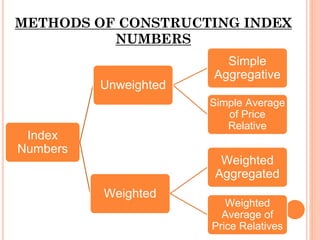

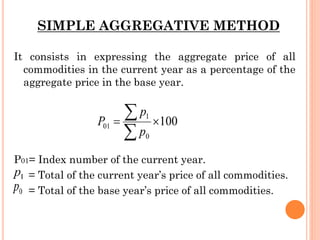

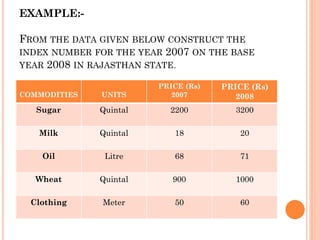

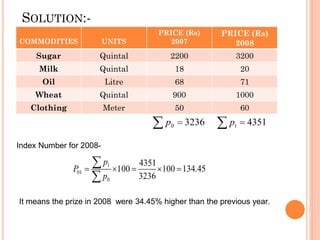

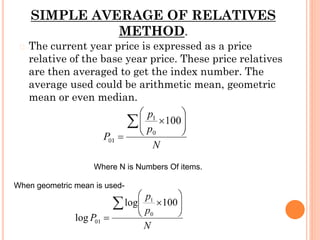

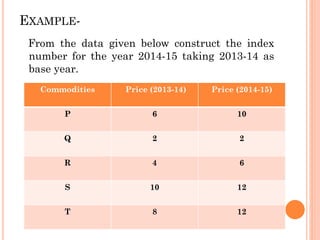

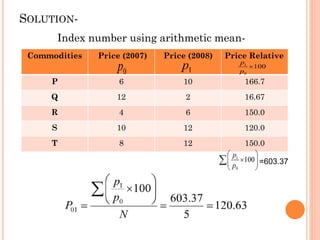

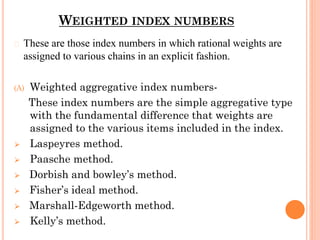

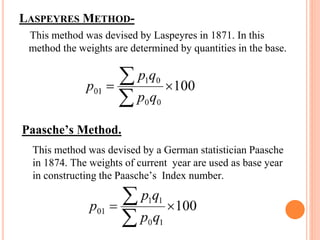

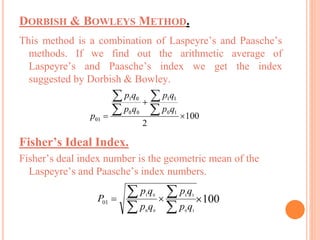

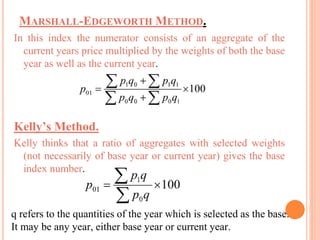

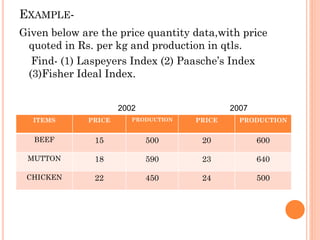

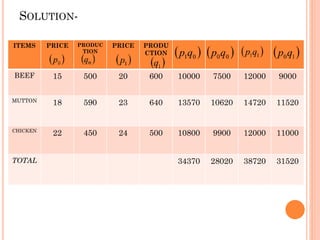

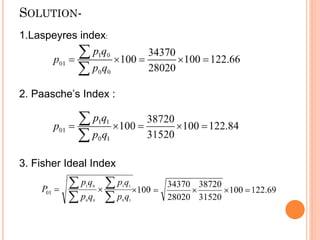

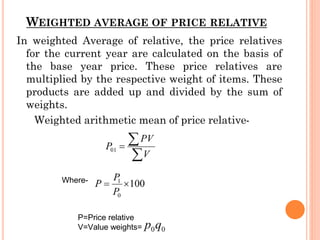

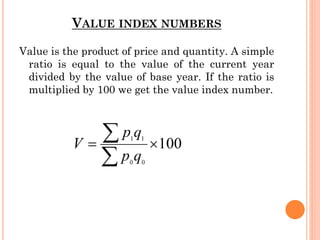

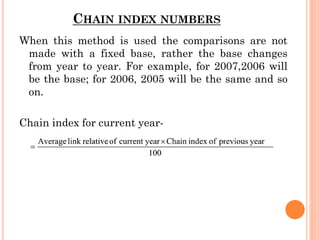

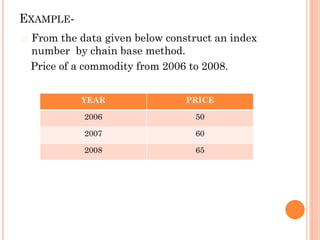

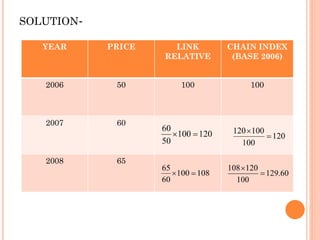

This document provides an overview of index numbers, which are statistical measures used to compare quantitative values over time. It defines index numbers as ratios measuring changes in economic variables. The document then describes different types of index numbers including price, quantity, value, and composite indexes. It also outlines various methods for constructing index numbers, such as simple, aggregative, weighted aggregative, and chain methods. Specific approaches like Laspeyres, Paasche, Fisher, and weighted average price relative methods are examined through examples.