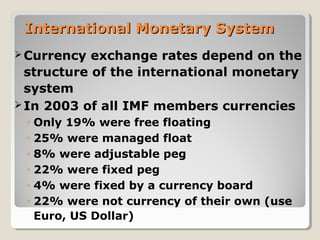

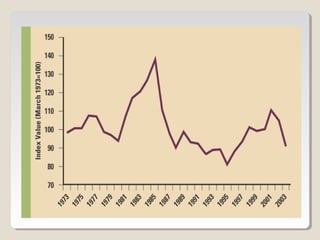

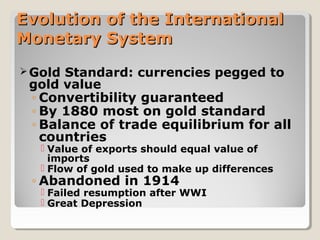

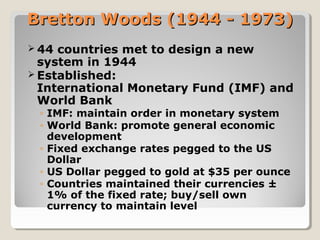

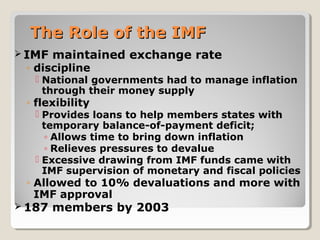

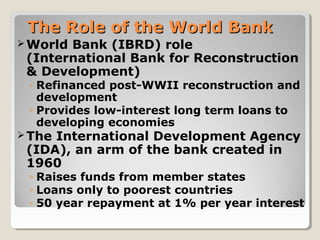

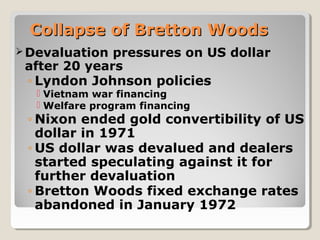

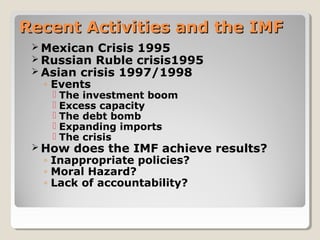

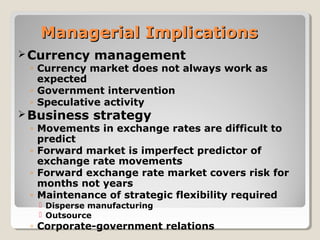

This document discusses the history and evolution of international monetary systems from the gold standard to the present day. It covers the Bretton Woods system established in 1944 which pegged currencies to the US dollar backed by gold. The system collapsed in the 1970s and was replaced by a system of floating exchange rates. The International Monetary Fund still works to maintain monetary stability and provides loans to countries experiencing economic crises. Managers must account for the difficulties of predicting exchange rate movements in their business strategies.