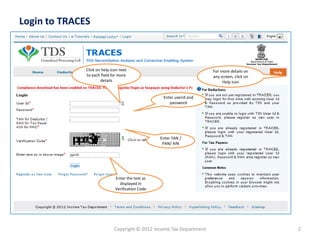

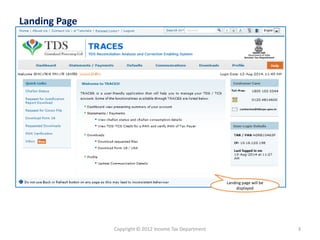

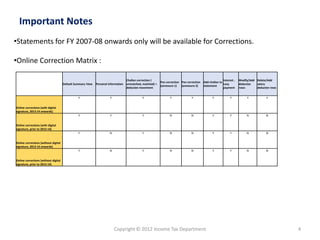

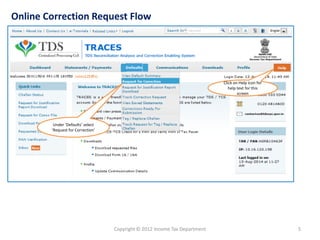

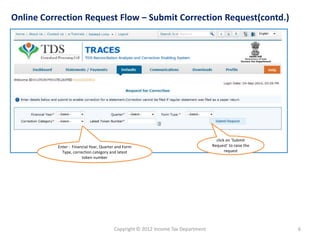

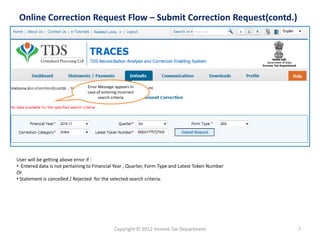

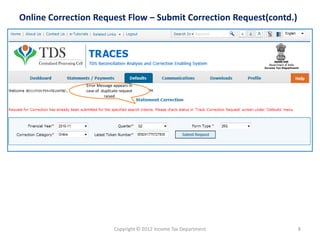

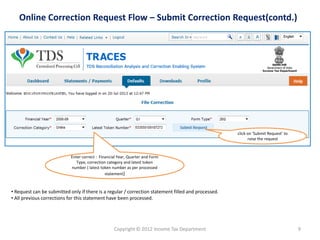

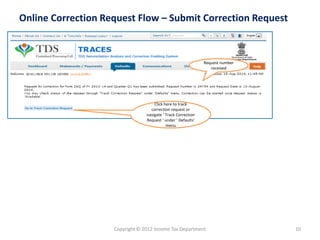

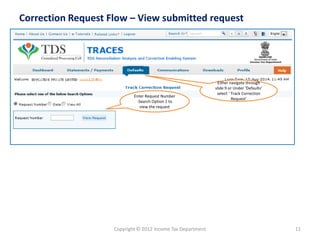

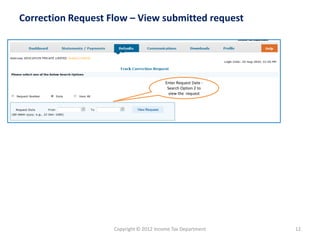

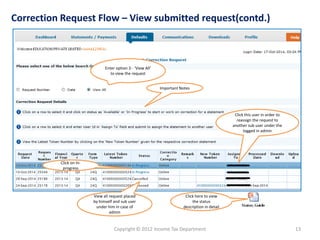

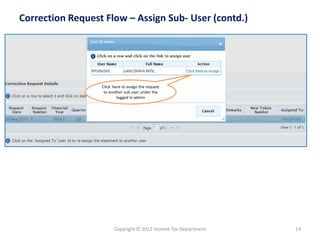

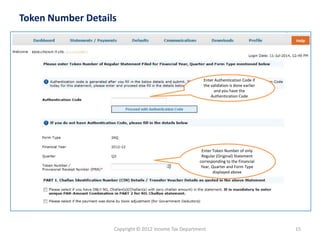

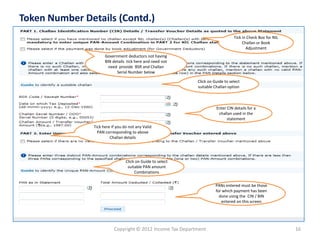

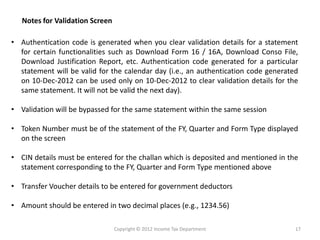

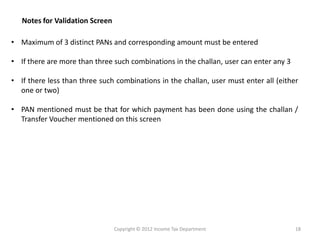

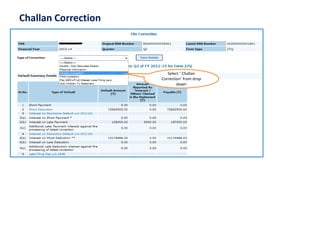

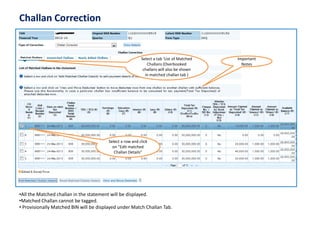

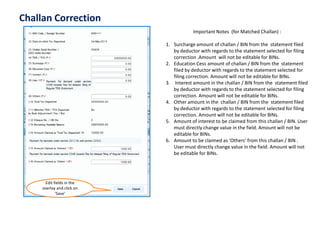

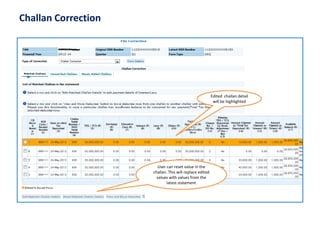

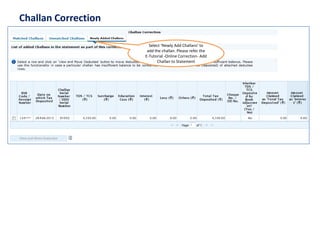

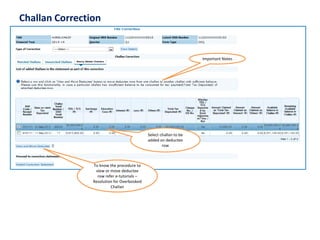

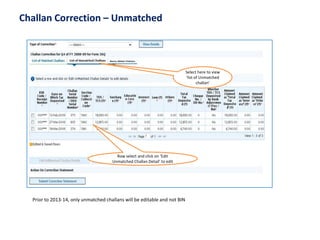

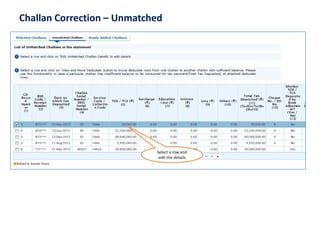

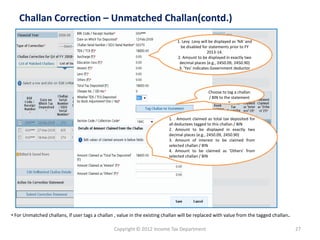

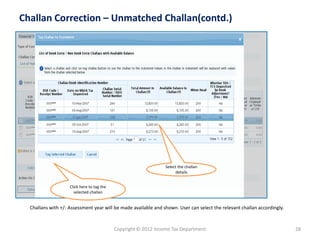

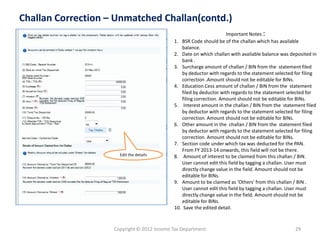

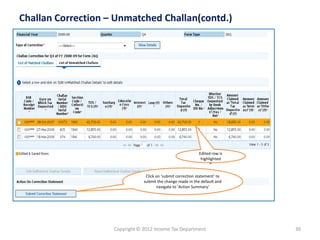

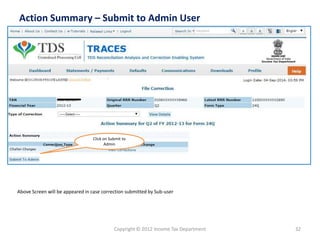

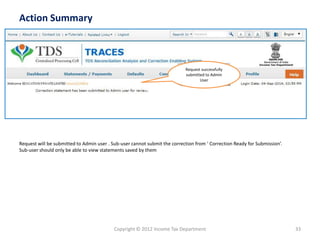

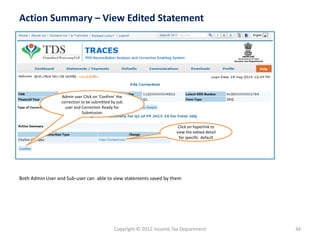

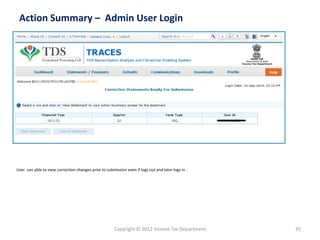

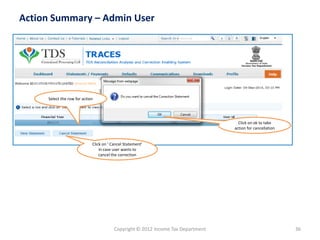

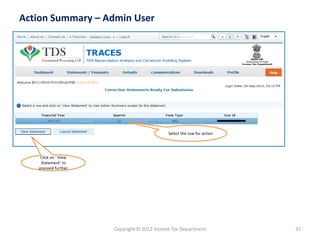

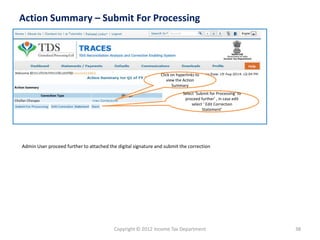

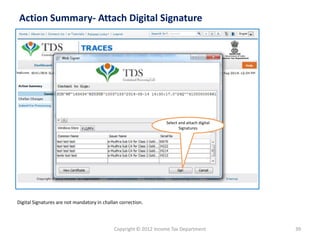

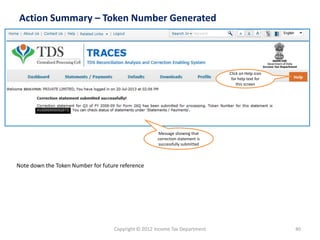

The document provides step-by-step instructions for using the online correction feature in TRACES to correct Form 24Q statements. It explains how to submit a correction request, view the status of requests, validate challan details, edit matched and unmatched challans, add new challans, and tag unmatched challans to deductee rows. Key points include submitting the request with the correct financial year, quarter and latest token number, and only editing fields that allow changes like interest claimed for unmatched challans prior to 2013-14.