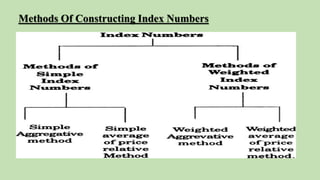

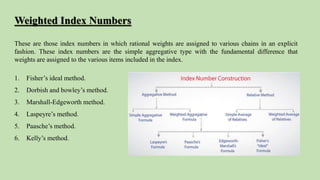

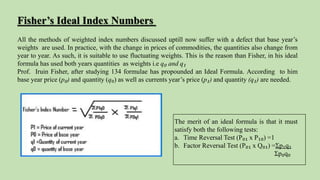

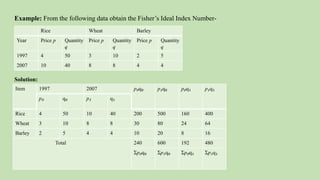

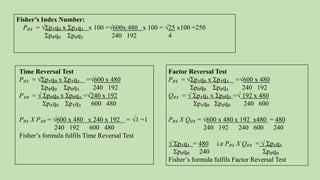

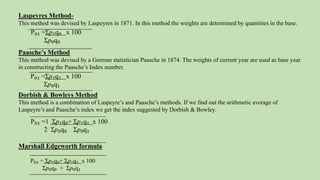

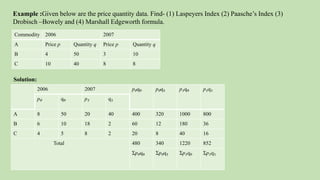

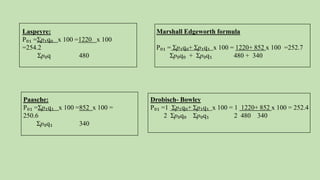

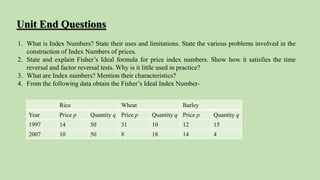

This document discusses index numbers and basic statistics. It begins by defining index numbers as devices that measure changes in variables over time or space. It notes that index numbers are specialized averages. The document then discusses different types of index numbers, methods for constructing them, advantages and disadvantages, and problems related to index numbers. It provides examples of calculating Fisher's ideal index number. In the end, it lists some required readings and resources for further learning about index numbers and basic statistics.