This document provides an overview of economics concepts for engineers, including:

1. Economic decision making involves factors like price, availability, and quality of raw materials. Life cycle costing adds up all costs of an asset over its lifetime.

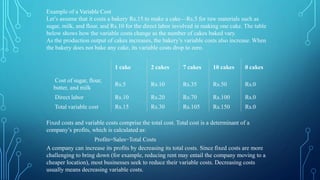

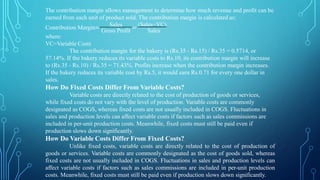

2. Fixed costs do not change with production levels, like rent or insurance. Variable costs change based on production, like materials.

3. Opportunity cost is the potential benefit missed from choosing one alternative over another. It represents the return that could have been earned by taking the next best alternative.

4. Life cycle costing adds up all costs associated with an asset from purchase to disposal, excluding salvage value. It provides a more accurate total cost estimate than initial