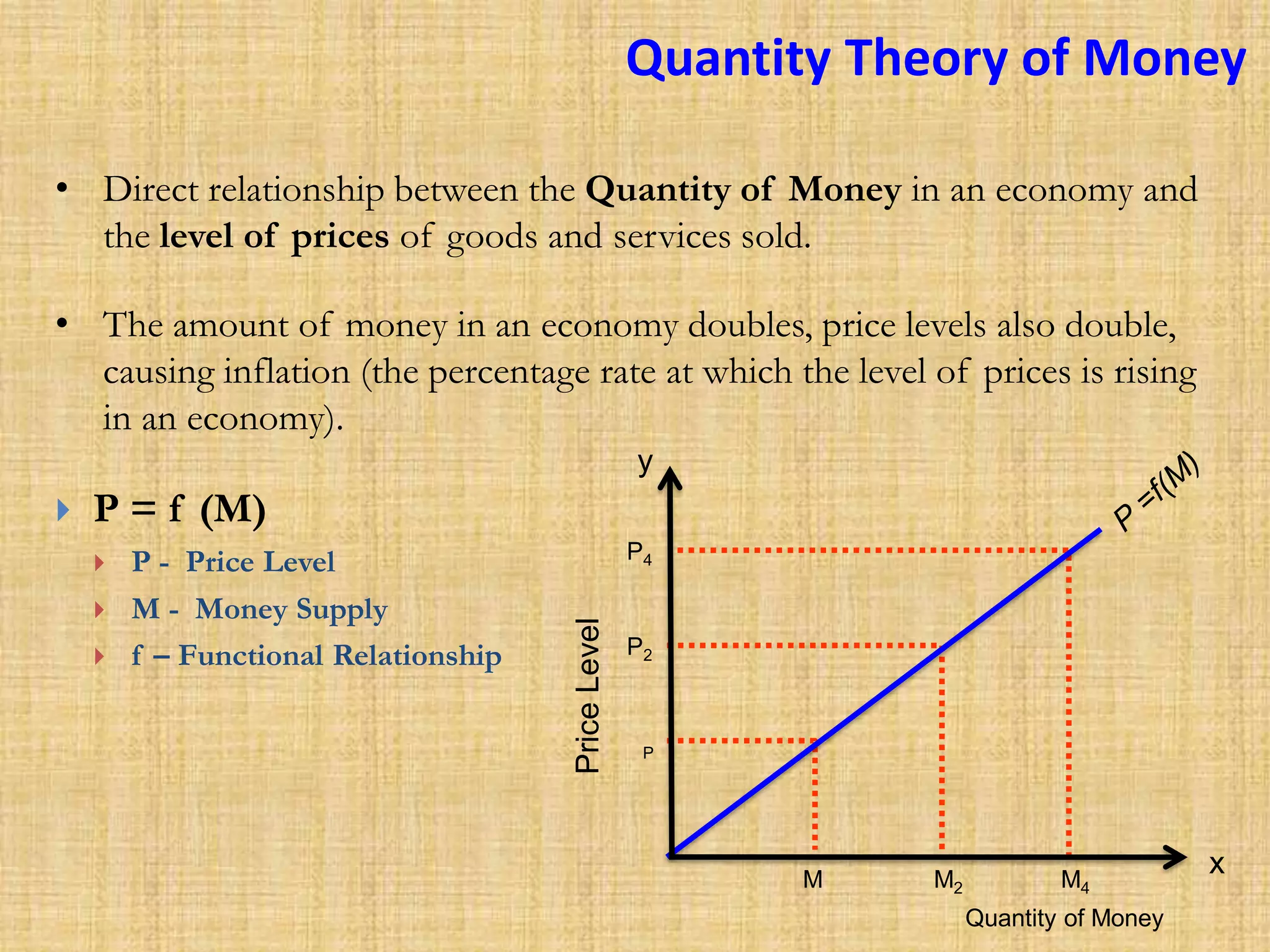

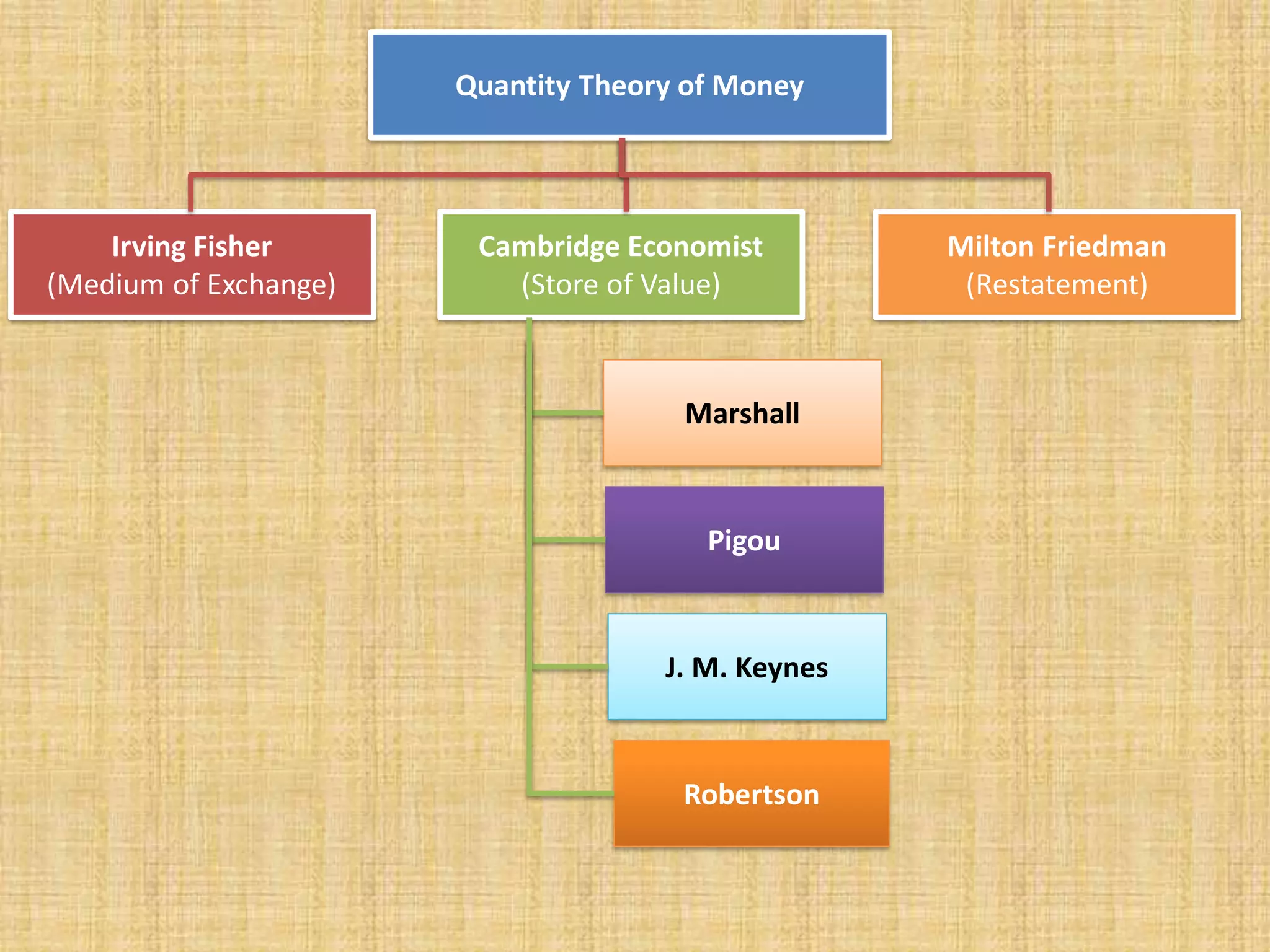

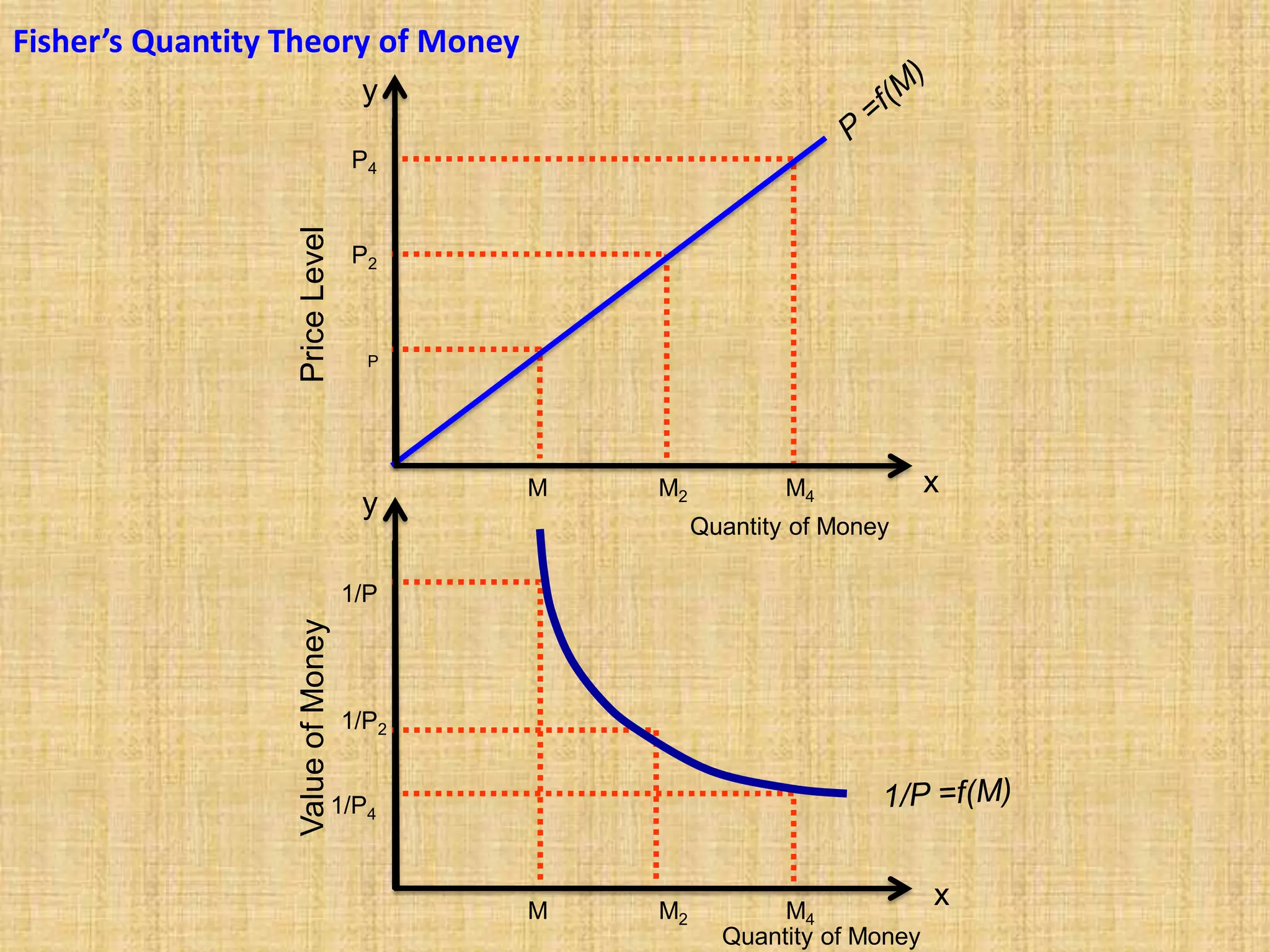

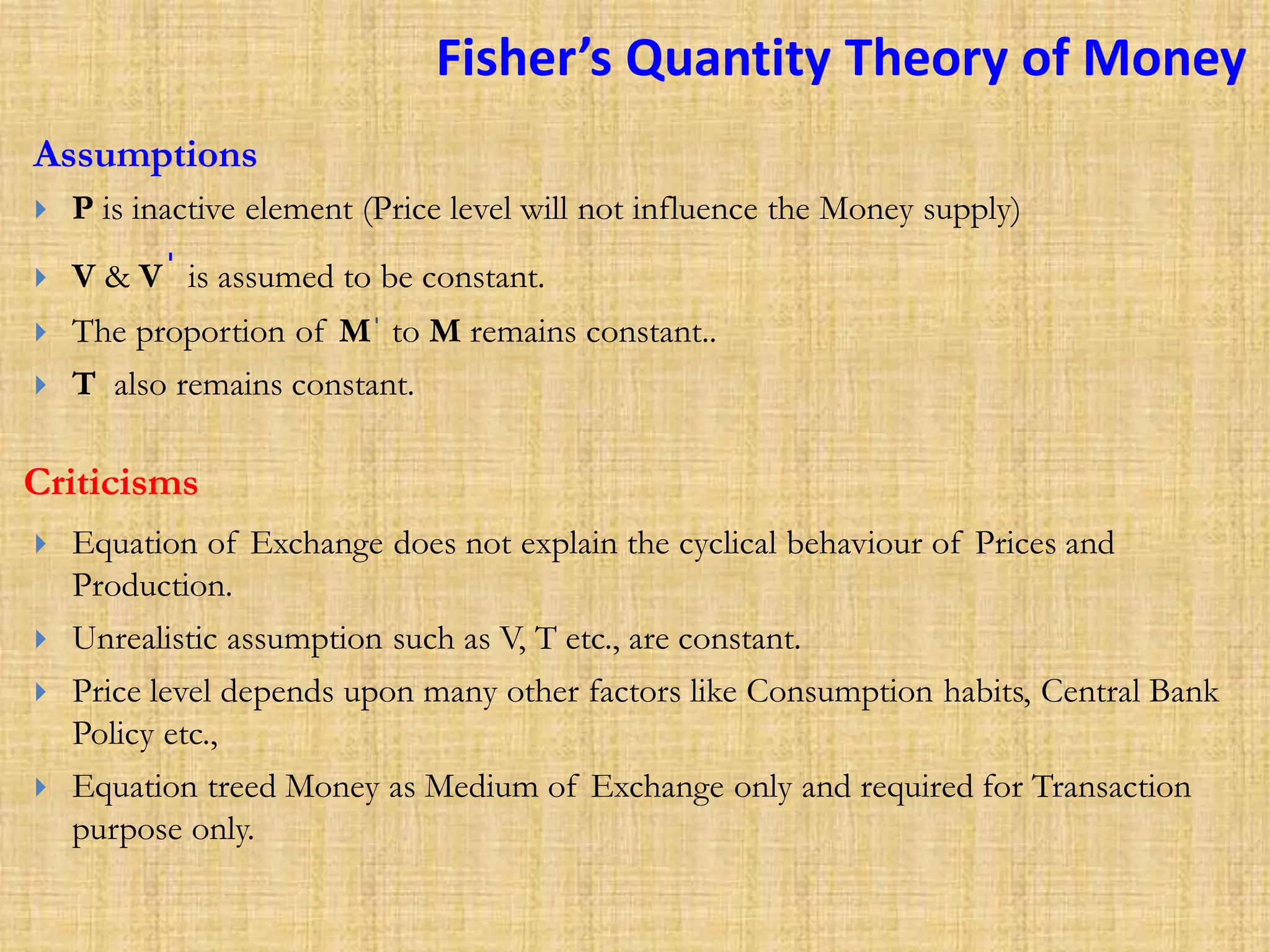

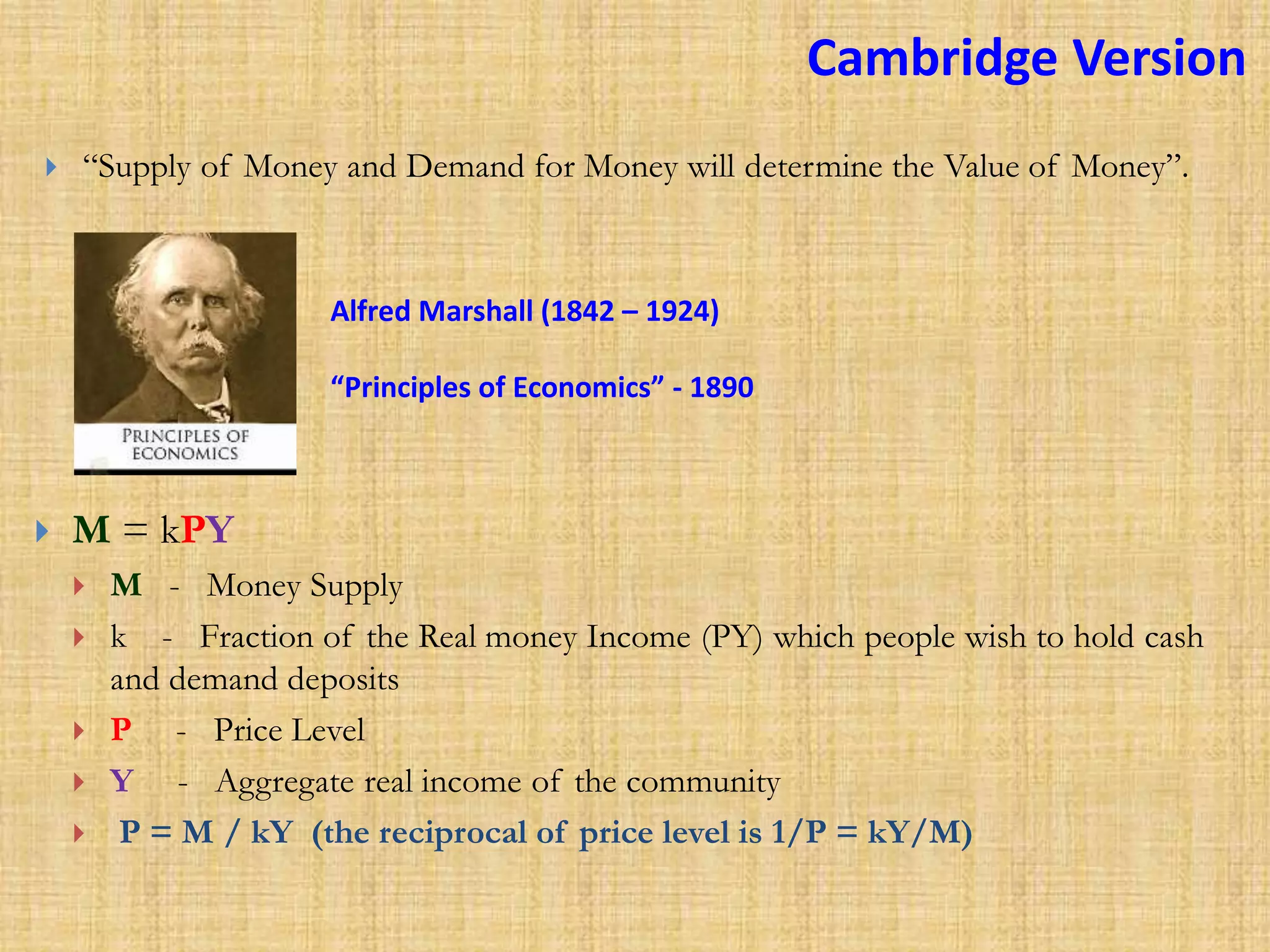

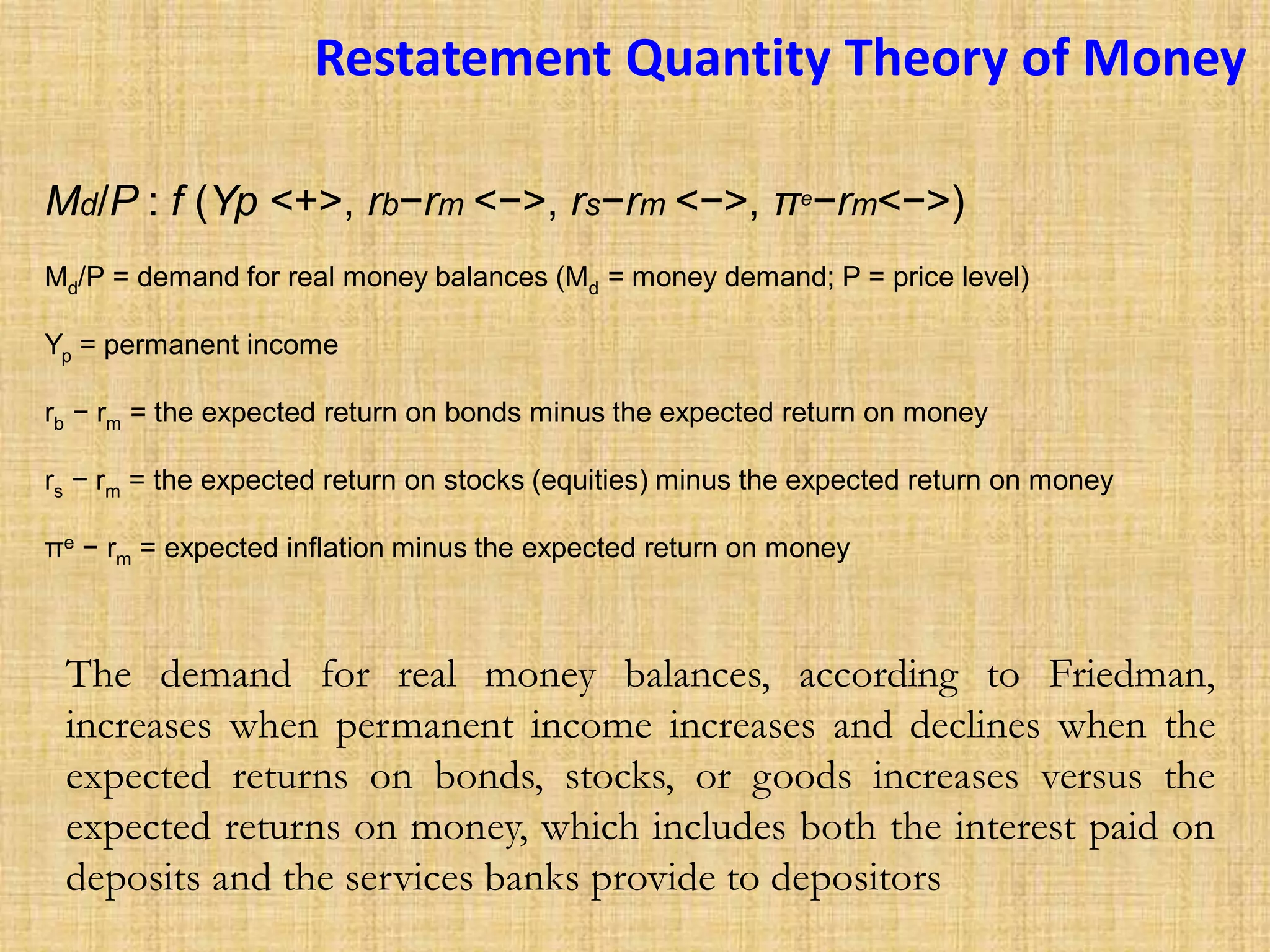

The document discusses the Quantity Theory of Money, which posits a direct relationship between the money supply in an economy and the price levels of goods and services. It covers historical contributions from economists like Davanzati, Locke, Hume, Fisher, and Friedman, highlighting different perspectives and criticisms of the theory. Key points include the notion that increasing the money supply leads to inflation and the varying assumptions and models proposed by economists to explain the dynamics of money, prices, and value.