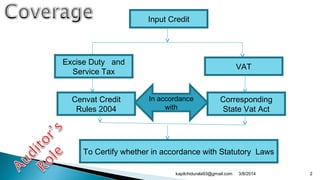

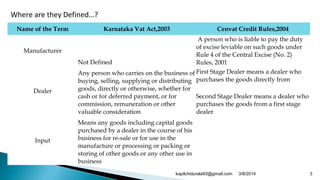

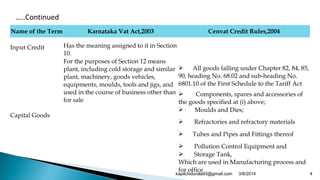

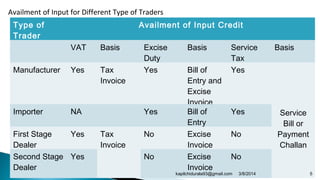

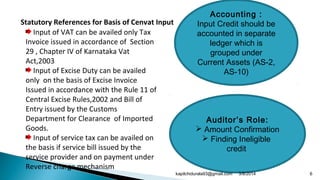

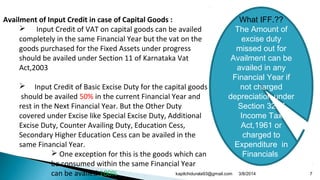

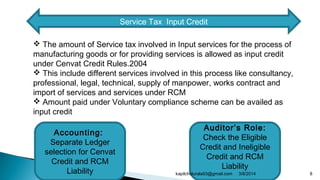

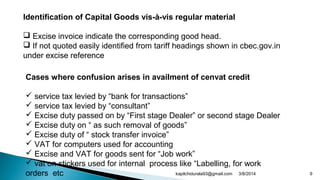

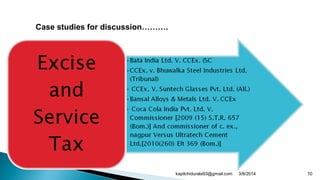

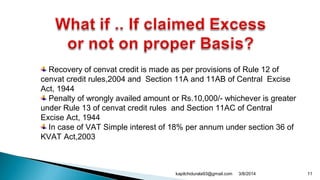

This document defines key terms related to input credit for VAT, excise duty, and service tax. It discusses how input credit can be availed for these taxes by manufacturers, importers, and first/second stage dealers based on statutory documents. Input credit for capital goods can be availed 50% in the current year and 50% in the next year for excise duty, but 100% in the current year for other duties and VAT. Service tax input credit is allowed based on input services involved in manufacturing or service provision. The document also covers identification of capital goods, cases of potential confusion in availing input credit, and penalties for wrongly availing input credit.