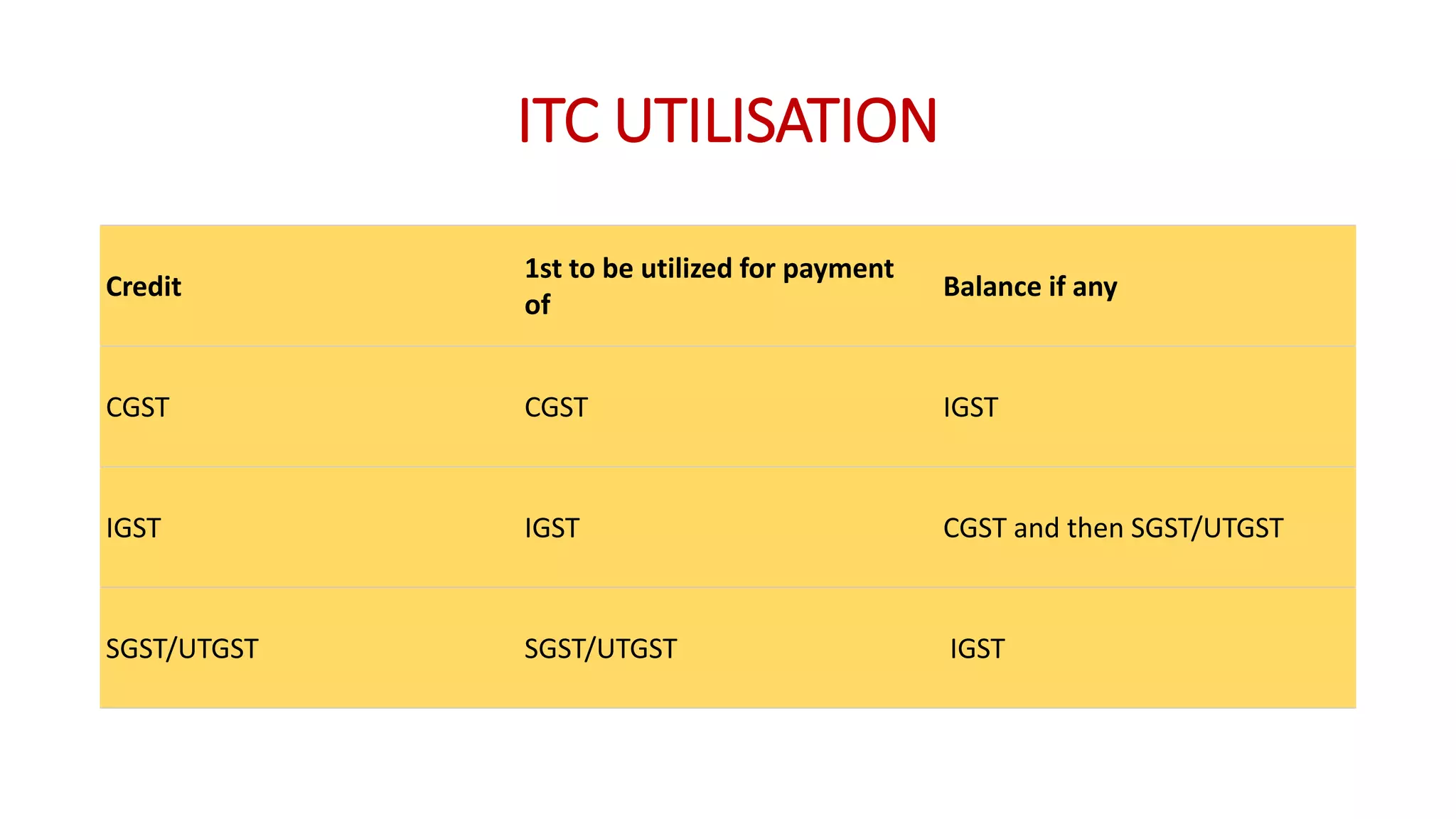

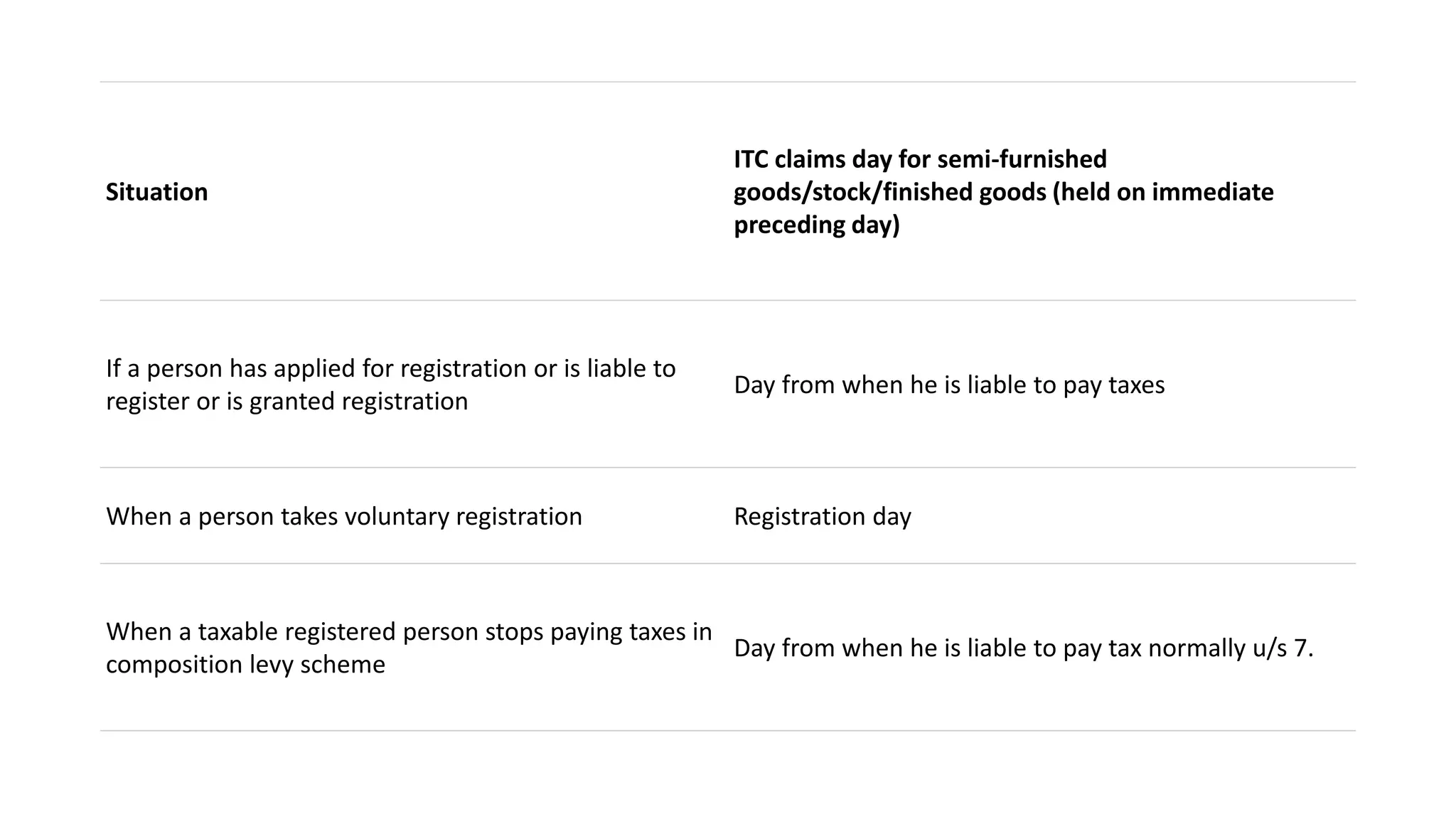

The document provides information on input tax credit under GST in India. It defines key terms like input tax, input service, capital goods, output tax, inward and outward supplies. It explains the process of availing and utilizing input tax credit and conditions that must be met like having a valid tax invoice and the supplier depositing the taxes. Certain items are ineligible for input tax credit like motor vehicles, food and beverages, life and health insurance, and works contract services for construction of immovable property. The time limit to claim input tax credit is within one year from the invoice date or the due date of filing annual return, whichever is earlier.