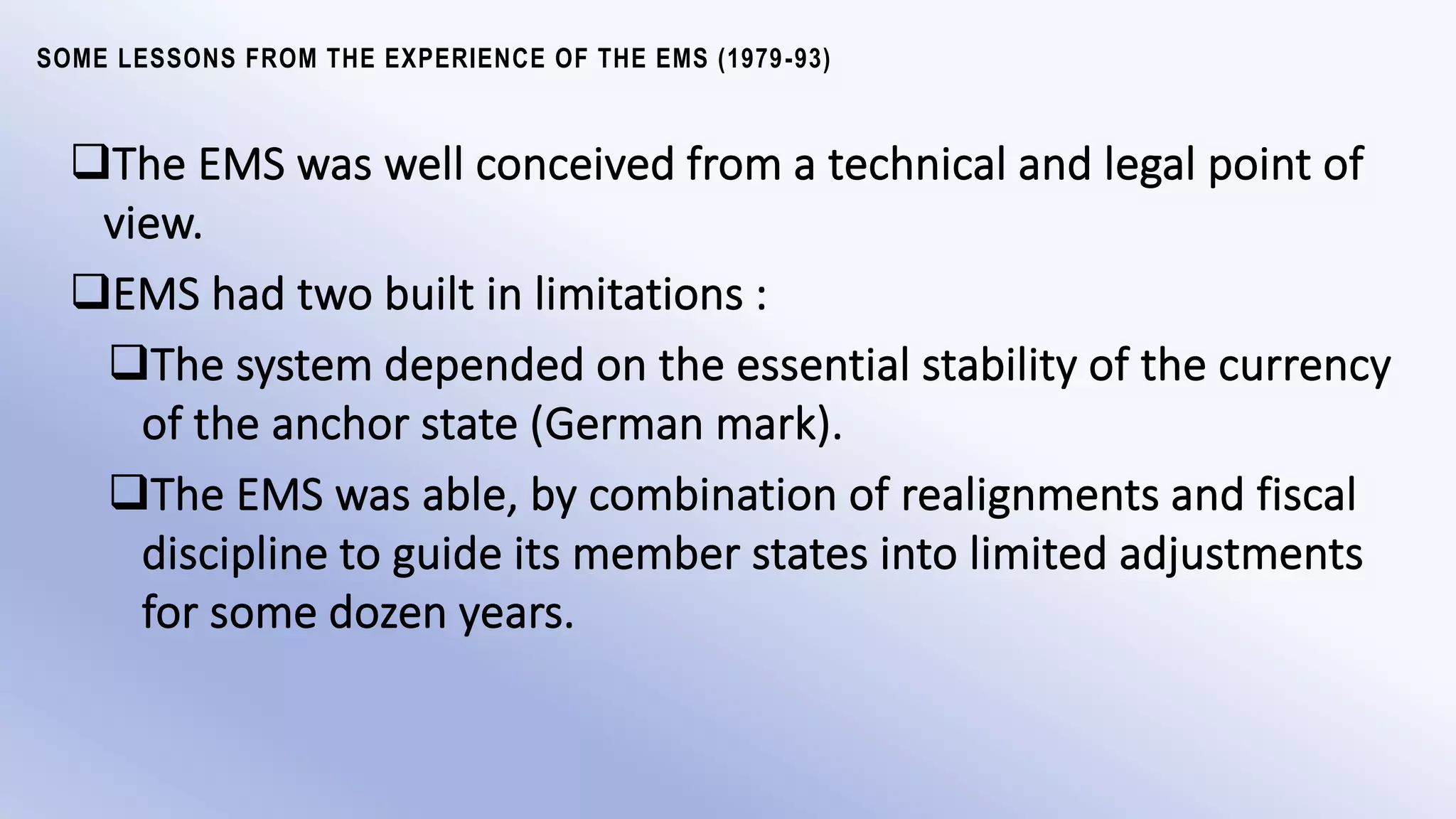

The document discusses the origin and development of the European Monetary System (EMS) and the later introduction of the Euro. It describes how the EMS was established in 1972 to link European currencies and stabilize exchange rates. The Exchange Rate Mechanism formalized central rates for currencies within prescribed margins. The goals were greater stability and economic convergence. However, the EMS collapsed in 1992-1993 due to currency crises forcing rates outside margins. The Maastricht Treaty established the Euro and steps to economic and monetary union, including establishing the European Central Bank and requiring member states to meet fiscal and debt criteria. The Euro was officially launched in 1999 among 11 initial members.

seems to say No. The community shall

not be liable for or assume the commitments of central government

….or public undertakings of any member state. A member state shall

not be liable…except in the case of, mutual financial guarantees for the

joint execution of the specific project.](https://image.slidesharecdn.com/theeuropeanmonetarysystem-210709084102/75/The-European-Monetary-System-20-2048.jpg)