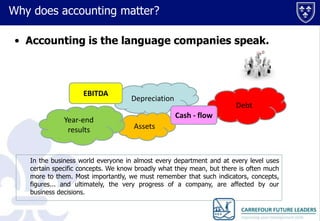

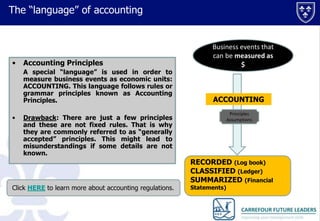

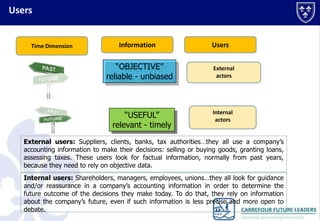

Accounting provides essential information about a company's financial situation and performance. It records, classifies, and summarizes business transactions and events in a standardized language using accounting principles. This information is important for both internal and external users. Investors, managers, and other decision makers rely on accounting data to assess the company's profitability, debts, cash flows, and overall financial position over time. How financial information is presented can influence perceptions of the company, so it is important for managers to understand accounting and ensure the reports provide a true and fair view.