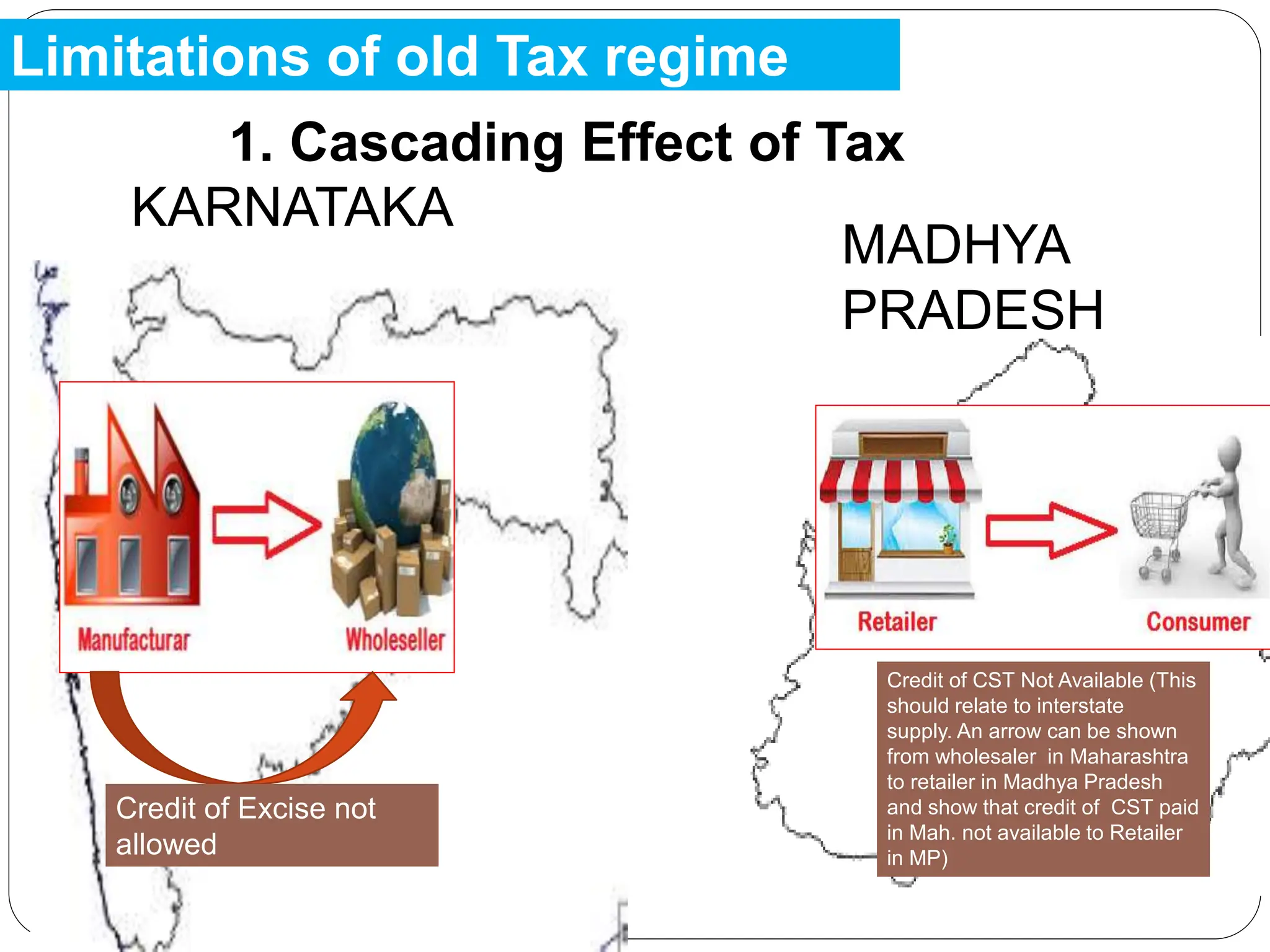

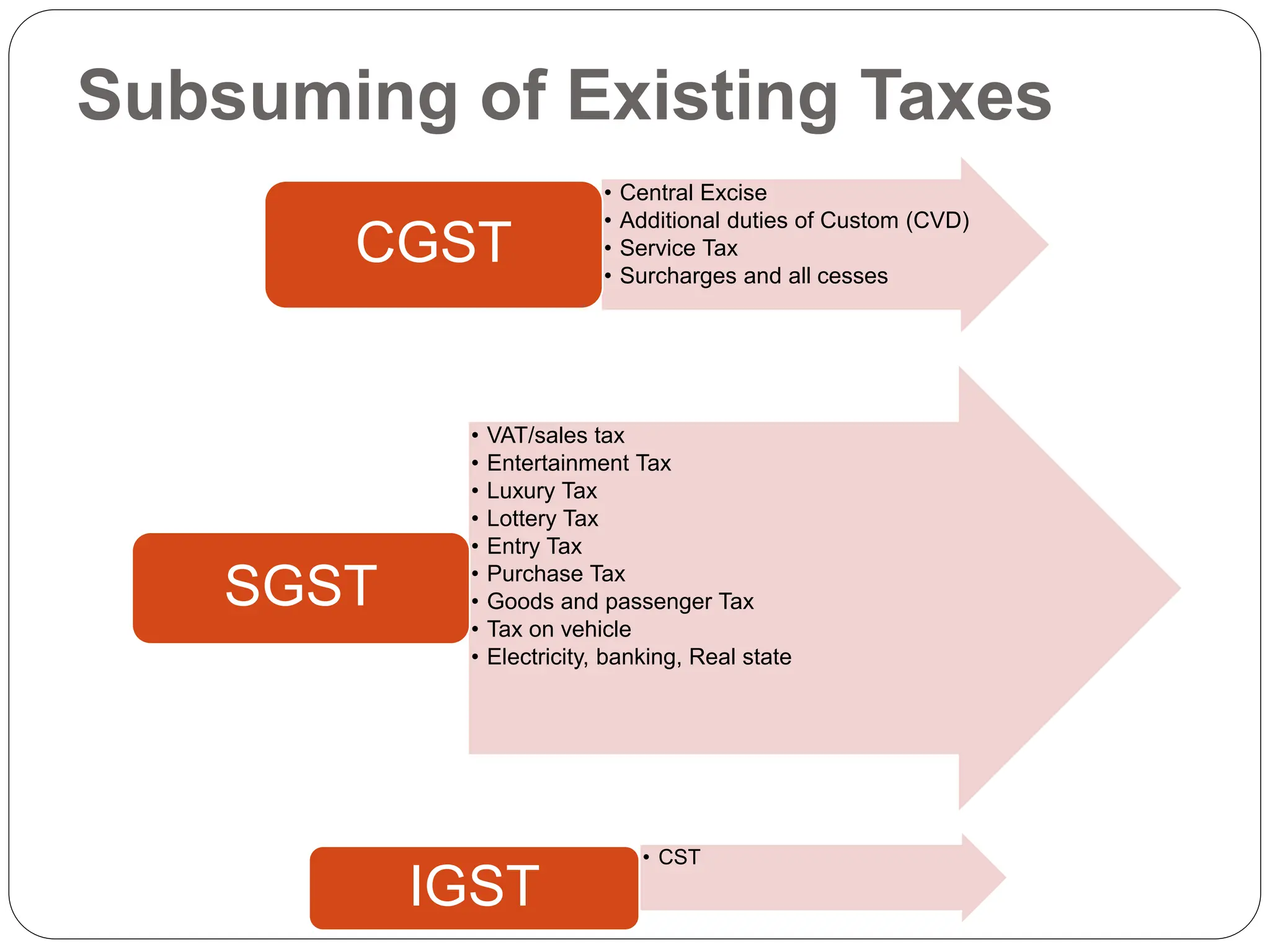

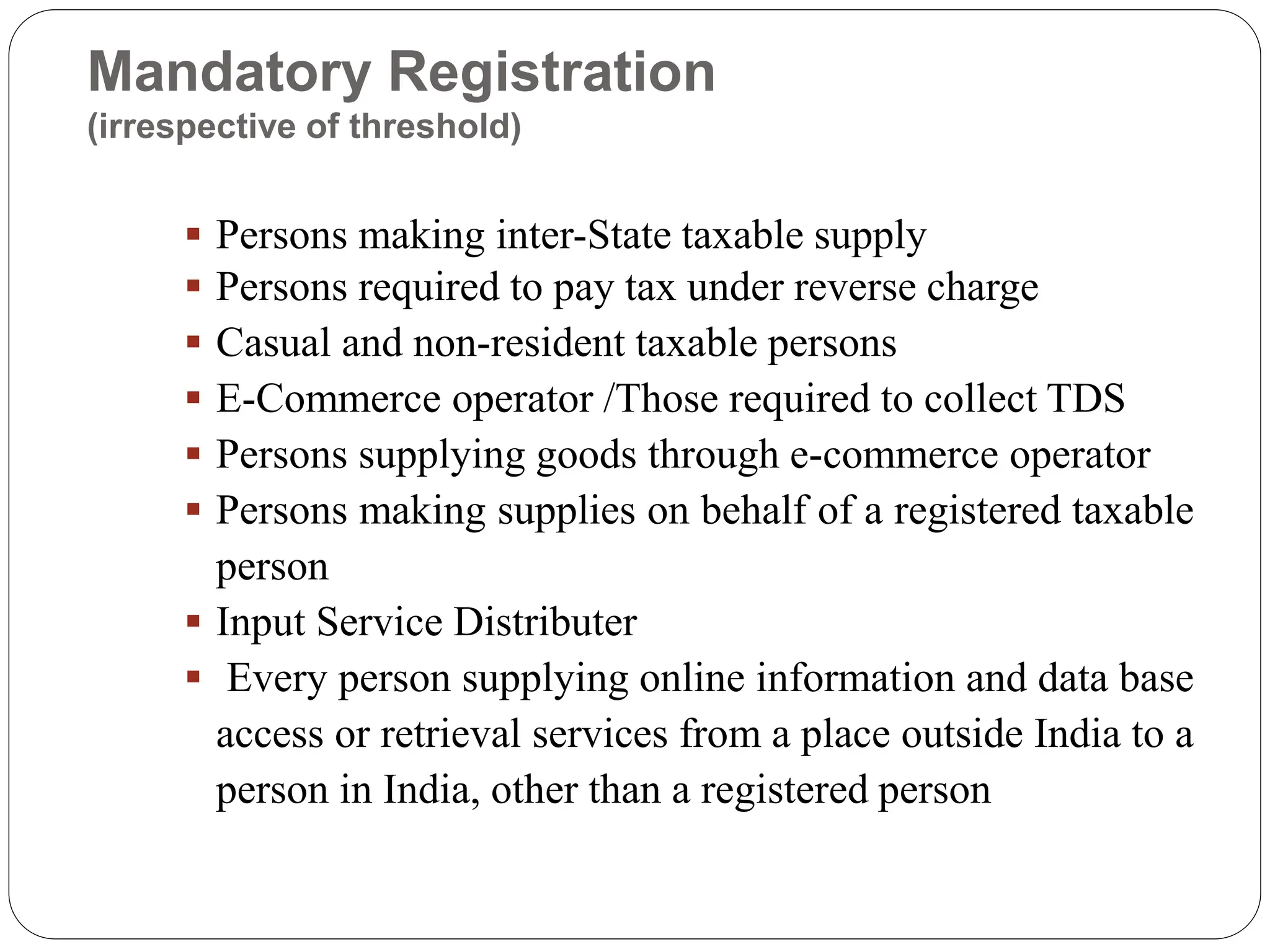

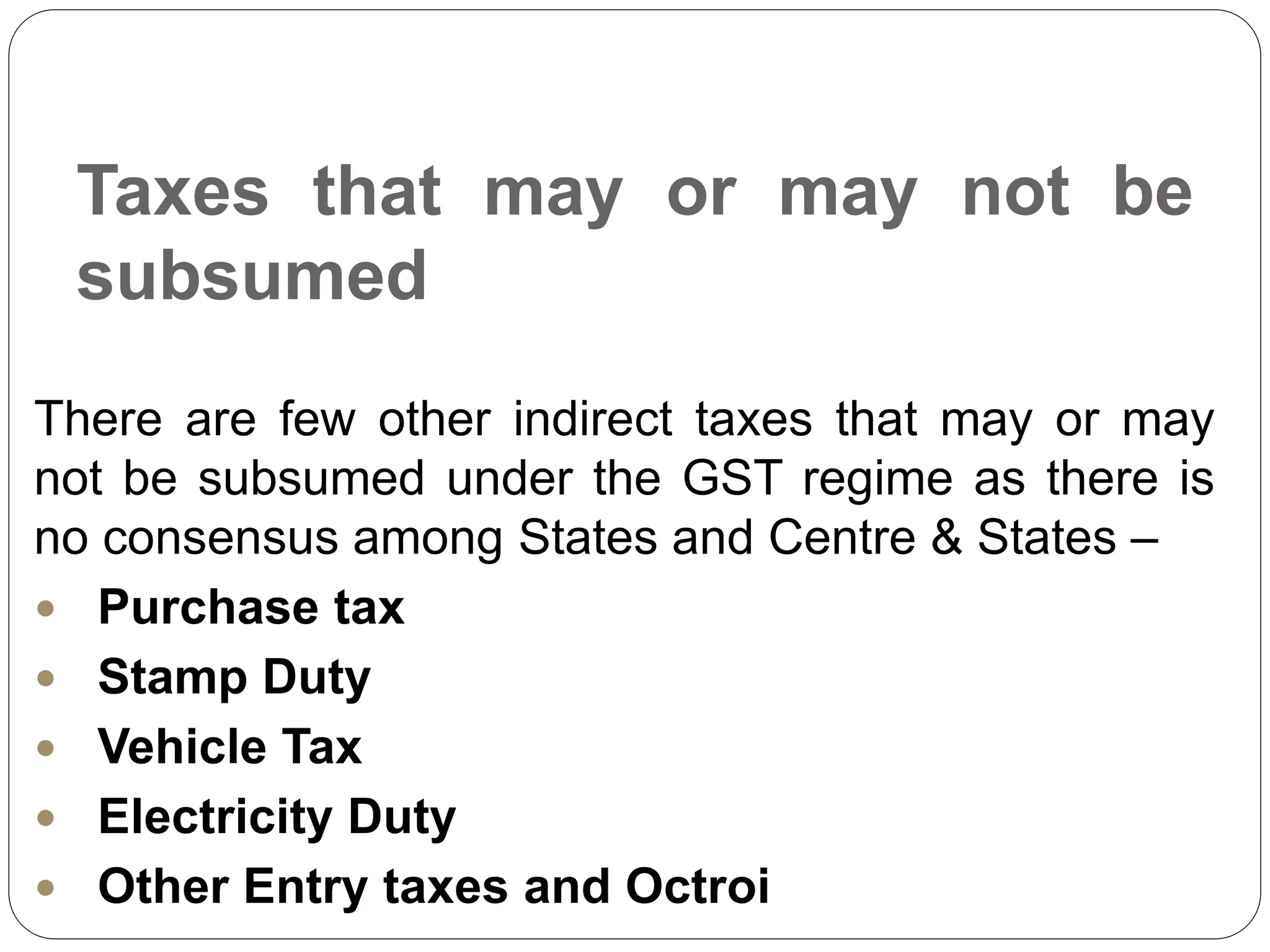

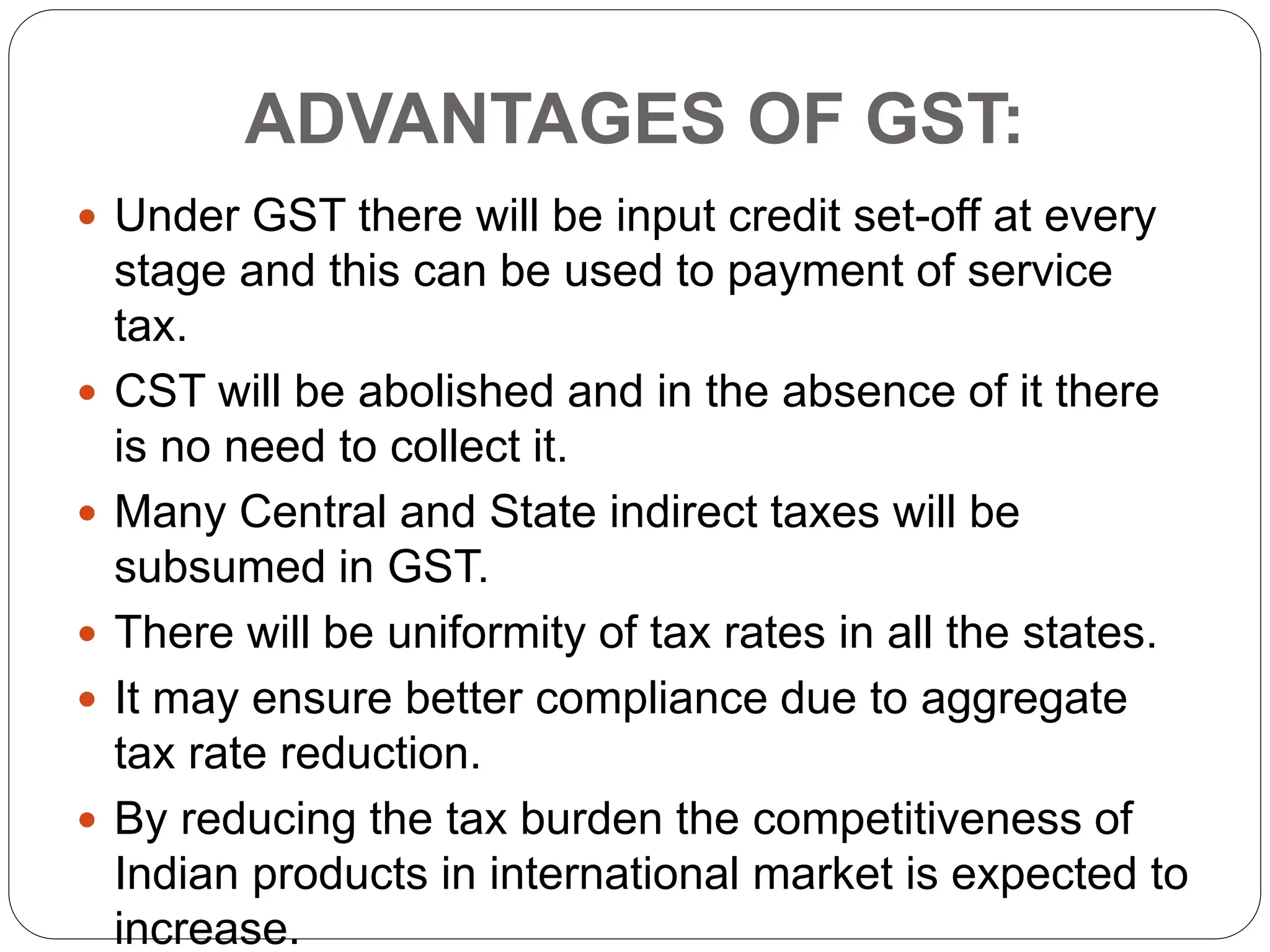

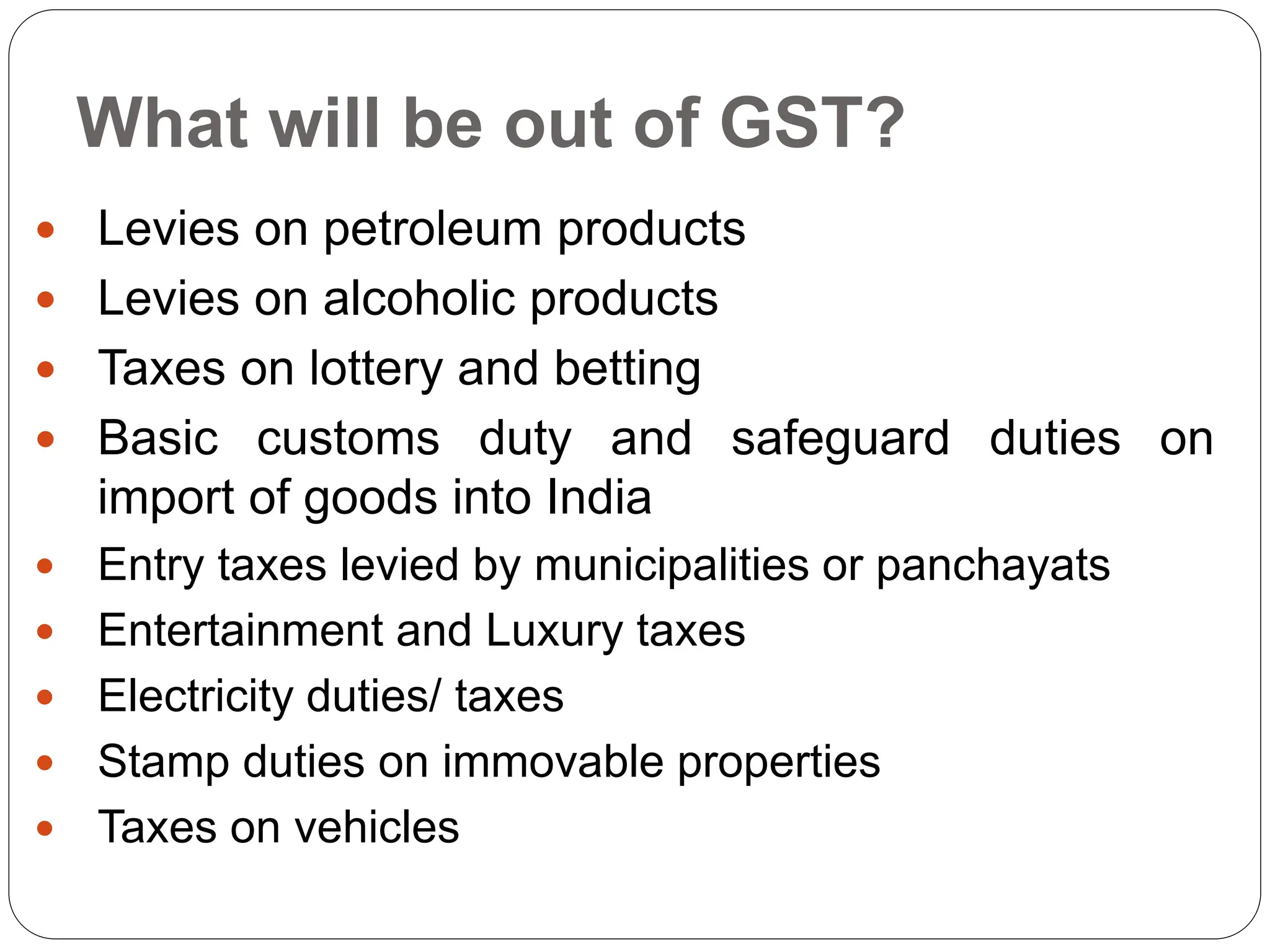

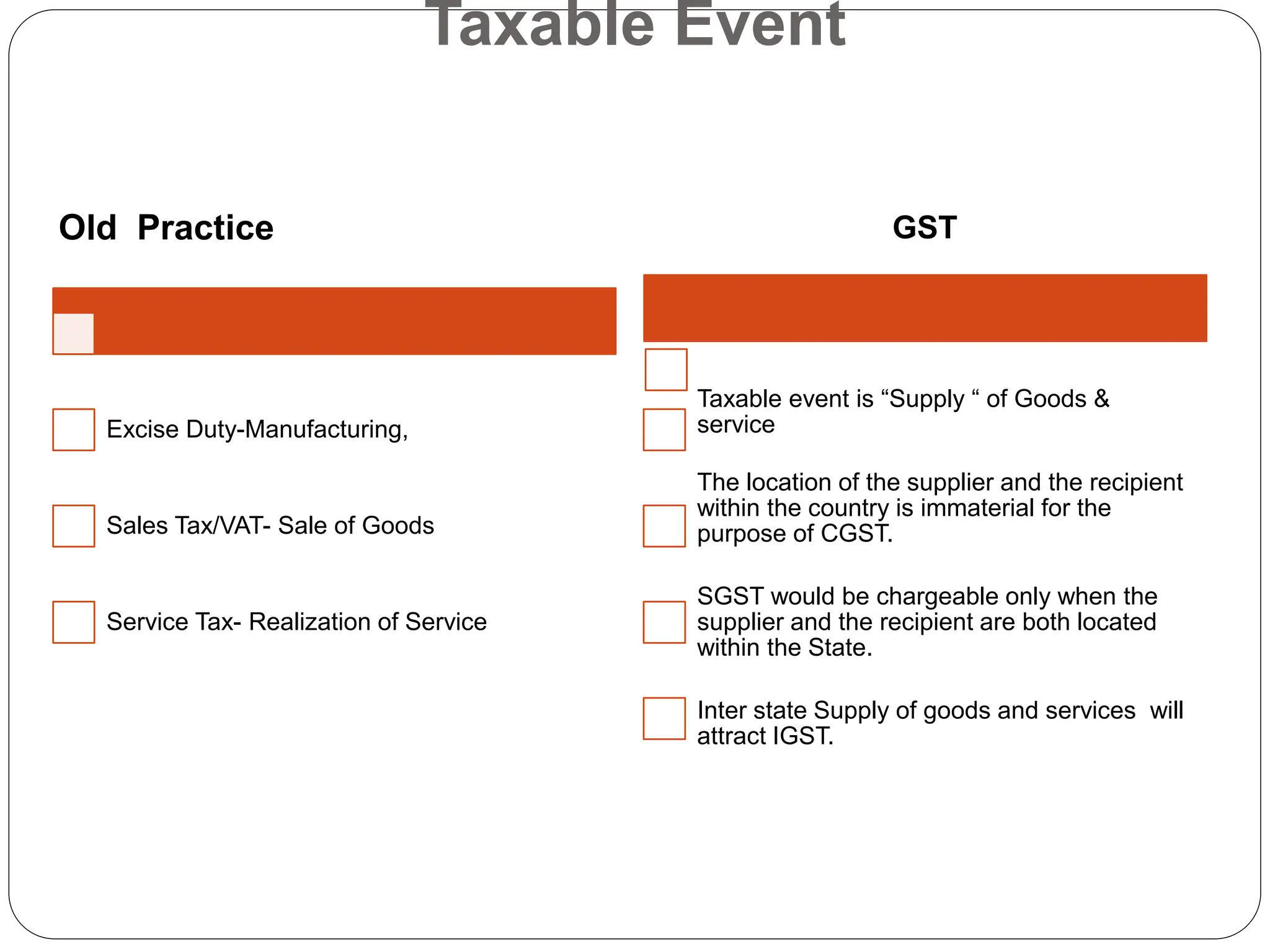

The document outlines the Goods and Services Tax (GST) in India, highlighting its comprehensive structure as a single tax on goods and services aimed at eliminating cascading tax effects. It details the milestones leading to the implementation of GST on July 1, 2017, and its expected benefits such as a unified tax system and input credit mechanism, contrasting it with the previous tax regime. The presentation also covers GST rates, exemptions, and the dual system involving Central GST (CGST) and State GST (SGST), aiming for equitable tax distribution and simplification of compliance for taxpayers.