBITDA represents earnings before interest, taxes, depreciation, and amortization and is a proxy for the cash generated by operations