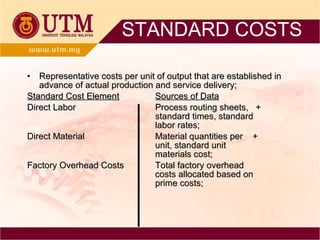

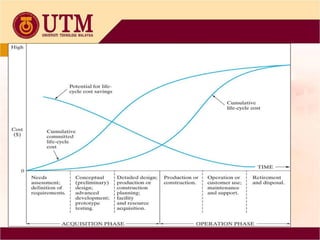

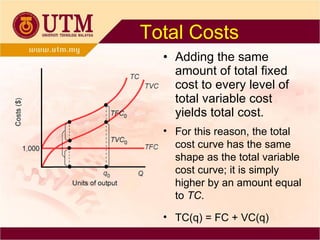

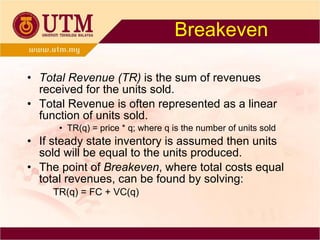

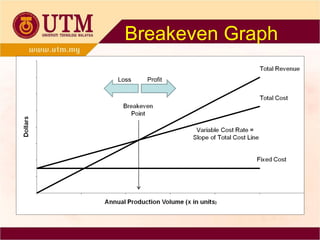

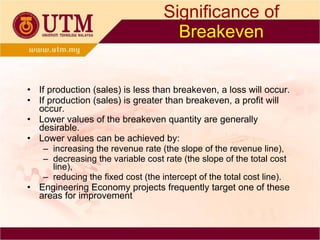

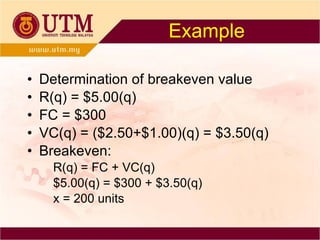

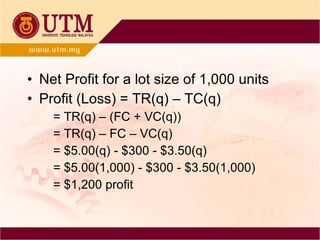

Cost estimating is used to determine project costs, profitability, and productivity improvements. The top-down approach uses historical data from similar projects, while the bottom-up approach breaks costs down into small units. Costs can be categorized as fixed, variable, incremental, direct, indirect, standard, opportunity, life-cycle, cash, book, and sunk. Breakeven analysis determines the production level where total revenue equals total costs.