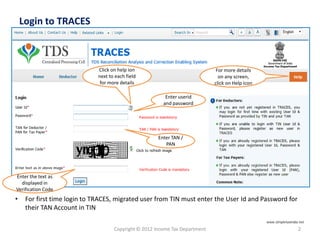

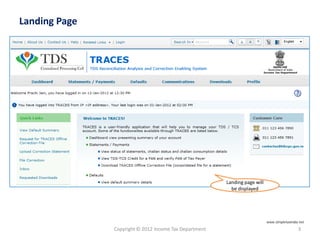

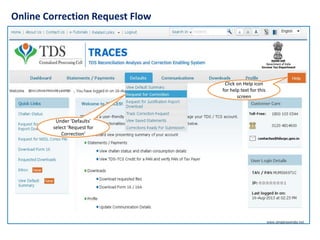

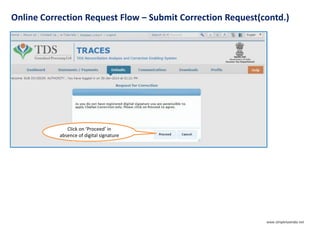

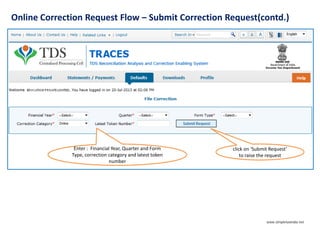

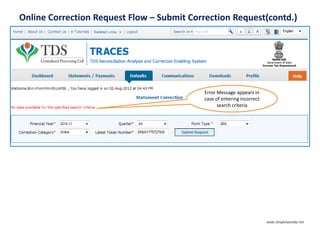

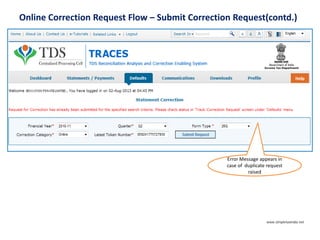

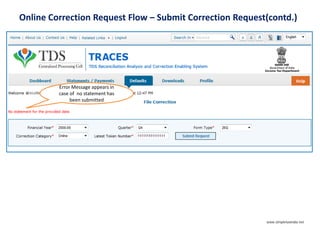

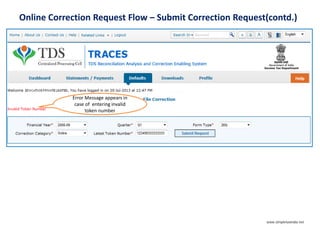

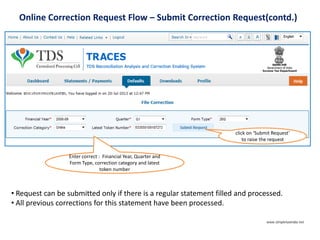

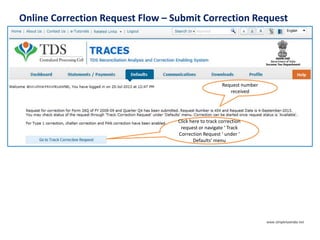

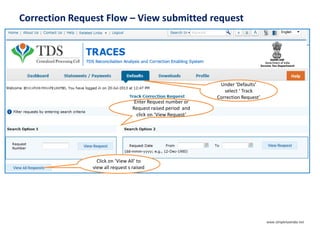

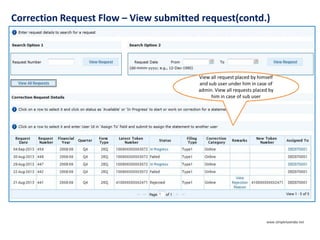

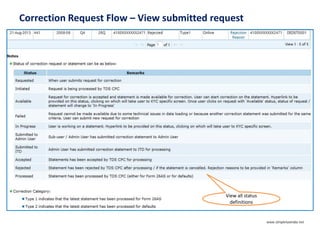

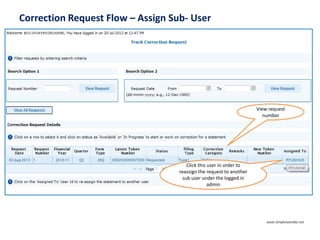

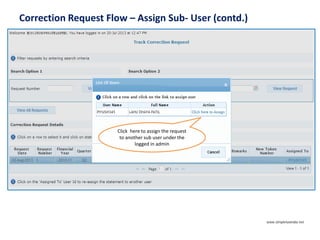

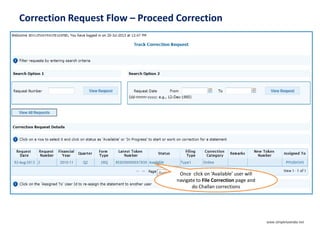

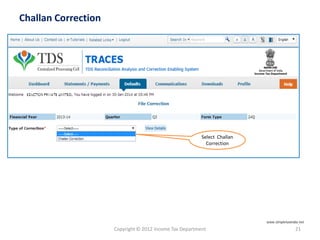

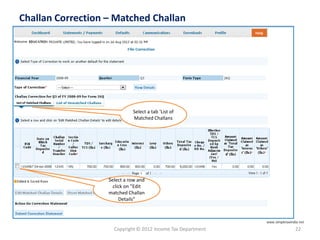

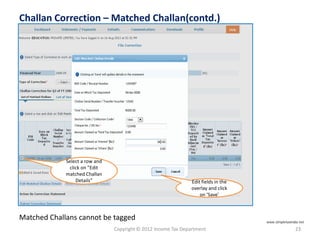

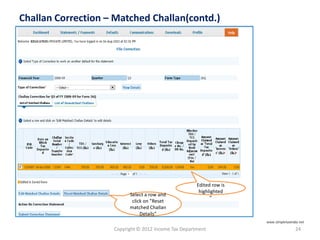

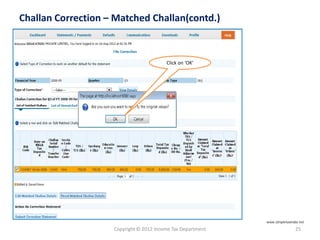

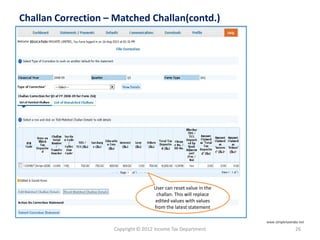

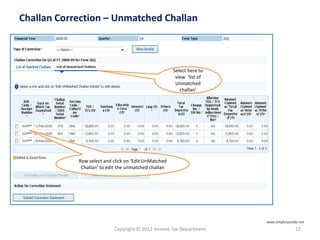

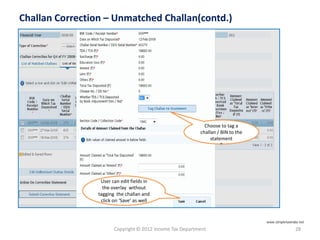

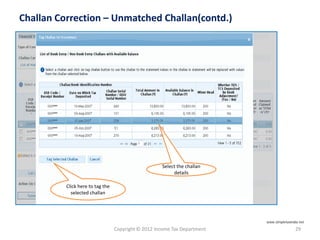

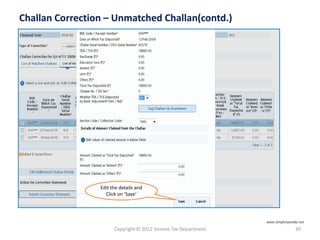

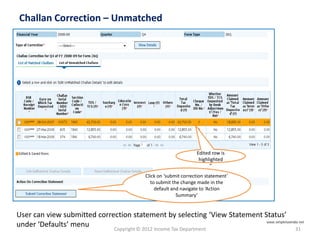

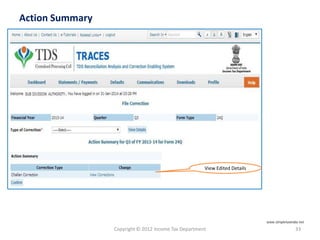

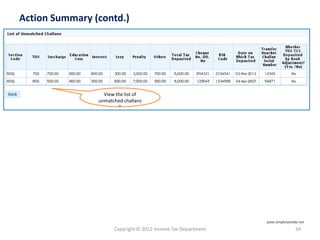

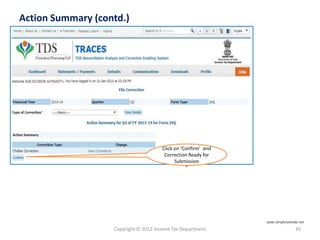

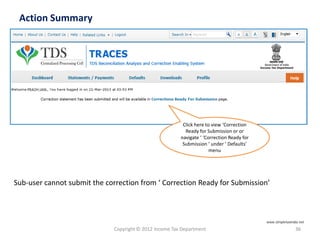

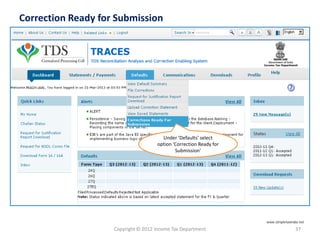

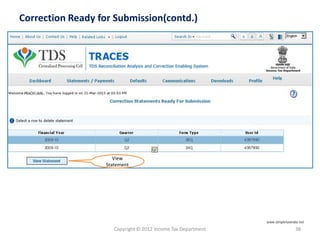

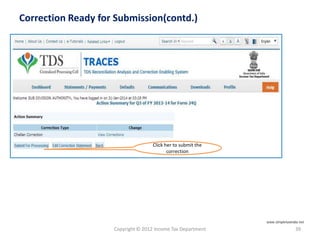

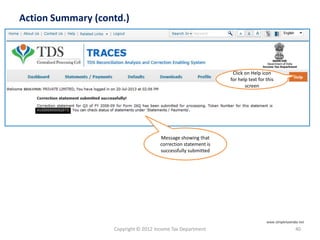

This document provides step-by-step instructions for submitting an online correction request and making corrections to a tax statement in the TRACES system. It explains how to log in to TRACES, select the correction request option, enter search criteria to find an existing statement, submit the request, view request status, proceed with corrections by editing challan details or tagging unmatched challans, submit the corrected statement, and view submission confirmation. Screenshots and help text are provided throughout to guide users through the correction process.