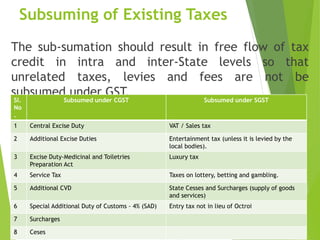

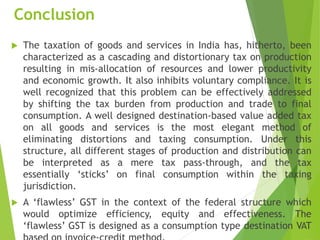

GST is a comprehensive indirect tax on manufacture, sale and consumption of goods and services throughout India. It replaces multiple taxes levied by the central and state governments. GST is proposed as a dual GST model where both the central and state government concurrently levy GST on a common tax base. GST will be levied at every stage of supply of goods and services based on the input tax credit method. This will ensure a seamless transfer of input tax credit between the central GST and state GST.