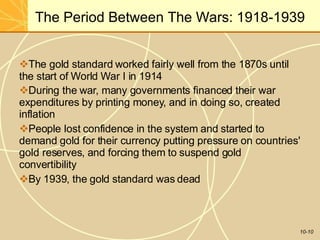

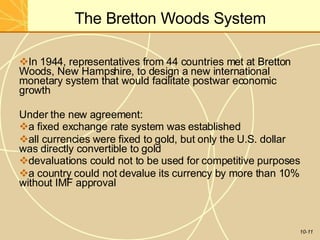

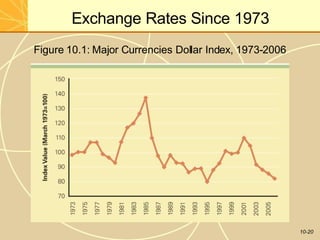

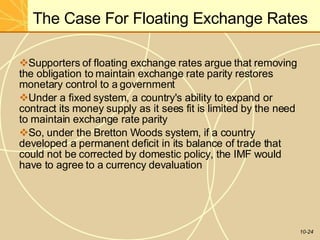

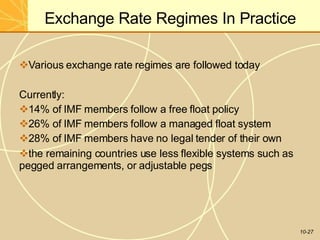

The document provides an overview of the international monetary system, including different exchange rate regimes like floating rates, pegged rates, and currency boards. It discusses the history of international monetary systems from the gold standard to Bretton Woods to the current floating rate system. It also examines financial crises like those in Mexico and Asia and debates around fixed versus floating rates. For managers, understanding the monetary system is important for currency management, business strategy, and relations with government.