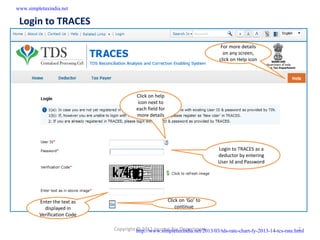

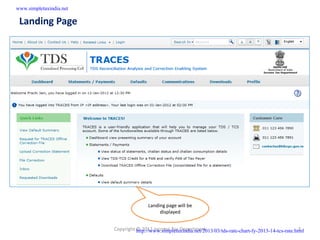

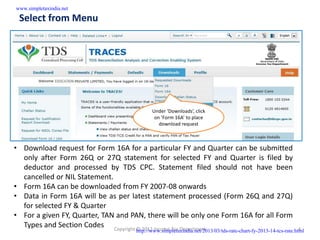

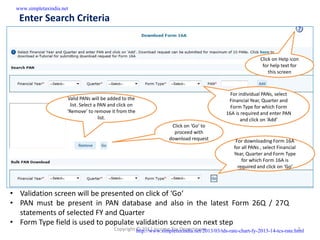

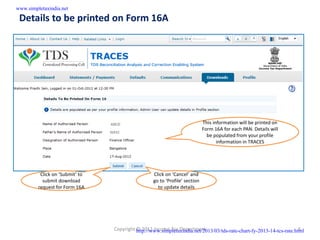

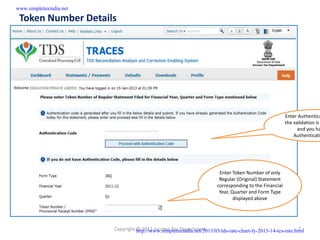

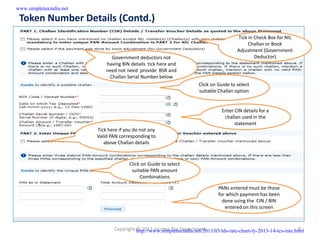

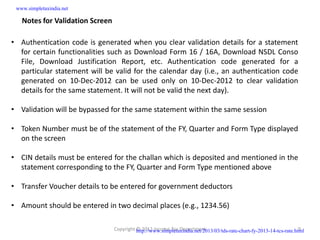

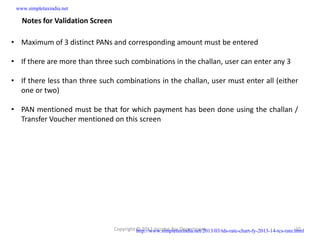

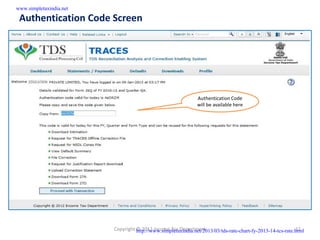

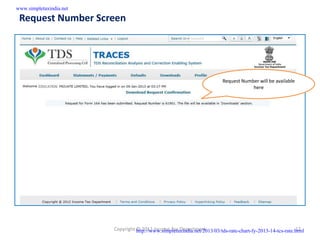

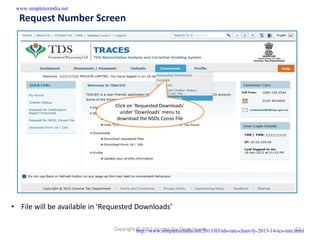

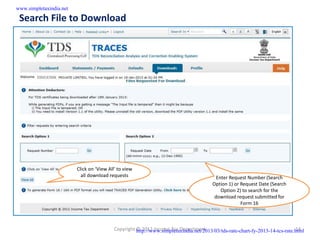

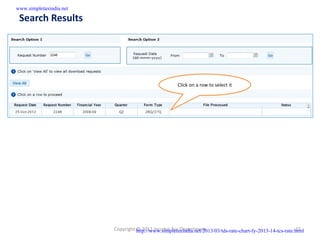

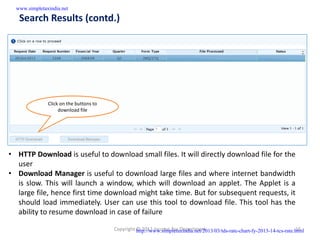

This document provides instructions for downloading Form 16A from the TRACES website. It outlines the steps to log in to TRACES, select Form 16A from the menu, enter search criteria such as financial year and quarter, PAN, and form type. It then describes validating the request by entering details from the taxpayer's Form 26Q/27Q statement, including the token number and payment details. Upon validation, users can submit their download request for Form 16A.