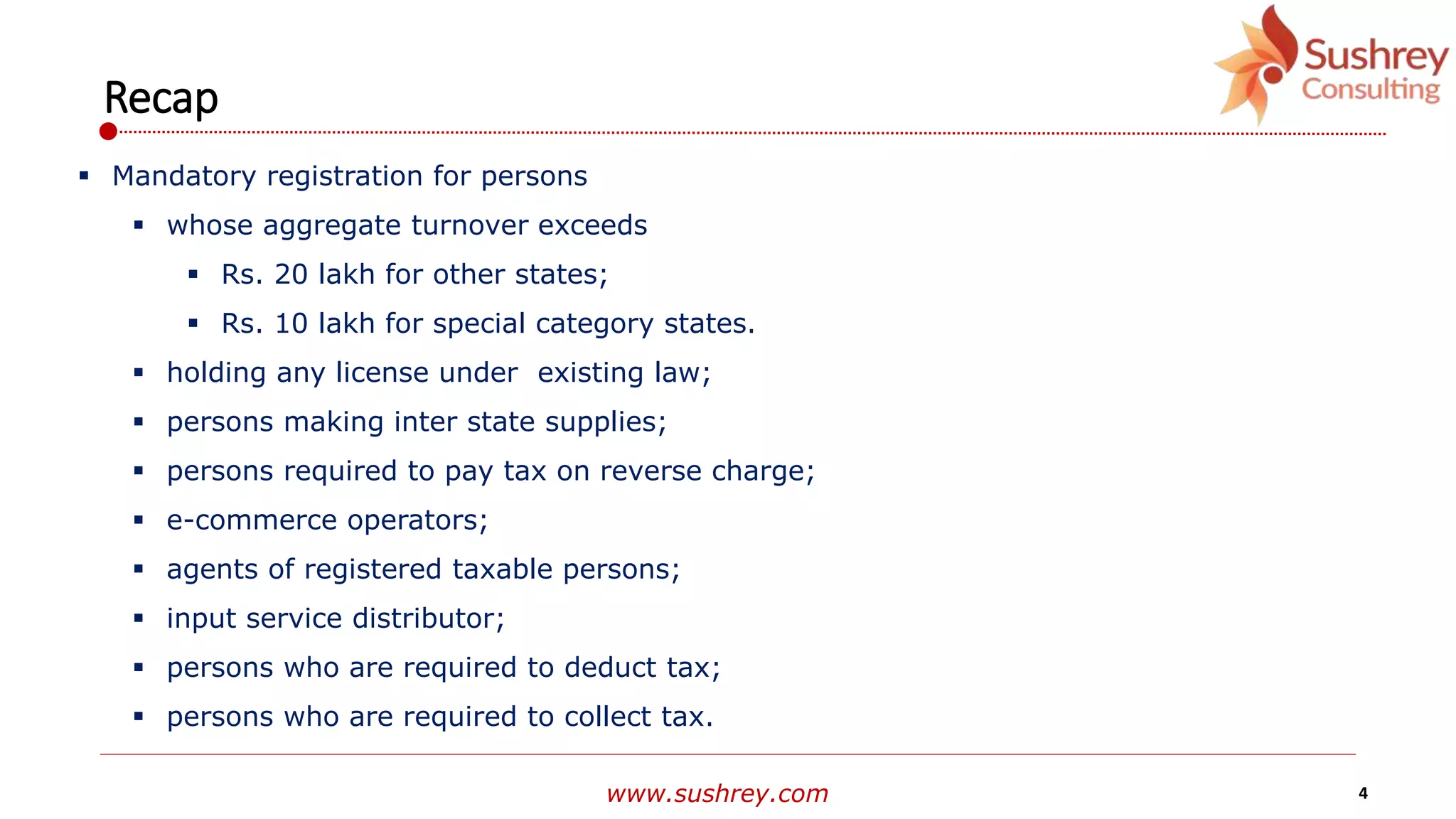

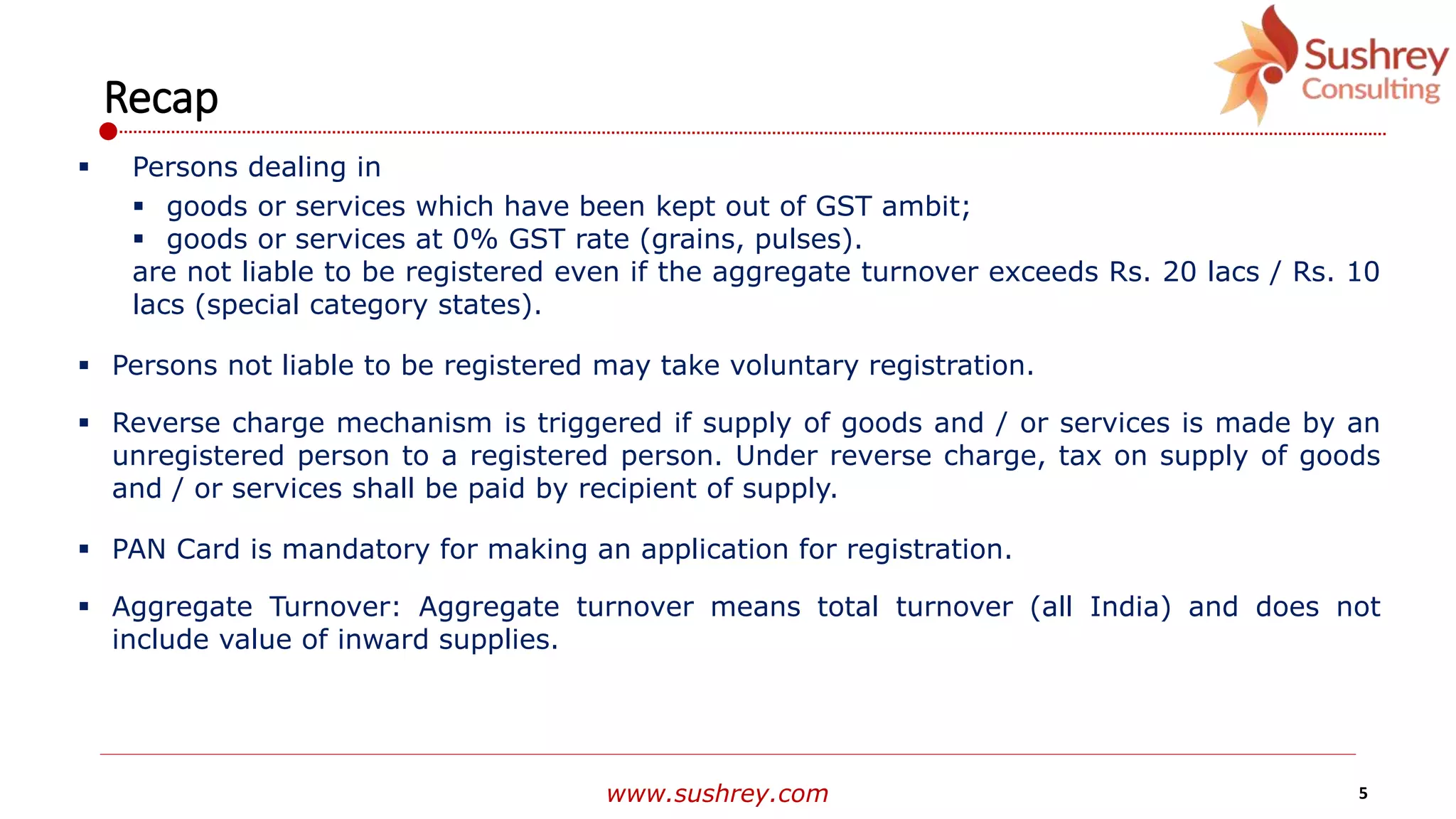

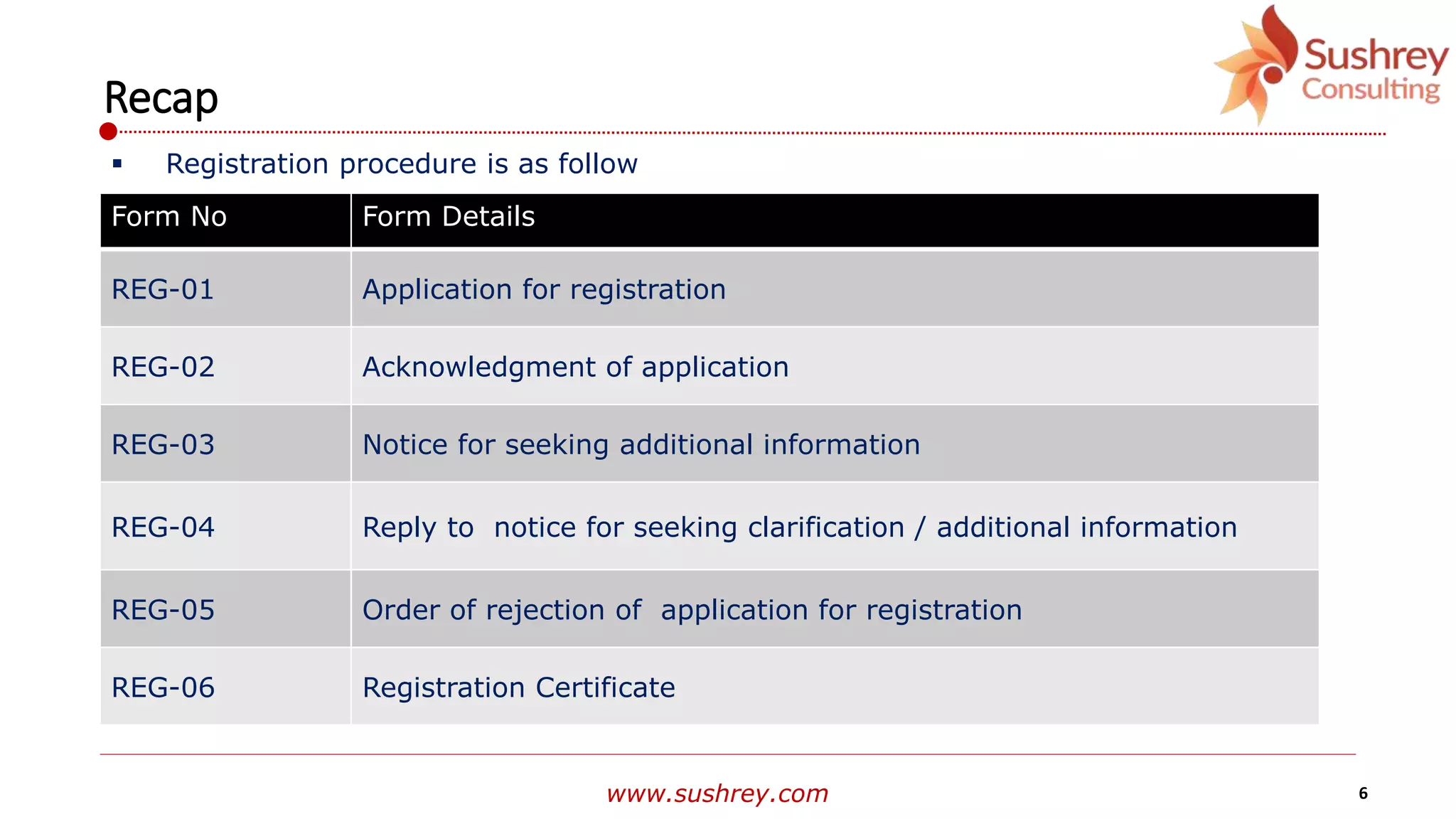

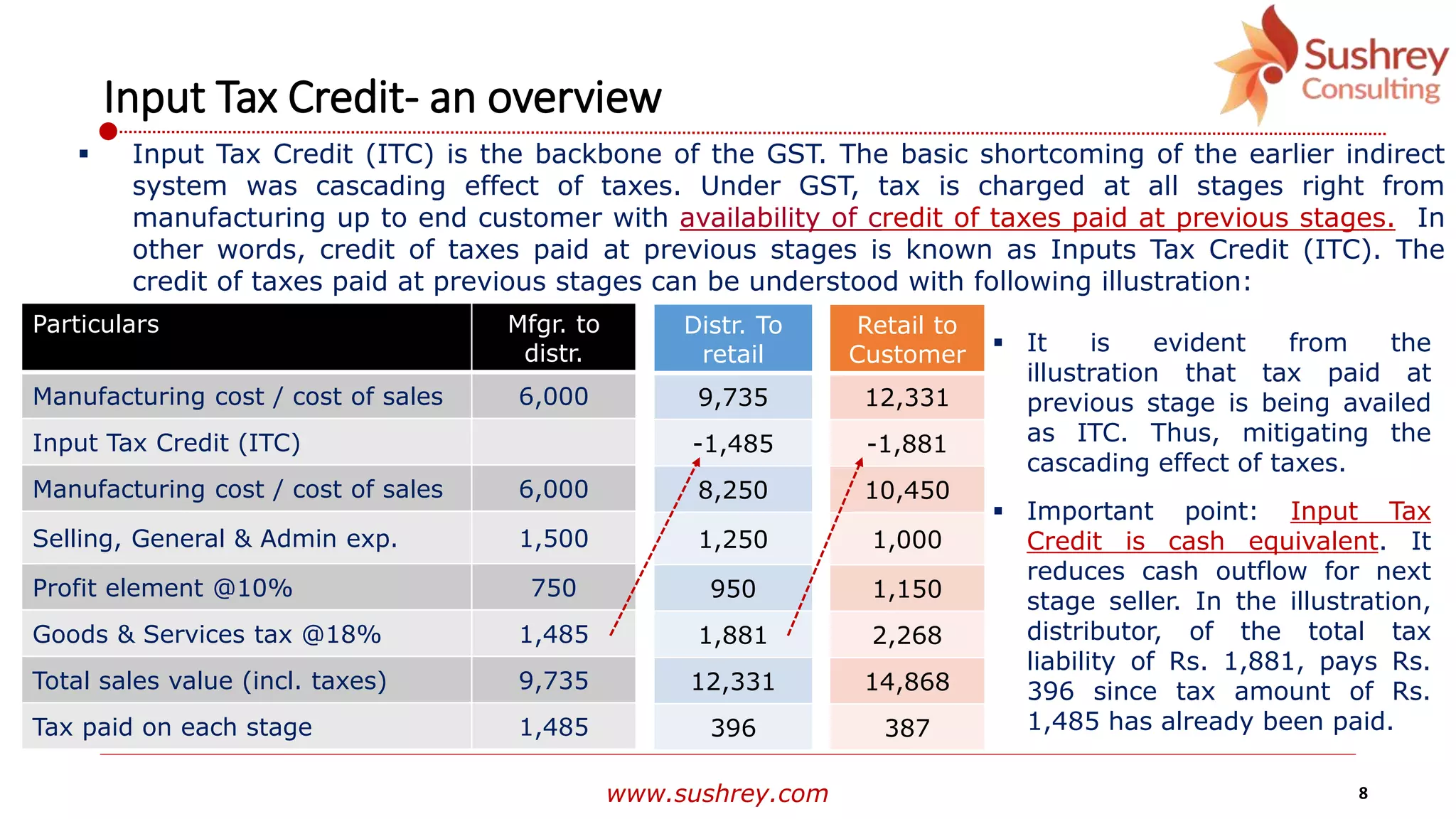

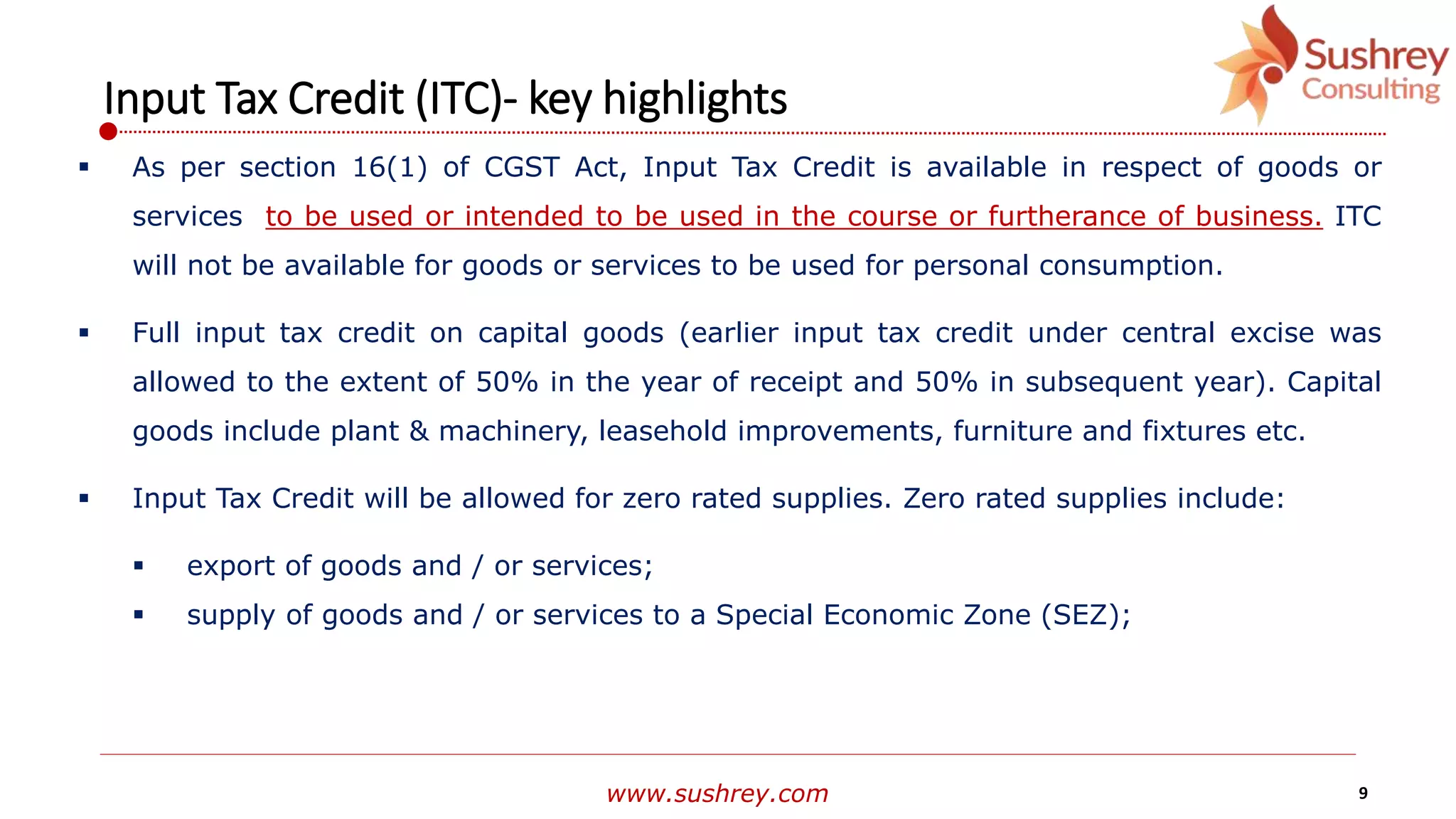

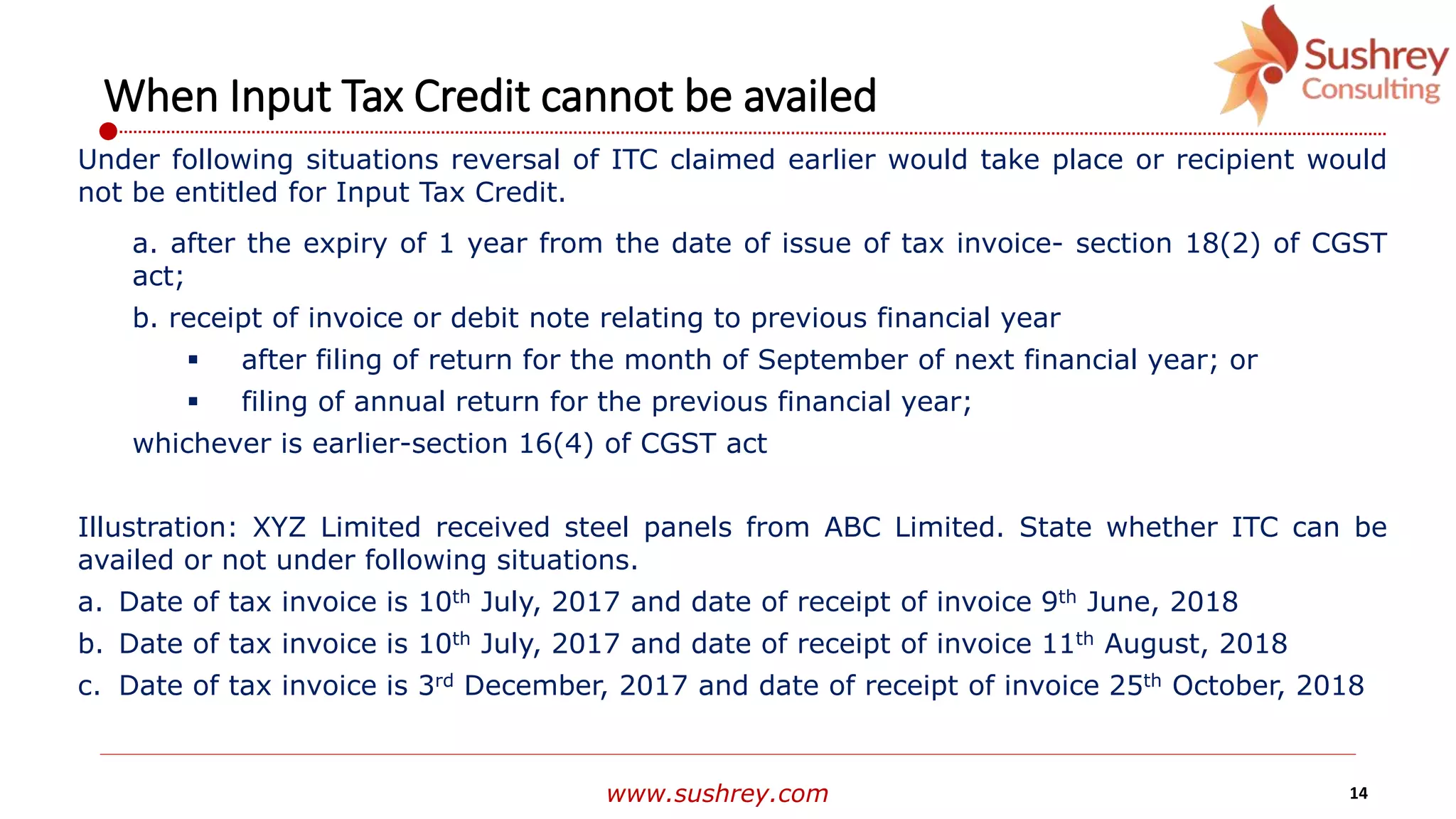

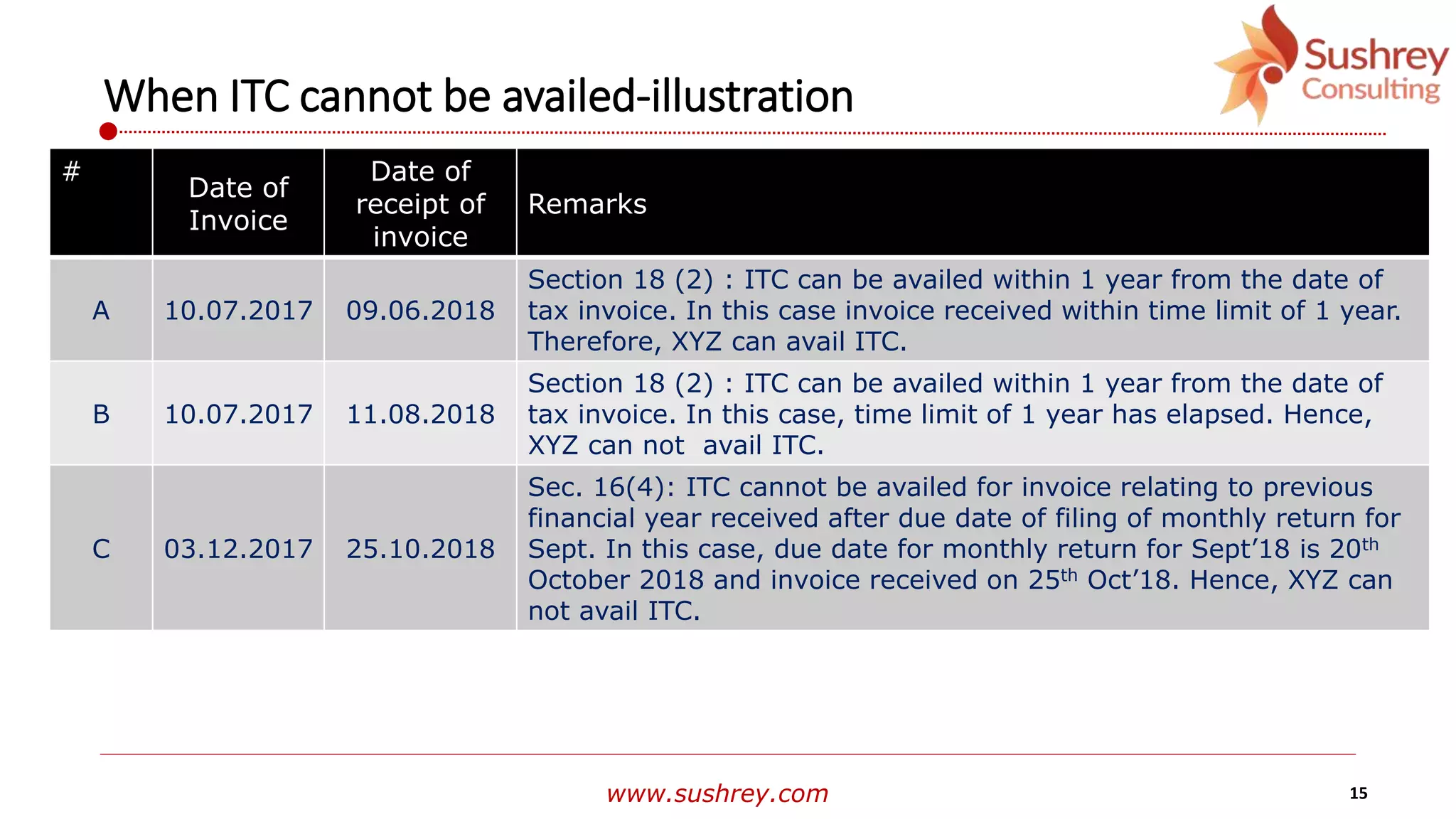

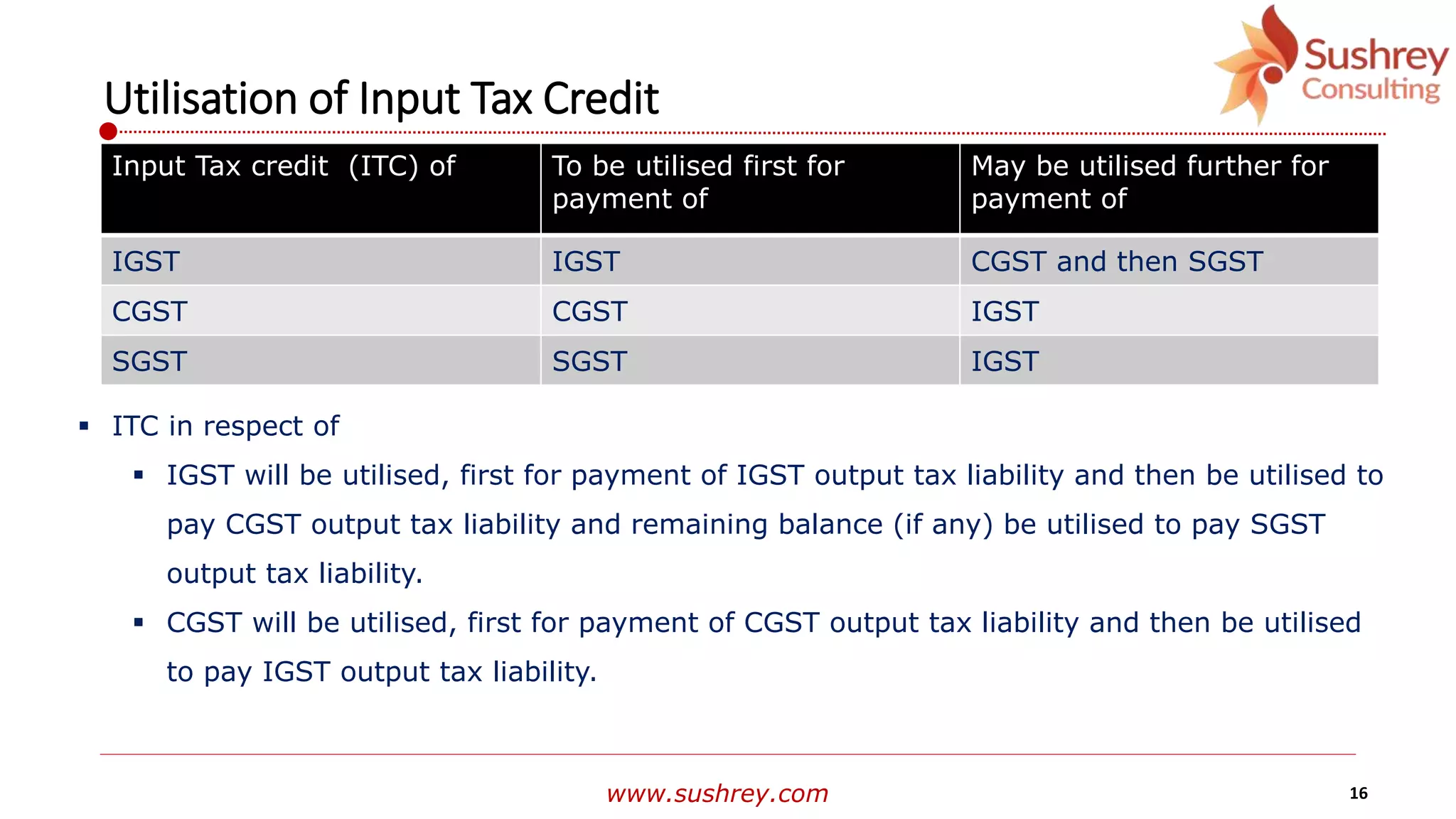

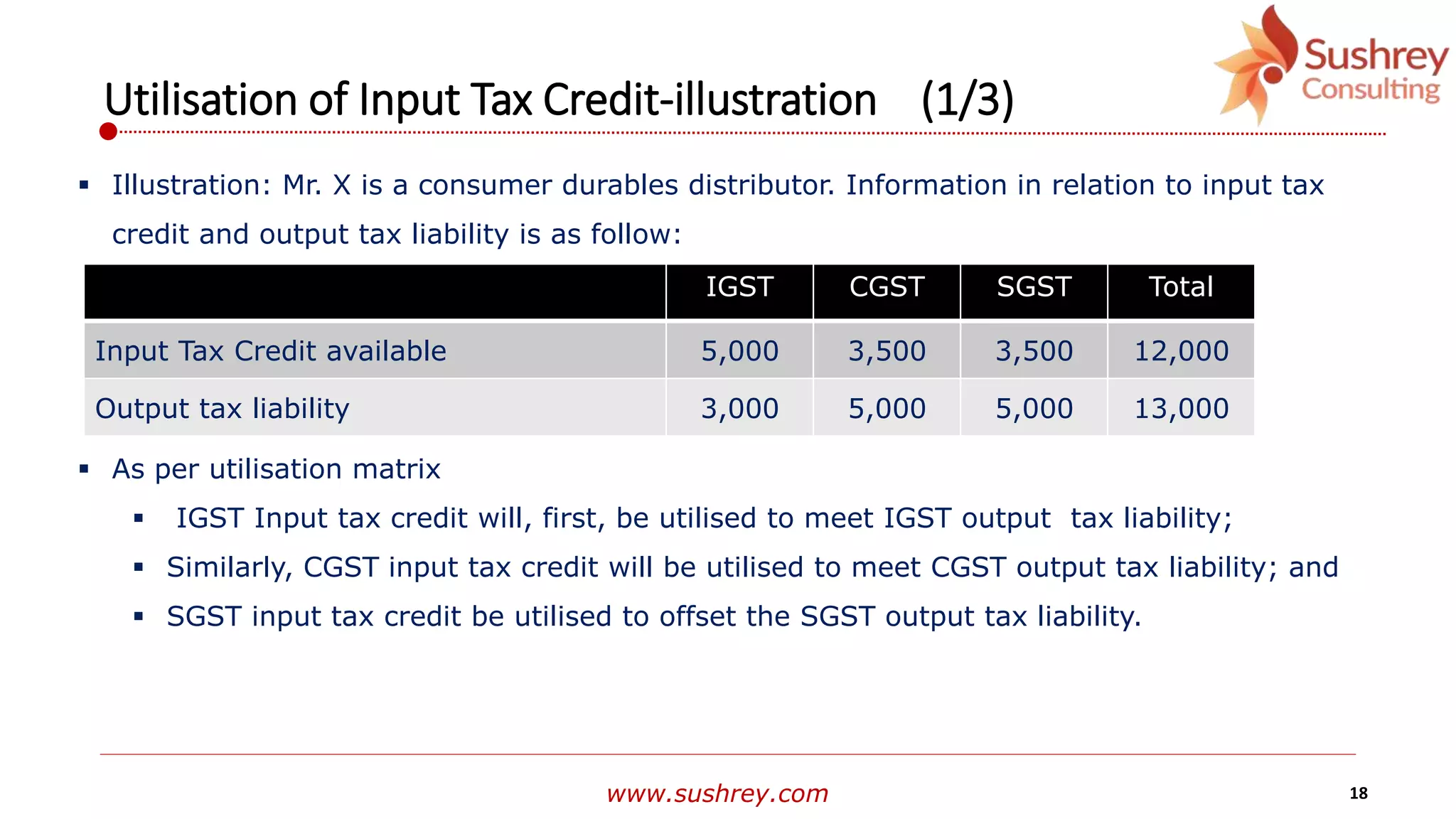

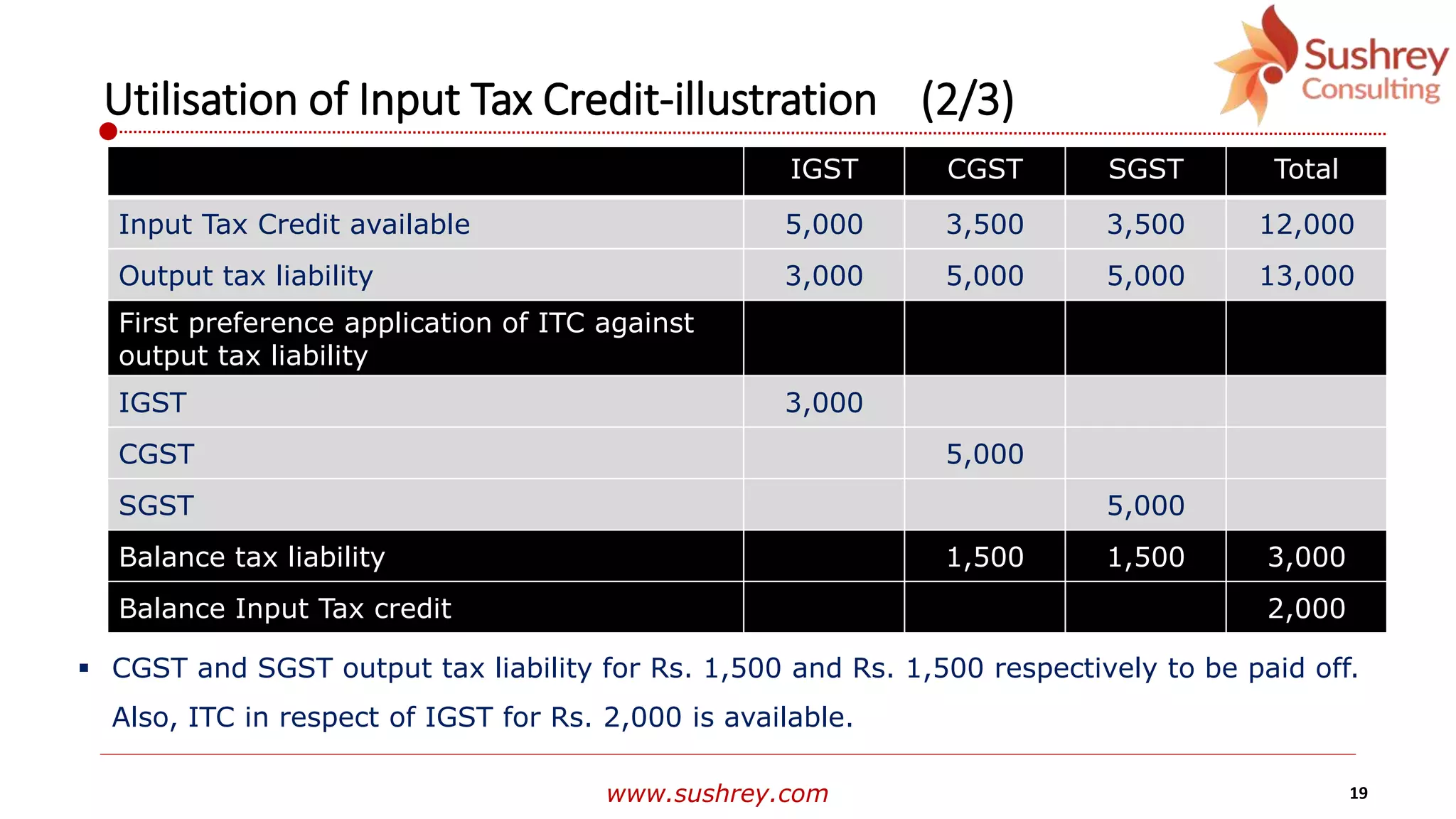

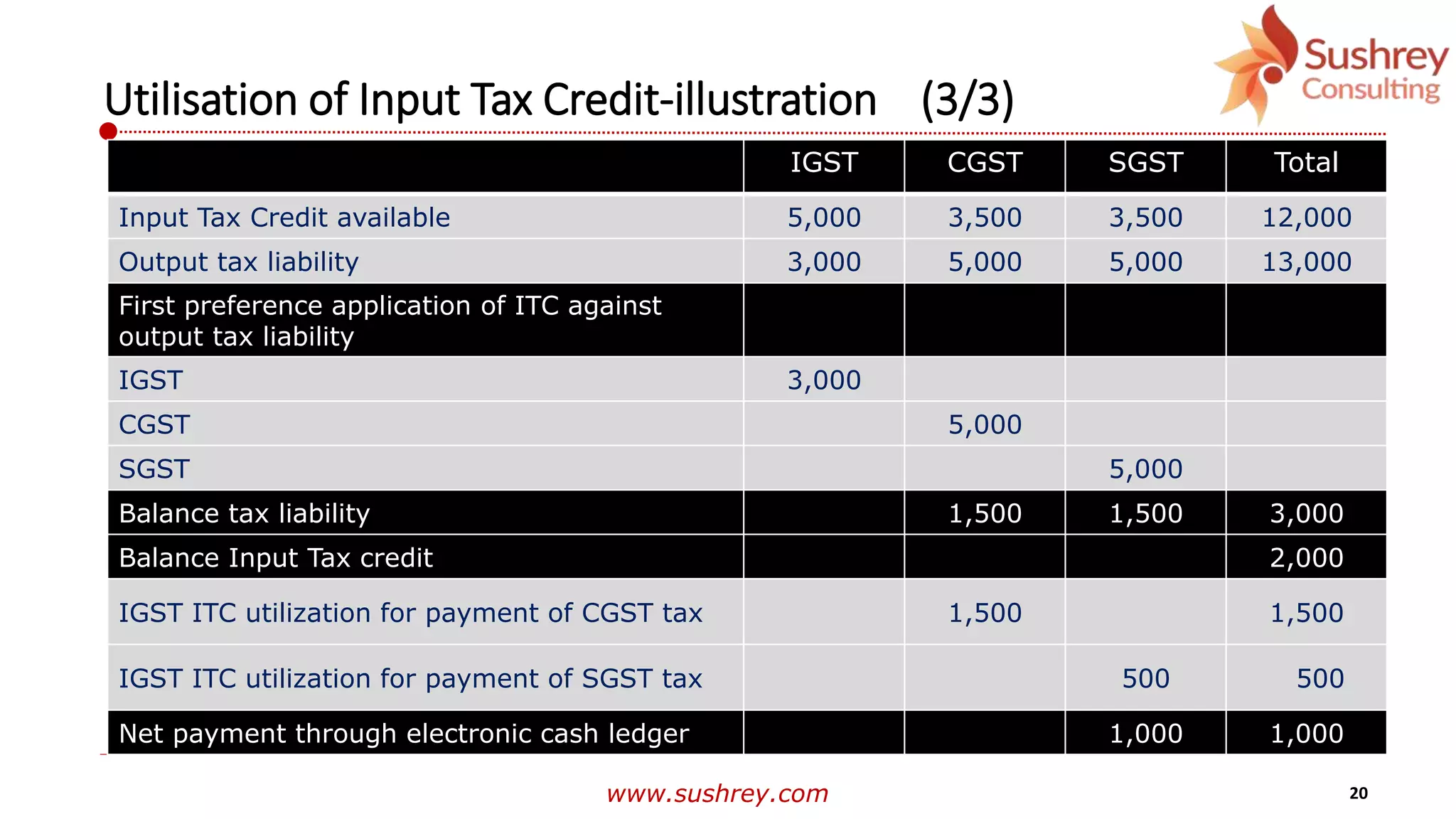

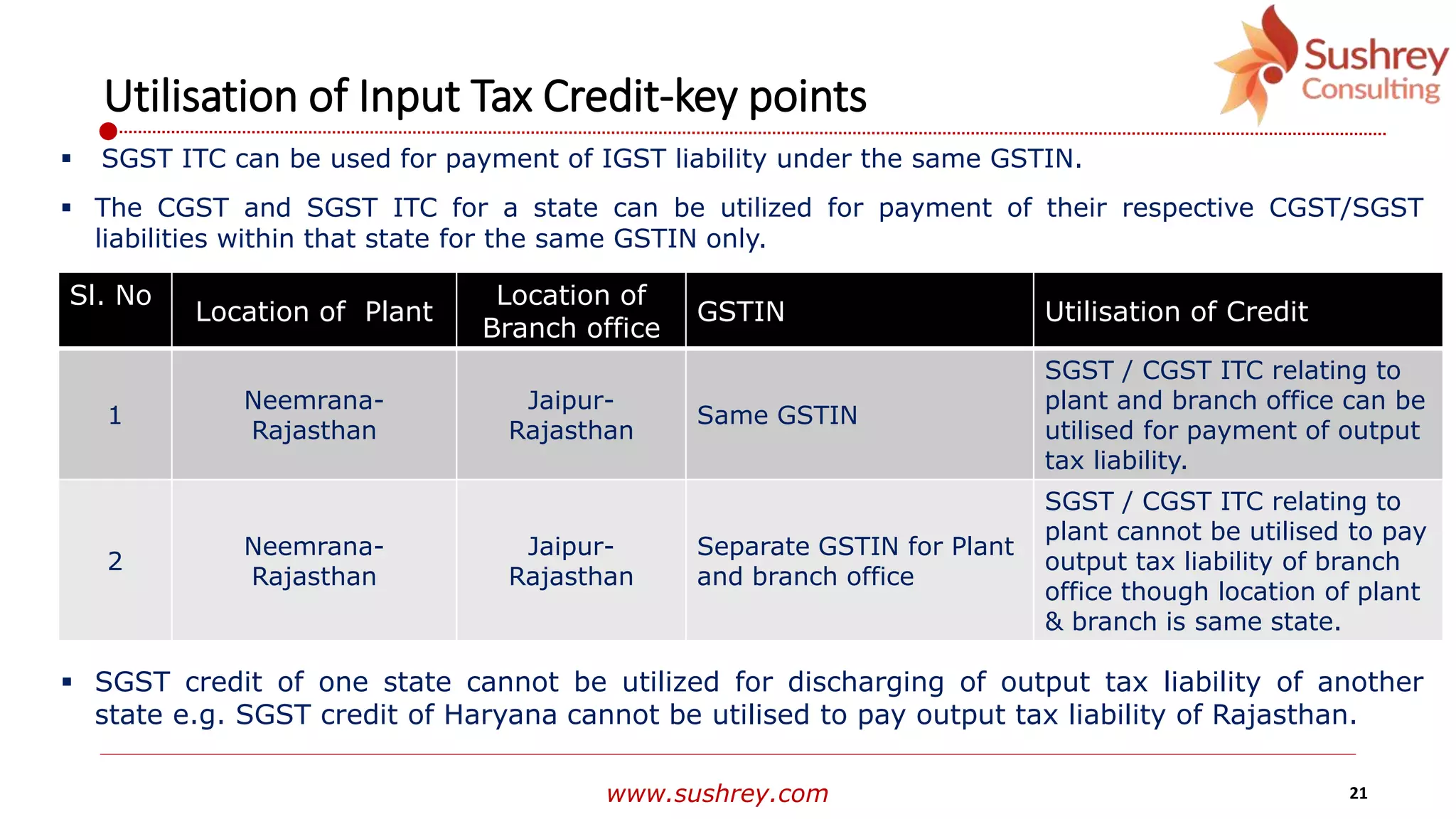

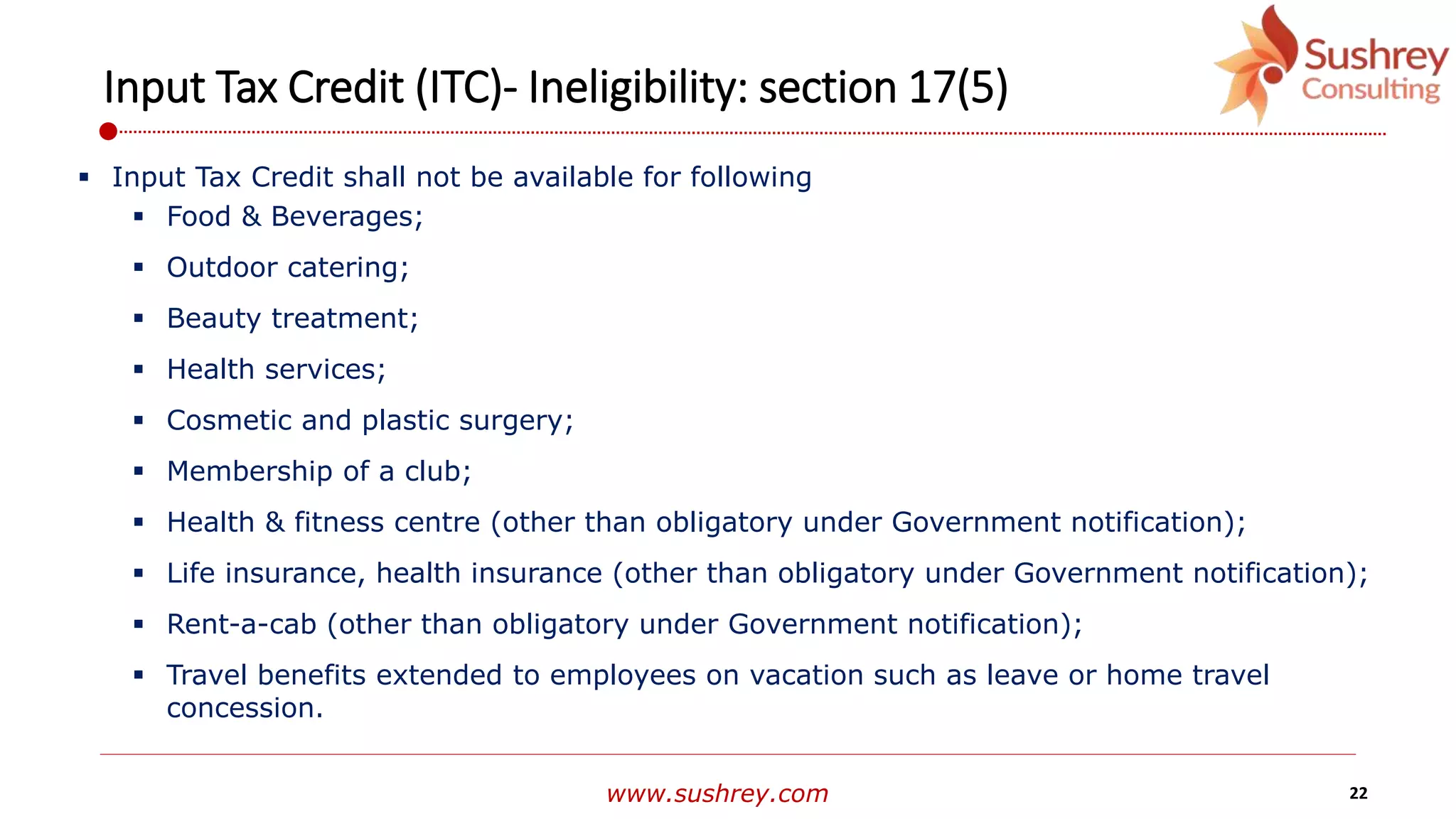

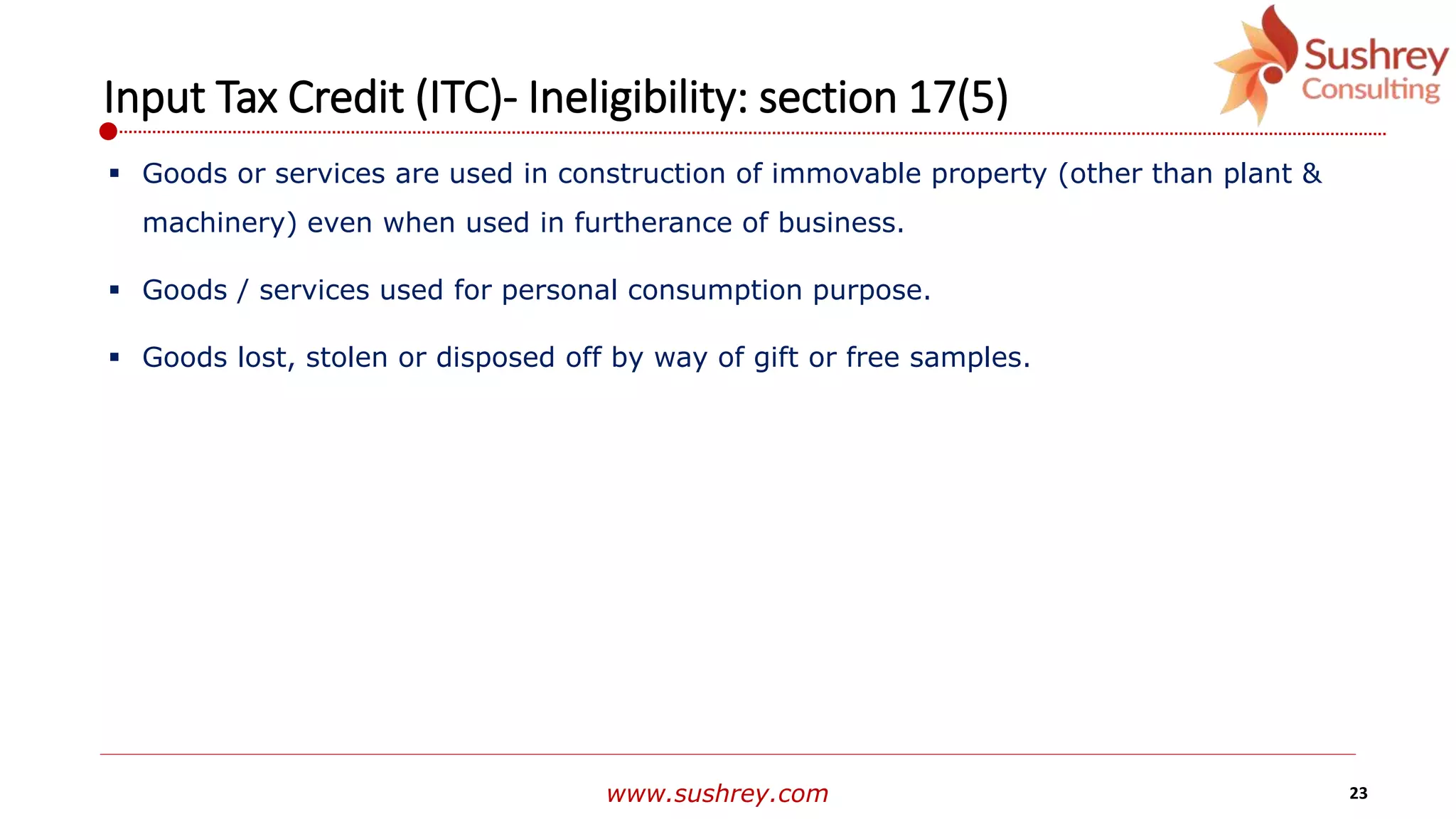

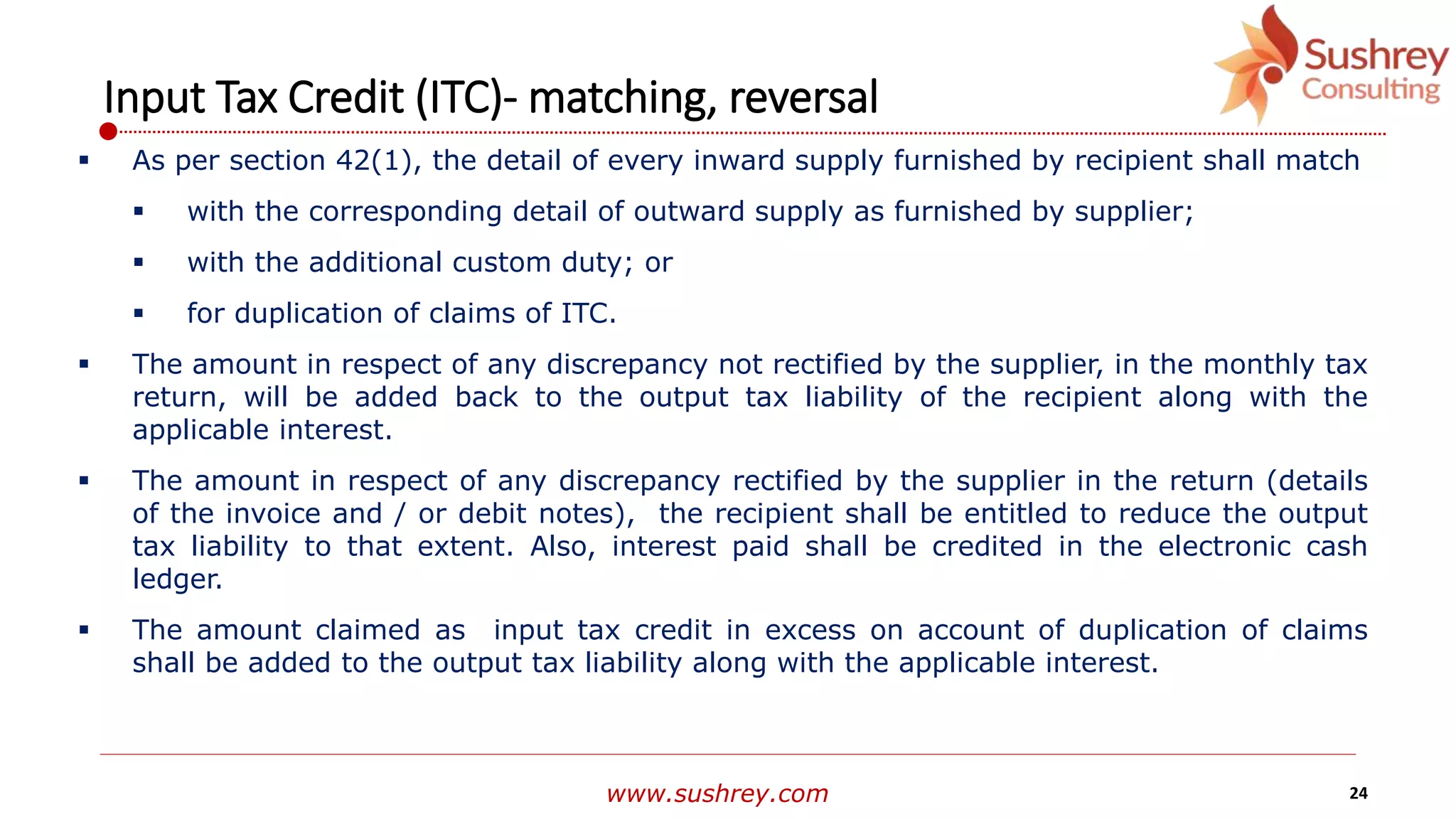

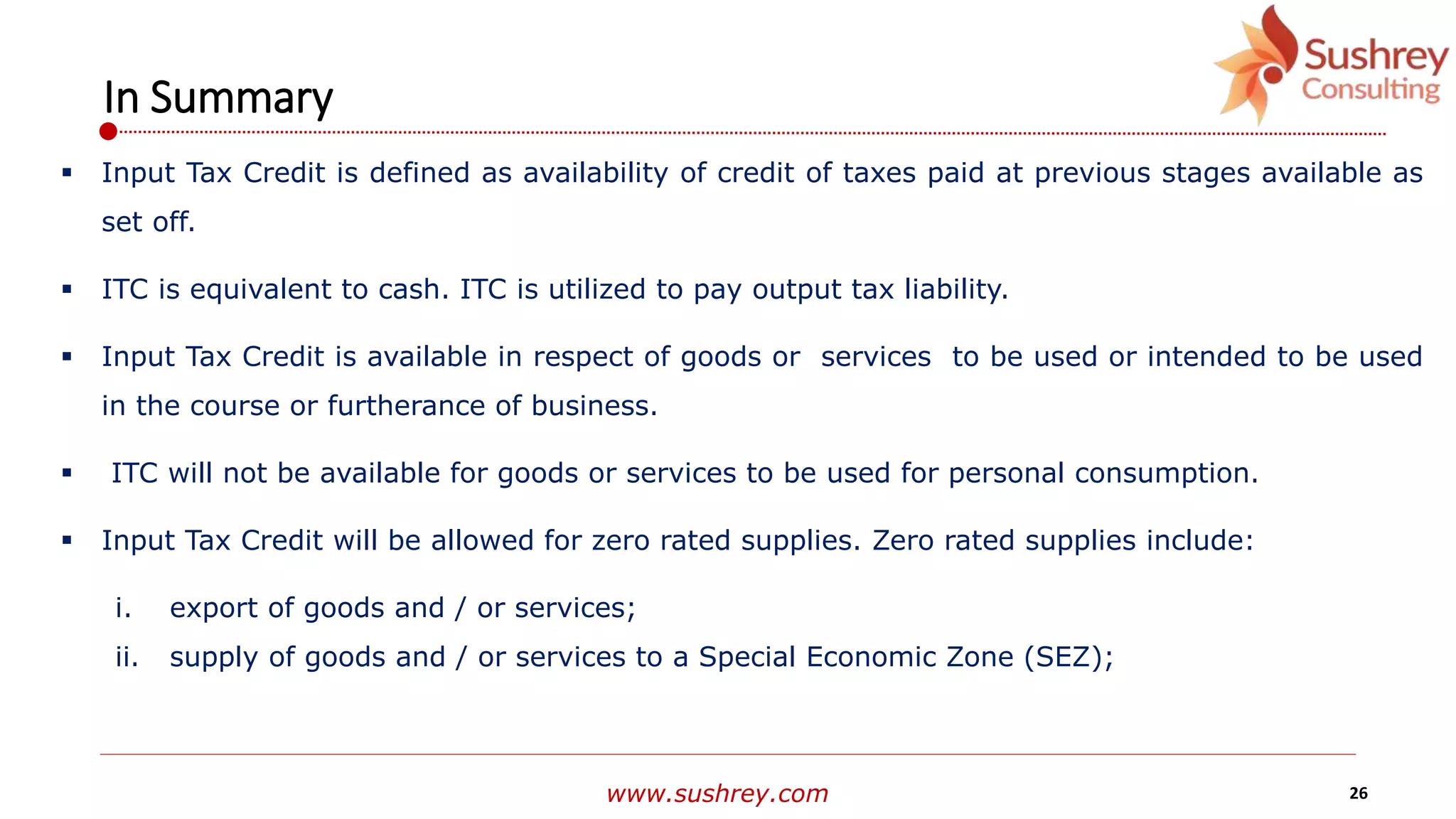

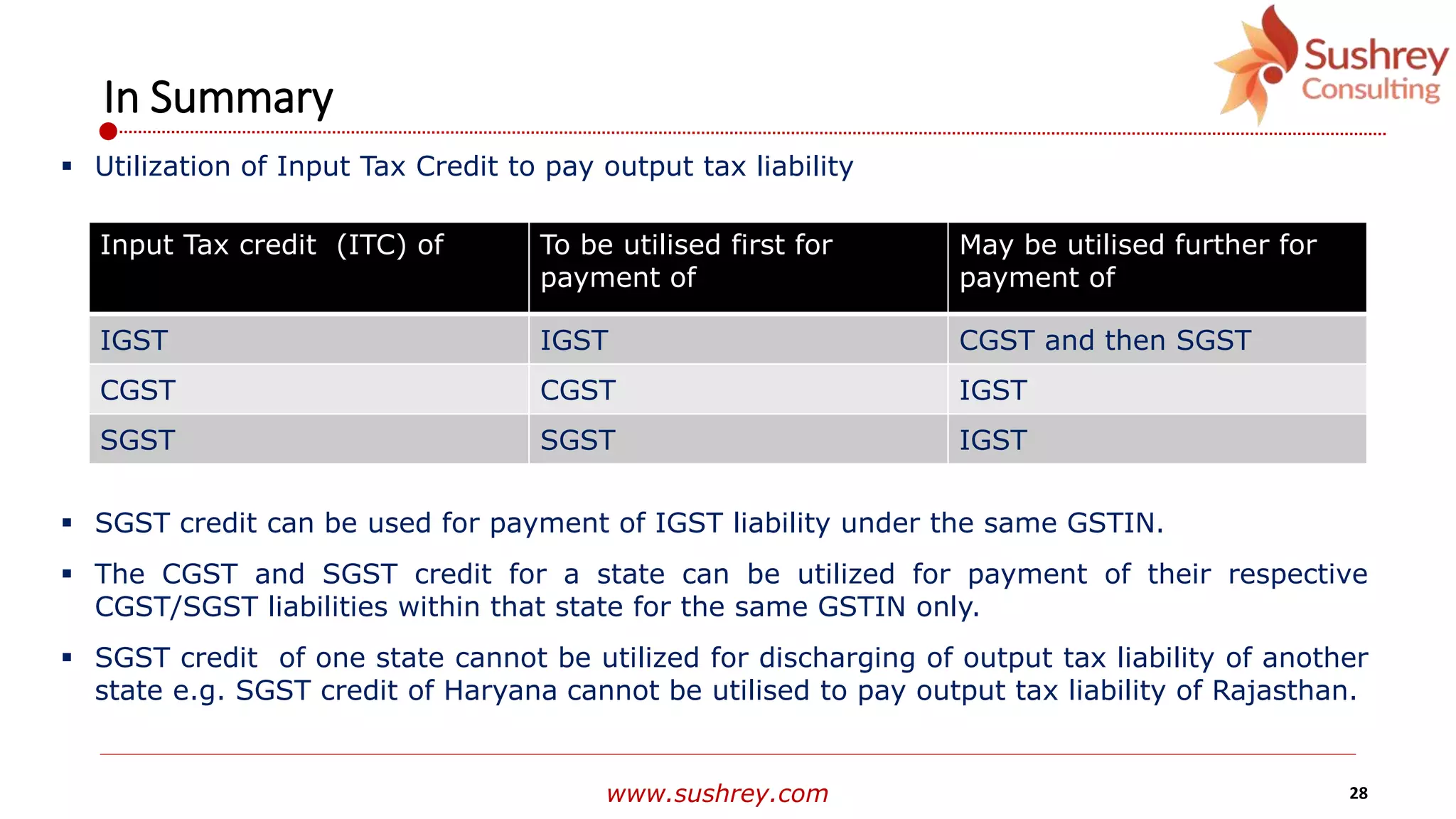

The document outlines the input tax credit (ITC) provisions under the Goods and Services Tax (GST) framework, emphasizing its role in mitigating the cascading effect of taxes by allowing credit for taxes paid at previous stages. It details the eligibility, conditions, and procedures for claiming ITC, as well as exceptions and ineligibilities for certain goods and services. Additionally, it explains the utilization of ITC for offsetting output tax liability and the processes concerning job work and compliance requirements.