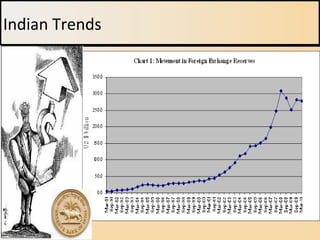

The document discusses foreign exchange (FX) reserves, defining them as external assets controlled by monetary authorities for financing balance of payments and regulating currency exchange rates. It presents trends in FX reserves for various countries, ranking China, Japan, and Russia among the top holders, and highlights their significance in foreign debt repayment and credit rating assessments. Additionally, it outlines sources and uses of these reserves, underscoring their role in stabilizing currencies and countering market volatility.

![Rank Country Billion USD (end of month)

1 People's Republic of China [note 1]

$ 2648.3 (Sep 2010)[2]

2 Japan $ 1019 (Jun 2009)[3]

— Eurozone $ 753 (Sep 2010)

3 Russia[note 2]

$ 476 (Oct 2010)[4]

4 Republic of China (Taiwan) $ 383.38 (Sept 2010) [5]

5 Saudi Arabia $ 410 (Dec 2009)[6]

6 India [note 2]

$ 297.96 (Oct 29, 2010)[7]

7 South Korea $ 293.35 (October 2010)[8]

8 Brazil[note 3]

$ 287 (Oct 2010)[9]

— Hong Kong $ 266.1(Sep 2010)

9 Switzerland[note 4]

$ 250 (Aug 2010)

10 Singapore $ 214.7 (Sep 2010)

11 Germany $ 184 (Sep 2009)

12 Thailand $ 159.1 (Sep 2010)[10]

13 Italy $ 144 (June 2010)

14 France $ 143 (June 2010)

15 United States $ 129 (July 2010)

Global Comparison](https://image.slidesharecdn.com/forexpresentation-101110013901-phpapp01/85/Foreign-Exchange-FX-reserves-6-320.jpg)