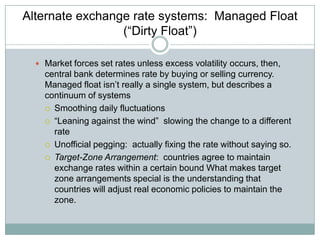

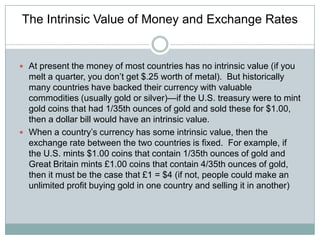

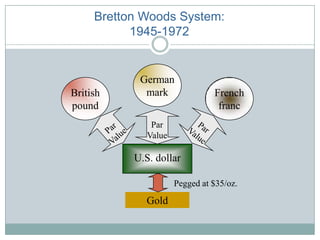

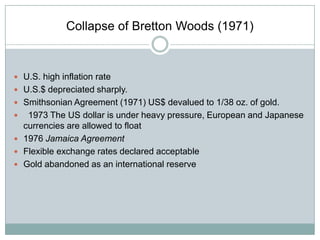

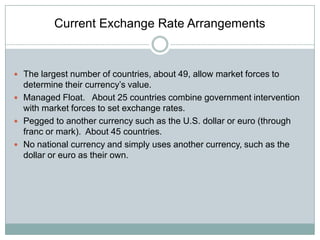

This document provides an overview of international monetary systems and exchange rate arrangements. It begins with a brief history, starting from bimetalism pre-1875, to the classical gold standard from 1875-1914, the interwar period, Bretton Woods system from 1945-1972, and the current flexible system. It then describes different types of exchange rate systems such as freely floating rates, managed floats, target zones, and fixed rates. Specific historical systems like the gold standard and Bretton Woods are explained in more detail. In summary, the document outlines the evolution of international monetary arrangements over time from commodity-backed systems to present-day mixed systems.