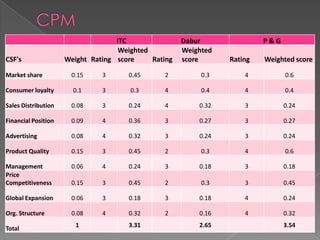

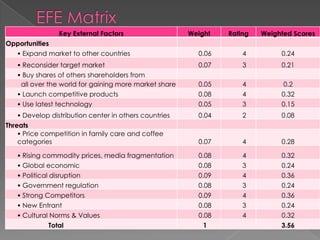

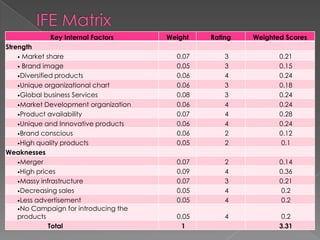

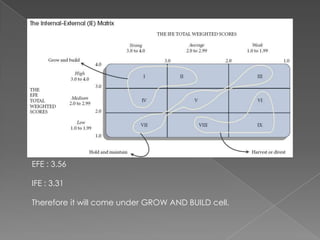

Based on the provided IFE score of 3.31 and EFE score of 3.56 for P&G, the IE Matrix analysis would place P&G in Cell II of the matrix, which is the "Grow and Build" quadrant.

This suggests that P&G has relatively strong internal factors based on the IFE score, and also faces favorable external opportunities based on the EFE score. The "Grow and Build" strategy recommended for Cell II would be to leverage P&G's strengths to capitalize on external opportunities through aggressive investment and expansion strategies.