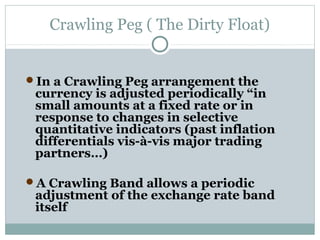

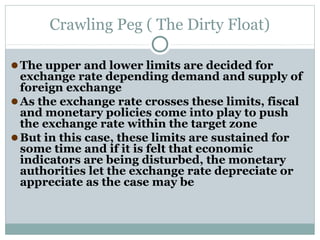

The international monetary system refers to the set of rules and institutions that govern foreign exchange between nations. Historically, systems included the gold standard and Bretton Woods system of fixed exchange rates pegged to the US dollar and gold. The collapse of Bretton Woods in 1971 led to a floating exchange rate system today where currencies fluctuate based on market forces. Current systems range from independent floating to managed floats and pegs that allow some flexibility. Understanding the monetary system helps managers with currency management, business strategy, and relations with governments.