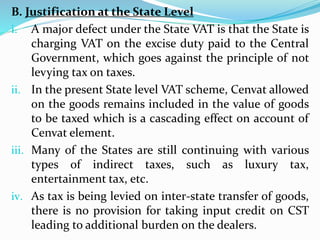

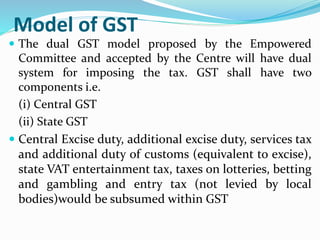

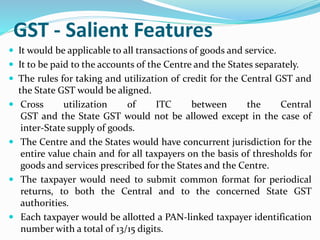

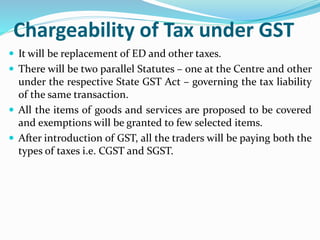

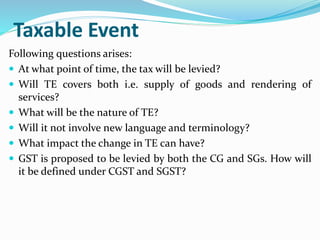

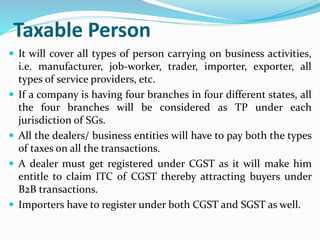

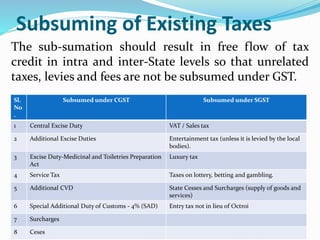

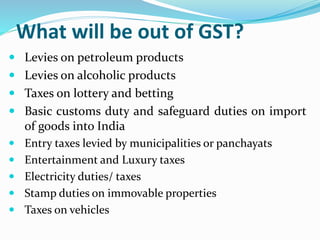

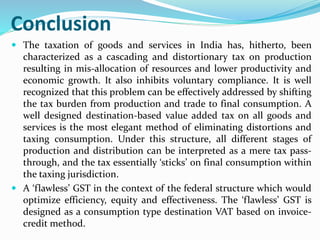

This document provides an overview of the Goods and Services Tax (GST) system proposed to be implemented in India. It defines GST as a comprehensive indirect tax on the manufacture, sale and consumption of goods and services that will replace existing central and state level taxes. The document discusses the need for GST, its justification by replacing existing complex tax structures. It describes the key features of GST including the dual GST model, taxable events, persons, rates, treatment of imports and exports, and advantages of the proposed system.