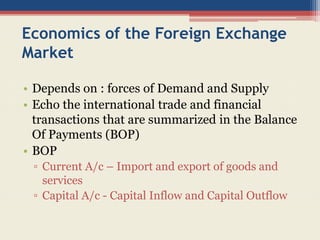

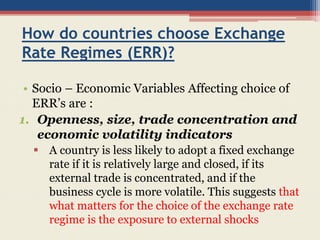

This document discusses different types of exchange rate regimes and factors that influence a country's choice of regime. It describes exchange rate regimes as fixed pegs, currency boards, monetary unions, managed floats, and free floats. Countries choose regimes based on their openness, economic volatility, financial market depth, inflation rates, and political stability. Deeper financial markets and greater exposure to external shocks make floating regimes more suitable, while fixed pegs provide stability in politically unstable environments with concentrated trade. Overall, the document examines how exchange rates are managed and the socioeconomic factors that determine a country's exchange rate regime.