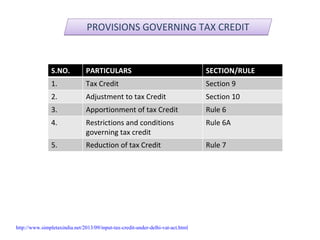

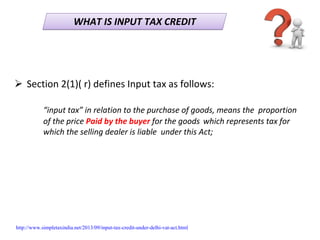

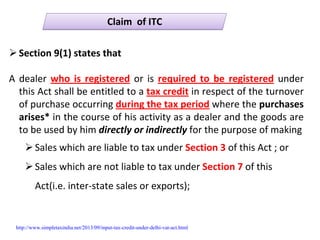

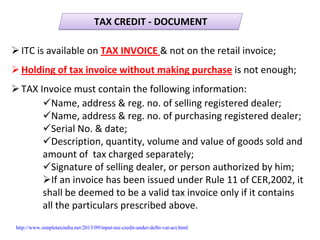

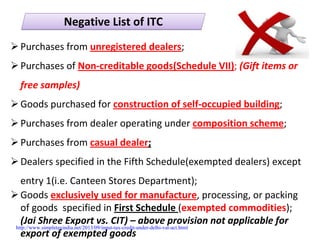

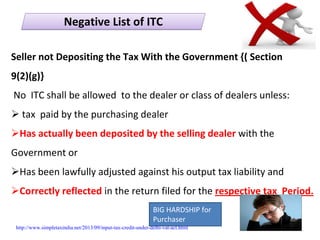

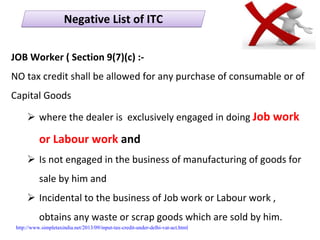

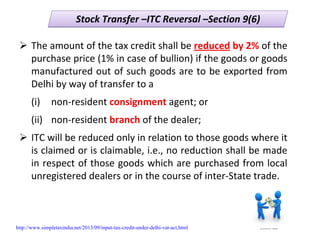

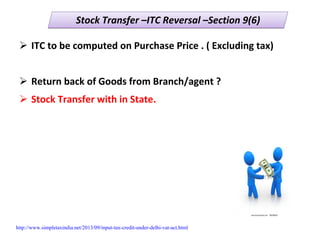

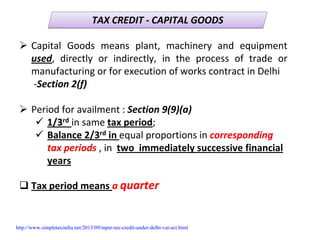

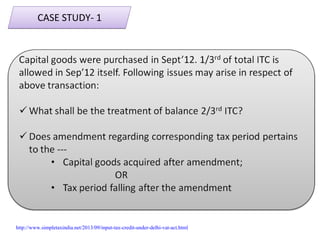

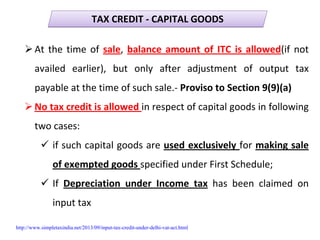

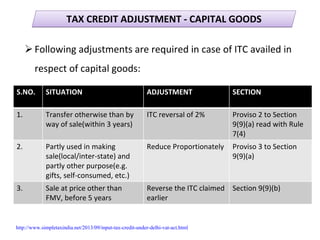

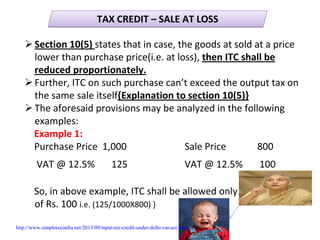

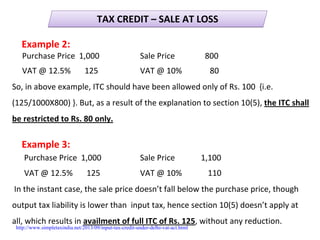

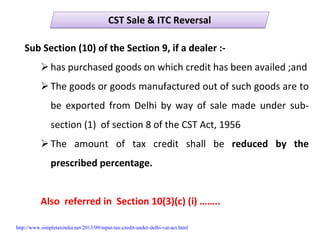

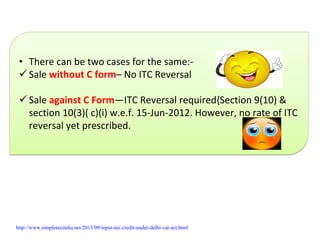

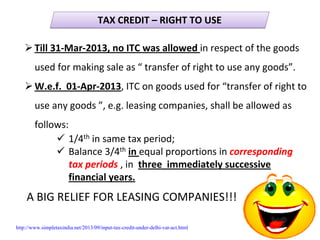

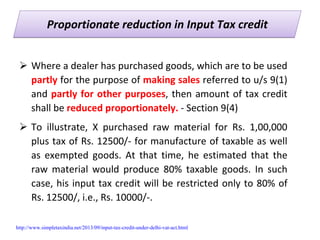

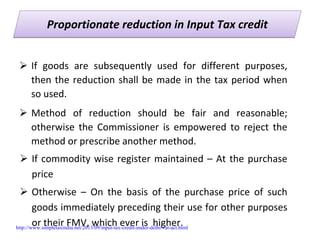

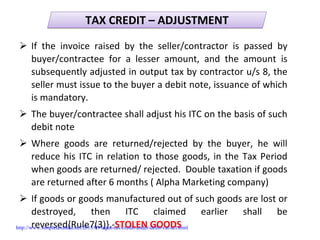

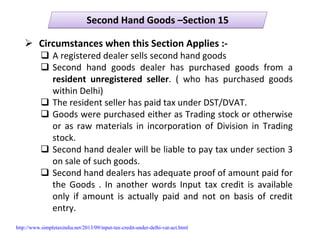

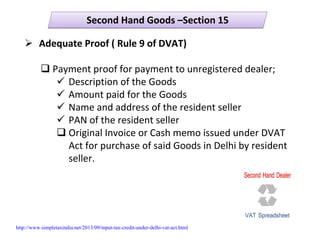

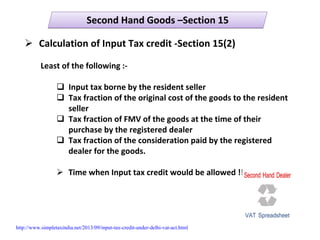

The document discusses input tax credit provisions under the Delhi VAT Act. It provides definitions and rules around claiming input tax credit, including eligible purchases, required documents, capital goods provisions, restrictions and conditions, adjustments required in certain cases, and examples. Key aspects covered include how input tax credit is only available for tax paid purchases from registered dealers using valid tax invoices, capital goods credits must be claimed over multiple periods, and reductions may apply for stock transfers, sales at a loss, or sales made under CST.