The document provides information on index numbers including:

1) Index numbers measure relative changes in variables like prices, quantities, or values over time by calculating the ratio of current to base values.

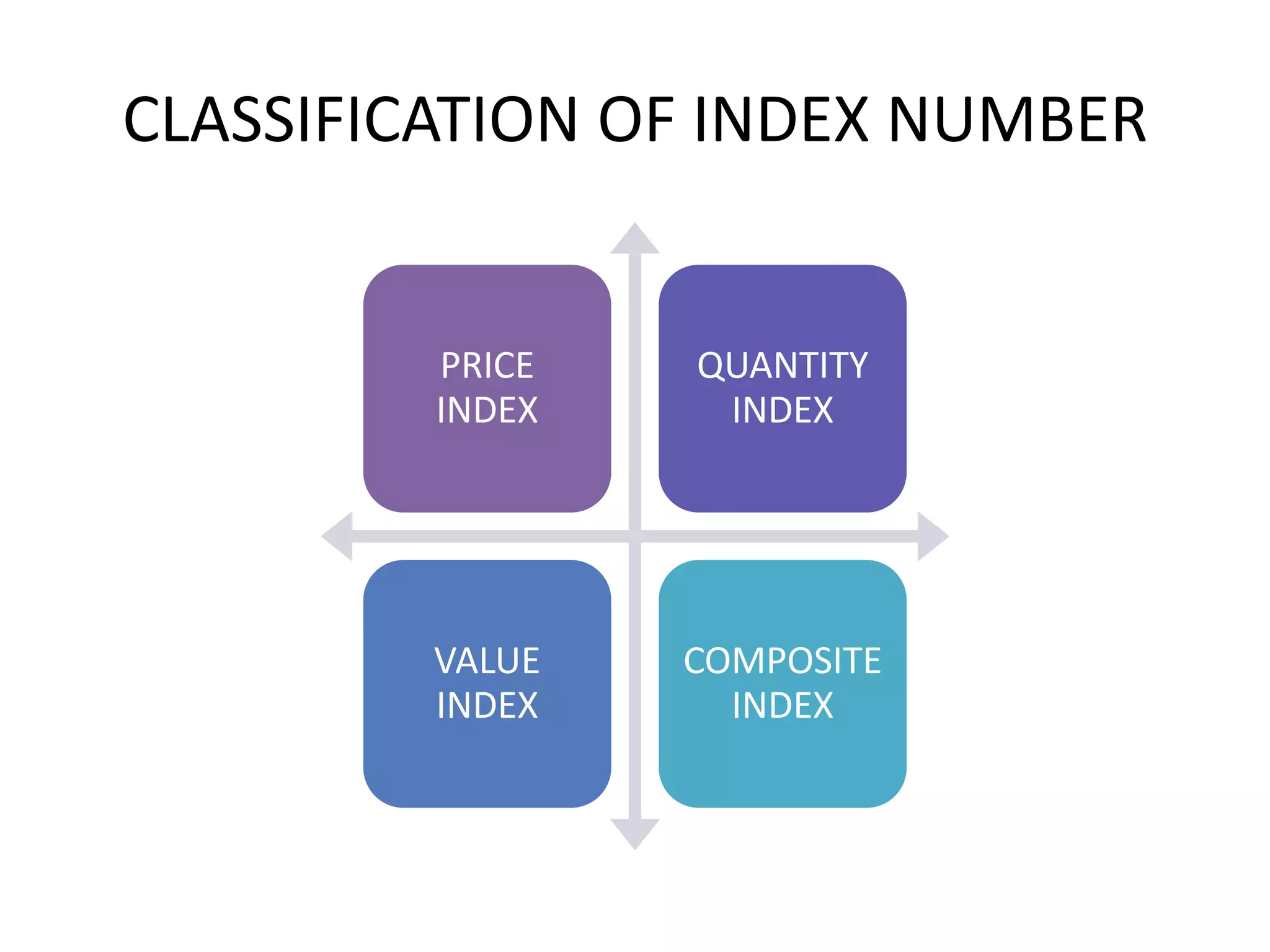

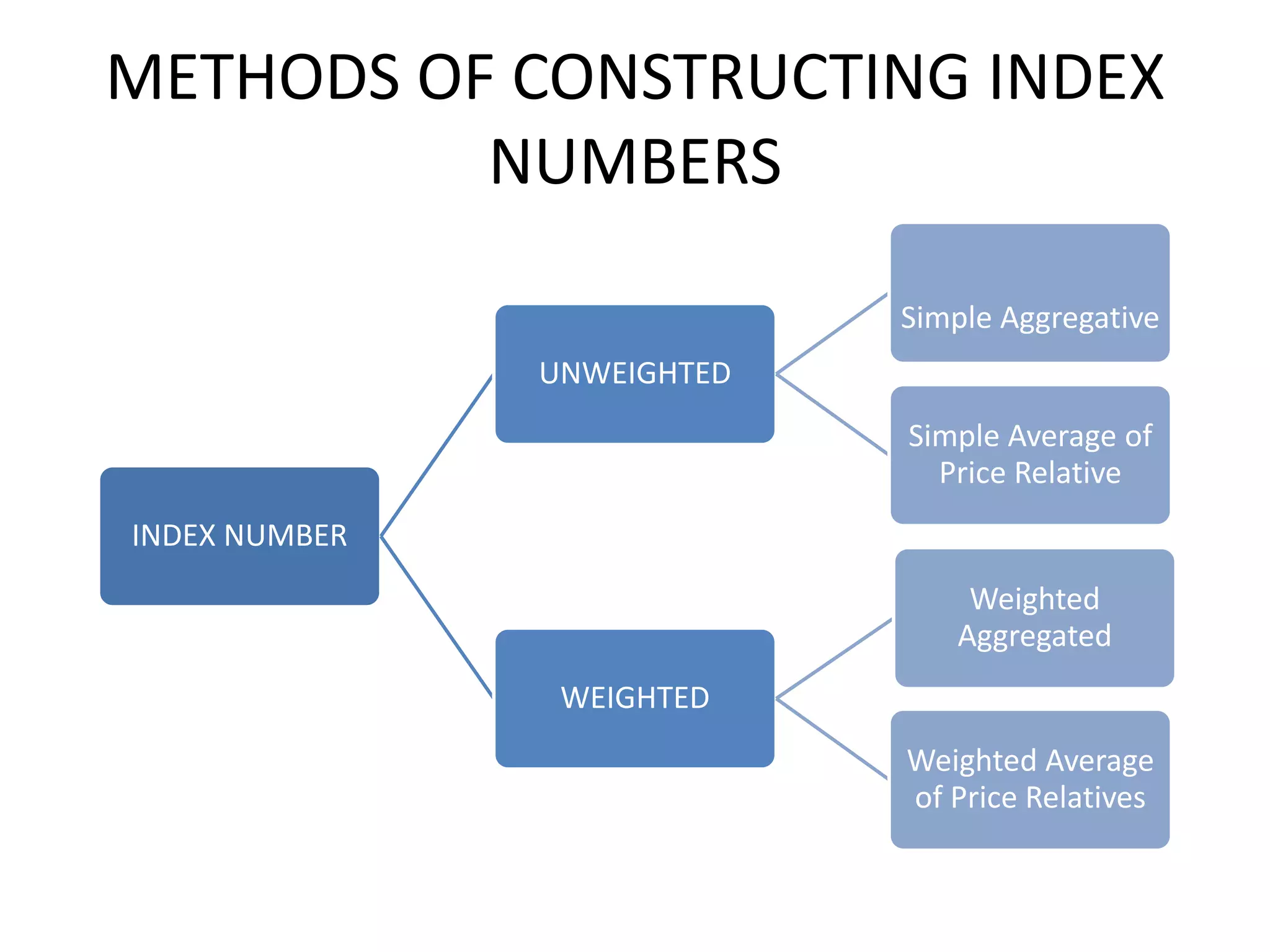

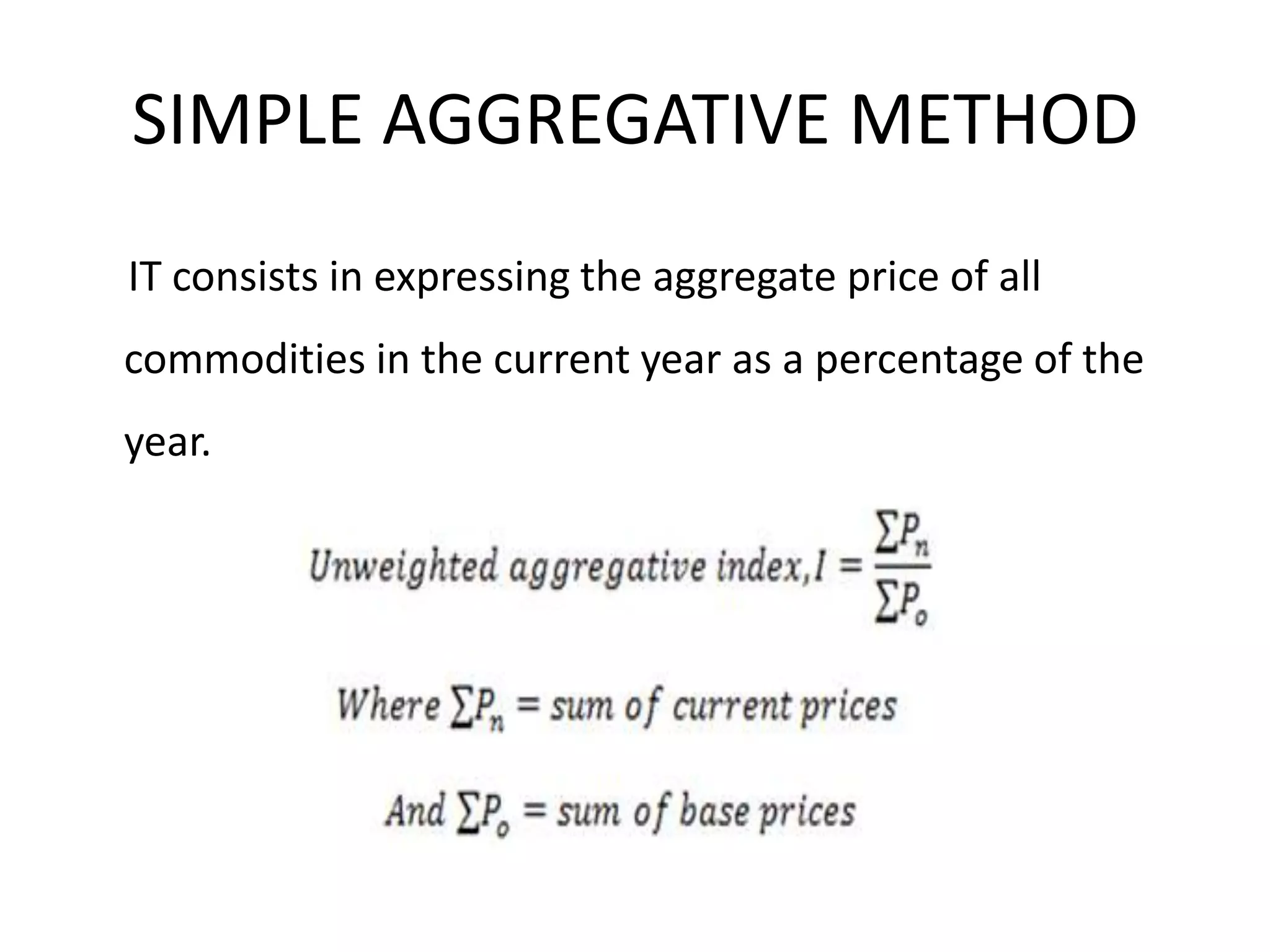

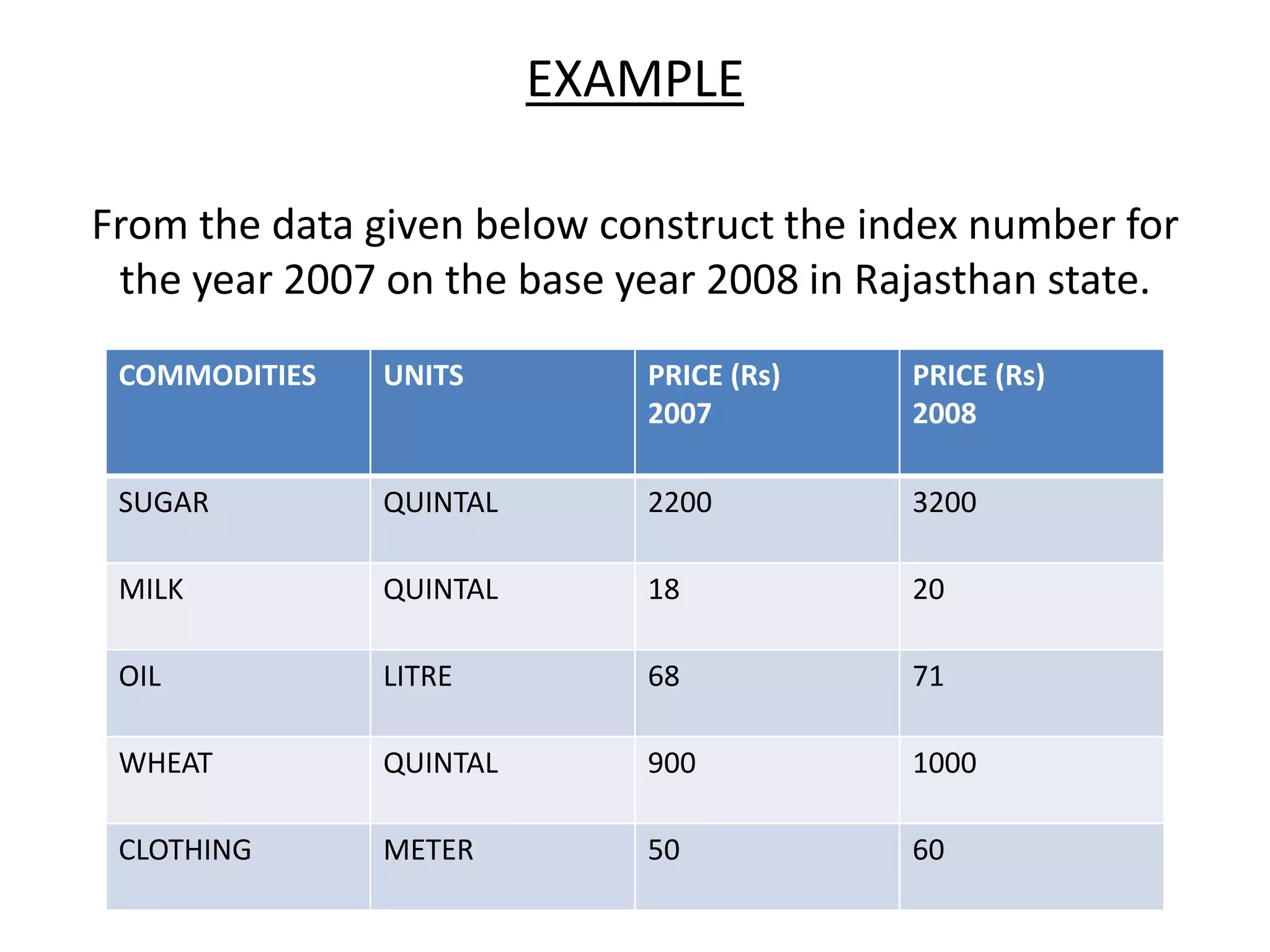

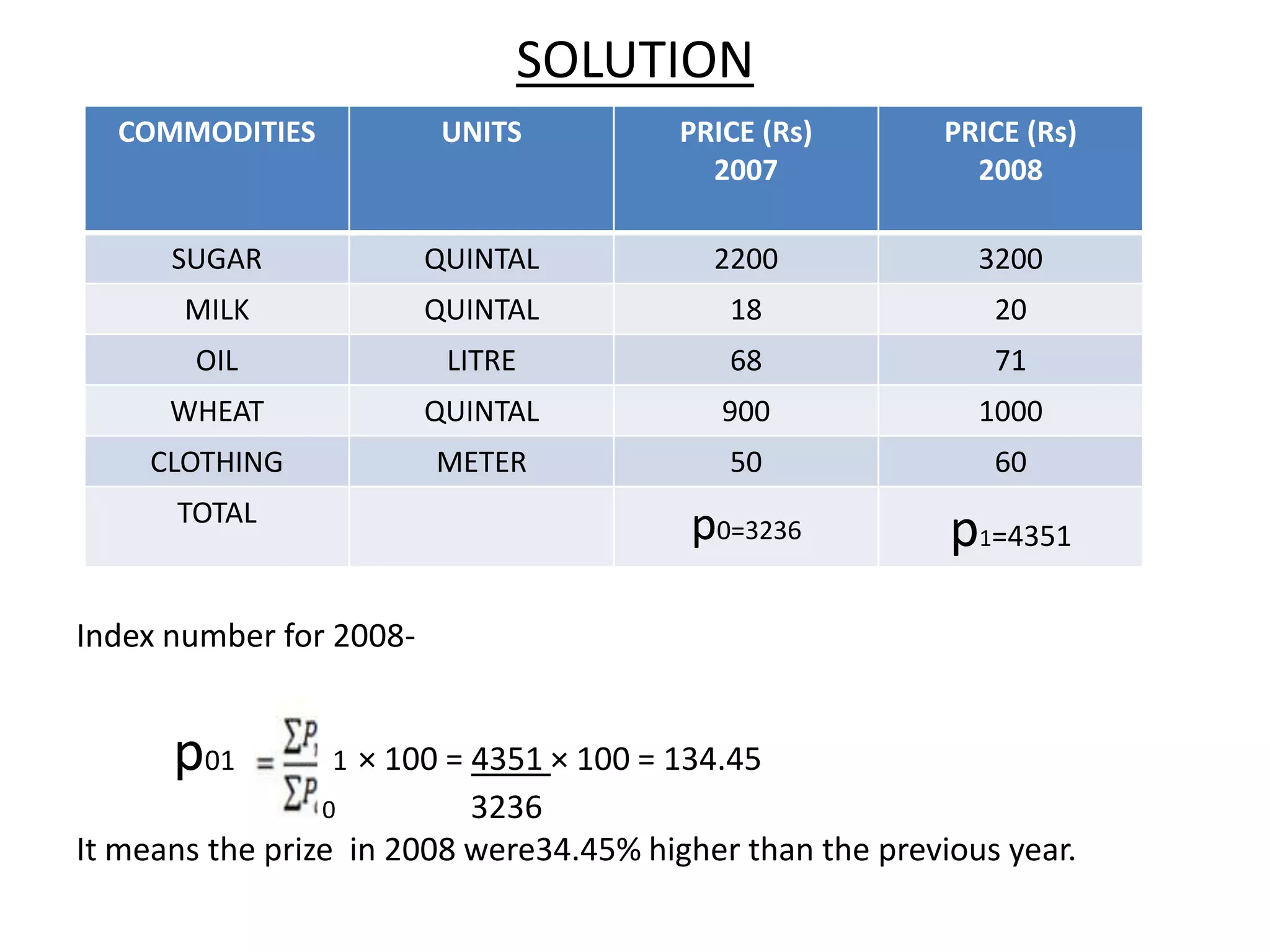

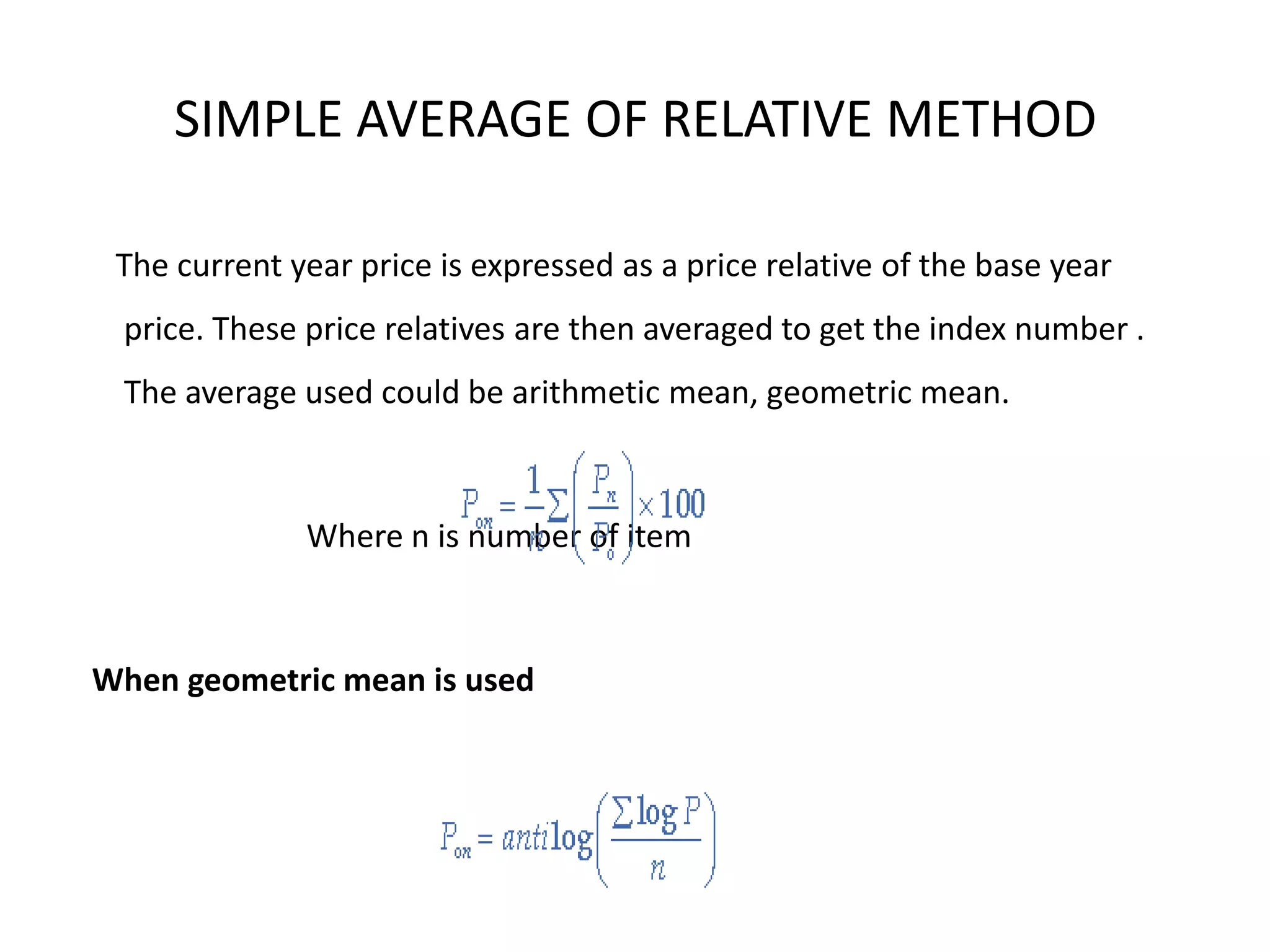

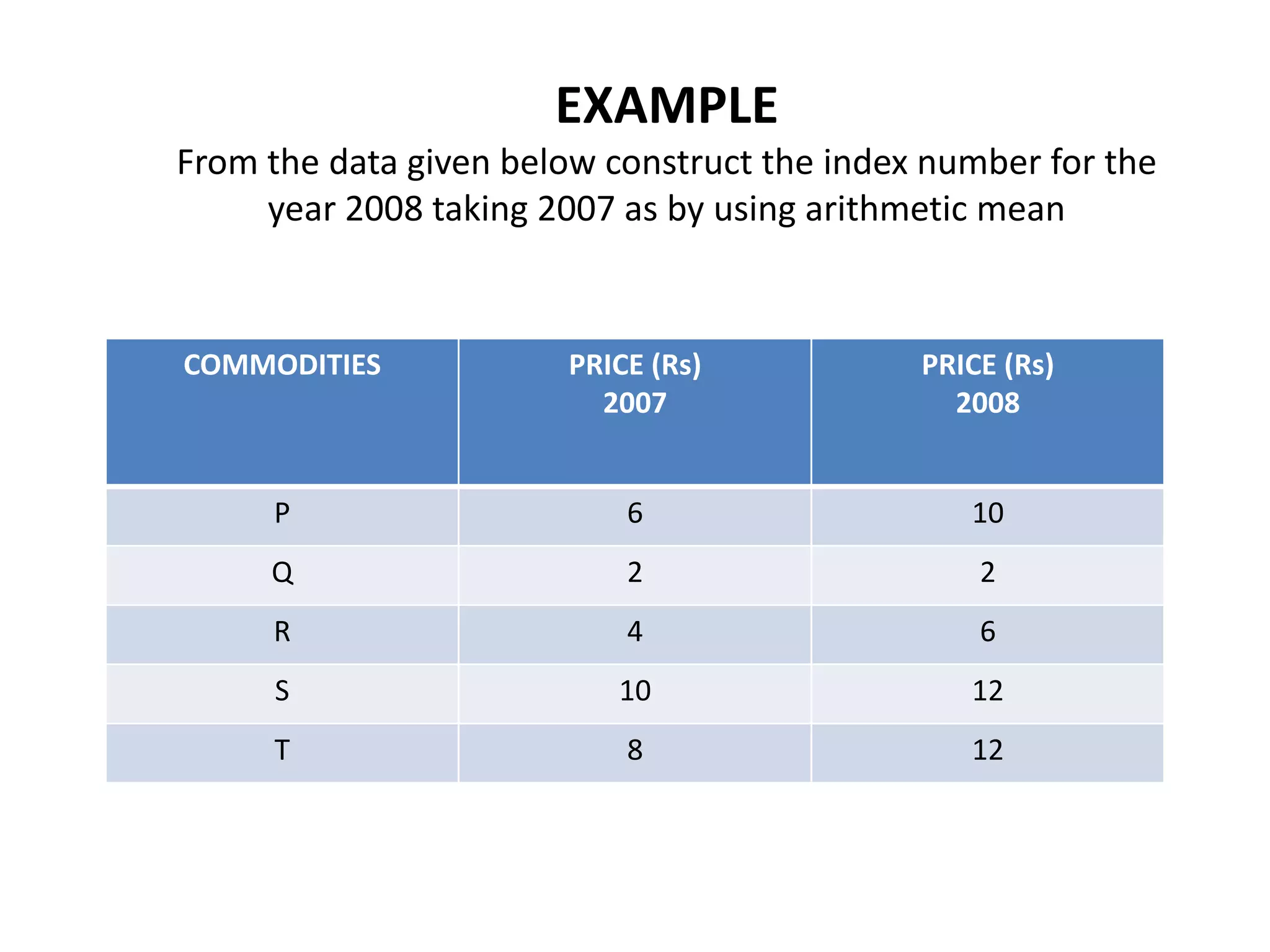

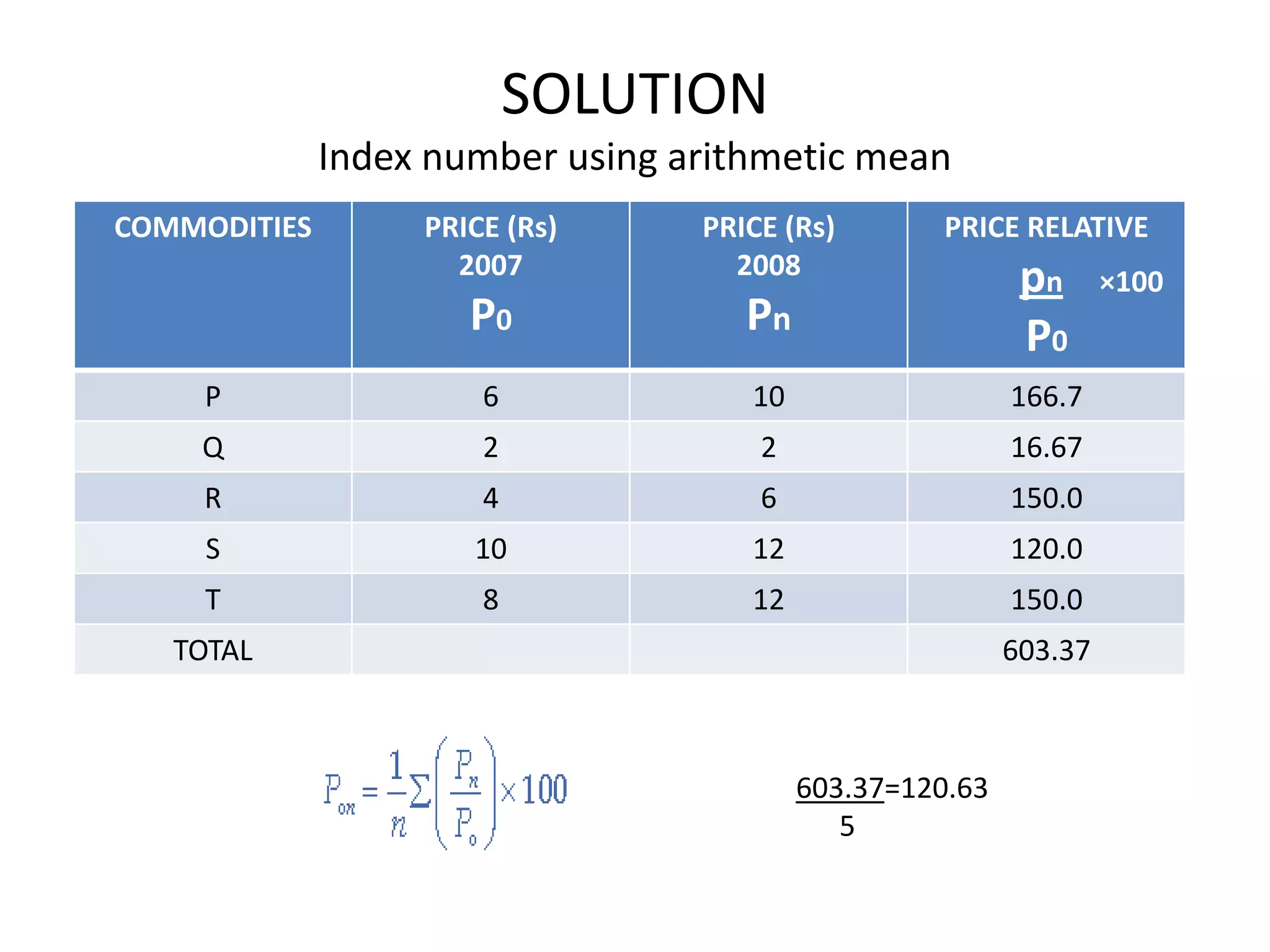

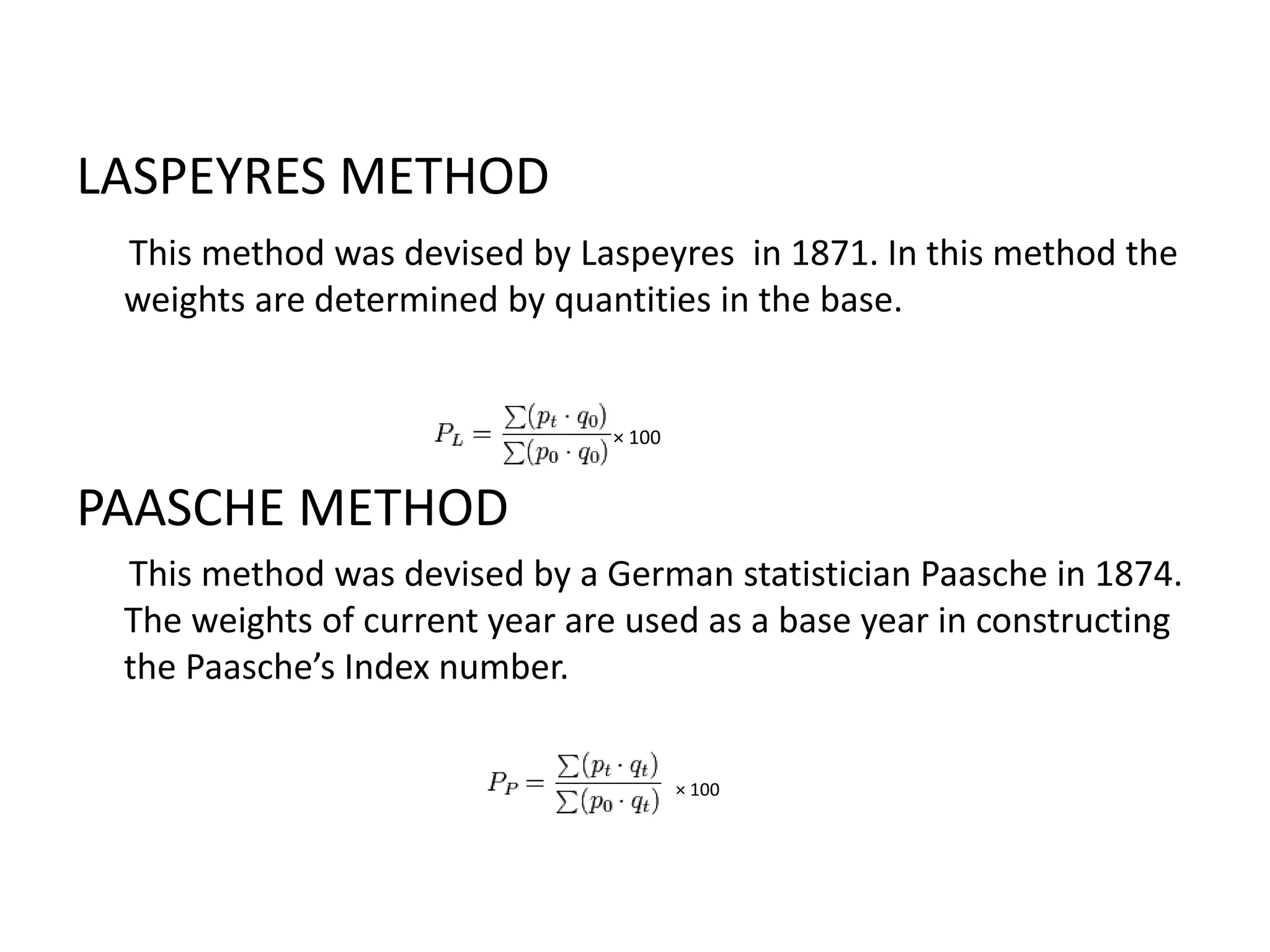

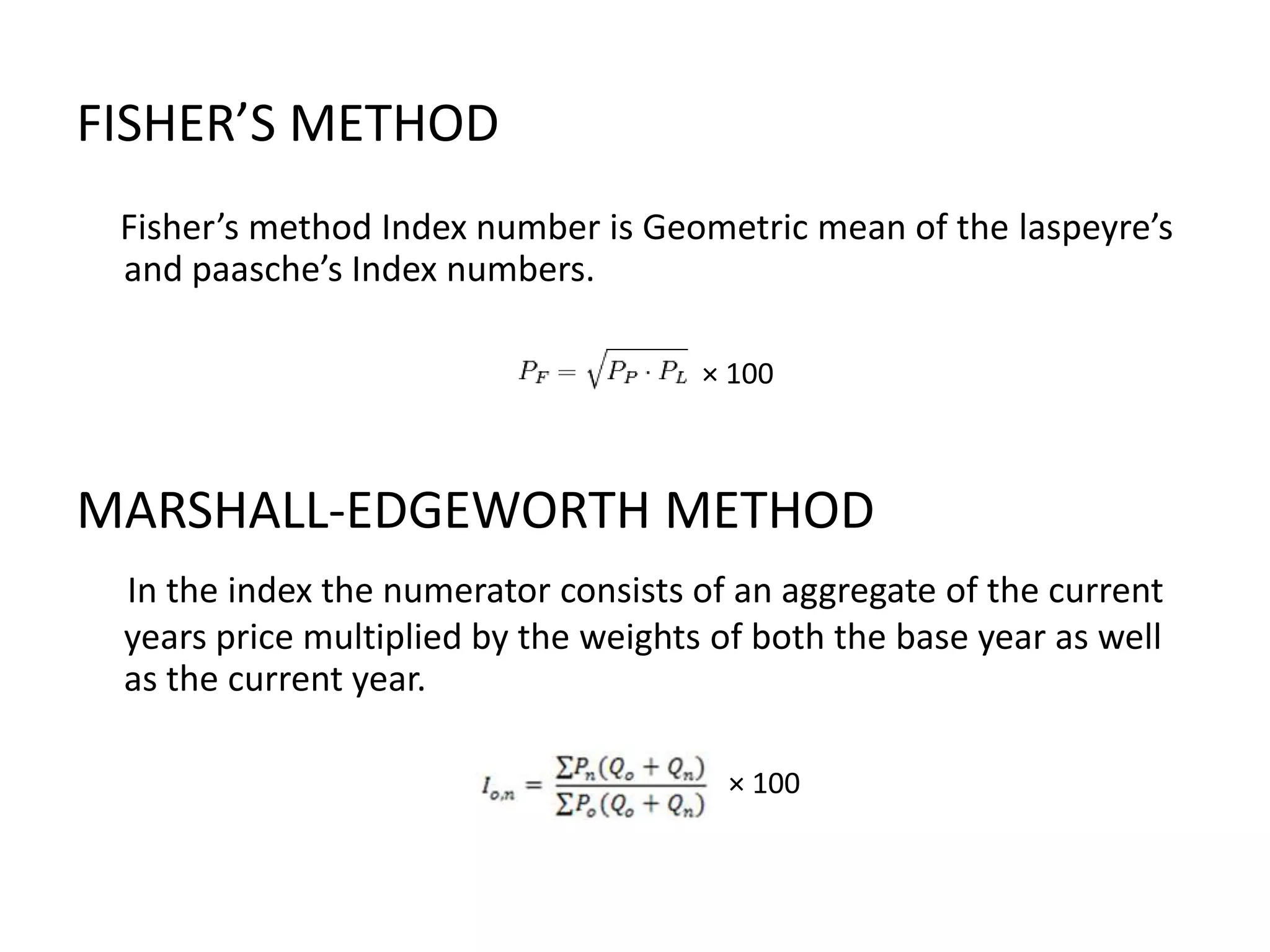

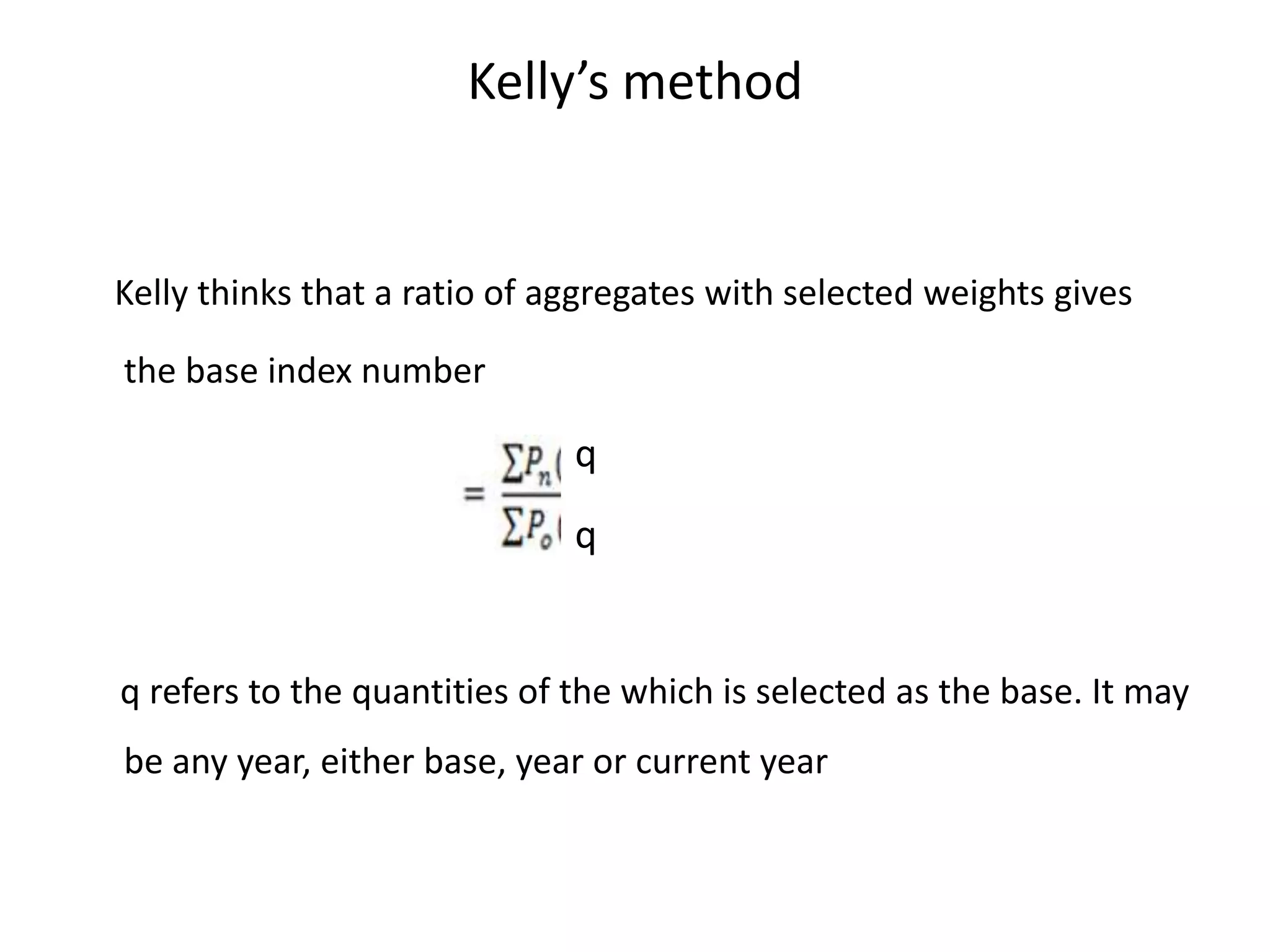

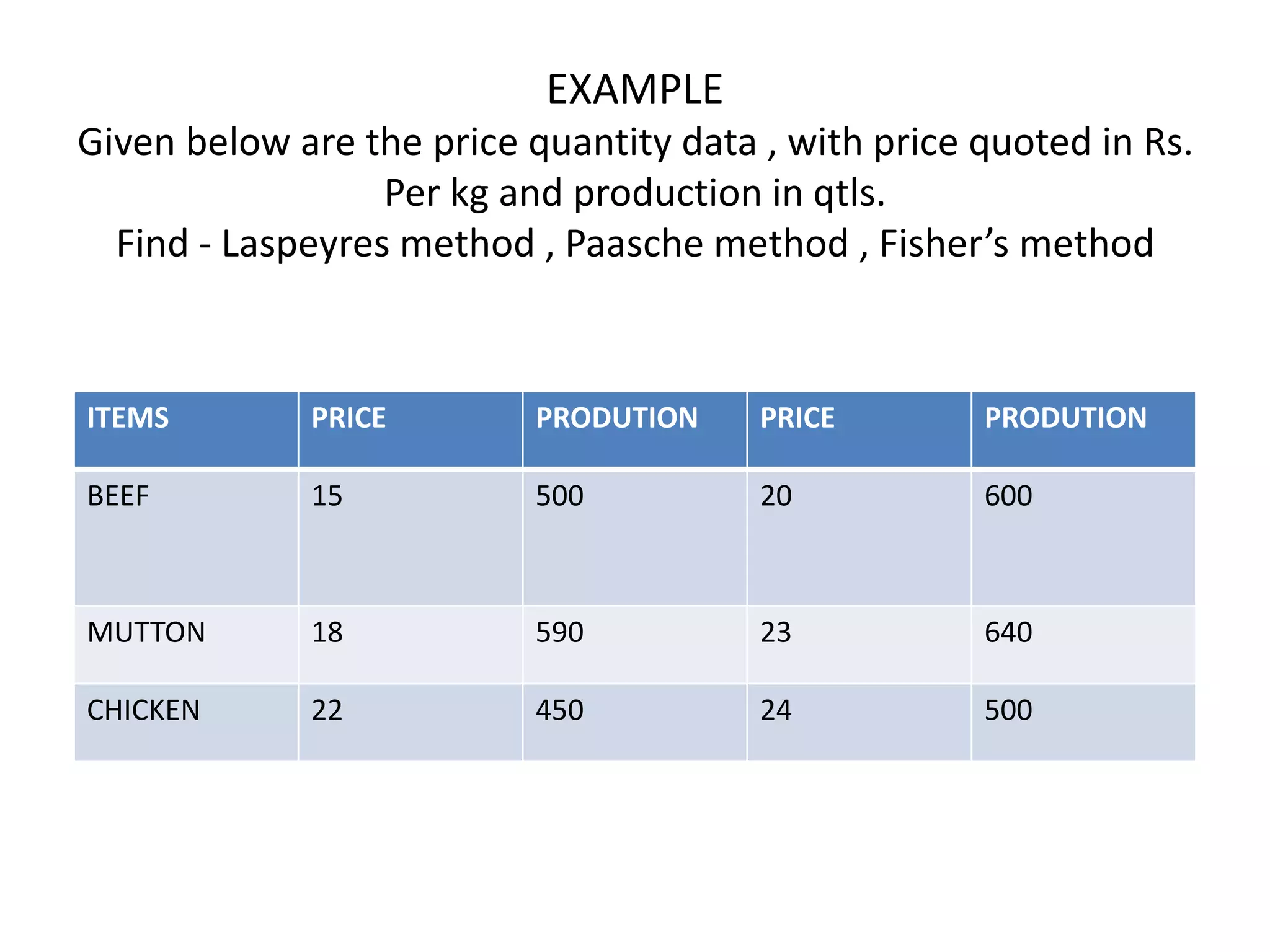

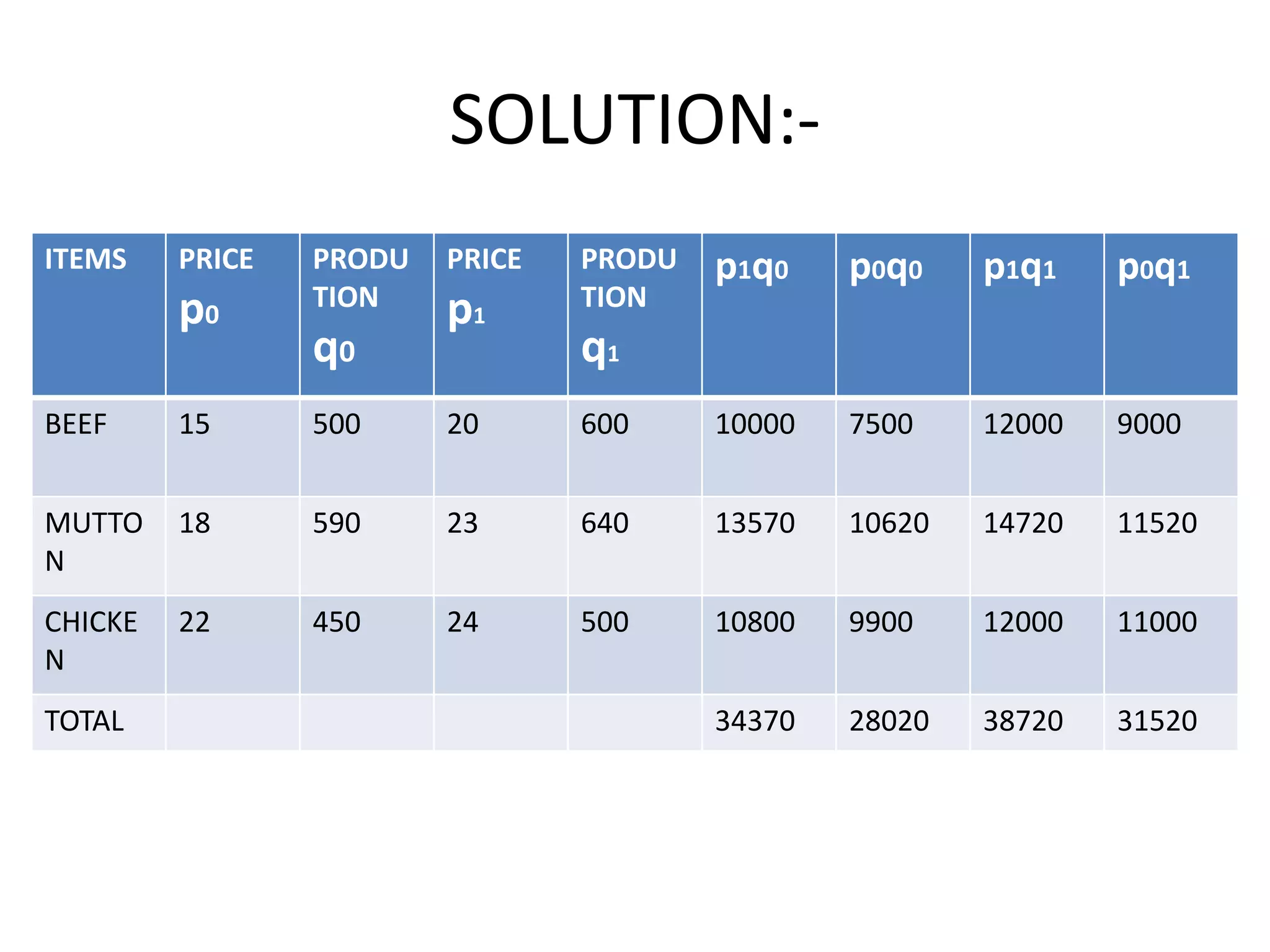

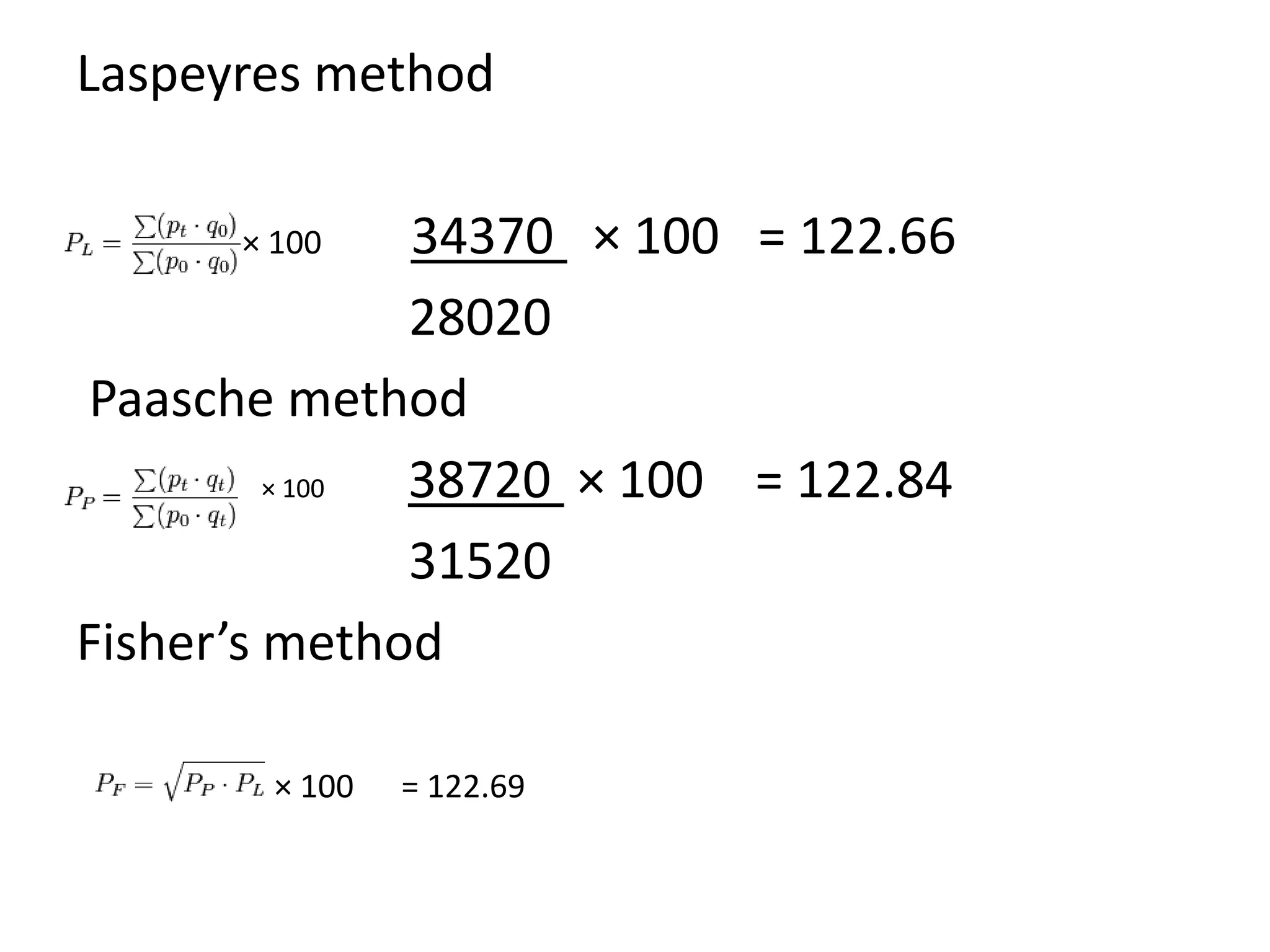

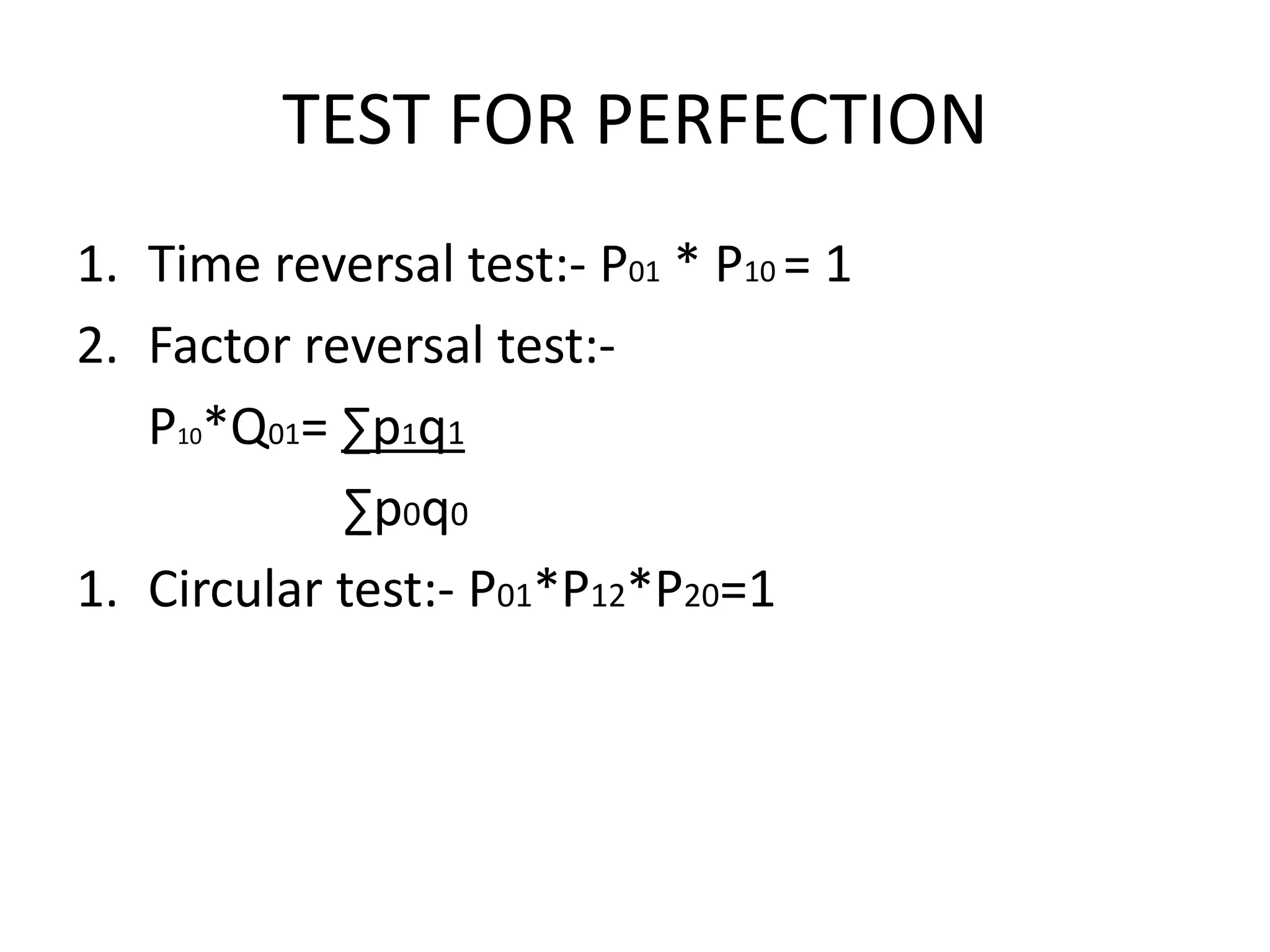

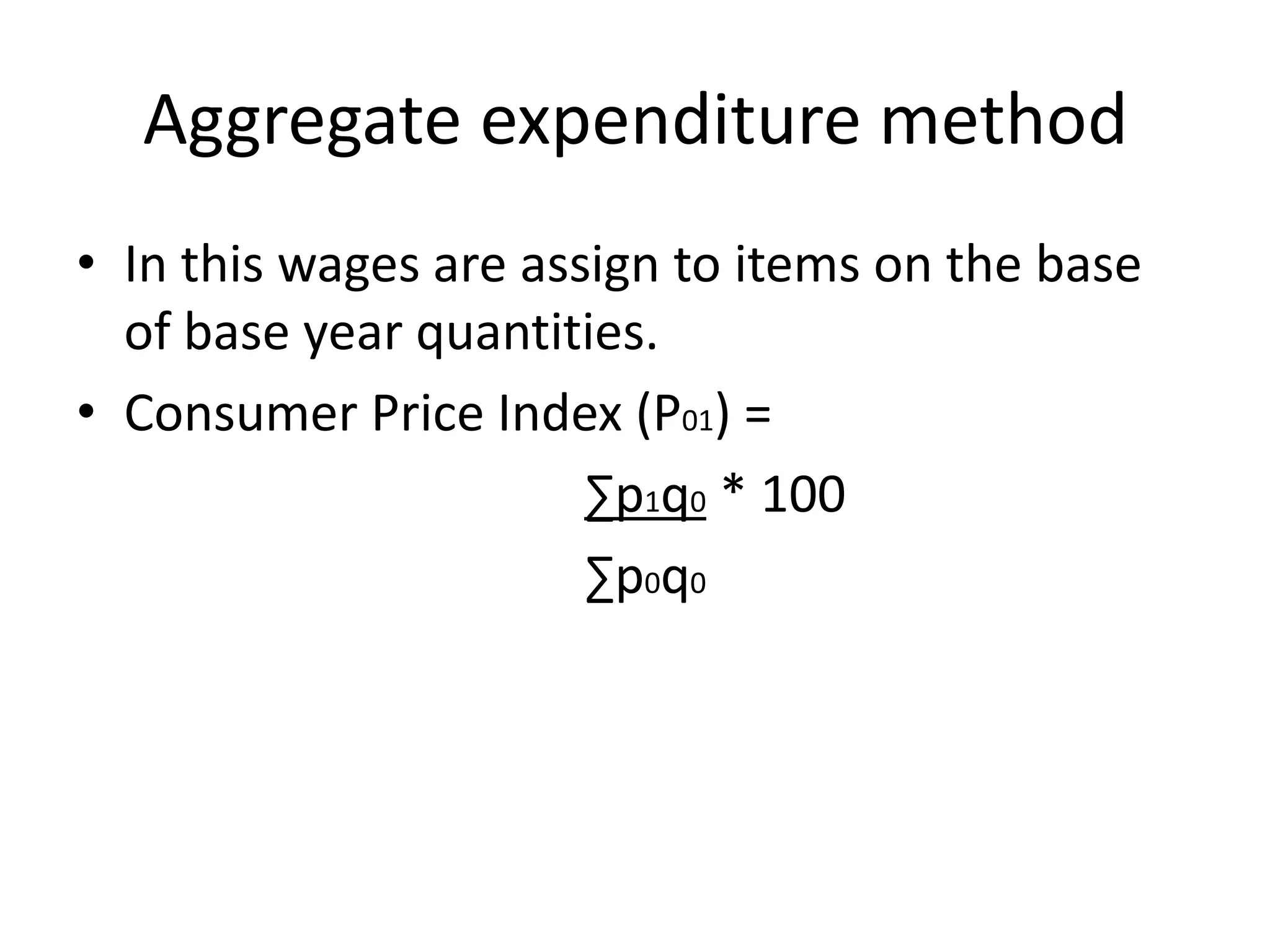

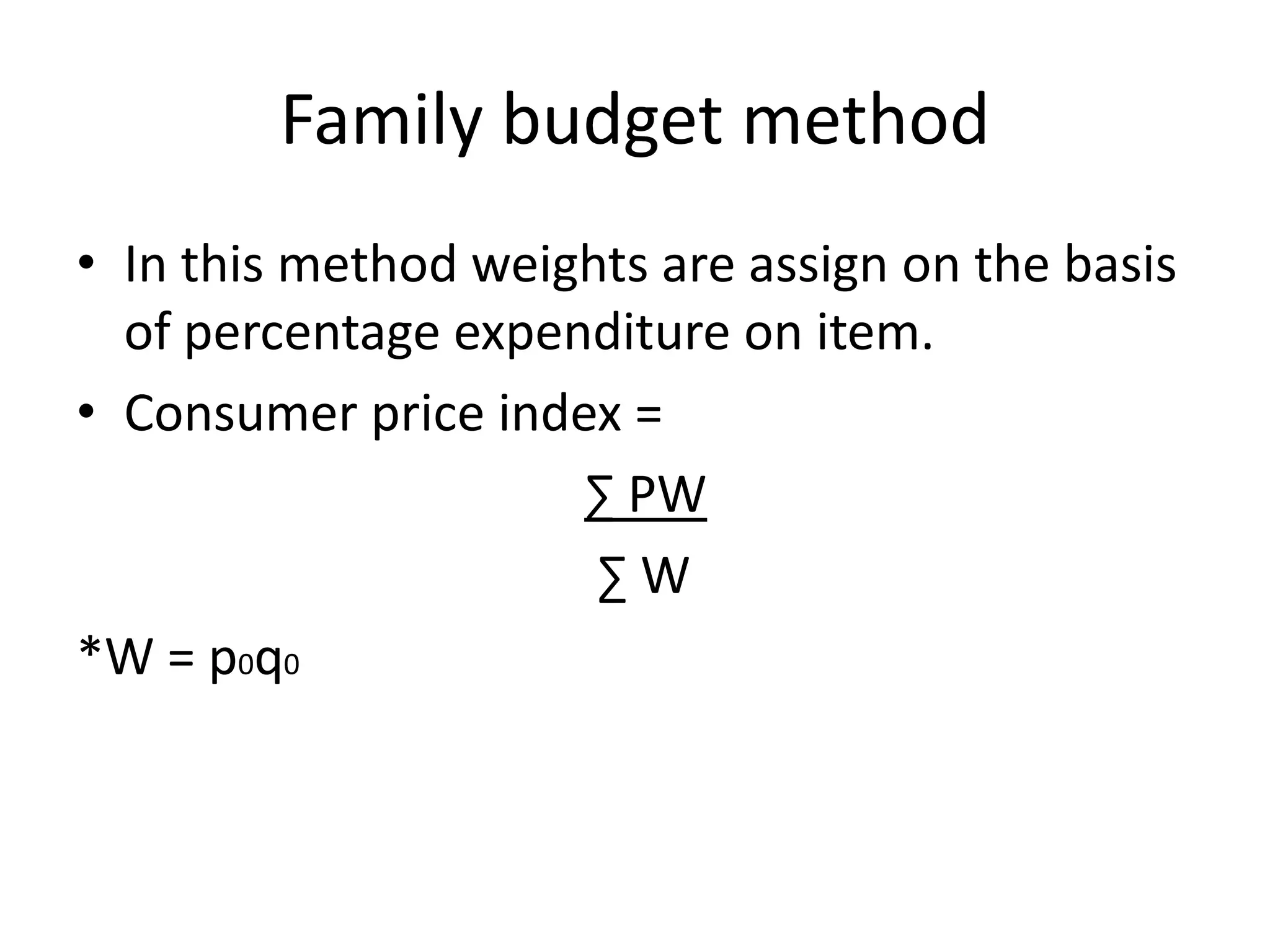

2) There are different types of index numbers such as price indexes, quantity indexes, and composite indexes. Methods for constructing indexes include simple aggregative, weighted aggregated, Laspeyres, Paasche, and Fisher's methods.

3) Index numbers have various uses including framing economic policies, revealing trends, and deflating monetary values. Problems in constructing indexes include choosing the base period, averages, commodities, and collecting data.