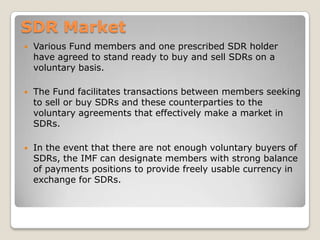

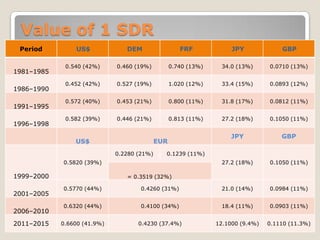

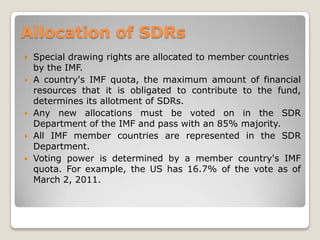

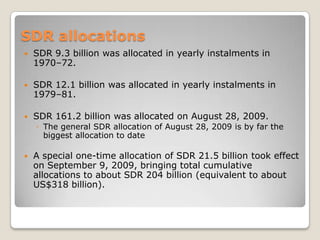

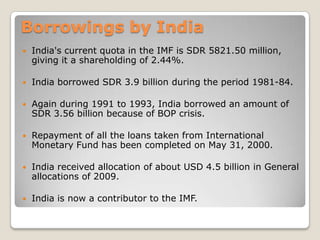

The document provides information about Special Drawing Rights (SDRs) created by the International Monetary Fund. It discusses that SDRs were created in 1969 as a supplemental international reserve asset intended to supplement a shortfall of gold and US dollars. The value of an SDR is defined by a weighted basket of currencies including the US dollar, Euro, British pound, and Japanese yen. SDRs are allocated to IMF members based on their IMF quota and can only be exchanged between central banks for freely usable currencies.