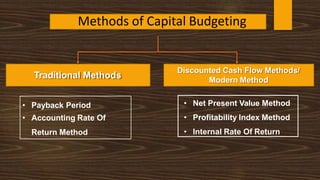

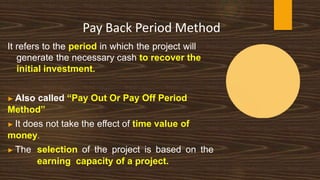

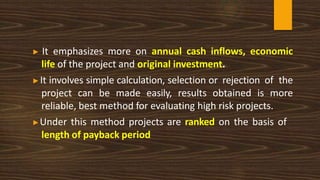

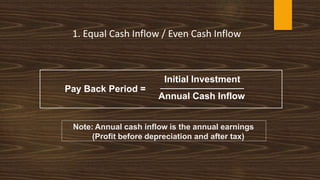

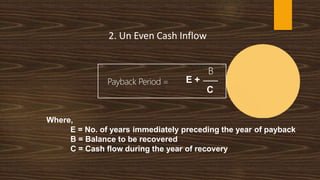

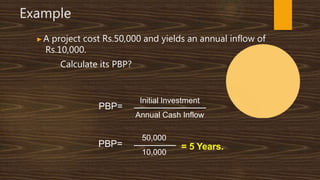

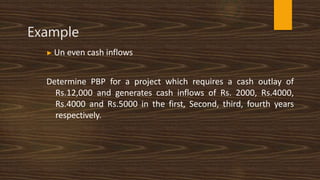

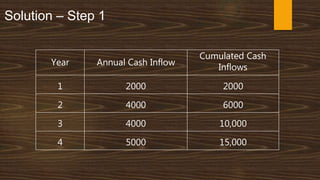

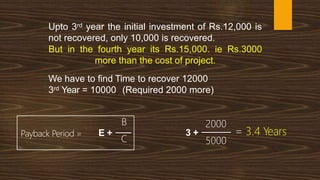

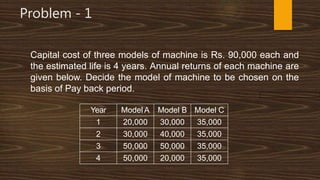

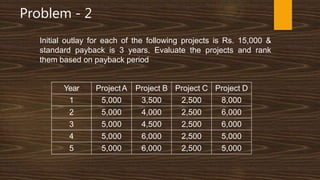

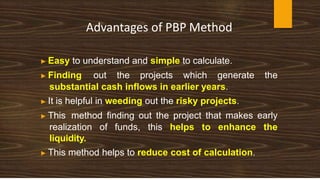

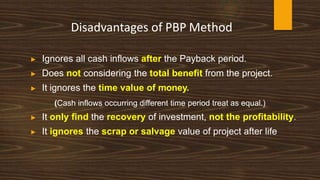

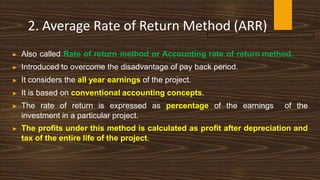

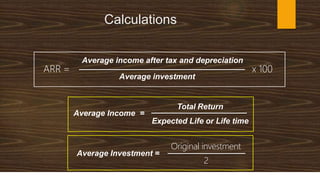

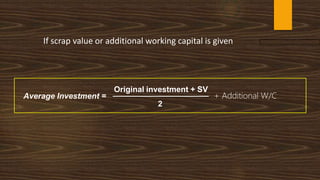

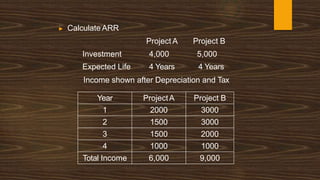

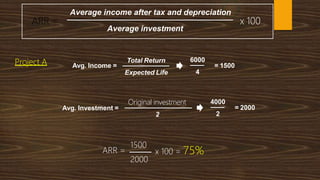

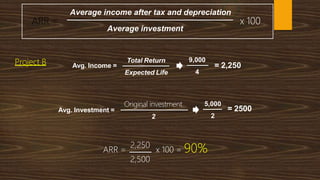

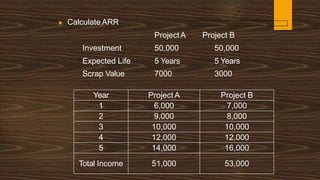

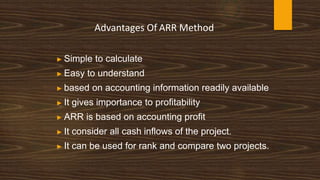

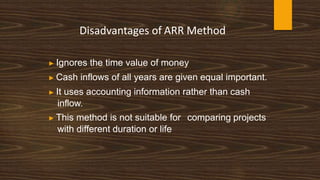

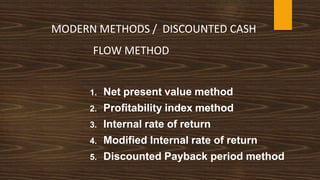

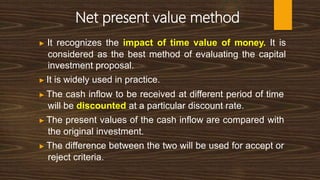

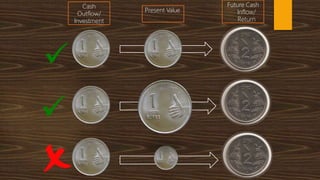

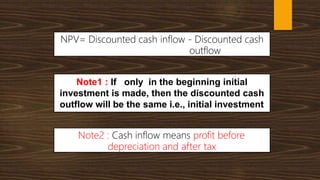

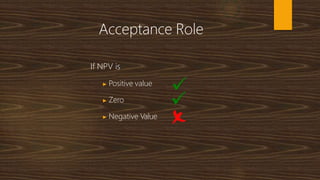

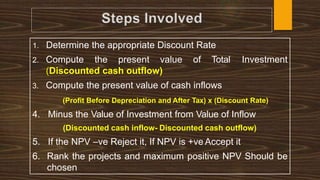

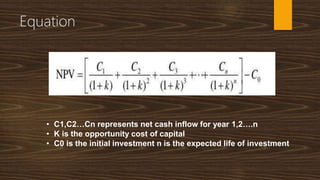

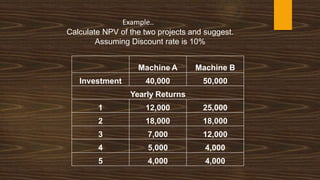

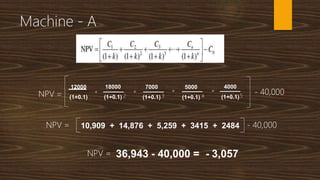

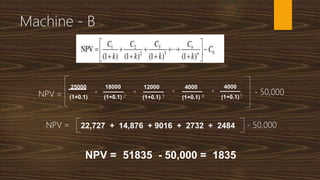

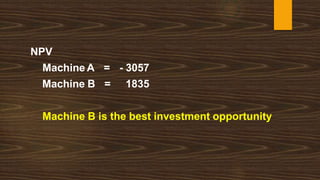

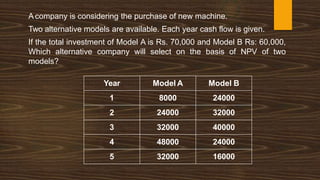

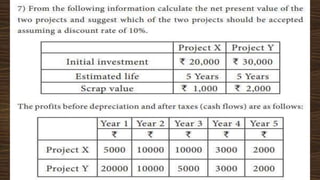

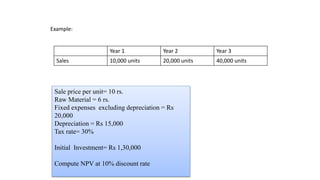

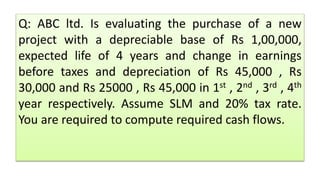

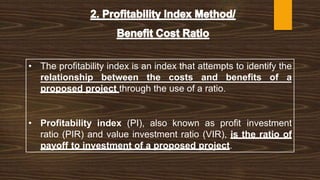

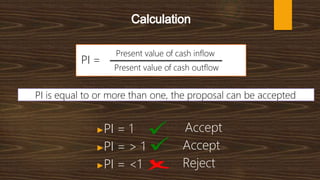

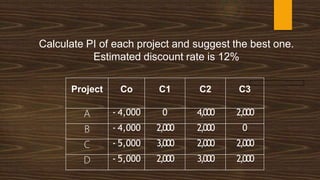

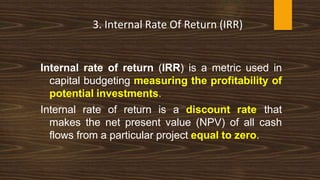

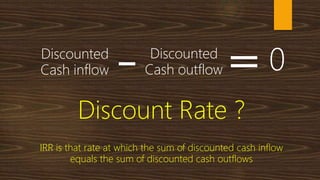

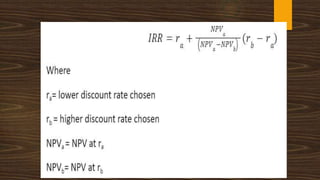

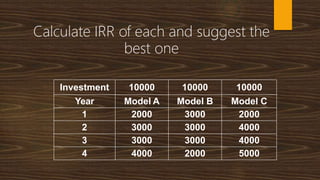

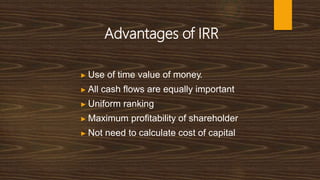

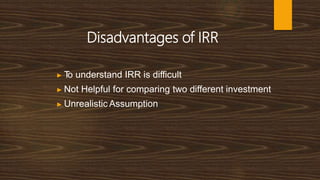

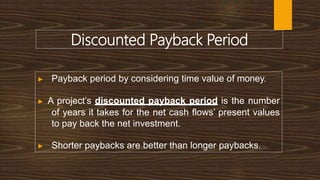

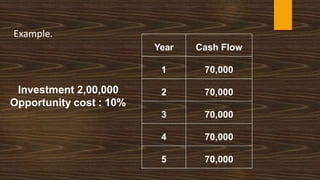

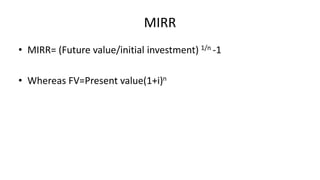

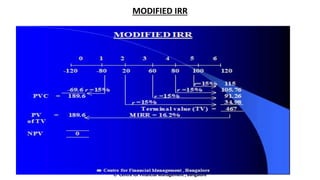

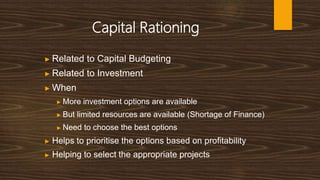

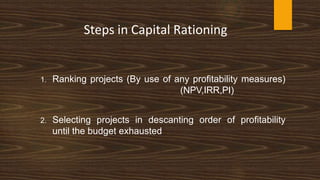

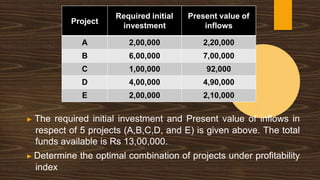

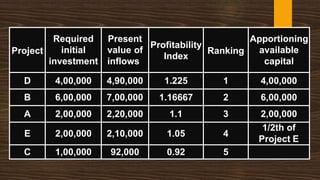

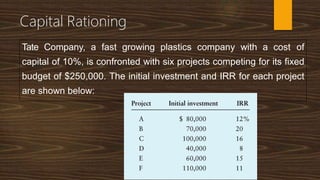

The document discusses various capital budgeting techniques used to evaluate long-term investment projects. It defines capital budgeting as the process of planning and approving large capital expenditures. Several traditional methods are described, including payback period and accounting rate of return. Payback period calculates the years to recover the initial investment, while accounting rate of return expresses profits as a percentage of average investment. Modern discounted cash flow methods take the time value of money into account, such as net present value (NPV) which discounts future cash flows to determine if a project's present value exceeds the initial investment. The document provides examples of calculating project metrics using these various capital budgeting techniques.