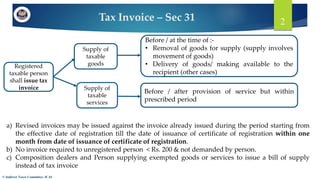

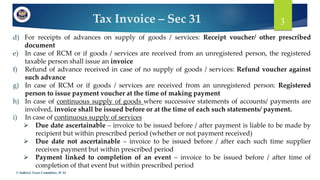

1) Tax invoices must be issued by registered taxpayers for taxable supplies of goods or services, before or at the time of removal, delivery, or provision. Credit and debit notes can be issued for adjustments.

2) Composition dealers and exempt supplies require bills of supply instead of tax invoices. Receipts are given for advances, and payment vouchers for reverse charge supplies from unregistered persons.

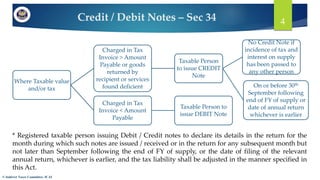

3) Credit notes must be issued within 30 days of the end of the financial year for excess charges. Debit notes are for short charges. Details must be declared in GST returns.