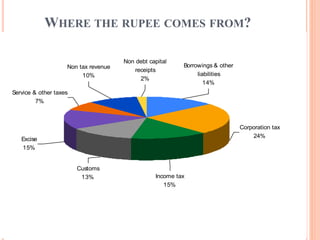

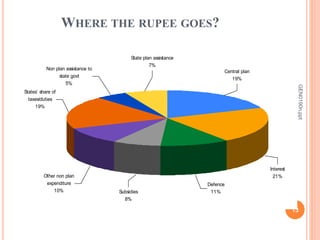

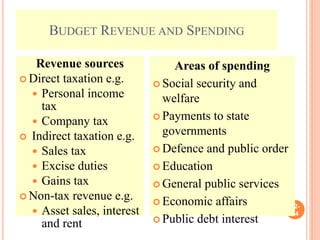

This document discusses budgetary deficits, including defining a budget and budget deficit, types of budgetary deficits, ways governments finance deficits, and causes and effects of deficits. It notes that governments can finance deficits through borrowing from the private sector, central bank, public, or overseas. Deficits can be caused by lack of cash flow, delayed collections, or economic downturn. While deficits can fund investments, wasteful spending is bad. The document also outlines India's budget revenues, expenditures, and implications of a large deficit for India's economic growth and inflation.