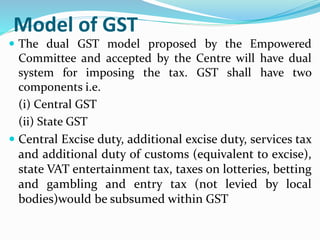

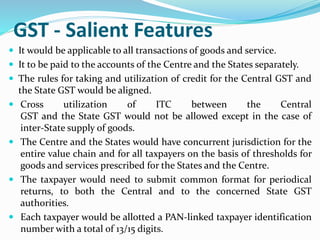

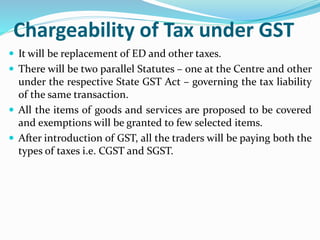

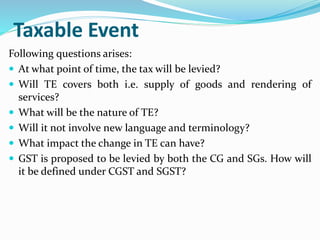

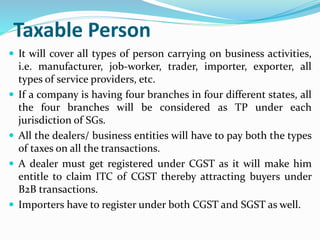

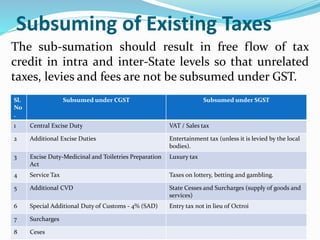

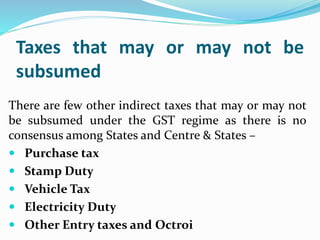

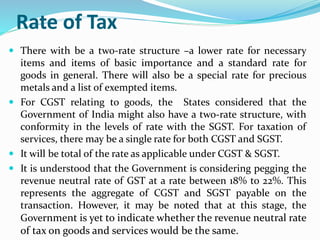

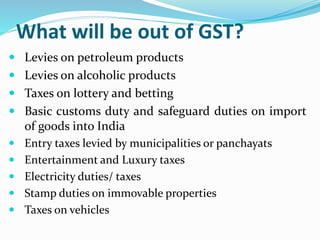

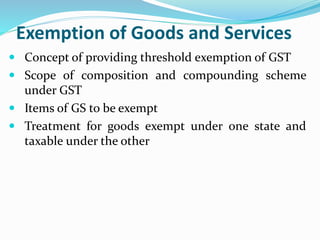

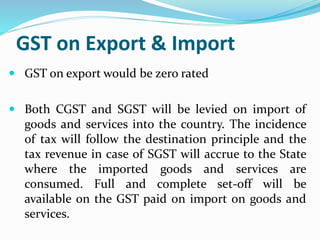

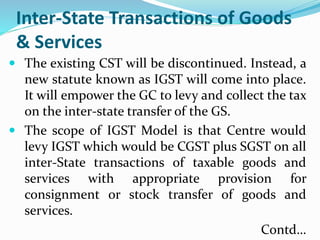

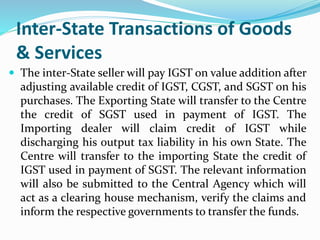

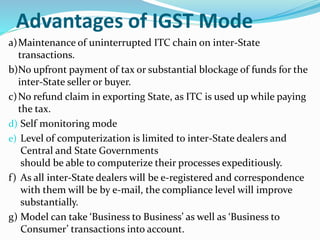

The document presents an overview of the Goods and Services Tax (GST) in India, emphasizing its significance as a comprehensive tax system that simplifies the existing multiple tax structures. It discusses the dual GST model that would integrate various central and state taxes, the justification for its implementation due to complexities in current tax structures, and the advantages of a unified tax approach. The document also outlines key features, tax chargeability, subsumed taxes, registration processes, and recent updates regarding the GST's implementation.