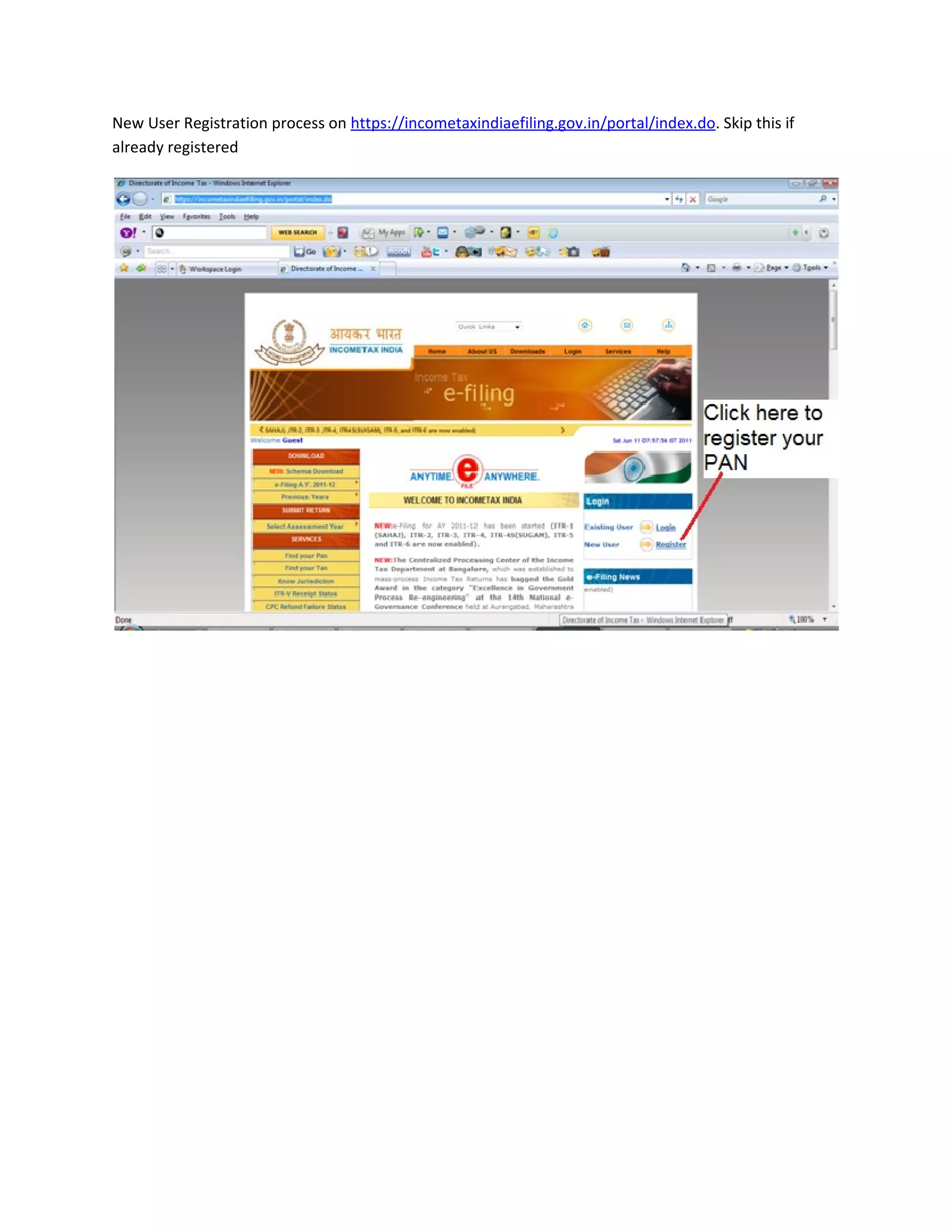

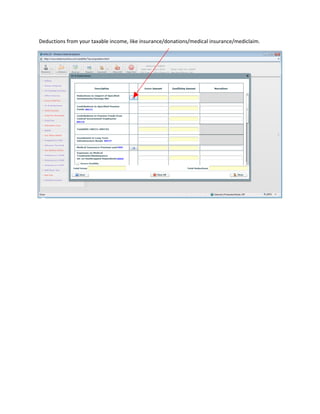

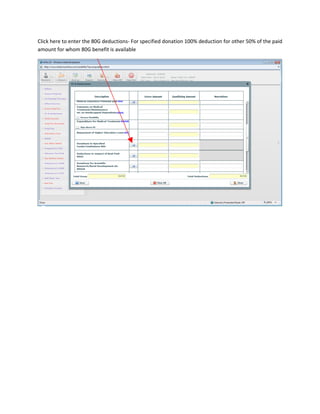

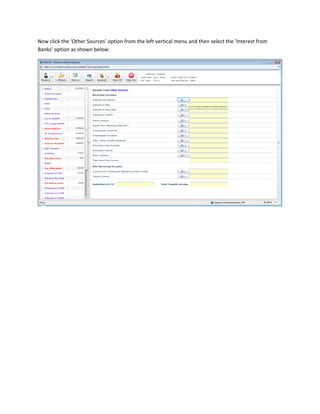

The document provides step-by-step instructions for new users on how to register and file income tax returns online through the income tax website. It describes registering by entering PAN details and personal information, then filing the return by entering income sources like salary, property, capital gains and deductions. It also covers generating an electronic return file, uploading it to the tax website, downloading and printing the acknowledgment, and mailing the signed copy to the tax office.