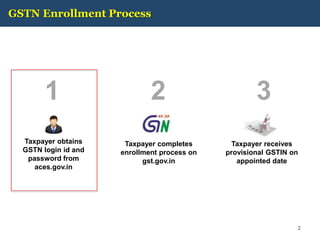

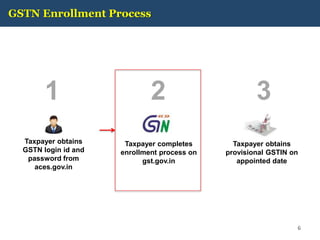

The document summarizes the process for migrating existing taxpayers to the Goods and Services Tax (GST) system in India. It involves the following key steps:

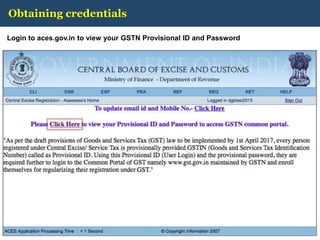

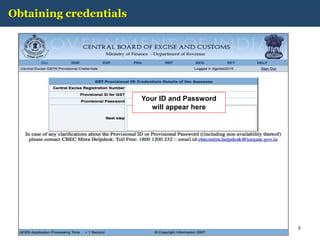

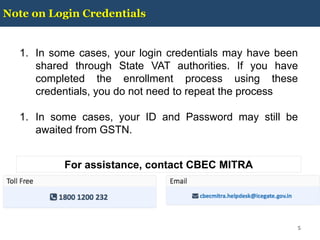

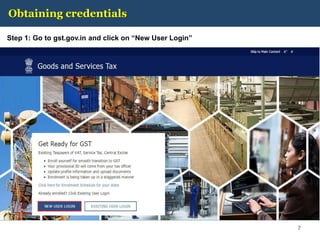

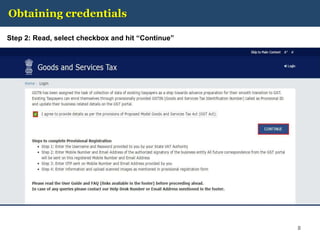

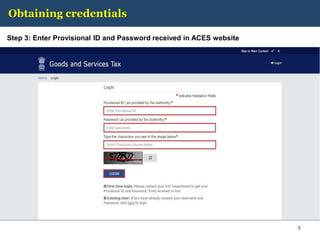

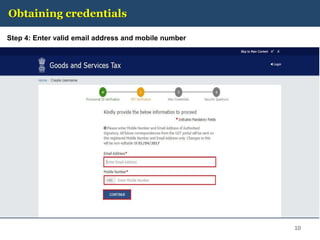

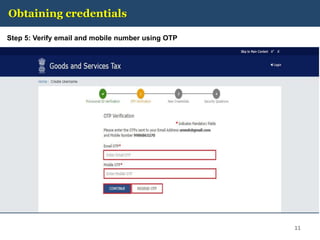

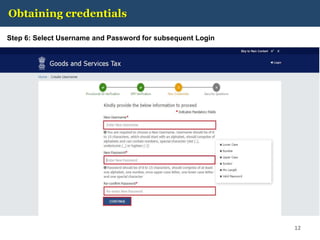

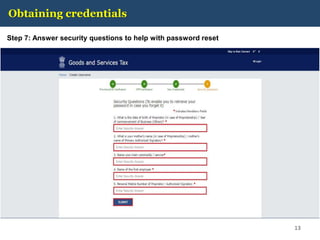

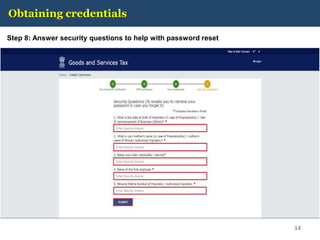

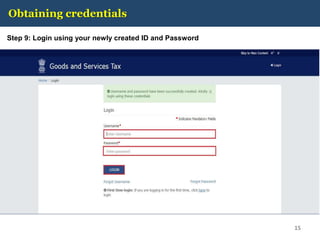

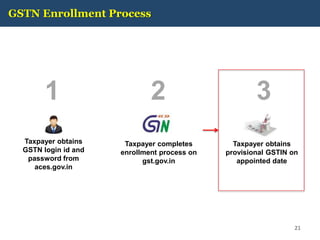

1. Taxpayers obtain a GSTN login ID and password from the aces.gov.in website to complete the enrollment process on gst.gov.in.

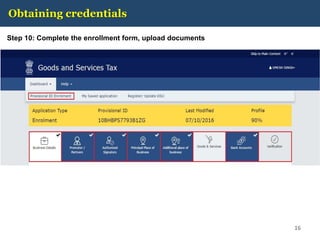

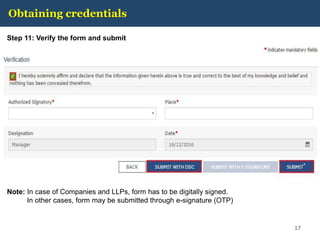

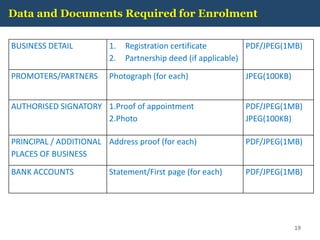

2. Taxpayers complete the enrollment process on gst.gov.in by providing business and registration details as well as uploading required documents.

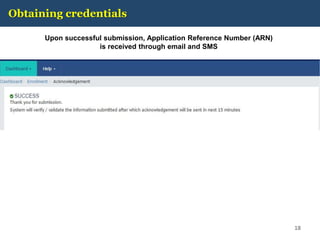

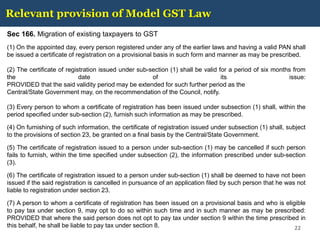

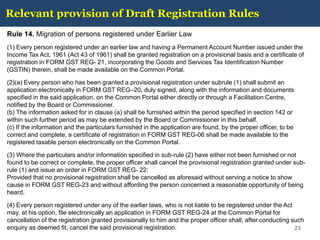

3. Upon successful submission, taxpayers receive a provisional GSTIN and final registration within 6 months if all information is verified correctly.