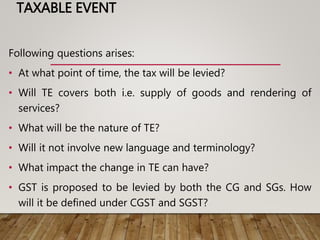

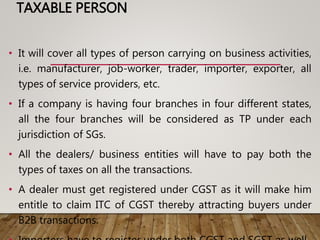

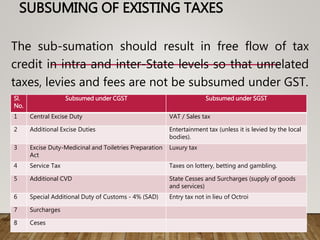

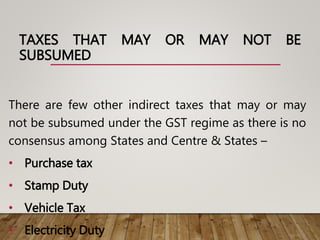

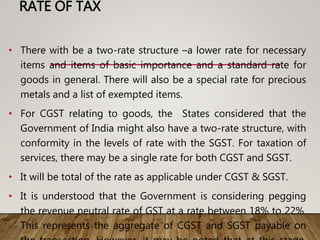

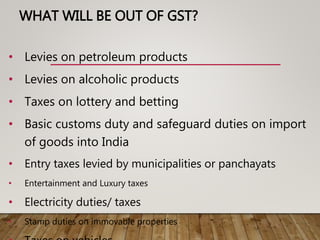

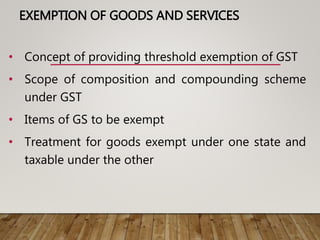

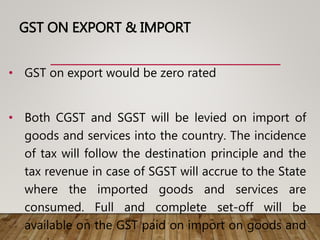

This document provides an overview of the Goods and Services Tax (GST) that is being implemented in India. It discusses what GST is, the need for GST to replace existing indirect taxes, how GST will work, including features like a dual GST model with Central and State components, taxable events, registration requirements, subsuming of existing taxes, rates, exemptions, inter-state transactions and more. It also covers the latest updates on GST implementation and emerging issues regarding transitioning to the new tax system. The conclusion emphasizes that GST aims to simplify indirect taxation by shifting the tax burden to final consumption from production and trade.