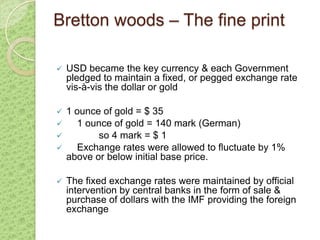

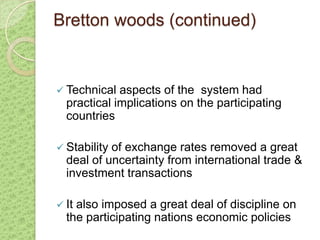

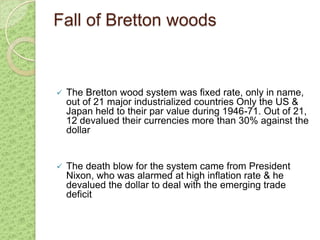

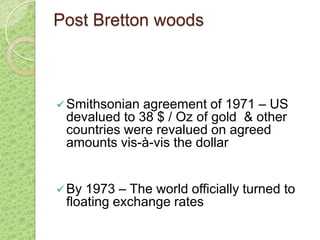

The document provides an overview of the international monetary system. It discusses the key features and issues with different exchange rate systems such as free float, managed float, target zones, and fixed rates. It outlines the history of international monetary systems including the gold standard, Bretton Woods system, and the move to floating exchange rates after 1971. The roles of the IMF and World Bank in providing stability and assistance to member countries are also summarized.