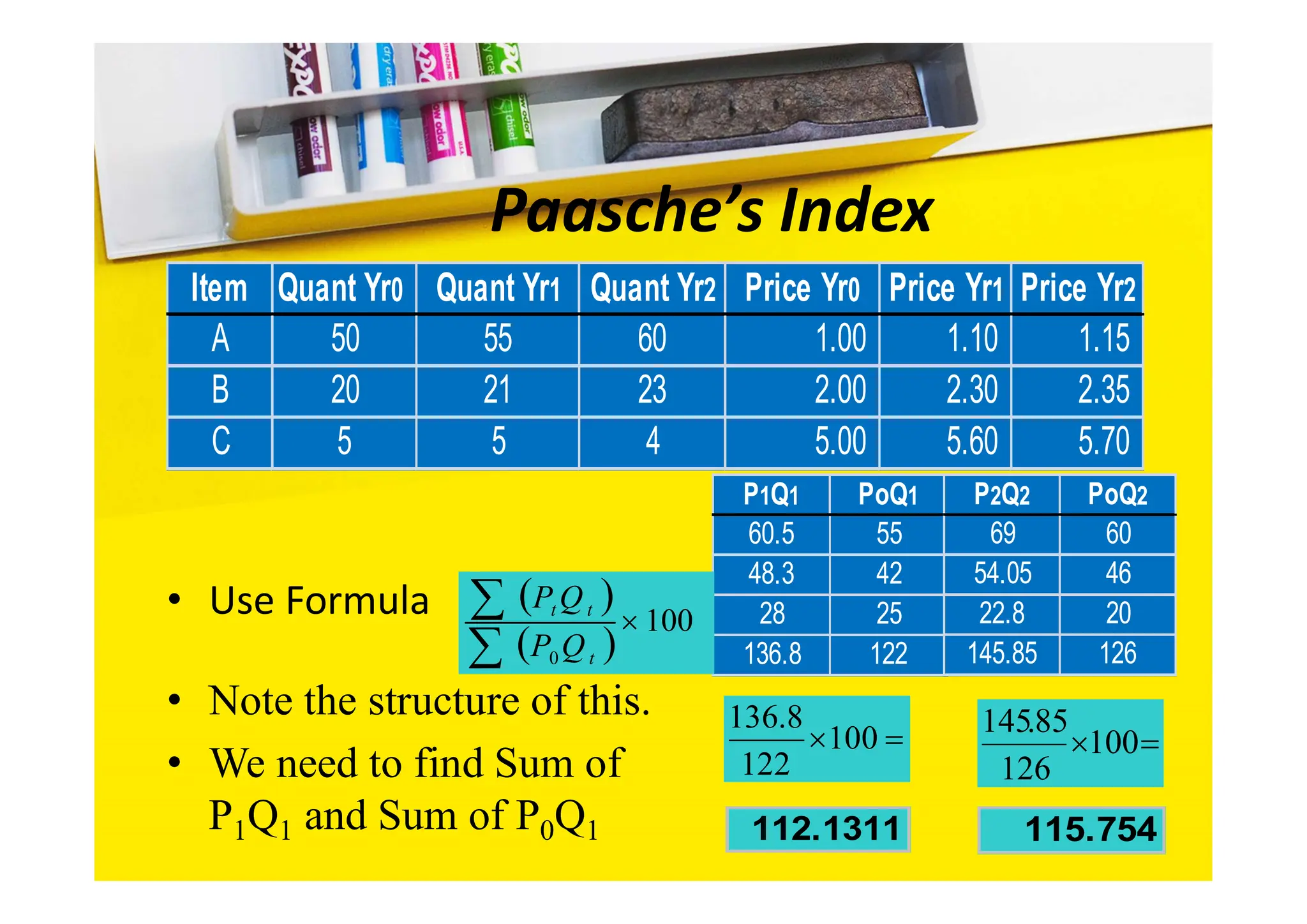

Index numbers are used to measure relative changes in variables like prices or quantities over time. There are different types of index numbers including price indices, quantity indices, and value indices. Price indices can be unweighted like a simple aggregate index or weighted like a Laspeyres or Paasche index which take into account quantities purchased. Fisher's ideal index takes the geometric mean of the Laspeyres and Paasche indices to offset their individual shortcomings in estimating cost of living changes.