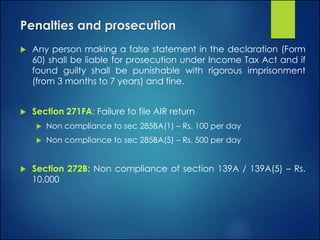

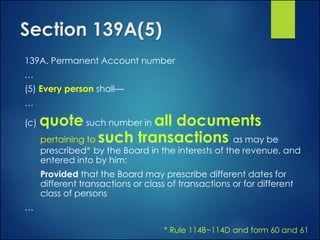

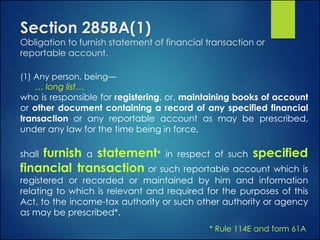

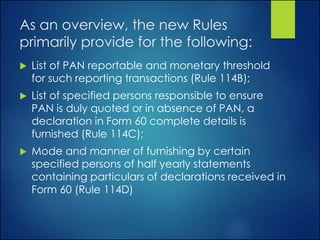

This document discusses new rules regarding PAN intimations and annual information reporting (AIR) under sections 139A(5) and 285BA(1) of the Income Tax Act. Key points:

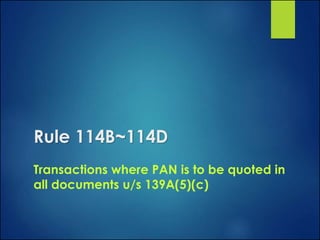

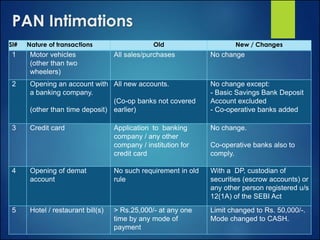

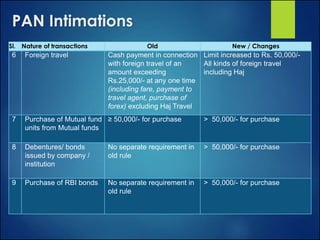

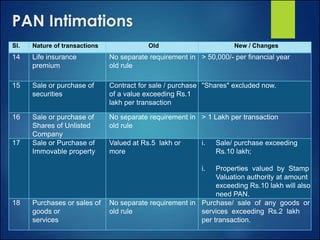

- New rules expand the scope of transactions requiring PAN to be quoted, such as purchase of life insurance, debentures, mutual funds, and transactions over Rs. 50,000.

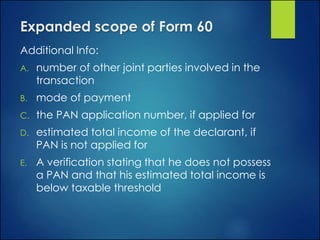

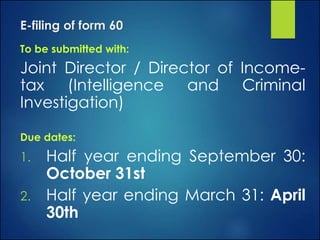

- Specified persons like banks and brokers are responsible for ensuring PAN is quoted and submitting half-yearly statements of declarations received on Form 60 for transactions without PAN.

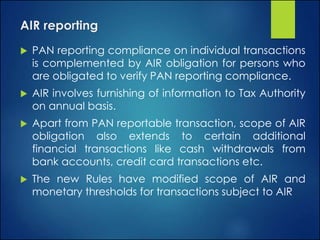

- AIR reporting now requires additional information from banks on cash transactions over Rs. 50,000, including deposits, withdrawals and purchase of bank

![AIR - changes in monetary limits

Nature of Financial

transaction

Earlier limit New limit

Credit card payments Payments aggregating to

≥ Rs. 2 lakhs in a financial

year

Payments (in respect of one or more cards)

aggregating to:

1. ≥ Rs. 1 lakh in cash

2. ≥ Rs. 10 lakhs by any other mode in a

financial year

Receipt from any person for

acquisition of bonds/ debentures

issued by company/ institution

(primary subscription)

≥ Rs. 5 lakhs Amount aggregating to ≥ Rs. 10 lakhs in a

financial year [Other than the amount

received on renewal of bond/ debenture]

Receipt from any person for

acquiring shares issued by a

company (primary subscription)

≥ Rs. 1 lakh

(public or rights issue)

(share application excluded)

(private placement excluded)

Amount aggregating to ≥ Rs. 10 lakhs in a

financial year

- share application money included

- Private placement included now

Receipt from any person for

acquiring units of a Mutual Fund

≥ Rs. 2 lakhs Amount aggregating to ≥ Rs. 10 lakhs in a

financial year [Other than amount received

on account of transfer of funds from one

scheme to another scheme of that Mutual

Fund]

Purchase or sale of immovable

property

≥ Rs. 30 lakhs as per

agreement

≥ Rs. 30 lakhs as per agreement or as

valued by stamp duty authority](https://image.slidesharecdn.com/f2245929-9c60-4e9c-adc4-ffb6ea58e78c-160212132910/85/PAN-intimation-and-new-AIR-reporting-requirements-24-320.jpg)