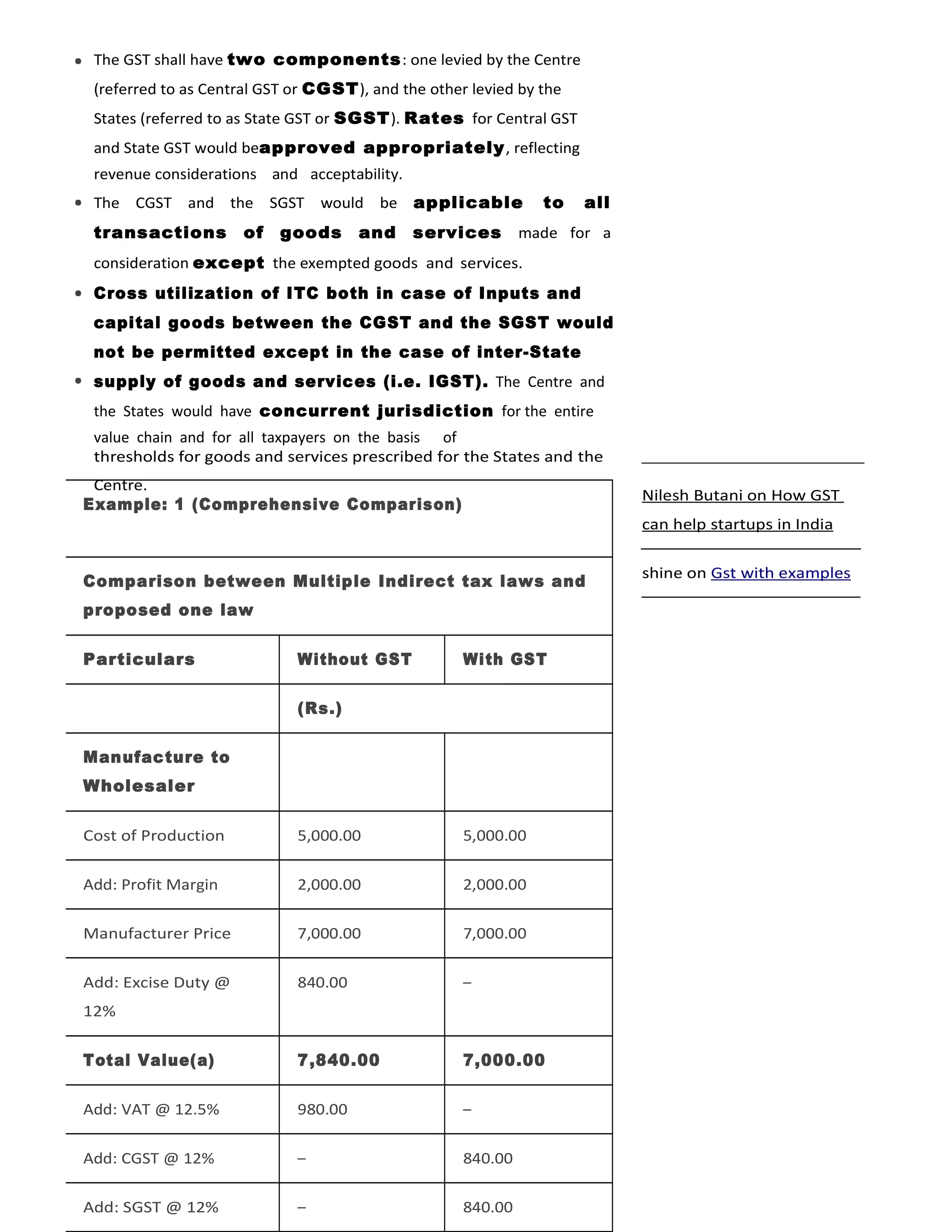

Goods and Services Tax (GST) is an important indirect tax reform in India that will replace multiple taxes imposed by central and state governments. It will be a dual GST with taxation powers shared between the central and state governments. While the central government can tax services and goods up to production, states can tax sale of goods. Constitutional amendments are needed to properly implement GST. GST will be a comprehensive tax on supply of goods and services that aims to eliminate cascading taxes and provide seamless input tax credits. It has faced delays in implementation due to lack of consensus among states on certain issues.